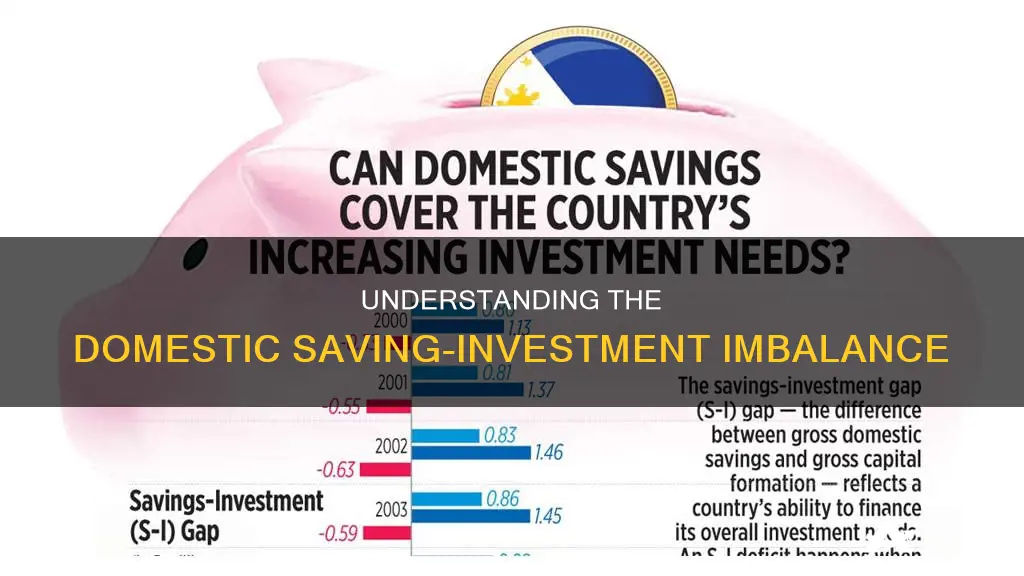

The domestic savings-investment gap is a concept that explores the relationship between a country's domestic saving rates and its economic growth. Neoclassical growth models assume that foreign savings can perfectly substitute domestic savings in financing domestic capital, implying that domestic saving rates should not impact a country's investment and growth rates. However, the divergence in growth rates between East Asian countries with high domestic saving rates and other emerging markets with low saving rates challenges this assumption. This has led to the suggestion that savings-investment gaps may explain the varying growth rates among countries. The savings gap is particularly prominent in smaller low-income countries, where high levels of poverty make it difficult to generate sufficient savings to fund investment projects, leading to increased reliance on foreign aid or borrowing. Additionally, the challenge of encouraging working-age citizens to save for their future has become a global concern for policymakers and pension-fund managers.

What You'll Learn

The impact of domestic saving rates on investment and growth rates

The relationship between domestic saving rates, investment, and economic growth has been the subject of extensive research in economics. Saving rates can influence investment and growth rates through various channels, including capital accumulation, consumption patterns, and financial market dynamics. Here are some key considerations regarding the impact of domestic saving rates on investment and growth rates:

- Capital Accumulation and Investment: Higher domestic saving rates generally lead to increased capital accumulation within a country. Savings provide the funds necessary for investment projects, including infrastructure development, business expansion, and technological advancements. This capital accumulation, in turn, drives economic growth by enhancing productivity, creating jobs, and generating sustainable economic development.

- Impact on Consumption: Domestic saving rates can influence consumption patterns in an economy. When individuals or households save more, they are effectively choosing to forgo current consumption in favor of future consumption. This shift in consumption patterns can have both short-term and long-term effects on investment and growth rates. In the short term, higher saving rates may lead to lower aggregate demand as consumers spend less. This can impact businesses' investment decisions, as they may choose to invest less in capacity expansion or new product development due to anticipated lower demand. However, in the long term, increased savings can lead to higher investment as funds become available for investment projects, potentially driving economic growth.

- Financial Market Dynamics: Saving rates also play a crucial role in shaping financial markets and investment opportunities. When individuals save more, financial institutions, such as banks, have access to a larger pool of funds that can be lent or invested. This increased availability of capital can lower borrowing costs, making it more attractive for businesses and entrepreneurs to invest in new ventures or expand existing operations. Additionally, higher domestic saving rates can reduce a country's reliance on foreign direct investment (FDI), decreasing the risks associated with volatile FDI flows.

- Economic Growth and Investment: The relationship between saving rates, investment, and economic growth is complex and bidirectional. While higher saving rates can boost investment and lead to economic growth, economic growth itself can also have a positive effect on domestic savings. As incomes rise, individuals and households may have more disposable income, enabling them to save more. This, in turn, can further stimulate investment and contribute to sustained economic growth.

- Country-Specific Factors: It is important to consider country-specific factors when examining the impact of domestic saving rates on investment and growth rates. In developing countries, for example, the relationship between savings and investment may be stronger due to limited access to external financing. Additionally, cultural and social factors can influence saving rates, such as attitudes towards debt, consumption patterns, and the level of trust in financial institutions.

In summary, domestic saving rates can have a significant impact on investment and growth rates through their influence on capital accumulation, consumption patterns, and financial market dynamics. While higher saving rates can lead to increased investment and economic growth, it is essential to consider the specific economic context, cultural factors, and potential short-term versus long-term effects of changes in saving behavior.

Purchasing a Condominium: Saving or Investing?

You may want to see also

Foreign savings as a substitute for domestic savings

Foreign savings accounts are more like investment accounts than traditional savings accounts for US individuals. They allow investors to put their money in a currency other than the dollar. Foreign savings accounts can be opened when an individual is in another country or by contacting an overseas bank online.

Foreign savings accounts may have higher interest rates than in the US, which may attract savers who are willing to take the risk that the exchange rate will work in their favour. However, if the high interest is coupled with devaluation of the saved currency (which often happens with inflation), any interest gains will be lost in the currency exchange.

A large number of countries have been able to finance a significant fraction of domestic investment using foreign finance for extended periods. While many of these countries are low-income countries where official finance is more important than private finance, there are also cases where a substantial fraction of domestic investment was financed via private capital inflows.

However, foreign savings are not a good substitute for domestic savings. Episodes of large and persistent current account deficits often do not end happily, but rather, they end abruptly with compression of the current account, real exchange rate depreciation, and a sharp slowdown in investment. Summing over the deficit episode and its aftermath, growth is slower than when countries rely on domestic savings. Therefore, while it is not impossible to finance growth and investment out of foreign savings, it is risky.

An econometric analysis of the Brazilian economy indicates a stable long-term relationship between the exchange rate and domestic savings. The relative devaluations of the real exchange rate positively and significantly affected domestic savings in 1994–2013. The results of the analysis performed on the two samples confirm the presence of substitution of foreign savings for domestic savings.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

The savings gap in low-income countries

The lack of domestic savings increases these countries' reliance on external sources of funding, such as aid or borrowing from overseas entities. This reliance can lead to further complications, including debt accumulation and the potential for aid dependency. Moreover, it underscores the challenge of persuading individuals in low-income countries to save for the future when they are already struggling to meet their basic needs in the present.

Various factors contribute to the savings gap in low-income countries. One key factor is the tendency for individuals to discount the future, focusing more on their immediate needs rather than long-term financial security. This is particularly prevalent in low-income populations, where citizens have very little disposable income to set aside for savings. Additionally, low-interest-rate environments can hinder the accumulation of capital, further exacerbating the savings gap.

To address the savings gap, policymakers must devise strategies to encourage savings while also recognizing the immediate needs of their citizens. This delicate balance requires a combination of mandates and voluntary measures. For instance, mandated pension contributions can help ensure that individuals set aside a portion of their income for the future, but such measures may not be feasible for those with extremely limited incomes. Therefore, policymakers must also consider incentives and education to help individuals understand the importance of saving and make it more appealing to do so.

Furthermore, investing pension-plan reserves in initiatives that promote strong economic development, such as infrastructure projects, can be a win-win solution. By improving the overall economic landscape and providing better services, individuals may be more motivated to save, recognizing the potential for a more prosperous future. Addressing the savings gap in low-income countries is a complex task that requires a nuanced approach that takes into account both short-term needs and long-term financial security.

Kids' Guide to Saving and Investing Wisely

You may want to see also

The challenge of persuading people to save for retirement

The domestic savings-investment gap refers to the shortfall in savings needed to fund investment projects, particularly in smaller low-income countries where high levels of extreme poverty make it difficult to generate sufficient savings. This problem is not limited to developing countries, however, and is a challenge faced by policymakers and pension-fund managers worldwide.

One key aspect of this challenge is understanding the importance of retirement planning and conveying this to individuals. This involves raising awareness about the long-term benefits of saving early and consistently. For instance, individuals need to grasp the concept of compounding, where their money grows faster over time as they earn interest on their interest. The earlier and more regularly they save, the more their money will multiply, making a significant difference in their retirement income.

Another challenge is addressing the issue of self-control. Saving for retirement requires individuals to forgo spending today for a more financially secure tomorrow. This can be particularly difficult when tempted by various short-term wants and needs. To overcome this, individuals can set up emergency funds to meet unexpected needs and budget for their desires, ensuring they can still save for the future while enjoying the present.

Additionally, the design of pension systems and retirement plans plays a crucial role in encouraging savings. In many cases, individuals are expected to bear the burden of financial management, with few jobs offering traditional pension plans. This shift towards self-managed retirement plans, such as 401(k)s, can be complex and intimidating, especially for those without a strong financial background. As a result, many individuals fail to take advantage of these plans or make suboptimal decisions, undermining their ability to save for retirement.

To address this, financial education and personalised counselling services can play a vital role in empowering individuals to make informed decisions about their retirement planning. This includes helping them navigate the complexities of Social Security, understanding the basics of personal finance, and staying updated on current trends and issues that may impact their retirement, such as inflation, healthcare costs, and life expectancy.

Furthermore, automation can be a powerful tool in helping individuals save for retirement. By setting up systems that automatically transfer a portion of their income to retirement accounts, individuals can save effortlessly without relying on willpower or memory. This strategy also reduces the temptation to spend money on other things, as it is never visible in their checking account.

In conclusion, persuading people to save for retirement requires a multi-faceted approach that combines financial education, incentives, and behavioural insights. By raising awareness, providing the right tools and support, and addressing the challenges of self-control and financial complexity, we can help individuals make informed decisions about their future and ensure they have the financial security they need during their retirement years.

National Saving Scheme: Smart Investment Strategies

You may want to see also

The role of government intervention in pension planning

A savings gap is a term used to describe the difficulty that many low-income countries face in generating sufficient savings to fund investment projects. This often results in an increased reliance on foreign aid or borrowing. In the context of pension planning, the savings gap refers to the disparity between the amount of money individuals have saved for their retirement and the amount needed to ensure a comfortable standard of living in their later years. This gap can be attributed to various factors, including inadequate personal savings, low interest rates, and insufficient pension contributions.

Mandated Pension Contributions

Government-mandated pension contributions are one of the most important interventions to encourage saving for retirement. However, as noted by Jan Walliser of the World Bank Group, this type of intervention often fails to reach a significant portion of the working-age population. Therefore, it is essential to design policies that not only mandate contributions but also provide education and incentives to encourage individuals to save voluntarily.

Persuasion and Policy Tools

Michael Rutkowski, a senior director for the Social Protection & Labor Global Practice, emphasizes the importance of using policy tools to persuade people to make wise financial choices. This includes implementing rules that define what should be mandated, such as contribution requirements, and what should be voluntary, such as additional savings options. Finding the right balance between mandates and voluntary choices is crucial in encouraging long-term financial security.

Social Equity and Financial Adequacy

When designing pension reform, it is essential to consider principles such as social equity and financial adequacy. Pension plans should aim to provide fair and equitable benefits to all retirees, regardless of their socio-economic background. Additionally, the benefits should be sufficient to maintain a decent standard of living in retirement.

Demographic Dividend

As noted by Fiona Stewart of the World Bank Group, policymakers should take advantage of their countries' "demographic dividend." This refers to the surge of younger workers entering the workforce and contributing to pension systems. By encouraging and enabling these individuals to start saving for retirement early in their careers, the overall pension fund can benefit from compound interest and stronger long-term growth.

Investment of Pension-Plan Assets

Ensuring adequate capital to fund future pension payments is a significant challenge. Pension-plan assets should be invested wisely in initiatives that promote strong economic development. For example, investing in infrastructure projects can be a win-win situation, as it creates social benefits and enhances the value of workers' lives, encouraging them to save for the future.

Addressing Poorly Designed Pension Systems

In some cases, retirees and near-retirees may be unable to afford to save due to poorly designed pension systems or economic crises, such as the global financial crisis of 2008. In such situations, government intervention is necessary to reform pension systems and ensure their long-term sustainability. This may involve preserving pensions for current pensioners and today's workers while also ensuring fairness and equity for future generations.

529 Savings Plans: Smart Investment Strategies, per Forbes

You may want to see also

Frequently asked questions

The domestic saving-investment gap is the shortfall in savings needed to fund investment projects, which is particularly pronounced in smaller low-income countries.

In smaller low-income countries, high levels of extreme poverty make it difficult for people to save enough to fund investment projects.

The domestic saving-investment gap can hinder a country's growth performance. Countries with low and declining self-financing ratios have been more affected by the recent global financial crisis.

Neoclassical growth models assume that foreign savings are perfect substitutes for domestic savings in financing domestic capital. However, these models fail to explain the divergence in growth rates between countries with high and low domestic saving rates.

Countries can increase the fraction of domestic savings used to finance domestic capital, also known as the self-financing ratio. This is particularly important for low-middle-income countries to improve their growth performance and reduce the impact of financial crises.