Portfolio optimization is a strategic financial tool that helps investors maximize returns and minimize risks. It involves analyzing various assets within a portfolio, such as stocks, bonds, and other investments, to create a well-balanced and diversified investment strategy. This process considers the historical performance, volatility, and correlation of different assets to determine the optimal allocation that can achieve the desired level of return with minimal risk.

One of the key applications of portfolio optimization is in wealth management, where financial advisors use this technique to tailor investment portfolios to their clients' financial goals and risk tolerance. It is also widely used by institutional investors, fund managers, and financial analysts to make informed decisions about asset allocation, rebalancing, and risk management.

By optimizing their portfolios, investors can achieve their financial objectives by creating efficient and well-structured investment portfolios.

What You'll Learn

Maximising return and minimising risk

Portfolio optimisation is a strategic financial tool that helps investors maximise their returns while minimising risk. It involves evaluating the historical performance, volatility, and correlation of different assets to determine the optimal allocation that can achieve the desired level of return with the least amount of risk.

The modern portfolio theory (MPT), introduced by Harry Markowitz in 1952, forms the basis for portfolio optimisation. MPT argues that an investment's risk and return characteristics should be evaluated in the context of how they impact the overall portfolio. By choosing an optimal mix of high-risk, high-return, and low-risk, low-return investments, investors can achieve their desired financial goals without taking on excessive risk.

MPT assumes that investors are risk-averse, meaning they prefer a less risky portfolio for a given level of return. This implies that investors should invest in multiple asset classes to reduce risk. The expected return of a portfolio is calculated as a weighted sum of the returns of its individual assets. The risk of a portfolio, on the other hand, is a function of the variances of each asset and the correlations between them.

To maximise return and minimise risk, investors can follow these key principles:

- Diversification: MPT emphasises diversification as a key component. By investing in a mix of assets with different risk and return profiles, investors can reduce the overall risk of their portfolio while still achieving their desired returns.

- Efficient Frontier: The efficient frontier is a graphical representation of the relationship between risk and expected return for efficient portfolios. Efficient portfolios are those that maximise expected return for a given level of risk. Investing in portfolios below the efficient frontier is not desirable as it fails to maximise returns relative to the risk taken.

- Risk Evaluation: Different approaches to portfolio optimisation measure risk differently. Standard deviation or variance are commonly used but are not robust. Other measures such as the Sortino ratio, CVaR (Conditional Value at Risk), and statistical dispersion provide more comprehensive risk assessments.

- Correlation: Negative correlation between assets can help reduce portfolio risk. For example, investing in government bond ETFs can reduce the risk of a stock portfolio as they are negatively correlated with stocks.

- Constraints: Regulatory constraints, illiquidity, taxes, and transaction costs are factors that can impact portfolio optimisation. These constraints can lead to a focus on a small subset of assets within the portfolio, potentially impacting diversification.

- Optimisation Techniques: Various optimisation techniques are available, including mean-variance optimisation, conditional value-at-risk, risk parity, tracking error, and the Kelly Criterion. Each technique helps identify portfolios that meet specific objectives, such as minimising risk, maximising returns, or achieving a balance between the two.

By applying these principles and techniques, investors can maximise their returns while minimising risk, ultimately creating a well-structured and efficient investment portfolio.

Saving Relationships: Worth the Investment?

You may want to see also

Optimal portfolio selection

The process of optimal portfolio selection is based on the idea that risk is intimately tied to uncertainty. The greater the uncertainty, the greater the risk. This uncertainty can be represented by a probability distribution, with the standard deviation serving as a measure of the uncertainty. Most people dislike uncertainty, so portfolios with high standard deviations are less preferred.

To pursue the goal of locating optimal investment strategies, it is necessary to quantify people's preferences regarding risk. This is done using a utility function that measures the desirability of a portfolio by considering the expected return and subtracting a quantity proportional to the square of the standard deviation of the return. This function can be illustrated using indifference curves, where an individual is indifferent between all portfolios on a given curve.

The selection of an optimal portfolio involves determining the optimal allocation between a risky portfolio and a risk-free asset. Investing in stocks can be risky, but this risk can be mitigated by allocating part of the investment to risk-free assets. The optimal combination of the risky and risk-free assets depends on the investor's preferences and their level of risk aversion.

There are various models and theories that guide optimal portfolio selection, including the Markowitz model, the Capital Asset Pricing Model (CAPM), and the prospect theory proposed by Kahneman and Tversky. These models consider factors such as an investor's preferences, efficient frontiers, and the relationship between risk and return.

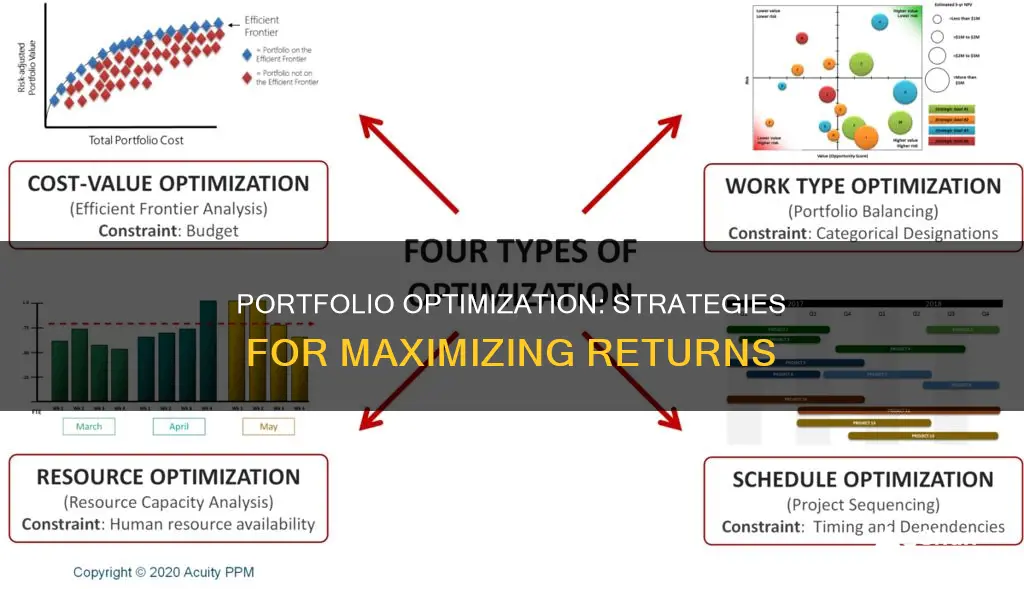

Additionally, there are different optimisation strategies available, such as mean-variance optimisation, conditional value-at-risk, risk parity, tracking error, and the Kelly Criterion, among others. These strategies aim to find portfolios that optimise specific criteria, such as risk-adjusted returns, expected tail loss, and portfolio assets' risk contributions.

Overall, optimal portfolio selection is a complex process that involves quantitative analysis, risk assessment, and an understanding of investor preferences. By carefully considering these factors, investors can construct well-balanced and diversified investment portfolios that align with their financial goals and risk tolerance.

Trade Deficit: Investment, Savings and the Economy

You may want to see also

Asset allocation

When optimizing a portfolio, the allocation of assets is typically done in two stages. The first stage focuses on determining the optimal mix of asset classes to hold. This could include deciding on the proportions of equities versus bonds in a portfolio. Equities and bonds have distinct financial characteristics and different levels of systematic risk, making them suitable for diversification. Holding a combination of these asset classes helps to mitigate non-systematic risks.

The second stage of asset allocation involves optimizing the weights of specific assets within each asset class. For instance, if an investor has decided to allocate a certain percentage of their portfolio to equities, the next step is to determine the allocation of that equity portion across different stocks. This could mean allocating a certain percentage to Stock X, another percentage to Stock Y, and so on.

Modern Portfolio Theory (MPT), introduced by Harry Markowitz in 1952, provides a framework for effective asset allocation. MPT suggests that investors can achieve optimal results by diversifying their portfolios with a mix of low-risk and high-risk investments. This diversification allows investors to maximize returns while maintaining an acceptable level of risk.

MPT emphasizes that the risk and return characteristics of each investment should be evaluated in the context of the overall portfolio. By constructing a portfolio with multiple assets, investors can aim for greater returns without taking on more risk. This approach is particularly useful for risk-averse investors who want to build efficient and diversified portfolios.

To further enhance diversification and risk management, practitioners often incorporate additional constraints when optimizing asset allocation. These constraints may include setting limits on asset, sector, or regional portfolio weights. For example, an investor may decide to limit their exposure to a particular industry sector to reduce the potential impact of industry-specific risks.

Additionally, portfolio optimization tools and models can aid in asset allocation decisions. These tools use historical performance, volatility, and correlation data to help investors identify the optimal allocation that aligns with their risk tolerance and financial objectives.

Overall, effective asset allocation through portfolio optimization enables investors to create well-diversified portfolios that maximize returns while managing risk in a way that suits their investment goals and risk appetite.

Investment Surpassing Savings: A Recipe for Economic Growth or Debt?

You may want to see also

Risk management

Diversification

Diversification is a fundamental concept in portfolio optimization. By spreading investments across various assets, such as stocks, bonds, real estate, and more, investors can reduce their overall risk. Diversification ensures that a single asset's poor performance does not significantly impact the entire portfolio. This strategy is based on the assumption that different assets have low correlations, meaning they don't move in the same direction all the time.

Risk Assessment and Measurement

Before investing, it is crucial to assess and measure the risk associated with each asset. Traditional measures like standard deviation or variance are commonly used. However, modern portfolio optimization techniques also consider other measures like the Sortino ratio, Conditional Value-at-Risk (CVaR), and statistical dispersion. These measures provide a more comprehensive view of risk, accounting for factors like downside risk and the impact of outliers.

Risk Aversion and Investor Profile

Understanding an investor's risk aversion and preferences is essential. Some investors are more risk-averse than others, and this should be reflected in the portfolio construction. The level of risk aversion can be quantified using a risk aversion parameter, which is used in utility functions to determine the optimal portfolio.

Risk Constraints and Limits

To manage risk effectively, portfolio optimization often involves setting constraints and limits. These constraints can include regulatory requirements, concentration risk limits, and sector or regional portfolio weight limits. For example, setting upper bounds on the weight attributed to a single asset can help mitigate concentration risk.

Risk Optimization Techniques

There are several optimization techniques available to minimize risk. Mean-Variance Optimization aims to find the optimal portfolio on the efficient frontier, balancing risk and return. Other techniques like Conditional Value-at-Risk, Risk Parity, and Tracking Error focus on minimizing different aspects of risk, such as expected tail loss or tracking error against a benchmark.

Regular Monitoring and Rebalancing

In conclusion, effective risk management in investment portfolio optimization involves a combination of diversification, risk assessment, investor profiling, risk constraints, optimization techniques, and regular monitoring. By incorporating these considerations, investors can make more informed decisions, mitigate potential losses, and create portfolios that align with their risk tolerance and financial goals.

Building a Balanced Investment Portfolio: An Example Guide

You may want to see also

Diversification

MPT, introduced by American economist Harry Markowitz in 1952, suggests that investors can achieve optimal results by choosing a mix of low-risk and high-risk investments based on their individual tolerance for risk. This theory assumes that investors are risk-averse and prefer a less risky portfolio for a given level of return. By diversifying their investments, investors can construct efficient portfolios that maximize returns without taking on excessive risk.

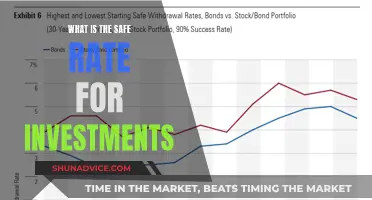

One of the benefits of diversification is the ability to reduce volatility. Choosing assets with a negative correlation, such as stocks and bonds, can lower the overall volatility of a portfolio. For example, stock investors can reduce risk by allocating a portion of their portfolios to government bond investments. The negative correlation between stocks and bonds helps reduce the portfolio's variance significantly.

Additionally, diversification allows investors to invest in multiple asset classes, further spreading their risk. For instance, investors can optimize their portfolios by determining the optimal weights of asset classes, such as equities and bonds, and then fine-tuning the weights of specific assets within each class. This two-step procedure helps eliminate non-systematic risks at both the individual asset and asset class levels.

To achieve effective diversification, investors should consider various factors, including historical performance, volatility, and correlation between different assets. By analyzing these factors, investors can make informed decisions about asset allocation and create well-diversified portfolios tailored to their financial goals and risk tolerance.

Reviving Nature: Planting vs. Preservation, Where Should We Invest?

You may want to see also

Frequently asked questions

Investment portfolio optimization is a strategic financial tool that helps investors maximize returns while minimizing financial risks. It involves analyzing various assets within a portfolio, such as stocks, bonds, and other investments, to create a well-balanced and diversified investment strategy.

Using a PowerPoint for investment portfolio optimization can help visualize complex financial data and strategies. It allows investors to present and communicate their optimization strategies effectively to clients, colleagues, or partners.

When creating an investment portfolio optimization PowerPoint, it's important to consider the following:

- The specific optimization methods and strategies used, such as mean-variance optimization or conditional value-at-risk.

- The time range and portfolio assets being considered.

- Any constraints or limitations, such as regulatory requirements, illiquidity, or tax implications.

- The level of risk aversion and the desired level of diversification.