Foreign Direct Investment (FDI) is a term used to describe an investment made by a company or individual in a foreign country, where the investor has a significant degree of control over the business or asset being invested in. In simpler terms, it's when a company from one country invests in a business or buys assets in another country, often with the goal of gaining a long-term interest in the new market. This can involve establishing a new business, acquiring an existing one, or expanding an existing business into a new country. FDI is a crucial aspect of the global economy, as it can bring capital, technology, and expertise to developing nations, fostering economic growth and development.

| Characteristics | Values |

|---|---|

| Definition | Foreign Direct Investment (FDI) is when a company or individual from one country invests in a business or asset in another country. |

| Investment Types | Horizontal FDI (establishing operations in a foreign market to produce the same goods as in the home country), Vertical FDI (expanding operations along the production chain), Conglomerate FDI (diversifying into new markets or industries). |

| Motivation | Access to new markets, resources, lower production costs, tax incentives, and economic development. |

| Impact | Job creation, technology transfer, increased competition, and economic growth in the host country. |

| Examples | A US company building a factory in Mexico, an Indian IT firm opening an office in the UK, or an investor buying property in a foreign country. |

| Regulatory Considerations | Host countries often have regulations and policies to attract FDI, including tax benefits, special economic zones, and investment promotion agencies. |

| Risks | Political instability, currency fluctuations, cultural barriers, and potential for exploitation by host countries. |

| Recent Trends | Increased focus on sustainable and responsible FDI, with a rise in green investments and investments in developing countries. |

What You'll Learn

- Foreign Direct Investment (FDI) is when a company invests in a business in another country

- FDI involves ownership or control of assets in a foreign country

- It can be in the form of equity, loans, or other financial instruments

- FDI often aims to gain a long-term economic benefit

- Governments may encourage FDI to boost economic growth and development

Foreign Direct Investment (FDI) is when a company invests in a business in another country

Foreign Direct Investment (FDI) is a powerful tool for businesses looking to expand their reach and tap into new markets. It involves a company investing in a business or asset in a different country, often with the goal of establishing a long-term presence and gaining a competitive edge. This type of investment is a strategic move that can bring numerous benefits to both the investing company and the host country.

In simple terms, FDI occurs when a company from one country decides to set up operations, acquire assets, or establish a subsidiary in another country. This could involve purchasing a local business, building a new facility, or even merging with a foreign company. The primary objective is to gain control over the operations and management of the new venture, ensuring a more significant impact on the host country's economy. For instance, a tech company might acquire a software development firm in a foreign country to access their talent pool and integrate their expertise into their own operations.

This investment is a significant driver of economic growth and development. When a company invests directly in a foreign country, it brings capital, technology, and expertise to that nation. This can lead to the creation of jobs, improved infrastructure, and the transfer of knowledge and skills to local workers. The host country benefits from increased foreign exchange reserves, improved trade balances, and the potential for long-term economic stability.

FDI also allows companies to diversify their operations and reduce risks associated with relying solely on their domestic market. By investing abroad, businesses can access new consumer bases, resources, and talent, which can lead to increased productivity and innovation. Moreover, it provides an opportunity to learn from different business cultures and practices, enabling companies to adapt and improve their strategies.

In summary, Foreign Direct Investment is a strategic move where a company expands its operations by investing in a business in another country. This investment has far-reaching benefits, from economic growth and job creation to knowledge transfer and market expansion. It is a powerful tool for businesses seeking to globalize their operations and contribute to the development of host countries.

Understanding the Difference: Long-Term Assets vs. PPE

You may want to see also

FDI involves ownership or control of assets in a foreign country

Foreign Direct Investment (FDI) is a term used to describe a significant and strategic investment made by a company or individual in a business or asset located in another country. It involves a substantial financial commitment and often represents a long-term interest in the host country's economy. At its core, FDI is about gaining ownership or control over assets, which can be tangible or intangible, in a foreign market. This ownership can take various forms, such as acquiring a significant stake in a local company, establishing a new business venture, or merging with an existing foreign enterprise.

When a company decides to invest in a foreign country, it typically aims to establish a presence that goes beyond a simple trade relationship. FDI often involves a more profound and lasting connection, where the investor seeks to influence and manage the operations of the acquired or established business. This could mean having a say in strategic decisions, appointing key personnel, and contributing to the overall management and direction of the foreign venture. The investor's goal is to create a sustainable and profitable relationship with the host country's market, often with the intention of generating returns on their investment over an extended period.

The assets that are the subject of FDI can be diverse. They may include physical assets like land, buildings, machinery, or natural resources. For instance, a company might invest in purchasing a factory in a foreign country to set up manufacturing operations. Alternatively, FDI can also involve intangible assets, such as intellectual property, trademarks, or even management expertise. In the digital age, FDI has expanded to include investments in technology infrastructure, software development, and online platforms, further showcasing the diverse nature of assets that can be the focus of foreign direct investment.

FDI is a powerful tool for international business expansion, as it allows companies to tap into new markets, access resources, and gain a competitive edge. It fosters economic growth and development in the host country by creating jobs, transferring knowledge and technology, and contributing to infrastructure development. Moreover, FDI can lead to increased competition, improved product quality, and the adoption of best practices in the local business environment. This, in turn, can benefit consumers and local businesses alike, creating a more dynamic and efficient market.

In summary, FDI involves a substantial investment that grants ownership or control over assets in a foreign country. It is a strategic move that enables businesses to expand globally, establish a local presence, and influence the operations of foreign ventures. FDI has the potential to drive economic growth, create opportunities, and foster international cooperation, making it a vital concept in the global business landscape. Understanding FDI is essential for businesses looking to expand internationally and for policymakers aiming to attract foreign investment to stimulate economic development.

Securing Wealth: Exploring the Safest Long-Term Investment Strategies

You may want to see also

It can be in the form of equity, loans, or other financial instruments

Foreign Direct Investment (FDI) is a type of investment where a company or individual from one country invests in a business or asset in another country. It involves establishing a lasting interest in a business enterprise located in a different country, with the primary goal of generating a financial return or profit. FDI is a crucial aspect of international trade and economic development, as it facilitates the flow of capital, technology, and expertise across borders.

When it comes to the forms of FDI, it can take various shapes, and understanding these is essential to grasp the concept fully. One common form is equity investment, where an investor provides capital to a foreign company in exchange for a share of ownership or equity in that company. This allows the investor to have a long-term stake in the business, enabling them to influence decision-making and benefit from the company's growth. For instance, a multinational corporation might invest in a foreign market by acquiring a local company, thereby gaining a significant equity stake and establishing a presence in that country.

Another form of FDI is loan or debt investment. In this case, an investor provides financial assistance to a foreign entity in the form of a loan, often with the expectation of interest payments and the eventual repayment of the principal amount. This type of investment can be particularly useful for businesses in developing countries that require capital for expansion or operational needs. For example, a foreign investor might lend funds to a local startup, helping them grow their business while also generating a return on their investment.

Additionally, FDI can also be structured as a combination of equity and debt, or through other financial instruments. This flexibility allows investors to tailor their investments to specific opportunities and risks. For instance, an investor might provide a mix of equity and loan financing to a foreign venture, offering both capital and strategic guidance. Other financial instruments could include guarantees, insurance, or even joint ventures, where two or more companies collaborate to invest in a new project or expand their operations internationally.

Understanding these different forms of FDI is crucial for businesses and investors looking to navigate the global market. It enables them to make informed decisions, assess risks, and maximize the potential benefits of international investments. By recognizing the various ways FDI can be structured, companies can effectively utilize this powerful tool for economic growth and expansion on a global scale.

Exploring Long-Term Investment Strategies: Building Wealth for the Future

You may want to see also

FDI often aims to gain a long-term economic benefit

Foreign Direct Investment (FDI) is a powerful tool for businesses and governments seeking to expand their global reach and gain a competitive edge in the international market. At its core, FDI involves an investment made by a company or individual in one country into business interests or assets in another country. This investment is typically aimed at establishing a long-term economic benefit, which can take various forms.

One of the primary goals of FDI is to create a sustainable and profitable venture in the host country. Investors often seek to acquire or establish a significant stake in a local business, allowing them to influence decision-making and strategic direction. By doing so, they can tap into new markets, access resources, and leverage the host country's economic advantages. For instance, a technology company might invest in a local startup to gain access to its innovative talent pool and local market knowledge, ultimately leading to a more robust and competitive global presence.

FDI often involves the transfer of capital, technology, and expertise from the investor's home country to the host nation. This transfer can stimulate economic growth and development in the recipient country. For example, an investor might bring advanced manufacturing techniques or management practices to a developing nation, improving productivity and potentially creating a ripple effect of positive economic changes. Over time, this can lead to increased local employment, improved infrastructure, and a more robust economy.

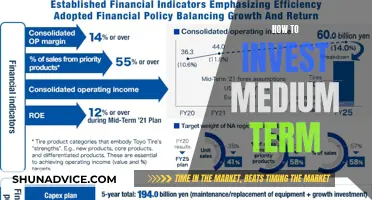

The long-term benefit of FDI is also evident in the potential for increased profitability and market share. Investors aim to build sustainable businesses that can generate returns over an extended period. This often involves diversifying revenue streams, expanding product or service offerings, and establishing a strong brand presence in the host market. By doing so, FDI can contribute to the overall economic growth and stability of the host country, making it an attractive strategy for businesses seeking global expansion.

In summary, FDI is a strategic investment approach that enables companies to expand internationally while aiming for long-term economic gains. It involves a careful consideration of market opportunities, cultural factors, and the potential for positive economic impact. Through FDI, businesses can establish a global footprint, transfer valuable assets, and contribute to the economic development of host countries, all while securing their own competitive advantage in the global marketplace.

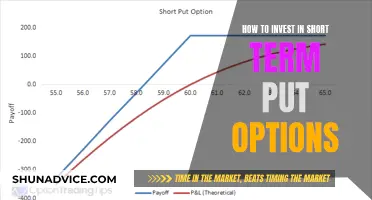

Understanding Short-Term Investments: Key Traits and Strategies

You may want to see also

Governments may encourage FDI to boost economic growth and development

Foreign Direct Investment (FDI) is a powerful tool that governments can utilize to stimulate economic growth and development within their countries. It involves an investment made by a company or individual in one country into business interests located in another country. This type of investment is significant because it brings capital, technology, and expertise from abroad, fostering economic growth and creating opportunities for the host country's economy.

Governments often play a crucial role in encouraging FDI as they can implement policies and strategies to attract foreign investors. One common approach is to offer incentives such as tax breaks, subsidies, or special economic zones with favorable regulations. These incentives aim to reduce the financial burden on foreign investors, making their operations more profitable and attractive. By doing so, governments can create a conducive environment for FDI, encouraging foreign companies to establish a presence in the country.

The benefits of FDI for economic growth are numerous. Firstly, it brings in much-needed capital, which can be used for infrastructure development, research and development, and job creation. Foreign investors often bring advanced technologies and management practices, leading to increased productivity and efficiency in the host country's industries. This can result in the modernization of local businesses and the development of new industries, ultimately diversifying the economy.

Moreover, FDI can contribute to the transfer of knowledge and skills. Foreign investors often bring their expertise and training programs, which can be shared with local employees, leading to skill development and capacity building. This knowledge transfer can enhance the overall human capital of the host country, making its workforce more competitive and adaptable to global market demands.

In addition, FDI can have a positive impact on the local community. It can create job opportunities, reduce unemployment rates, and improve the standard of living for residents. Foreign companies may also contribute to the development of supporting industries, such as suppliers and service providers, further stimulating economic activity and creating a network of interdependent businesses.

In summary, governments can effectively utilize FDI as a catalyst for economic growth and development. By implementing strategic policies and offering incentives, they can attract foreign investors, leading to increased capital inflows, technology transfer, and skill development. The positive effects of FDI can have a lasting impact on the host country's economy, creating a more prosperous and globally competitive nation.

Long-Term Investing: The Ultimate Strategy for Wealth Creation

You may want to see also

Frequently asked questions

Foreign Direct Investment is when a company or individual from one country invests in a business or project in another country. This investment is usually aimed at establishing a long-term relationship and gaining a significant degree of control over the business in the host country.

FDI is unique because it involves a lasting interest in the host company, often with the investor having a degree of control or ownership. This is in contrast to portfolio investments, where money is invested in a company's shares without seeking control. FDI also differs from portfolio investments in that it is typically a long-term commitment.

FDI can bring numerous advantages to the host country. It can lead to job creation, technology transfer, and improved infrastructure. Investors often bring new skills and knowledge, which can enhance the local economy. FDI can also attract further investment, creating a positive cycle of economic growth.

Foreign investors can bring new business practices and management techniques, which can improve the efficiency of local companies. They may also provide access to international markets, helping local businesses expand their reach. FDI can also lead to increased competition, which can drive innovation and improve product/service quality.

While FDI is generally beneficial, there can be challenges. One concern is the potential for environmental degradation if proper regulations are not in place. Additionally, there might be cultural or social impacts on the host country, especially if the investment leads to significant changes in local industries or communities.