Exchange-Traded Funds (ETFs) are a popular investment vehicle that offers investors a way to diversify their portfolios and gain exposure to various markets and asset classes. When considering ETFs as a long-term investment strategy, it's important to understand their unique characteristics and how they can fit into a well-rounded investment plan. ETFs are designed to track an index, sector, or specific investment strategy, providing investors with a cost-effective and efficient way to invest in a basket of securities. Over the long term, ETFs have demonstrated the potential to provide stable returns, making them an attractive option for investors seeking to build wealth over an extended period. This introduction sets the stage for a discussion on the suitability of ETFs for long-term investment goals.

What You'll Learn

- Historical Performance: ETFs have shown consistent long-term growth, outpacing traditional stocks

- Diversification Benefits: ETFs offer broad market exposure, reducing risk over time

- Low Costs: Management fees are typically lower, making ETFs cost-effective for long-term investors

- Tax Efficiency: ETFs may generate fewer taxable events, appealing for long-term wealth building

- Liquidity and Flexibility: ETFs can be traded like stocks, allowing for quick adjustments in a long-term strategy

Historical Performance: ETFs have shown consistent long-term growth, outpacing traditional stocks

The historical performance of Exchange-Traded Funds (ETFs) reveals a compelling trend that has attracted investors seeking long-term growth. Over the past several decades, ETFs have consistently demonstrated an ability to outperform traditional stocks, making them an attractive option for those aiming to build wealth over time. This performance is particularly notable when compared to the broader market, as ETFs have often provided a more stable and diversified approach to investing.

One key factor contributing to the long-term success of ETFs is their low-cost structure. ETFs typically have lower expense ratios compared to actively managed mutual funds, allowing investors to keep more of their returns. This cost efficiency, combined with the ability to track a diverse range of assets, has made ETFs a popular choice for long-term investors. For instance, the SPDR S&P 500 ETF (SPY), one of the oldest and most widely held ETFs, has consistently grown over the years, outpacing the performance of the S&P 500 index.

Historical data also shows that ETFs have provided a more stable investment journey. During market downturns, ETFs often exhibit less volatility compared to individual stocks, as they hold a basket of securities. This diversification reduces the impact of any single stock's performance on the overall fund, making ETFs a more reliable long-term investment strategy. For example, during the 2008 financial crisis, many equity ETFs experienced losses, but the overall impact was less severe compared to the losses incurred by individual stocks.

Furthermore, the long-term growth of ETFs can be attributed to their ability to track various market indices. ETFs are designed to mirror the performance of a specific index, such as the S&P 500, NASDAQ-100, or even international markets. This indexing approach has proven to be highly effective over time, as it provides investors with broad market exposure and a low-cost way to gain access to diverse asset classes. The consistency of this performance has been a significant draw for investors seeking a steady, long-term return.

In summary, the historical performance of ETFs indicates a strong case for their use as a long-term investment strategy. Their consistent growth, low costs, and ability to provide stable, diversified exposure to various markets make ETFs an attractive option for investors looking to build wealth over an extended period. As with any investment, careful consideration and research are essential, but the data suggests that ETFs have the potential to outperform traditional stocks in the long run.

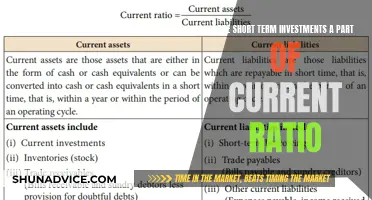

Understanding Short-Term Investments: Are They Current Assets?

You may want to see also

Diversification Benefits: ETFs offer broad market exposure, reducing risk over time

The concept of diversification is a cornerstone of long-term investing, and Exchange-Traded Funds (ETFs) are a powerful tool to achieve this. ETFs provide investors with a way to gain broad exposure to various markets, sectors, or asset classes, which can significantly reduce risk over time. This is particularly important for long-term investors who aim to build a resilient portfolio that can weather market volatility.

One of the key advantages of ETFs is their ability to offer instant diversification. Instead of buying individual stocks or bonds, which can be risky and time-consuming, ETFs allow investors to own a basket of securities in a single transaction. For example, an investor can purchase an ETF that tracks the S&P 500, instantly gaining exposure to 500 of the largest U.S. companies across various sectors. This broad market exposure helps to spread risk, as the performance of the ETF is not reliant on the success of a single company but rather the overall market.

Over time, this diversification effect can lead to more stable returns. When the market experiences a downturn, not all sectors will be affected equally, and some may even perform well. By holding a diverse range of assets, ETFs can help investors avoid the pitfalls of individual stock selection and market timing. For instance, during a tech stock bubble, an ETF that includes a mix of technology, healthcare, and consumer staples companies will likely experience less extreme volatility compared to a portfolio heavily weighted towards tech stocks.

Additionally, ETFs often have lower fees and expenses compared to actively managed mutual funds, making them an attractive option for cost-conscious investors. Lower fees mean more of the investment returns are retained by the investor, further enhancing the long-term benefits of diversification. This cost-efficiency is particularly important when building a large, diversified portfolio, as it ensures that more of the investment growth goes towards the investor's financial goals.

In summary, ETFs provide a practical and efficient way to achieve broad market exposure, which is a critical component of long-term investing. By offering instant diversification, ETFs help reduce the risk associated with individual stock selection and market volatility. This makes ETFs an excellent choice for investors seeking a balanced approach to building a resilient and stable investment portfolio over time.

Maximizing Returns: Smart Short-Term Investment Strategies

You may want to see also

Low Costs: Management fees are typically lower, making ETFs cost-effective for long-term investors

When considering long-term investments, Exchange-Traded Funds (ETFs) offer a compelling option for investors who prioritize cost-efficiency. One of the key advantages of ETFs is their low-cost structure, which makes them an attractive choice for those aiming to build wealth over an extended period. Management fees, a significant component of the overall expense ratio, are typically lower for ETFs compared to actively managed mutual funds. This reduced cost is primarily due to the passive nature of ETF management, where the fund tracks an index or a specific market segment, requiring less active intervention.

The lower management fees associated with ETFs contribute to their overall cost-effectiveness. Over time, these savings can accumulate and significantly impact an investor's returns. For instance, a study comparing the expense ratios of ETFs and mutual funds over a decade revealed that ETFs generally incur lower costs, which can result in higher net asset values and, consequently, higher returns for investors. This is particularly beneficial for long-term investors who aim to maximize their gains while minimizing expenses.

Additionally, the low-cost structure of ETFs is further enhanced by their tax efficiency. ETFs generally experience lower turnover rates compared to actively managed funds, leading to reduced capital gains distributions. This means that investors are less likely to incur short-term tax liabilities, which can eat into their long-term gains. As a result, ETFs provide a more tax-efficient way to invest, especially for those who hold their positions for extended periods.

For long-term investors, the cost savings associated with ETFs can be substantial. By keeping management fees and other expenses low, ETFs enable investors to retain a larger portion of their returns, which can compound over time. This is a critical factor in building wealth, as it allows investors to benefit from the power of compounding without incurring excessive fees that can erode returns.

In summary, the low management fees associated with ETFs make them a cost-effective choice for long-term investors. This cost advantage, combined with tax efficiency, contributes to the overall attractiveness of ETFs as a long-term investment strategy. By minimizing expenses, investors can maximize their potential returns and build a more substantial portfolio over time.

CDs: Long-Term Savings or Short-Term Strategy?

You may want to see also

Tax Efficiency: ETFs may generate fewer taxable events, appealing for long-term wealth building

When considering long-term investments, tax efficiency is a crucial factor that can significantly impact your wealth-building strategy. Exchange-Traded Funds (ETFs) offer a unique advantage in this regard, making them an attractive option for investors aiming to build long-term wealth. One of the key benefits of ETFs is their ability to minimize taxable events, which can be particularly advantageous for long-term investors.

In traditional investment portfolios, frequent buying and selling of individual stocks or mutual funds can lead to a higher tax burden. This is because each transaction may trigger capital gains taxes, which can eat into your investment returns. ETFs, on the other hand, offer a more tax-efficient approach. They are designed to track an index, and as a result, they typically hold their positions for extended periods. This means that ETFs generally experience fewer transactions, reducing the likelihood of triggering capital gains taxes.

The tax efficiency of ETFs is particularly appealing for long-term wealth accumulation. Over time, the accumulation of small tax liabilities can add up, potentially eroding the overall returns of your investment. By minimizing these taxable events, ETFs allow investors to retain a larger portion of their gains, which can contribute to the growth of their investment portfolios. This is especially beneficial for investors who are looking to build wealth over an extended period, as it enables them to make the most of their investment strategies without incurring excessive tax costs.

Additionally, ETFs often provide investors with the opportunity to diversify their portfolios across various assets, sectors, or markets. This diversification can further enhance tax efficiency by spreading out the tax implications of transactions. When an ETF rebalances its holdings or adjusts its composition, it may sell some assets and buy others, but these transactions are often less frequent and less likely to trigger significant tax consequences.

In summary, ETFs offer a compelling solution for investors seeking tax-efficient long-term wealth-building strategies. Their ability to minimize taxable events, combined with the potential for diversification, makes them a valuable tool in an investor's arsenal. By understanding and utilizing the tax advantages of ETFs, investors can optimize their portfolios and potentially achieve their financial goals more effectively.

Understanding NAV: The Key to Investment Clarity

You may want to see also

Liquidity and Flexibility: ETFs can be traded like stocks, allowing for quick adjustments in a long-term strategy

The concept of liquidity and flexibility is a key advantage of Exchange-Traded Funds (ETFs) when considering them as a long-term investment strategy. ETFs offer investors a unique blend of benefits that can be particularly appealing for those looking to build a long-term portfolio. One of the most significant advantages is the ability to trade ETFs like stocks, which provides investors with a high level of liquidity.

Liquidity refers to how easily an asset can be converted into cash without significantly impacting its price. ETFs, being listed on stock exchanges, can be bought and sold throughout the trading day, similar to individual stocks. This real-time trading capability allows investors to make adjustments to their portfolio quickly and efficiently. For long-term investors, this means they can react swiftly to market changes, rebalance their holdings, or take advantage of emerging opportunities without the delays often associated with other investment vehicles.

The trading flexibility of ETFs is another critical aspect. Investors can easily buy or sell ETFs during the trading day, which is especially useful when implementing a long-term strategy. For instance, if an investor identifies a sector that is expected to grow significantly over the next few years, they can quickly purchase the corresponding ETF to gain exposure to that sector. Conversely, if a holding is underperforming, the investor can sell the ETF to reallocate capital to more promising opportunities. This ability to make rapid changes in response to market dynamics or personal investment goals is a significant advantage of ETFs over other investment vehicles, such as mutual funds, which typically have a longer settlement period.

Furthermore, the liquidity and flexibility of ETFs enable investors to implement various long-term investment strategies. For example, investors can use ETFs to create a diversified portfolio, allowing them to spread risk across different asset classes, sectors, or geographic regions. This diversification can be adjusted over time as market conditions change, ensuring that the portfolio remains aligned with the investor's long-term objectives. Additionally, ETFs can be used for tactical trading, where investors can take advantage of short-term market movements while still maintaining a long-term perspective.

In summary, the liquidity and flexibility of ETFs, facilitated by their stock-like trading nature, make them an attractive option for long-term investors. This feature enables investors to quickly adapt to market changes, rebalance their portfolios, and implement various investment strategies, all while benefiting from the cost-efficiency and transparency associated with ETFs. By leveraging these advantages, investors can build and manage a dynamic, responsive portfolio that aligns with their long-term financial goals.

Long-Term Investment Strategies: Navigating the Market's Future

You may want to see also

Frequently asked questions

Yes, Exchange-Traded Funds (ETFs) can be an excellent choice for long-term investors. ETFs are designed to track an index, sector, commodity, or other assets, and they offer a diversified portfolio of securities. This diversification can help reduce risk over the long term, as individual stock volatility is mitigated by the overall performance of the fund. ETFs also have the advantage of low costs and high liquidity, making them accessible and efficient for investors with long-term financial goals.

ETFs and mutual funds both provide a way to invest in a diversified portfolio, but there are some key differences. ETFs trade on an exchange like a stock, which means they can be bought and sold throughout the day, providing more flexibility for investors. Mutual funds, on the other hand, are bought and sold at the end of the trading day at a price based on the fund's net asset value (NAV). ETFs often have lower expense ratios compared to actively managed mutual funds, making them a cost-effective option for long-term investors.

Absolutely! ETFs can be a powerful tool for retirement planning. They offer a simple and cost-effective way to invest in a wide range of assets, which can help build wealth over time. Many ETFs are designed to mimic popular market indexes, ensuring a well-rounded investment approach. Additionally, ETFs can be easily incorporated into retirement accounts like IRAs or 401(k)s, providing tax advantages and potential long-term growth. Diversifying your retirement portfolio with various ETFs can help manage risk and provide a steady return over the long haul.