Investment is a fundamental concept in finance, representing the act of allocating money or resources with the expectation of generating an income or profit over time. In simple terms, it involves putting your money to work in various assets or projects to achieve financial growth. This can include buying stocks, bonds, real estate, or even starting a business. The goal is to make your money work for you by utilizing it in a way that can generate returns, whether through interest, dividends, or capital gains. Understanding investment is crucial for anyone looking to build wealth, secure their financial future, or achieve specific financial goals.

What You'll Learn

- Investment is the act of committing money or capital to earn a return

- It involves putting money into assets with the expectation of growth

- Common investment options include stocks, bonds, real estate, and mutual funds

- Understanding risk and return is crucial for successful investing

- Diversification helps manage risk by spreading investments across different asset classes

Investment is the act of committing money or capital to earn a return

Investment is a fundamental concept in personal finance and business, representing the act of allocating money or capital with the expectation of generating a profit or return. It involves a deliberate decision to channel funds into various assets, projects, or ventures, aiming to grow wealth over time. This process is a cornerstone of financial planning and is essential for individuals and organizations seeking to secure their financial future and achieve long-term goals.

In simple terms, investment is about putting your money to work. It means you are not just keeping your cash in a savings account earning minimal interest but instead, you are utilizing it to create something of value. This could be in the form of purchasing stocks, bonds, real estate, starting a business, or even funding a new idea or invention. The primary goal is to make your money work harder by investing in something that has the potential to appreciate in value or generate income.

When you invest, you are essentially taking a risk, but one that is carefully calculated. You are betting that the asset or venture you are investing in will perform as expected, leading to a positive return. This return can come in various forms, such as capital gains (an increase in the value of the investment), dividends (a portion of the profits paid to investors), or interest (earned on savings or loans). The key is to identify opportunities that offer a reasonable chance of a positive outcome while managing the associated risks.

Investment strategies can vary widely, from long-term buy-and-hold approaches to short-term, more aggressive tactics. Diversification is a common strategy, where investors spread their money across different asset classes to minimize risk. This might include a mix of stocks, bonds, real estate, and alternative investments like commodities or derivatives. Each asset class has its own level of risk and potential return, and a well-diversified portfolio can help investors weather market volatility.

Understanding investment is crucial for anyone looking to build wealth and achieve financial independence. It requires a combination of knowledge, research, and discipline. Investors must stay informed about market trends, assess their risk tolerance, and make informed decisions based on their financial goals. Whether it's investing in the stock market, starting a business, or purchasing property, the key is to recognize that investment is a powerful tool for creating financial security and achieving personal or organizational objectives.

Understanding Cash Equivalents: Short-Term Liquid Investments Explained

You may want to see also

It involves putting money into assets with the expectation of growth

Investment, in simple terms, is the act of allocating your money or resources with the goal of increasing your wealth over time. It's a fundamental concept in personal finance and is a key strategy for building long-term financial security. When you invest, you're essentially giving your money the opportunity to grow by purchasing assets that you believe will appreciate in value. This could be anything from stocks and bonds to real estate, commodities, or even your own business. The core idea is to put your money to work, allowing it to earn returns and potentially accumulate wealth.

The process begins with identifying what you want to invest in. This could be a stock of a company you believe in, a piece of property, or a mutual fund that pools money from many investors to invest in a diversified portfolio. The key is to research and choose assets that you think will perform well and provide a return on your investment. This could be through dividends, rental income, or an increase in the asset's value. For example, if you invest in a company's stock, you're essentially buying a small piece of that company, and if the company performs well, the value of your investment can increase.

Once you've made your investment, it's important to monitor its performance. This involves keeping track of the asset's value and any income it generates. Regularly reviewing your investments allows you to make informed decisions about whether to hold, buy more, or sell. It's a dynamic process that requires ongoing attention and adjustment as market conditions and your financial goals evolve.

The beauty of investing is that it offers the potential for long-term wealth creation. Over time, with strategic investments and a bit of patience, your money can grow significantly. This is particularly powerful when considering the power of compound interest, where your earnings also earn interest, leading to exponential growth. However, it's essential to remember that investing also carries risks, and there's always the possibility of losing some or all of your investment.

In summary, investment is about taking calculated risks with your money to achieve growth. It requires research, a long-term perspective, and a willingness to adapt to market changes. By understanding the basics and staying informed, you can make informed decisions about where and how to invest, potentially building a substantial financial future.

Long-Term Investment Strategies: Navigating the Market's Future

You may want to see also

Common investment options include stocks, bonds, real estate, and mutual funds

Investing is essentially putting your money to work with the expectation of generating a return over time. There are numerous ways to invest, each with its own level of risk and potential reward. Here's a breakdown of some common investment options:

Stocks: This is a fundamental building block of investing. When you buy a stock, you're essentially purchasing a small ownership share in a company. For example, if you buy 100 shares of Apple Inc., you own 0.001% of the company. Stocks represent a claim on the company's assets and profits. Investors buy stocks hoping that the company's value will increase over time, allowing them to sell their shares at a higher price in the future. This can be done directly by purchasing individual stocks or through mutual funds or exchange-traded funds (ETFs) that hold a basket of stocks.

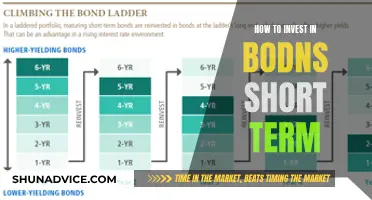

Bonds: Bonds are a type of debt instrument. When you invest in a bond, you're essentially lending money to a government or corporation. In return, the issuer promises to pay you a fixed amount of interest at regular intervals and repay the principal amount (the initial sum you invested) when the bond matures. Bonds are generally considered less risky than stocks but offer lower potential returns. They are a popular choice for conservative investors seeking regular income and capital preservation.

Real Estate: Investing in real estate involves purchasing property, such as residential or commercial buildings, land, or real estate investment trusts (REITs). This can be a direct purchase of a property or through a REIT, which is a company that owns and operates income-generating real estate. Real estate investments offer the potential for rental income, property value appreciation, and tax advantages. However, they often require a significant amount of capital upfront and can be illiquid, meaning it may take time to buy or sell a property.

Mutual Funds: Mutual funds are a way to pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other assets. By investing in a mutual fund, you indirectly own a portion of each security held by the fund. This diversification helps reduce risk because it's not all your money is tied to the performance of a single stock or asset class. Mutual funds are managed by professional fund managers who decide how to allocate the fund's assets. They come in various types, such as equity funds, bond funds, and balanced funds, each with its own level of risk and investment strategy.

These investment options provide a starting point for understanding the diverse world of investing. Each has its own characteristics, risks, and potential rewards, and investors often choose a combination of these options to build a well-rounded investment portfolio. It's important to research and understand the risks and potential returns associated with each investment before making any decisions.

Secure Your Future: Long-Term Investment Strategies for Savvy Investors

You may want to see also

Understanding risk and return is crucial for successful investing

Understanding risk and return is a fundamental concept in investing, and it's crucial to grasp these ideas to make informed decisions about your financial future. In simple terms, risk refers to the possibility of losing some or all of your investment, while return is the profit or gain you expect to make from your investment. These two factors are inextricably linked and play a pivotal role in determining the success of your investment journey.

When you invest, you're essentially entrusting your money to a particular asset or venture with the expectation of generating a positive outcome. This could be anything from stocks and bonds to real estate, commodities, or even your own business. The concept of risk is inherent in any investment, as markets are inherently unpredictable, and external factors can influence the value of your assets. For instance, economic downturns, political instability, or industry-specific challenges can impact the performance of your investments.

Return, on the other hand, is the reward you seek for taking on that risk. It represents the profit or gain you expect to earn from your investment. Returns can be measured in various ways, such as the percentage increase in the value of your investment over time or the annualized rate of return. Understanding the potential return on your investment is essential because it helps you assess whether the risk you're taking is justified. A higher potential return often indicates a higher level of risk, and investors must weigh this carefully.

The relationship between risk and return is often described by the famous saying, "The higher the risk, the higher the potential return." This means that if you're willing to take on more risk, you might also expect a greater reward. For example, investing in small, emerging companies may offer higher potential returns but also carries a higher risk of loss. Conversely, investing in government bonds is generally considered less risky but may provide lower returns.

To make successful investment decisions, it's essential to evaluate your risk tolerance, which is your ability and willingness to withstand potential losses. Understanding your risk tolerance helps you choose investments that align with your financial goals and comfort level with risk. Diversification is also a key strategy to manage risk. By spreading your investments across different asset classes and sectors, you can reduce the impact of any single investment's poor performance on your overall portfolio.

In summary, grasping the concepts of risk and return is vital for investors as it enables them to make strategic choices. It empowers individuals to assess the potential rewards against the associated risks, ensuring that their investment decisions are well-informed and aligned with their financial objectives.

Is CIV a Long-Term Investment? Unlocking the Potential of a Crypto Project

You may want to see also

Diversification helps manage risk by spreading investments across different asset classes

Diversification is a fundamental concept in investing that aims to reduce risk by allocating your investments across various asset classes. It's a strategy that involves not putting all your eggs in one basket, so to speak. By spreading your investments, you're essentially minimizing the potential impact of any single asset's performance on your overall portfolio. This approach is particularly important for long-term investors who want to ensure their financial goals are met, even during market downturns.

The idea behind diversification is to balance your portfolio's risk and return. Different asset classes, such as stocks, bonds, real estate, commodities, and cash, have varying levels of risk and potential returns. For instance, stocks are generally considered riskier but offer higher potential returns over the long term, while bonds are more stable but provide lower returns. By diversifying, you can take advantage of the potential upside of stocks while also having a safety net in the form of bonds or other less volatile assets.

When you diversify, you're not just buying different types of investments; you're also considering different sectors, industries, and geographic regions. This means that even if one sector or region experiences a decline, your overall portfolio may still perform well due to the positive contributions from other areas. For example, if the technology sector takes a hit, your investment in healthcare or consumer staples might still show growth, thus stabilizing your portfolio's performance.

The key to successful diversification is to maintain a balanced allocation across asset classes that aligns with your investment goals and risk tolerance. This requires regular review and adjustment of your portfolio to ensure it remains diversified and continues to meet your objectives. It's a long-term strategy that can help investors navigate market volatility and potentially increase their chances of achieving financial success.

In summary, diversification is a powerful tool for managing risk in investing. By spreading your investments across various asset classes, you can reduce the impact of any single investment's performance and potentially enhance your overall financial returns. This strategy is a cornerstone of prudent investing, allowing investors to build a robust and resilient portfolio.

Disclosing Short-Term Investments: A Guide for Audit Professionals

You may want to see also

Frequently asked questions

Investment is the act of allocating money or other resources with the expectation of generating an income or profit over time. It involves committing funds to various assets or projects with the goal of growing wealth.

When you invest, you typically provide capital to a business, a financial institution, or a government entity. In return, you expect to receive a return on your investment, which can be in the form of interest, dividends, or capital appreciation. The value of your investment can increase over time, and you can withdraw or sell it when you need the funds or when it reaches a desired value.

There are numerous investment options, including stocks, bonds, mutual funds, real estate, commodities, and derivatives. Stocks represent ownership in a company, bonds are loans to governments or corporations, mutual funds pool money from multiple investors to invest in a diversified portfolio, real estate can be physical properties or real estate investment trusts (REITs), and commodities include tangible assets like gold, oil, or agricultural products.

Investing is a way to grow your money and potentially earn a higher return than what traditional savings accounts offer. It allows individuals to build wealth over the long term, plan for retirement, finance education, or achieve other financial goals. By carefully selecting investment vehicles and diversifying, investors can manage risk and potentially benefit from the growth of their investments.