Investing long-term savings is a crucial step towards building wealth and achieving financial goals. It involves a strategic approach to managing your money, allowing it to grow over time through various investment vehicles. This guide will explore the key considerations and strategies for long-term investing, including understanding your risk tolerance, setting clear financial objectives, and diversifying your portfolio to optimize returns while managing risk effectively. By following these principles, you can make informed decisions to secure your financial future and potentially achieve significant wealth accumulation.

What You'll Learn

- Diversify: Spread investments across asset classes for risk management

- Research: Study market trends, historical data, and expert insights

- Set Goals: Define financial objectives for retirement, education, or emergencies

- Risk Tolerance: Assess your ability to withstand market volatility

- Tax Efficiency: Optimize savings by understanding tax-advantaged investment options

Diversify: Spread investments across asset classes for risk management

When it comes to long-term savings, diversification is a key strategy to manage risk and optimize returns. The concept is simple: instead of putting all your eggs in one basket, you spread your investments across different asset classes to reduce the impact of any single asset's performance on your overall portfolio. This approach is a fundamental principle in investing, often recommended by financial advisors to ensure stability and growth over time.

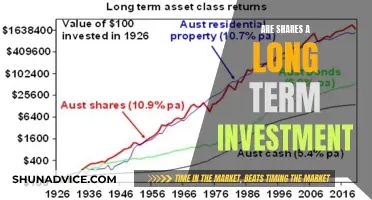

Asset classes are broad categories of investments, each with its own characteristics and risk levels. Common asset classes include stocks, bonds, real estate, commodities, and cash equivalents. By diversifying, you aim to capture the benefits of each asset class while minimizing the risks associated with any one of them. For instance, stocks generally offer higher potential returns but come with higher risk, while bonds are considered safer but may provide lower returns. Real estate and commodities can offer diversification benefits, especially in volatile markets.

The idea is to allocate your savings in a way that reflects your risk tolerance and investment goals. A common strategy is to use a percentage-based approach, where you decide on a target allocation for each asset class. For example, you might allocate 60% of your portfolio to stocks, 30% to bonds, and the remaining 10% to alternative investments like real estate funds or commodities. This allocation can be adjusted over time based on market conditions and your changing financial goals.

Diversification also involves investing in different sectors and industries within each asset class. For instance, within the stock market, you can choose between technology, healthcare, financial, or consumer goods sectors, each with its own unique characteristics and risks. This further reduces the impact of any single company or industry's performance on your portfolio.

By diversifying across asset classes, you create a balanced investment strategy that can weather market volatility. This approach is particularly important for long-term savings, as it allows your investments to grow and compound over time, providing a more stable and secure financial future. It's a fundamental step in building a robust investment portfolio that aligns with your financial objectives.

Maximizing Long-Term Investment Returns: Understanding the Time Horizon

You may want to see also

Research: Study market trends, historical data, and expert insights

Before diving into long-term savings and investments, it's crucial to arm yourself with knowledge. This research phase is where you lay the foundation for your investment journey. Here's a breakdown of what you should focus on:

Market Trends:

- Identify Asset Classes: Understand the different types of investments available (stocks, bonds, real estate, commodities, etc.). Each asset class has its own characteristics, risks, and potential returns.

- Study Market Cycles: Markets don't move in a straight line. They fluctuate based on economic conditions, geopolitical events, and investor sentiment. Learning about market cycles can help you anticipate potential ups and downs.

- Sector Analysis: Different sectors (technology, healthcare, energy, etc.) perform differently over time. Researching sector-specific trends can help you identify areas with strong growth potential.

Historical Data:

- Past Performance: Look at historical returns of various investment options. While past performance doesn't guarantee future results, it can provide valuable insights into how different assets have behaved over time.

- Volatility Analysis: Understand the volatility (risk) associated with different investments. Historically volatile assets might offer higher returns but also come with greater risk.

- Long-Term Trends: Analyze long-term trends in the market. This can help you identify patterns and make more informed decisions about your investment strategy.

Expert Insights:

- Financial Advisors: Consult with financial advisors or investment professionals. They can provide personalized advice based on your financial goals, risk tolerance, and time horizon.

- Research Reports: Read research reports from reputable sources like investment banks, brokerage firms, and financial publications. These reports often offer in-depth analysis and insights into specific industries, sectors, or investment strategies.

- Online Resources: There are numerous online resources, blogs, and forums where experts share their insights and opinions. However, be cautious and verify the credibility of the sources.

Remember:

- Don't Rely Solely on One Source: Cross-reference information from multiple sources to get a well-rounded understanding.

- Stay Informed: The investment landscape is constantly evolving. Stay updated on market news, economic indicators, and regulatory changes that could impact your investments.

- Diversify Your Research: Explore different perspectives and approaches to gain a comprehensive view of the market and investment opportunities.

Unlocking Intermediate-Term Wealth: Strategies for Smart Investing

You may want to see also

Set Goals: Define financial objectives for retirement, education, or emergencies

When it comes to investing your long-term savings, setting clear and defined goals is an essential first step. This process involves a deep understanding of your financial aspirations and priorities, ensuring that your investment strategy is tailored to your unique needs. Here's a guide on how to set these goals effectively:

Retirement Planning:

Start by envisioning your ideal retirement lifestyle. Consider the age at which you plan to retire and the number of years you aim to enjoy this retirement phase. Calculate the estimated costs of living during retirement, including daily expenses, travel, hobbies, and any anticipated major purchases. This calculation will give you a target amount you need to accumulate. For instance, if you envision a retirement budget of $40,000 per year, and you plan to retire at 65, you might aim to save a substantial amount over the next few decades to reach this goal.

Education Funds:

If you have children or plan to support their education, setting educational savings goals is crucial. Determine the cost of your desired education, whether it's a college degree, vocational training, or a specific skill-building program. Research the average tuition fees and associated expenses for the institutions you're considering. For instance, if you aim to save for your child's college education, which typically costs $20,000 per year, and they plan to attend university for four years, you can calculate the total amount needed and start investing accordingly.

Emergency Funds:

Life often presents unexpected financial challenges, and having an emergency fund is crucial. Set a goal to save a specific amount that will cover your living expenses for a certain period, typically 3 to 6 months. This fund will provide a safety net for unforeseen circumstances, such as medical emergencies, job loss, or home repairs. For example, if your monthly expenses amount to $2,000, an emergency fund goal of $6,000 to $12,000 could be a realistic target.

Defining these financial objectives is a critical step in the investment process, as it allows you to create a structured plan. It enables you to choose appropriate investment vehicles, such as stocks, bonds, mutual funds, or real estate, each offering different levels of risk and potential returns. By setting clear goals, you can make informed decisions about asset allocation, regularly review and adjust your strategy, and stay motivated to work towards your financial milestones. Remember, the key is to make these goals specific, measurable, and achievable, ensuring that your long-term savings strategy is well-defined and aligned with your personal financial vision.

Maximizing Returns: The Power of Long-Term Investment Strategies

You may want to see also

Risk Tolerance: Assess your ability to withstand market volatility

When it comes to investing your long-term savings, understanding your risk tolerance is crucial. It's a measure of how comfortable you are with the potential ups and downs of the market. This assessment is essential because it directly influences the types of investments you make and can significantly impact your financial journey. Here's a guide to help you evaluate your risk tolerance and make informed decisions:

- Define Your Investment Goals: Before diving into risk tolerance, consider your financial goals. Are you saving for retirement, a child's education, or a specific purchase? Short-term goals might require a more conservative approach, while long-term goals, like retirement, often benefit from a higher risk tolerance. Understanding your goals will help you determine the level of risk you're willing to take. For instance, if you need the money in a few years for a down payment on a house, you might opt for less volatile investments to avoid potential losses.

- Evaluate Your Emotional Comfort: Risk tolerance is not just about numbers; it's also about your emotional comfort with market fluctuations. Markets can be unpredictable, and investing involves a degree of uncertainty. Some individuals can handle market volatility better than others. If the thought of a market decline makes you anxious, you might prefer a more conservative strategy. Conversely, if you're comfortable with short-term market swings and believe in the long-term growth potential, you may be inclined towards riskier investments.

- Assess Your Time Horizon: Your investment time horizon is the period for which you plan to hold an investment. Longer time horizons often allow for more risk as there's more time to recover from potential losses. Younger investors, for instance, might be more inclined to take on higher risks since they have decades to weather market storms. In contrast, someone approaching retirement might opt for more conservative investments to preserve capital.

- Understand Risk Types: Risk tolerance assessment involves recognizing different types of risk. Market risk refers to the potential for losses due to market fluctuations. Credit risk is the possibility of default on debt obligations, and liquidity risk is the difficulty in converting an asset into cash without impacting its value. Understanding these risks will help you make informed choices. For instance, if you're risk-averse, you might prefer government bonds over high-risk, high-reward stocks.

- Create a Diversified Portfolio: Diversification is a key strategy to manage risk. It involves spreading your investments across various asset classes like stocks, bonds, real estate, and commodities. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. This approach ensures that even if one investment underperforms, others may compensate, providing a more stable investment experience.

- Regularly Review and Adjust: Risk tolerance is not a static concept; it can change over time. Life events, financial goals, and market conditions may prompt a reevaluation of your risk tolerance. Regularly reviewing your portfolio and adjusting your asset allocation accordingly is essential. For example, as you get closer to retirement, you might reduce your exposure to risky assets to preserve capital.

In summary, assessing your risk tolerance is a critical step in investing long-term savings. It involves understanding your goals, emotional comfort, time horizon, and the various types of risks associated with investments. By creating a diversified portfolio and regularly reviewing your strategy, you can navigate the market with confidence, ensuring your investments align with your financial aspirations. Remember, investing is a long-term journey, and a well-thought-out risk tolerance assessment will guide you towards success.

Unlocking Short-Term Gains: The Matching Concept's Role

You may want to see also

Tax Efficiency: Optimize savings by understanding tax-advantaged investment options

When it comes to long-term savings, tax efficiency is a crucial aspect to consider as it can significantly impact your overall returns. Understanding tax-advantaged investment options is a smart strategy to optimize your savings and potentially grow your wealth over time. Here's a guide to help you navigate this important aspect of investing:

Tax-Efficient Investment Strategies: One of the primary goals of tax-efficient investing is to minimize the impact of taxes on your investment gains. This can be achieved through various strategies. Firstly, consider contributing to tax-advantaged retirement accounts such as a 401(k) or an Individual Retirement Account (IRA). These accounts offer tax benefits, allowing your savings to grow faster. For instance, contributions to traditional IRAs may be tax-deductible, providing an immediate tax benefit. Additionally, investments within these accounts often grow tax-free until withdrawals are made, which can be a significant advantage over time. Another strategy is to invest in tax-efficient mutual funds or exchange-traded funds (ETFs) that focus on long-term growth. These funds typically have lower tax liabilities due to their investment approach, which can result in higher after-tax returns for investors.

Tax-Efficient Asset Allocation: Diversification is key to long-term success, and it also plays a role in tax efficiency. By allocating your investments across different asset classes, you can take advantage of tax-efficient options. For example, investing in a mix of stocks, bonds, and real estate can provide tax benefits. Stocks and real estate investments may offer tax advantages through depreciation or tax credits. Proper asset allocation ensures that you're not concentrating your investments in a single tax category, which could lead to higher tax implications.

Long-Term Holding Periods: Holding your investments for the long term is a powerful strategy to minimize taxes. When you invest for the long term, you benefit from lower short-term capital gains taxes, which are typically higher than long-term rates. Long-term capital gains taxes are often more favorable, especially for higher-income earners. This strategy encourages investors to stay invested through market fluctuations, allowing their savings to grow and potentially accumulate more wealth over time.

Tax-Loss Harvesting: This strategy involves selling investments that have decreased in value to offset capital gains from other investments. By realizing losses, you can use them to reduce the tax burden on future gains. Tax-loss harvesting is particularly useful for investors with a mix of winning and losing positions. It allows you to manage your tax liability while potentially realizing gains from other investments.

Consultation and Professional Advice: Given the complexity of tax laws and investment options, seeking professional advice is highly recommended. Financial advisors or tax professionals can provide tailored strategies based on your specific circumstances. They can help you navigate the various tax-advantaged investment options available, ensuring that your long-term savings strategy is optimized for tax efficiency.

Understanding Long-Term Investment: A Guide to Current Asset Classification

You may want to see also

Frequently asked questions

Long-term investing is a strategy that involves holding investments for an extended period, often years or even decades. The key to maximizing growth is to focus on a well-diversified portfolio that includes a mix of assets such as stocks, bonds, and real estate. Diversification helps reduce risk by not putting all your eggs in one basket. Consider investing in index funds or exchange-traded funds (ETFs) that track a specific market or sector, as these offer broad exposure and are generally more cost-effective than actively managed funds.

Tax efficiency is crucial when investing for the long term. One strategy is to take advantage of tax-advantaged accounts, such as 401(k)s or individual retirement accounts (IRAs). These accounts allow your investments to grow tax-free or tax-deferred, depending on the type of account. Additionally, consider investing in tax-efficient funds or ETFs that minimize distributions and capital gains. Holding investments for the long term can also help reduce the impact of short-term capital gains taxes, as these are typically lower than ordinary income tax rates.

One of the biggest mistakes is timing the market, which involves trying to predict when to buy or sell investments based on market trends. This approach often leads to poor outcomes, as markets are inherently unpredictable in the short term. Another mistake is being overly conservative or risk-averse, which can result in missed growth opportunities. It's important to strike a balance between risk and reward. Finally, avoid the temptation to frequently rebalance your portfolio, as this can incur unnecessary transaction costs and may disrupt your long-term investment strategy.