Investments in working capital refer to the strategic allocation of financial resources to support a company's day-to-day operations and short-term financial needs. It involves managing the company's assets and liabilities to ensure smooth business functioning and optimize cash flow. This includes investing in inventory, accounts receivable, and accounts payable, as well as managing short-term debts and obligations. Effective working capital management is crucial for a company's financial health, as it enables businesses to meet their short-term obligations, maintain liquidity, and support long-term growth.

What You'll Learn

- Investment in machinery and equipment to enhance productivity and efficiency

- Upgrading software and technology to improve data management and decision-making

- Training and development programs for employees to boost skills and performance

- Research and development initiatives to innovate and stay competitive in the market

- Infrastructure investments to create a robust and sustainable working environment

Investment in machinery and equipment to enhance productivity and efficiency

Investing in machinery and equipment is a strategic decision that can significantly impact a company's productivity and efficiency. This type of investment is a crucial component of working capital, as it directly influences a company's ability to produce goods and services, manage operations, and ultimately, drive profitability. When a business allocates resources to acquire new machinery and equipment, it aims to streamline processes, reduce waste, and improve overall output.

The primary goal of such investments is to automate and optimize various stages of production. For instance, installing advanced manufacturing machines can lead to faster and more precise assembly lines, reducing the time and effort required to produce goods. This automation not only speeds up the production process but also minimizes human error, ensuring higher-quality products. Additionally, modern equipment often comes with built-in features that enhance energy efficiency, further reducing operational costs for the company.

In the context of working capital, investing in machinery and equipment is a long-term strategy. It involves a significant outlay of funds, but the benefits can be substantial and long-lasting. By acquiring state-of-the-art technology, companies can future-proof their operations, ensuring they remain competitive in a rapidly evolving market. This type of investment also contributes to a company's ability to adapt to changing customer demands and industry trends, as it provides the necessary infrastructure for innovation and flexibility.

Furthermore, the impact of these investments extends beyond the production floor. Upgrading machinery and equipment can lead to improved inventory management, allowing companies to maintain optimal stock levels and reduce the risk of overproduction or stockouts. This, in turn, enhances cash flow and ensures that the business can meet customer needs efficiently. Efficient inventory management is a critical aspect of working capital management, as it directly influences a company's financial health and stability.

In summary, investing in machinery and equipment is a powerful tool for businesses to boost productivity and efficiency. It enables companies to stay competitive, adapt to market changes, and improve overall operational performance. While it requires a substantial initial investment, the long-term benefits can significantly contribute to a company's success and sustainability in a dynamic business environment. This strategic approach to working capital management is essential for any organization aiming to maximize its output and minimize costs.

Unlocking Retirement Savings: The Power of Roth IRA Investments

You may want to see also

Upgrading software and technology to improve data management and decision-making

Investing in working capital is a strategic decision that involves allocating resources to ensure a company's short-term financial health and operational efficiency. One critical aspect of this investment is the upgrade and integration of software and technology systems. These upgrades are essential to enhance data management capabilities and improve the overall decision-making process within an organization.

Modernizing data management systems is a powerful way to increase efficiency and accuracy. Outdated software often leads to data inconsistencies, manual errors, and delayed information processing. By implementing advanced data management tools, companies can automate data collection, entry, and validation processes. This automation reduces the risk of human errors and ensures that financial data is up-to-date and reliable. For instance, investing in a robust accounting software system can streamline financial reporting, making it easier to generate accurate financial statements and identify potential discrepancies.

Upgrading technology also enables better data analysis and visualization. Advanced analytics software and business intelligence tools provide valuable insights by processing large datasets. These tools can identify trends, predict cash flow patterns, and offer recommendations for optimizing inventory levels and payment terms. With real-time data visualization, companies can make informed decisions quickly, especially in dynamic markets where agility is crucial. For example, implementing a supply chain management system with predictive analytics can help businesses forecast demand, optimize inventory, and reduce holding costs.

Furthermore, integrating various software systems and databases is vital for a comprehensive view of the company's financial health. By connecting different departments' data, such as sales, accounting, and logistics, organizations can gain a holistic understanding of their operations. This integration allows for better collaboration and communication between teams, ensuring that everyone works with the same, up-to-date information. As a result, decision-making becomes more efficient, and the company can adapt to market changes swiftly.

In summary, investing in working capital by upgrading software and technology is a strategic move that significantly impacts a company's performance. It enables improved data management, reduces errors, and empowers businesses to make data-driven decisions. With the right tools and systems in place, companies can enhance their operational efficiency, gain a competitive edge, and ultimately drive sustainable growth. This investment in technology is a long-term strategy that pays off by ensuring the organization's financial stability and adaptability.

Investments That Pay Their Way

You may want to see also

Training and development programs for employees to boost skills and performance

Investing in working capital is a strategic decision that involves allocating resources to ensure a company's short-term financial stability and operational efficiency. It is a crucial aspect of business management, as it directly impacts a company's ability to meet its short-term obligations and maintain smooth day-to-day operations. Working capital investment primarily focuses on managing the company's current assets and liabilities, such as cash, accounts receivable, inventory, and accounts payable. The goal is to optimize the use of these resources to maximize profitability and minimize financial risk.

Training and development programs play a vital role in enhancing the skills and performance of employees, which, in turn, can significantly impact the overall effectiveness of working capital management. By investing in employee training, companies can ensure that their workforce is equipped with the necessary knowledge and abilities to handle various tasks efficiently. This is especially important in the context of working capital, where employees are often responsible for critical functions like accounts receivable management, inventory control, and cash flow forecasting.

One effective training strategy is to design comprehensive programs that cover a wide range of topics related to working capital management. These programs should aim to educate employees about the fundamentals of working capital, including its definition, calculation, and significance in business operations. For instance, training sessions could explain how working capital is calculated by subtracting current liabilities from current assets and why it is essential for a company's short-term survival. By providing a solid theoretical foundation, employees will better understand the practical implications of their roles in managing working capital.

Additionally, practical training modules should be included to simulate real-world scenarios that employees might encounter in their daily tasks. For example, a training exercise could involve a mock scenario where employees must decide how to allocate funds to optimize inventory levels while meeting customer demand. Such exercises help employees apply their knowledge and develop problem-solving skills specific to working capital management. This hands-on approach ensures that training translates into improved performance and better decision-making when dealing with actual working capital challenges.

Furthermore, ongoing training and development should be a continuous process to keep employees updated with industry trends and best practices. Regular workshops, seminars, or online courses can be organized to introduce new techniques and technologies that can enhance working capital management. For instance, training on advanced accounting software or supply chain management systems can improve efficiency and reduce errors in inventory management and accounts receivable. By regularly refreshing employees' skills, companies can ensure that their working capital management practices remain effective and adaptable to changing market conditions.

In summary, investing in working capital is closely tied to the skills and performance of employees. Training and development programs are essential tools to empower employees with the knowledge and abilities required to manage working capital effectively. By providing a combination of theoretical education and practical exercises, companies can ensure that their workforce is capable of handling the complexities of working capital management. Regular training updates will further ensure that employees stay ahead of industry advancements, ultimately contributing to the overall success and financial health of the organization.

Retirement Planning: Navigating the Investment Maze

You may want to see also

Research and development initiatives to innovate and stay competitive in the market

Research and development (R&D) initiatives are crucial for businesses to maintain a competitive edge in today's rapidly evolving market. Investing in R&D allows companies to innovate, improve their products and services, and stay ahead of the competition. This strategic approach involves allocating resources to explore new ideas, technologies, and processes that can drive growth and differentiation.

One key aspect of R&D is identifying market gaps and consumer needs. Companies should conduct thorough market research to understand emerging trends, customer preferences, and industry developments. By analyzing this data, businesses can pinpoint areas where they can introduce innovative solutions, filling existing voids in the market. For example, a tech company might identify a growing demand for sustainable energy solutions and invest in R&D to develop cutting-edge renewable energy technologies. This proactive approach not only addresses a market need but also positions the company as an industry leader.

The R&D process should be structured and systematic. It often involves brainstorming sessions, where creative ideas are generated and evaluated. This can be followed by prototyping and testing, allowing companies to refine their concepts and ensure they meet the desired standards. For instance, a pharmaceutical firm might invest in R&D to discover and develop new drugs by screening potential compounds, conducting clinical trials, and gathering data to ensure safety and efficacy. This rigorous process is essential to bringing innovative products to market.

Additionally, collaboration and partnerships can significantly enhance R&D efforts. Companies can leverage the expertise of universities, research institutions, or other businesses to gain access to specialized knowledge and resources. By forming strategic alliances, organizations can accelerate innovation, share risks, and combine complementary strengths. For instance, a car manufacturer might partner with a tech startup to integrate advanced driver-assistance systems into their vehicles, offering customers a unique and competitive advantage.

In summary, investing in R&D is vital for businesses to stay competitive and innovative. It enables companies to identify market opportunities, develop cutting-edge solutions, and adapt to changing consumer demands. By allocating resources strategically and fostering a culture of innovation, organizations can ensure their long-term success and maintain a strong position in the market. This approach empowers businesses to lead the way in their respective industries and stay ahead of the competition.

Invest or Repay Debt: The Smart Money Move

You may want to see also

Infrastructure investments to create a robust and sustainable working environment

Investing in infrastructure is a strategic approach to creating a robust and sustainable working environment, which is essential for any organization's long-term success and productivity. This type of investment focuses on enhancing the physical and technological foundations that support daily operations, ultimately improving efficiency and fostering a positive work culture.

One key aspect of infrastructure investments is the development and maintenance of office spaces. A well-designed and equipped workplace can significantly impact employee satisfaction and productivity. This includes ensuring that offices are spacious, well-lit, and ergonomically designed to accommodate various work styles. Investing in modern office furniture, such as adjustable desks and chairs, can promote better posture and reduce physical strain, leading to improved health and reduced absenteeism. Additionally, providing comfortable and aesthetically pleasing work environments can boost morale and create a sense of pride among employees.

Another critical area of investment is in communication and technology infrastructure. Upgrading to high-speed internet, reliable network connections, and advanced software systems can revolutionize how teams collaborate and operate. Efficient communication tools enable seamless information exchange, facilitate remote work capabilities, and enhance overall connectivity. For instance, implementing video conferencing systems can bridge geographical gaps, allowing for more effective virtual meetings and fostering a more connected workforce. Moreover, investing in cloud-based solutions can provide scalable and secure data storage, ensuring that businesses can adapt to changing demands and maintain data integrity.

Infrastructure investments also encompass the development and maintenance of essential utilities and services. This includes ensuring a reliable power supply, implementing efficient heating, ventilation, and air conditioning (HVAC) systems, and providing access to clean water and sanitation facilities. Well-maintained facilities contribute to a healthy and comfortable working environment, reducing the risk of illnesses and promoting employee well-being. Additionally, investing in waste management systems and recycling programs demonstrates a commitment to environmental sustainability, which is increasingly important to both employees and customers.

Furthermore, infrastructure investments should extend to the creation of safe and secure transportation networks. This involves maintaining and upgrading roads, parking facilities, and public transportation options. Efficient transportation infrastructure enables employees to commute to and from work safely and comfortably, reducing travel-related stress and improving overall job satisfaction. Well-designed transportation systems can also contribute to a more diverse and inclusive workforce, as they provide accessibility options for individuals with different abilities and needs.

In summary, infrastructure investments play a pivotal role in shaping a robust and sustainable working environment. By focusing on physical spaces, communication technologies, essential utilities, and transportation networks, organizations can create a foundation that supports employee well-being, enhances productivity, and fosters a positive company culture. These investments not only improve operational efficiency but also contribute to the long-term success and competitiveness of the business in today's rapidly evolving market.

Unveiling the Role of Investment Bankers in M&A Deals: A Strategic Guide

You may want to see also

Frequently asked questions

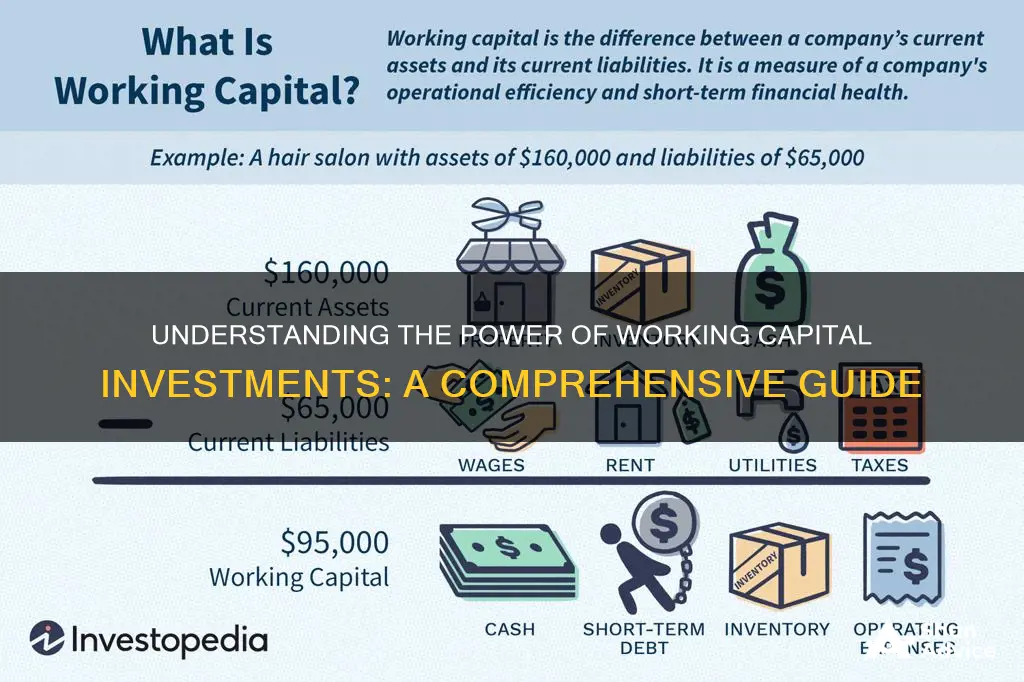

Working capital refers to the capital or funds that a business uses to finance its day-to-day operations and short-term liabilities. It is the difference between a company's current assets (such as cash, accounts receivable, and inventory) and its current liabilities (such as accounts payable and short-term loans).

Working capital is crucial for a company's financial health and operational efficiency. It ensures that a business has sufficient funds to cover its short-term obligations, manage cash flow, and invest in growth opportunities. Positive working capital indicates a company's ability to meet its financial commitments and sustain its operations.

Working capital is calculated using the following formula: Working Capital = Current Assets - Current Liabilities. For example, if a company has $50,000 in current assets and $30,000 in current liabilities, its working capital is $20,000.

Working capital can be sourced through various means. Common sources include retained earnings, accounts payable management, short-term loans, lines of credit, and investor funding. Businesses often aim to maintain a healthy balance between these sources to ensure a stable cash flow.

Investing in working capital can have several advantages. It allows businesses to optimize their inventory levels, improve cash flow management, and enhance overall operational efficiency. By having sufficient working capital, companies can take advantage of growth opportunities, negotiate better terms with suppliers, and maintain a competitive edge in the market.