Long-term investment in mutual funds is a popular option for individuals. Long-term investments are those that go far in time, such as 3, 5, or 10 years. They are a good way to finance future goals like higher education, buying a house, or retirement. Equity-oriented schemes are considered one of the best long-term investment options. While they are more volatile in the short term than hybrid and debt funds, equities have a higher potential for growth. A well-diversified equity fund is more likely to offer stable growth over a long period.

There are several benefits to long-term investments in mutual funds. Firstly, they allow investors to reap the benefits of compounding. Secondly, they enable investors to diversify their investment portfolios, which helps to minimise risk. Lastly, long-term investments provide time to correct any investment mistakes and maximise returns.

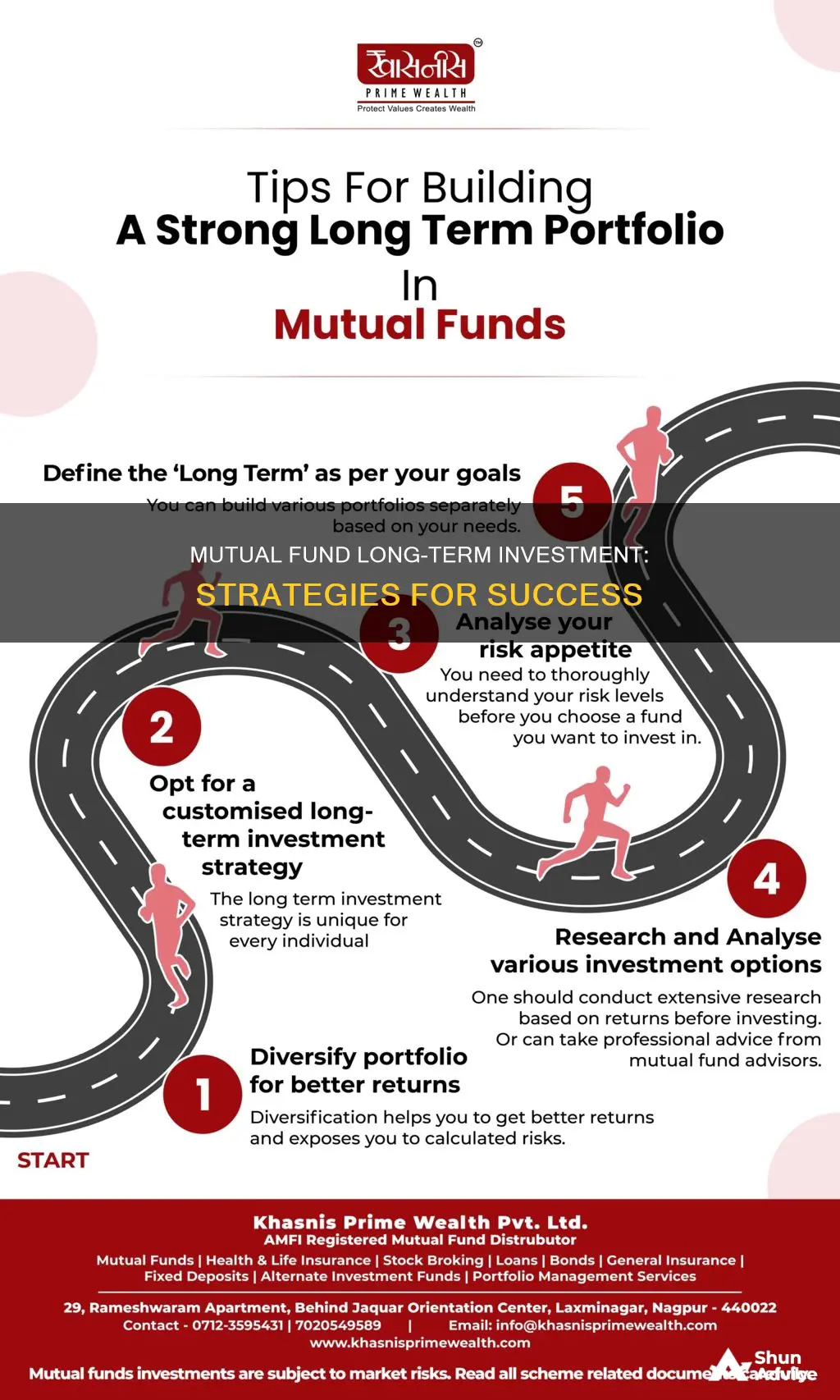

When choosing a long-term mutual fund, it is important to consider your risk profile and the time horizon of your goals. Investors can invest in high-risk, high-return funds for long-term goals, while those with a low-risk appetite can opt for low-risk funds for short-term goals.

What You'll Learn

- Long-term investments allow you to correct any investment mistakes

- Long-term investments let you harness the power of compounding

- Long-term investments enable you to diversify your portfolio

- Long-term investments are ideal for financing future goals, such as higher education, home, retirement, etc

- Long-term investments give you time to monitor and check out alternative options to maximise your returns

Long-term investments allow you to correct any investment mistakes

Long-term investments in mutual funds are those that have a long time horizon, typically several years. They are often associated with higher risk and higher returns.

Diversification

Diversification is a risk management strategy that involves investing in a variety of assets or asset classes to reduce the impact of any single investment on the overall portfolio. By investing in mutual funds with a long-term horizon, you can benefit from diversification across different companies, industries, or sectors. This helps to mitigate the risk of any one investment performing poorly and allows for a smoother portfolio performance over time.

Time to recover from mistakes

Long-term investments provide a longer time horizon for your investments to recover from any mistakes or poor performance. Short-term market fluctuations or negative returns may be offset by the potential for higher returns over a longer period. This also gives you more flexibility to adjust your investment strategy if needed.

Compounding returns

Compounding occurs when the returns generated by an investment are reinvested to generate additional earnings over time. Long-term investments in mutual funds allow for more compounding periods, which can lead to exponential growth in the value of your investments. This effect is more pronounced over longer periods, helping to correct any short-term mistakes or underperformance.

Riding out market volatility

Market volatility can cause short-term fluctuations in the value of your investments. By investing for the long term, you can ride out these short-term ups and downs and focus on the bigger picture. Historical data shows that stock markets tend to provide positive returns over longer periods, despite short-term corrections or bear markets.

Benefit from dollar-cost averaging

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the market price. This strategy is commonly used in long-term investment plans and helps to reduce the impact of market volatility. By investing a fixed amount regularly, you purchase more units when the price is low and fewer units when the price is high, which can help to lower your average cost per unit over time. This strategy can help to correct any mistakes or poor timing in your investment decisions.

College Fund: When to Shift to Safer Investments?

You may want to see also

Long-term investments let you harness the power of compounding

Long-term investments are a great way to finance your future goals, such as higher education, buying a home, or retirement planning. Generally, long-term goals have a horizon of more than ten years.

Suppose you invest Rs 10,000 per month from the age of 25 until you retire at 55 years. With mutual funds (reinvest option) and an expected rate of return of 12%, your principal investment portfolio would be worth Rs 36 lakh at maturity. By reinvesting the returns, your investment corpus would grow to a substantial Rs 3.5 crore at redemption (maturity) after 30 years.

This example highlights the power of compounding, which can be best utilised when investments are planned for the long term. The longer the investment horizon, the more your money can work for you, and the greater the potential for higher returns.

Additionally, long-term investments provide the benefit of time to correct any investment mistakes. As a beginner, you may need to learn some technicalities and make critical decisions to minimise losses and maximise returns. Long-term investments allow you to monitor your portfolio, giving you the flexibility to make adjustments and improve your investment strategy.

When it comes to long-term investments, equity-oriented schemes are considered one of the best options. While they may be more volatile in the short term compared to hybrid and debt funds, equities have a higher growth potential. A well-diversified equity fund is likely to offer stable growth over an extended period.

To summarise, long-term investments, particularly in equity and balanced funds, offer the advantage of compounding returns, providing the potential for substantial growth over time. They also allow for flexibility and adjustments to your investment strategy, setting you up for success in achieving your financial goals.

American Century Investments: A Leading Mutual Fund Company?

You may want to see also

Long-term investments enable you to diversify your portfolio

Long-term investments are a great way to diversify your portfolio. Here are some reasons why:

Time to diversify your portfolio

Long-term investments give you the time to diversify your portfolio and balance risk. By investing across different sectors and asset classes, you can reduce the impact of any single investment's poor performance on your overall portfolio. This is a key advantage of mutual funds, as they pool your money with other investors, allowing the fund manager to invest in a wider variety of securities.

Compounding benefits

The longer your investment horizon, the more you can benefit from compounding returns. For example, if you invest Rs 10,000 per month from the age of 25 until you retire at 55, with a 12% expected rate of return, your portfolio could be worth Rs 3.5 crore at maturity. This is because the returns generated by your initial investments are reinvested, generating their own returns, and so on.

Correcting investment mistakes

Long-term investments also give you the time to correct any investment mistakes you may make, especially if you are a beginner. You can monitor your portfolio's performance and make adjustments as needed to maximise returns and minimise losses.

Less impact from market downturns

When you invest for the long term, short-term market fluctuations and downturns have less impact on your portfolio's performance. This is because you have time to ride out any short-term volatility and benefit from the overall upward trend of the market over time.

Higher potential returns

While short-term investments tend to be lower-risk and offer more stable returns, long-term investments have the potential for higher returns. This is especially true for equity-oriented schemes, which have higher growth potential than hybrid or debt funds, even though they are more volatile in the short term.

Suitability for long-term goals

Long-term investments are ideal for financing long-term goals such as higher education, buying a home, or retirement. These goals typically have a horizon of beyond ten years, and the longer investment timeframe allows you to take advantage of compounding returns and market growth over time.

Index Fund Investing: Ally Invest Options and Strategies

You may want to see also

Long-term investments are ideal for financing future goals, such as higher education, home, retirement, etc

Long-term investments are ideal for financing future goals, such as higher education, homeownership, and retirement. These investments typically have a horizon of more than ten years and offer a range of benefits for investors.

One of the key advantages of long-term investments is the power of compounding. For example, investing Rs 10,000 per month from the age of 25 until retirement at 55, with a expected rate of return of 12%, would result in a portfolio worth Rs 36 lakh at maturity. The power of compounding can be harnessed by investing for the long term, allowing your investments to grow exponentially over time.

Long-term investments also provide the benefit of a diversified portfolio. Mutual funds, for instance, typically invest in a diverse range of securities across different sectors, which helps to minimise risk and balance your investment portfolio. This diversification ensures that your investments are not dependent on the performance of a single sector or security, reducing the impact of market volatility.

Additionally, long-term investments give you the time and flexibility to correct any investment mistakes. As a beginner, you may need to learn some technicalities and make critical investment decisions to minimise losses and maximise returns. Long-term investments allow you to monitor your portfolio, explore alternative options, and adjust your investment strategy as needed.

When it comes to long-term investments, it is generally advised to start early. This enables investors to take more risks during their early years of investing and benefit from the compounding effect over a longer period. With a longer time horizon, market downturns and short-term risks become less significant, and the potential for higher returns increases.

While long-term investments are ideal for future goals, it is important to note that they may not be suitable for short-term objectives. Short-term investment options, such as debt funds or fixed deposits, are typically less volatile and can be a better choice for more immediate financial targets.

Best Fidelity IRA Funds for Your Retirement Savings

You may want to see also

Long-term investments give you time to monitor and check out alternative options to maximise your returns

Long-term investments are those that go far in time, such as 3, 5, or 10 years. They are a great way to finance your future goals, like higher education, buying a house, or retirement. One of the main benefits of long-term investments is that they give your money time to grow in value and benefit from the power of compounding. For example, if you invest Rs 10,000 per month from the age of 25 until you retire at 55 years, with mutual funds (reinvest option) and an expected rate of return of 12%, your principal investment portfolio would be Rs 36 lakh at maturity. By investing Rs 1,20,000 in the first year, your principal would be enhanced to Rs 1,28,093 in the second year, and so on, resulting in a total investment corpus of Rs 3.5 crore at the time of redemption (maturity) after 30 years.

Another benefit of long-term investments is that they allow you to monitor and check out alternative options to maximise your returns. As a beginner, you may need time to learn some technicalities and make critical investment decisions that will help minimise losses and generate returns. This is especially true for certain mutual funds, such as equity and balanced funds, which can be subject to market volatility. A good mutual fund, like a good batsman, will go through some ups and downs, but if you stay invested for the long term, you will benefit from its overall impressive performance.

Long-term investments also give you the advantage of a diversified portfolio. Mutual funds usually invest in a basket of securities across different sectors, which helps to minimise and balance risk while maximising gains.

When it comes to long-term investments, it is always advised to start early so that you can take more risks in your early years of investing and earn more through compounding. The longer the period of investing, the higher the chance of gaining returns, and market downturns and other risks seem minor in comparison.

Mutual Funds: Smart Investment or Risky Business?

You may want to see also

Frequently asked questions

Long-term investment means holding different assets like mutual funds, securities, shares and stocks for more than a year. This is a good timeframe in terms of taxation. However, a year is not the ideal investment horizon to reap good returns. Long-term investments are typically investments that span several years, such as 3, 5, or 10 years.

There are several benefits to long-term investments. Firstly, they allow you to reap the benefits of compounding. Secondly, they enable you to diversify your investment portfolio, which helps to balance risk and maximise gains. Lastly, long-term investments give you time to correct any investment mistakes and maximise your returns.

There is no one-size-fits-all answer to this question as it depends on your risk profile and investment goals. However, some popular options for long-term investments include equity funds, large-cap funds, mid-cap funds, small-cap funds, and balanced funds. It is recommended to consult a financial advisor to determine which funds align with your investment strategy.

Yes, it is important to remember that mutual funds, especially those focused on equity, can be volatile in the short term. Additionally, past performance does not guarantee future results, so it is essential to carefully consider your investment decisions and monitor your portfolio regularly.