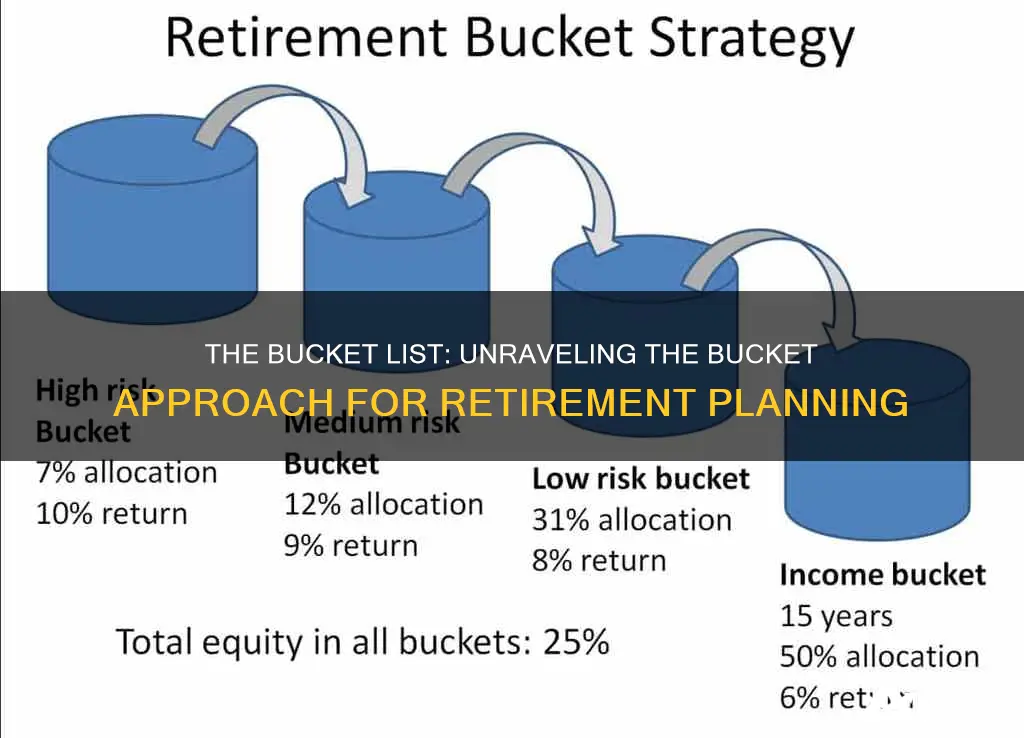

The bucket approach to retirement investment is a distribution method that helps retirees manage their competing goals. It involves creating buckets for different forms of retirement savings, which are then used to cover living expenses, pursue hobbies, or leave a legacy for family members. The approach is based on separating assets according to when they will be spent, creating a cash cushion for the early years of retirement while maximising the rest over a longer period. The number of buckets, what they represent, and what they are called may vary, but the typical approach involves three buckets for short-term, mid-term, and long-term needs.

| Characteristics | Values |

|---|---|

| Number of Buckets | 3 or more |

| Purpose of Buckets | Immediate (short-term), intermediate, and long-term |

| Bucket 1 | Cash and cash equivalents (low risk and volatility) |

| Bucket 2 | Fixed-income (medium risk and volatility) |

| Bucket 3 | Equities (higher risk and volatility) |

| Bucket Refill | Interest income, dividends, and investment performance |

| Bucket Maintenance | Replenish Bucket 1 from Bucket 2, and Bucket 2 from Bucket 3 |

What You'll Learn

The three-bucket strategy: short-term, intermediate, and long-term

The three-bucket strategy is a retirement investment approach that divides your sources of income into three buckets: short-term, intermediate, and long-term. Each bucket has a different level of risk and return to match varying time horizons. Here's a detailed look at each bucket:

Short-Term Bucket

The short-term bucket typically contains money that you'll need to access within the next one to four years. This bucket is focused on low-risk, highly liquid investments that provide easy access to funds. Examples include high-yield savings accounts, money market accounts, certificates of deposit (CDs), and short-term treasury bills. The goal is to have around one to five years' worth of expenses in this bucket, so you don't have to worry about stock market volatility.

Intermediate-Term Bucket

The intermediate-term bucket is designed for expenses that will occur between years five and ten of your retirement. This bucket aims to strike a balance between moderate risk and stable returns. Investments in this bucket should ideally match or slightly outperform inflation without taking on excessive risk. Examples include longer-maturity bonds, preferred stocks, income funds, and real estate investment trusts (REITs).

Long-Term Bucket

The long-term bucket is for money that you want to grow over a longer period, typically at least seven to ten years. This bucket can accommodate high-risk, volatile investments that have the potential for significant growth. Examples include growth stocks, small-cap stocks, high-yield bonds, private equity funds, and venture capital investing. The long-term bucket is expected to refill the short-term and intermediate-term buckets through its growth.

The three-bucket strategy offers a visual and organisational tool to help retirees navigate market fluctuations and ensure a steady income during retirement. It provides flexibility, allowing customisation based on individual retirement goals and preferences. However, it requires ongoing monitoring, periodic adjustments, and rebalancing to ensure optimal performance.

Wealth in the 16th Century: Investing in Land and Trade

You may want to see also

The benefits of the bucket approach

The bucket approach to retirement investment is a simple, flexible, and effective strategy that offers several benefits for retirees.

One of its key advantages is that it provides a sense of security and peace of mind. By dividing assets into separate buckets, retirees can easily visualize and understand their financial situation, which helps to manage retirement fears and emotions, especially during volatile market conditions. This mental accounting framework makes it easier to plan, quantify, and prioritize spending and legacy objectives.

The bucket approach also helps to navigate market fluctuations. The short-term bucket, typically filled with low-risk, liquid assets, ensures access to cash in the immediate years of retirement, so retirees don't have to worry about stock market downturns. This allows the long-term bucket, which holds riskier investments, to recover from volatility and compound over time.

Additionally, the bucket approach is highly customizable and flexible. It can be tailored to individual retirement goals, risk tolerances, and personal preferences, providing a stable and predictable framework that is easy to track and monitor.

The strategy also offers a clear roadmap for retirement planning, removing some of the complexities and guesswork involved in investing and distribution strategies. This makes it easier for retirees to stick to their financial plans and avoid impulsive decisions driven by short-term market movements.

Finally, the bucket approach can be combined with other portfolio construction and distribution methodologies, making it a dynamic and adaptable strategy for retirement planning.

The Debt Dilemma: Navigating the Investment vs. Loan Repayment Conundrum

You may want to see also

The drawbacks of the bucket approach

The bucket approach to retirement income is a simple, flexible, and easy-to-implement strategy that helps retirees manage their investments and expenses. However, there are some potential drawbacks to this approach that should be considered:

- Time and effort: The bucket strategy requires ongoing monitoring and periodic adjustments, which can be time-consuming and challenging. It requires discipline and a long-term commitment to generating a set return.

- Accuracy of estimates: One of the biggest pitfalls of the bucket strategy is underestimating retirement expenses and overestimating investment returns. It is difficult to predict annual expenses and lifespan accurately, and failing to consider health changes and other factors later in life can derail retirement plans.

- Limited utility: The bucket strategy may not be suitable for everyone, especially those with higher wealth. It is important to consider personal factors such as risk tolerance, goals, health, and desired investment outcomes before adopting this approach.

- Conservative approach: The bucket strategy is conservative and requires setting aside substantial amounts of cash that could otherwise be invested. This can be frustrating if the broader stock market is performing well while your portfolio doesn't see the same gains.

- Missed opportunities: The bucket strategy may cause investors to allocate more money to fixed income than is necessary, potentially missing out on better long-term results using a cash reserve and equity strategy.

- Complexity: While the bucket strategy is simple in concept, it can be complex to execute, especially without the help of a financial advisor. There is a lack of standardized tools to calculate allocations across buckets, and portfolio reporting software may have trouble managing multiple buckets.

- Rebalancing challenges: Without the right tools and expertise, rebalancing between buckets can be challenging. It requires careful management to ensure that the portfolio doesn't become too risky later in retirement if the 'safe' buckets are depleted.

Cruise Investments: Worth the Money?

You may want to see also

The bucket approach vs traditional asset allocation

The bucket approach and traditional asset allocation are two strategies for managing investments and withdrawals in retirement. Here, we will compare and contrast these approaches to highlight their key differences and help you decide which one might be more suitable for your needs.

The Bucket Approach

The bucket approach, also known as the bucket strategy, involves dividing retirement assets into separate "buckets" or categories based on time horizons and risk tolerance. Typically, there are three buckets:

- Cash Bucket: This bucket contains highly liquid and low-risk investments such as cash, money market funds, or certificates of deposit (CDs). It covers living expenses and emergency funds for the next 2-5 years.

- Fixed Income or Intermediate-Term Bucket: This bucket is designed for the middle years of retirement, usually covering years 3-10. It includes fixed-income investments like bonds, Treasury Inflation-Protected Securities (TIPS), and short to intermediate-term high-quality bonds.

- Growth or Long-Term Bucket: This bucket is for assets that won't be needed for at least 10 years. It contains high-growth and high-risk investments, primarily stocks, but also potentially junk bonds, real estate securities, emerging-market bonds, and precious metals equities.

The bucket approach provides a psychological benefit by giving retirees peace of mind, especially during market downturns. It allows them to keep short-term investments in cash or liquid securities, ensuring that their near-term expenses are covered. This strategy also enables retirees to take more risk with their long-term investments, as they can afford to ride out market volatility.

However, one of the challenges of the bucket approach is determining when and how to refill the cash bucket. If funds are taken from the growth bucket to refill it, it may negatively impact the long-term growth of that bucket. Additionally, there is a lack of standardised tools for calculating allocations across buckets, and portfolio reporting software may struggle to accommodate this strategy.

Traditional Asset Allocation

Traditional asset allocation involves maintaining a fully diversified portfolio across a broad spectrum of asset classes. It treats all assets alike, and there is only one target asset allocation to maintain. This strategy typically aims for a withdrawal rate of 4-5% each year.

One of the advantages of this approach is its simplicity. It is easier for financial advisors to maintain and is more predictable over the long term. Additionally, it benefits from dollar-cost averaging, which minimises the risk of short-term market volatility by buying at different times and prices.

However, one of the drawbacks of traditional asset allocation is that it can be emotionally challenging for retirees. During sharp market downturns or corrections, seeing the aggregate value of their retirement account trending lower can cause worry and lead to risk-averse behaviour or poor decision-making.

Both the bucket approach and traditional asset allocation have their advantages and disadvantages. The bucket approach provides psychological benefits and allows for more nuanced risk management but has implementation challenges. On the other hand, traditional asset allocation is simpler and benefits from dollar-cost averaging but may not provide the same level of emotional comfort during market downturns. The choice between these strategies depends on factors such as an individual's risk tolerance, time horizon, and the complexity they are comfortable with.

Inflation-Proof Retirement: Navigating Investments in Uncertain Times

You may want to see also

How to maintain the bucket approach

Maintaining the bucket approach requires consistency and a focus on the long term. Here are some steps to help you maintain the bucket approach for retirement investment:

- Set your strategy: Determine how many buckets or compartments you need and what they represent. Consider your short-term, mid-term, and long-term needs, and decide on the time periods you need to cover. You can be creative and adapt a playbook or make your own, as long as it's consistent.

- Educate yourself and seek advice: Understand the bucket approach thoroughly and consider seeking advice from a financial planner or advisor. They can help you tailor the strategy to your specific needs and goals.

- Fund the buckets: Allocate your assets to the different buckets based on their characteristics and your goals. For example, you may want to place money from an inheritance in the first bucket or put a Roth individual retirement account in the fifth bucket for long-term growth.

- Maintain buckets over time: Keep track of your spending and regularly replenish the cash bucket when it gets depleted. Stay on top of rebalancing your investments across the buckets to maintain your desired allocation. Look for opportunities to harvest gains when the markets are performing well.

- Monitor and adjust: The bucket approach requires regular monitoring and adjustments to account for market conditions and your changing needs over time. This may include shifting funds between buckets or making changes to your investment strategy.

- Consider the drawbacks and opportunities: Be aware of the potential drawbacks of the bucket approach, such as the time and effort required to manage it effectively. Also, consider the opportunity cost of allocating more funds to fixed income than may be necessary.

- Stick to the plan: Maintaining discipline and sticking to your plan is crucial. The bucket approach is designed to help you make informed decisions and stay on track with your retirement goals. Avoid the temptation to spend too freely or make impulsive investment choices.

- Seek support: Managing your retirement investments can be complex and time-consuming. Consider seeking ongoing support from a financial professional who can provide guidance and help you stay accountable.

Airlines: Where to Invest Now

You may want to see also

Frequently asked questions

The bucket approach is a distribution method used by retirees to manage their retirement spending and investing. It involves segregating retirement savings into three buckets: short-term, intermediate, and long-term. Each bucket is invested differently and aims to accommodate different needs, providing a direct alignment between mental buckets and actual buckets (i.e. accounts).

The bucket approach provides a feeling of security for retirees concerned about the future performance of their investments. It minimises the need to sell when markets are down, allowing retirees to draw on other funds such as their substantial cash reserves. It also helps to control emotions during stock market volatility and provides a roadmap for planning retirement income.

Monitoring is crucial to the bucket approach, and adjustments need to be made periodically according to market conditions. Setting up and managing the strategy can be time-consuming and may require the help of a financial planner. Additionally, the strategy may be too conservative for some retirees, potentially leading to a dwindling income over time.