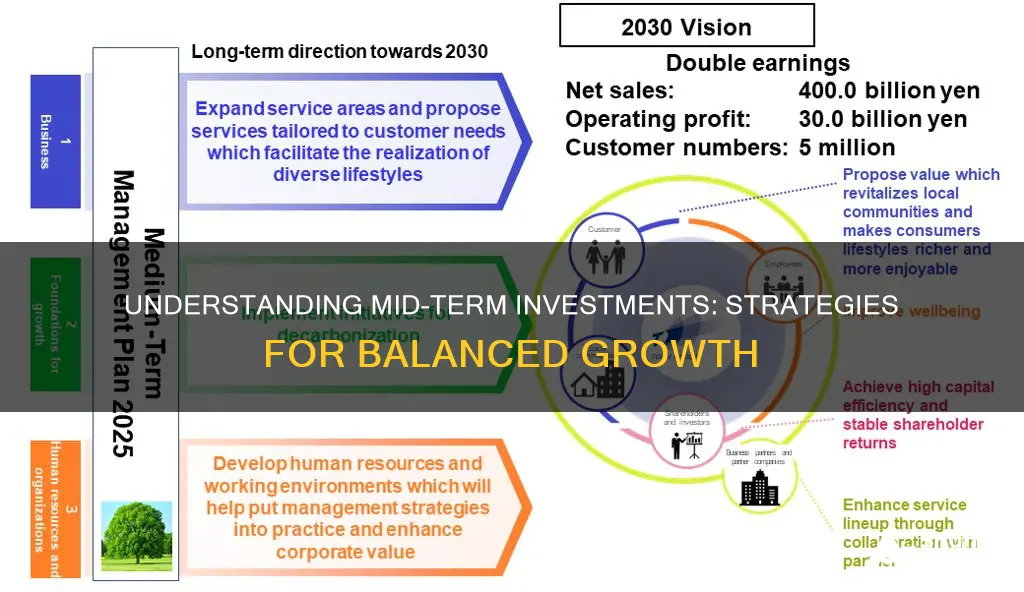

Mid-term investments are a type of financial strategy that involves committing capital for a period typically ranging from one to five years. These investments aim to balance risk and return, offering a middle ground between the short-term volatility of stocks and the long-term stability of bonds. Mid-term investments often include a mix of assets such as stocks, bonds, and alternative investments, providing investors with a diversified portfolio that can weather market fluctuations while still offering the potential for growth. This approach is particularly attractive to investors seeking a more stable yet dynamic investment strategy, allowing them to capitalize on market opportunities while minimizing the risks associated with long-term commitments.

What You'll Learn

- Definition: Mid-term investments are financial assets held for a period between short-term and long-term

- Risk: These investments offer moderate risk and return, suitable for balanced portfolios

- Examples: Stocks, bonds, and mutual funds are common mid-term investment options

- Strategy: Investors use mid-term investments to balance risk and potential returns over the medium term

- Tax Implications: Tax considerations vary, impacting the overall return on mid-term investments

Definition: Mid-term investments are financial assets held for a period between short-term and long-term

Mid-term investments are a crucial component of financial planning and asset management, representing a strategic approach to capital allocation. These investments are characterized by their holding period, which falls between the more immediate short-term and the long-term horizons. This middle ground allows investors to balance the need for liquidity and the potential for growth, making it an essential tool for diversifying portfolios and managing risk.

In the realm of finance, mid-term investments typically refer to financial instruments or assets that are expected to be held for a duration that is longer than a few months but not as extended as a decade or more. This duration provides investors with a window of opportunity to benefit from market trends and economic cycles while also ensuring a level of liquidity that is not available in long-term investments. The key idea is to strike a balance between the potential for capital appreciation and the need for regular access to funds.

These investments often include a variety of financial products, such as corporate bonds, preferred stocks, and certain types of real estate investments. Corporate bonds, for instance, offer a fixed income stream over a defined period, providing a steady return while also allowing investors to benefit from potential capital gains if the bond price increases before maturity. Preferred stocks, on the other hand, offer a combination of dividend income and potential capital appreciation, making them an attractive mid-term investment option.

The strategy behind mid-term investments is to provide a stable income stream and capital growth, which can be particularly appealing to investors seeking a more conservative approach. It allows for a more dynamic investment strategy compared to long-term holdings, which may be less liquid, while also avoiding the short-term volatility often associated with short-term investments. This approach is especially relevant for retirement planning, where investors need a steady income stream to support their financial goals over the long term.

In summary, mid-term investments are a strategic financial approach, offering a blend of liquidity, income generation, and capital appreciation. By understanding and utilizing this investment strategy, individuals can construct well-rounded portfolios that cater to their financial objectives and risk tolerance, ensuring a more secure and prosperous financial future.

Matic's Long-Term Potential: A Crypto Investment Strategy

You may want to see also

Risk: These investments offer moderate risk and return, suitable for balanced portfolios

Mid-term investments are a strategic approach to financial planning, offering investors a balance between risk and return. These investments are designed to provide a moderate level of risk, making them an attractive option for those seeking a stable yet dynamic investment strategy. The term "mid-term" typically refers to a time horizon of 3 to 5 years, allowing investors to benefit from potential growth while also minimizing the volatility often associated with long-term investments.

In the context of risk, mid-term investments are considered moderate-risk assets. This means they offer a higher potential return compared to low-risk investments but with less risk than high-risk, short-term options. Investors often use these investments to diversify their portfolios, creating a balanced approach that can withstand market fluctuations. For instance, a well-diversified portfolio might include a mix of mid-term investments, such as corporate bonds, preferred stocks, and certain types of real estate investments.

The key advantage of this risk-return profile is that it caters to a wide range of investors. Those who prefer a more conservative approach can still benefit from potential growth, while those seeking a more aggressive strategy can find a suitable middle ground. Mid-term investments often provide a steady income stream, which is particularly appealing to retirees or those approaching retirement age, as it offers a reliable source of funds without the high volatility of short-term investments.

When considering mid-term investments, investors should focus on assets that have a history of steady growth and a low correlation to traditional financial markets. This could include certain types of exchange-traded funds (ETFs), which offer diversification across various sectors or asset classes. Additionally, mid-cap stocks, which are shares of companies with a market capitalization between $2 billion and $10 billion, often fall into this category, providing a balance of growth potential and stability.

In summary, mid-term investments are a strategic choice for investors seeking a moderate risk-return profile. They offer a balanced approach, allowing investors to benefit from potential growth while also minimizing the volatility associated with more aggressive or conservative strategies. By incorporating these investments into a well-diversified portfolio, investors can create a stable and dynamic financial plan suitable for various investment goals and risk tolerances.

Are NFTs a Long-Term Investment? Exploring the Future of Digital Art

You may want to see also

Examples: Stocks, bonds, and mutual funds are common mid-term investment options

Mid-term investments are a strategic approach to financial planning, aiming to balance risk and reward over a medium-term horizon, typically ranging from one to five years. These investments are designed to offer a blend of capital appreciation and income generation, making them suitable for investors seeking a more stable yet potentially profitable strategy. When considering mid-term investments, several asset classes stand out for their versatility and potential to meet these objectives.

One of the most well-known mid-term investment options is stocks, also known as equities. Investing in stocks means purchasing shares of a company, which entitles the investor to a portion of the company's ownership and, consequently, a claim on its profits. Stocks are attractive for mid-term investors because they offer the potential for significant capital growth over time. While stock prices can be volatile in the short term, a well-diversified portfolio of stocks, carefully selected based on fundamental analysis and long-term growth prospects, can provide a steady return over the mid-term. This investment strategy is particularly appealing to those who want to build wealth over time, as it aligns with the long-term growth potential of companies.

Bonds are another essential component of mid-term investment portfolios. A bond is essentially a loan made by an investor to a borrower, typically a government or a corporation. In return for lending the money, the investor receives regular interest payments (coupon payments) and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks, especially government bonds, which are backed by the full faith and credit of a government. Mid-term bond investments offer a steady income stream, making them attractive for investors seeking regular cash flow. Additionally, bonds can provide portfolio diversification, reducing overall risk through their lower correlation with stocks.

Mutual funds are a popular investment vehicle that can be used for mid-term financial goals. A mutual fund is a professionally managed investment fund that pools money from many investors to invest in a diversified portfolio of securities, such as stocks, bonds, or a combination of both. Mutual funds offer investors an easy way to access a diversified portfolio without having to select individual securities. They are managed by fund managers who make investment decisions on behalf of the shareholders. Mid-term mutual funds can be categorized into various types, such as growth funds, income funds, or balanced funds, each with its own investment strategy and risk profile. This flexibility allows investors to tailor their mid-term investment approach to their specific needs and risk tolerance.

In summary, mid-term investments are a strategic approach to financial planning, and stocks, bonds, and mutual funds are excellent examples of assets that can be utilized to achieve this goal. Stocks offer the potential for significant capital growth, bonds provide a steady income stream, and mutual funds offer diversification and professional management. By carefully selecting and combining these investment options, investors can create a well-rounded portfolio that balances risk and reward, making it an ideal strategy for those looking to build wealth over the medium term.

Navigating Deflation: Strategies for Long-Term Investment Success

You may want to see also

Strategy: Investors use mid-term investments to balance risk and potential returns over the medium term

Mid-term investments are a strategic approach for investors seeking to optimize their portfolios and manage risk effectively. This investment strategy involves holding assets for a period typically ranging from one to five years, allowing investors to strike a balance between short-term volatility and long-term growth potential. By adopting a mid-term perspective, investors aim to capitalize on market opportunities while mitigating the risks associated with both short-term market fluctuations and long-term commitments.

The primary objective of mid-term investments is to provide a stable and consistent return over the medium term. This approach often involves a careful selection of assets that offer a blend of growth and income potential. Investors may choose from various investment vehicles, such as corporate bonds, preferred stocks, or carefully curated portfolios of stocks and bonds. The key is to identify securities that provide a steady income stream while also allowing for capital appreciation over the mid-term horizon.

One of the advantages of this strategy is the ability to adapt to changing market conditions. Mid-term investments provide investors with flexibility, enabling them to adjust their portfolios based on economic trends, industry performance, and individual security analysis. For instance, if a particular sector is experiencing a downturn, investors can rebalance their holdings to reduce risk or shift investments to more promising areas. This adaptability is crucial in navigating the complexities of financial markets and ensuring that the portfolio remains aligned with the investor's goals.

Additionally, mid-term investments often require a more in-depth analysis of individual securities compared to short-term trading strategies. Investors need to carefully assess the financial health, management quality, and growth prospects of the companies they invest in. This thorough evaluation process helps in making informed decisions and building a robust portfolio that can weather market volatility. By focusing on fundamental analysis and long-term fundamentals, investors can identify companies with strong competitive advantages and sustainable growth potential.

In summary, mid-term investments are a strategic approach that enables investors to balance risk and potential returns over the medium term. This strategy offers a flexible and adaptive approach to portfolio management, allowing investors to navigate market complexities and capitalize on opportunities. By carefully selecting assets and conducting thorough research, investors can build a well-diversified portfolio that provides a steady income stream and long-term capital appreciation. This investment approach is particularly suitable for those seeking a more stable and consistent return while still being exposed to market growth potential.

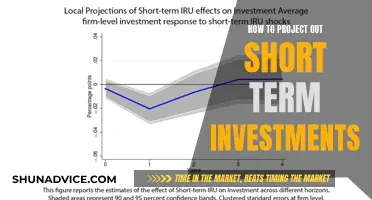

Master Short-Term Investing: Strategies for Profiting from Futures

You may want to see also

Tax Implications: Tax considerations vary, impacting the overall return on mid-term investments

When it comes to mid-term investments, understanding the tax implications is crucial as they can significantly impact your overall return. These investments typically fall between short-term and long-term holdings, often lasting for a period of one to five years. During this time, the tax treatment can vary depending on the type of asset and your jurisdiction's tax laws.

In many countries, short-term capital gains are taxed at a higher rate than long-term gains. This means that if you sell a mid-term investment, the tax rate on the profit may be more favorable compared to holding it for a longer period. For instance, in some jurisdictions, short-term capital gains are taxed as ordinary income, while long-term gains may be taxed at a lower rate or even exempt. This difference in tax treatment can result in a higher net return for mid-term investments, especially if the holding period is just over a year.

However, it's important to note that the tax rules can be complex and vary across different asset classes. For example, real estate investments may have unique tax considerations, including property taxes, depreciation, and potential tax benefits for rental income. Similarly, tax treatment for investments in stocks, bonds, or mutual funds can differ, with some offering tax advantages like tax-deferred growth or tax-free distributions. Understanding these nuances is essential for investors to make informed decisions and optimize their tax efficiency.

Additionally, tax laws often provide incentives for certain types of investments. Governments may offer tax breaks or deductions for specific sectors or activities, such as encouraging investment in small businesses or promoting renewable energy projects. These incentives can further impact the tax implications of mid-term investments, making them an attractive option for investors seeking to maximize their returns while also contributing to specific economic goals.

In summary, mid-term investments offer a unique tax treatment that can vary depending on the investment type and jurisdiction. Investors should carefully consider the tax implications to ensure they make the most of their investment strategy. Consulting with a tax professional or financial advisor can provide personalized guidance, helping investors navigate the complex world of tax laws and optimize their overall returns.

Unlocking Long-Term Wealth: Safe and Simple Investment Strategies

You may want to see also

Frequently asked questions

Mid-term investments typically refer to assets or securities that are held for a period longer than short-term but not as long-term as long-term investments. This category often includes investments with maturity dates or holding periods ranging from a few months to several years. Examples might include corporate bonds with a maturity of 2-10 years, certain mutual funds, or real estate investments that are not considered long-term but also not immediate liquid assets.

Mid-term investments offer a balance between risk and return. They provide a longer horizon for growth compared to short-term investments but with less volatility and risk than long-term investments. These investments are often suitable for investors who want to diversify their portfolios and have a moderate risk appetite. Mid-term investments can also be a strategic choice for those who want to take advantage of potential market growth while still having some liquidity and the ability to react to market changes within a reasonable timeframe.

Short-term investments are typically held for a period of less than a year and are designed for quick access to capital with minimal risk. Examples include money market accounts, high-yield savings accounts, and short-term government bonds. Long-term investments, on the other hand, are held for an extended period, often 10 years or more, and are intended for retirement planning or long-term financial goals. They may include stocks, real estate, or certain mutual funds. Mid-term investments fall between these two categories, offering a compromise between liquidity, risk, and potential returns.