In a long-term deflationary environment, investing requires a strategic approach to navigate the challenges of decreasing prices and potential economic slowdowns. This guide will explore effective investment strategies, focusing on assets that can provide stability and growth over time, such as real estate, commodities, and carefully selected stocks that can benefit from deflationary conditions. It will also discuss the importance of diversification and risk management to ensure your portfolio is well-protected and positioned for long-term success.

What You'll Learn

- Identify Deflationary Assets: Research and select assets like real estate, commodities, or stablecoins that tend to perform well during deflation

- Diversify Your Portfolio: Spread your investments across various sectors and asset classes to mitigate risk and capitalize on multiple opportunities

- Focus on Quality: Prioritize companies with strong fundamentals, robust balance sheets, and a history of resilience in economic downturns

- Consider Inflation-Protected Securities: Invest in Treasury Inflation-Protected Securities (TIPS) or similar instruments to hedge against inflation and protect your purchasing power

- Stay Informed and Adapt: Continuously monitor economic indicators and market trends, adjusting your strategy as needed to navigate the deflationary environment effectively

Identify Deflationary Assets: Research and select assets like real estate, commodities, or stablecoins that tend to perform well during deflation

In a deflationary environment, where prices are generally falling, certain assets tend to thrive due to their intrinsic value and limited supply. Here's a guide on identifying and selecting the right assets to invest in during such economic conditions:

Real Estate: One of the most traditional and reliable investments during deflation is real estate. When prices are falling across the economy, tangible assets like property can hold their value or even appreciate. Real estate is a hedge against inflation as it provides a physical asset that is not subject to the same price fluctuations as other goods and services. During deflation, people might be more inclined to buy properties at discounted prices, making it an attractive investment opportunity. Research local markets to identify areas with strong demand and limited supply, ensuring that your real estate investments are in prime locations.

Commodities: Deflation often leads to a decrease in the prices of various commodities, making them an attractive investment option. Gold, silver, and other precious metals are classic examples of deflation-resistant assets. These commodities have a limited supply and are considered a store of value, especially during economic downturns. Other commodities like oil, natural gas, and agricultural products can also be profitable investments. The key is to identify those with stable or increasing demand, ensuring their prices remain relatively stable or even rise during deflationary periods.

Stablecoins: In the cryptocurrency space, stablecoins are an innovative solution to combat volatility. These are cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset, often a fiat currency or a commodity. Stablecoins offer the benefits of cryptocurrencies without the price volatility associated with other digital assets. During deflation, stablecoins can provide a safe haven for investors, especially those looking to diversify their portfolios. Research and select stablecoins that are widely recognized and have a strong track record of maintaining their peg, ensuring they can act as a reliable store of value.

When researching and selecting these deflationary assets, it's crucial to consider market trends, historical performance, and the underlying factors that make these assets resilient during economic downturns. Diversifying your portfolio across these asset classes can help mitigate risks and potentially yield significant returns in a long-term deflationary environment. Remember, while these assets have historically performed well, past performance is not indicative of future results, and market conditions can always change.

Unveiling the Secrets: How Short-Term Investments Are Manipulated

You may want to see also

Diversify Your Portfolio: Spread your investments across various sectors and asset classes to mitigate risk and capitalize on multiple opportunities

In a long-term deflationary environment, diversifying your investment portfolio becomes even more crucial. Deflation can lead to reduced consumer spending and business investment, impacting various sectors differently. By spreading your investments across a wide range of sectors and asset classes, you can mitigate risk and potentially capitalize on opportunities that arise during this economic climate. Here's a detailed guide on how to approach portfolio diversification in such a scenario:

- Understand the Deflationary Environment: Begin by thoroughly understanding the economic conditions you're operating in. Deflation is characterized by falling prices and can be influenced by various factors such as technological advancements, increased productivity, or a decrease in the money supply. During deflation, certain sectors may thrive while others struggle. For instance, sectors like technology and healthcare often show resilience, as they tend to innovate and adapt to changing market conditions. On the other hand, sectors like real estate and consumer discretionary may face challenges due to reduced consumer spending.

- Sector Allocation: Diversify your portfolio by allocating assets across different sectors. Here's how you can approach it:

- Technology and Innovation: Invest in companies that drive technological advancements, such as software developers, artificial intelligence firms, and renewable energy companies. These sectors often create new opportunities and can benefit from government support during economic downturns.

- Healthcare and Pharmaceuticals: The healthcare sector is generally recession-resistant, as people will always require medical care. Consider investing in pharmaceutical companies, medical device manufacturers, and healthcare service providers.

- Consumer Staples: These are essential goods and services that people continue to purchase even during economic downturns. Include companies in the food, beverages, and household products sectors in your portfolio.

- Financial Services: Banks and financial institutions can benefit from low-interest rates and may offer attractive opportunities in a deflationary environment. However, exercise caution and research thoroughly before investing in this sector.

- Infrastructure and Utilities: These sectors provide essential services and are often considered safe havens during economic crises. Invest in companies that own and operate power plants, water treatment facilities, and transportation networks.

Asset Class Diversification: Diversifying across various asset classes is essential to managing risk. Here's how you can diversify:

- Stocks: Allocate a portion of your portfolio to stocks, focusing on the sectors mentioned above. Consider both large-cap and small-cap companies to capture growth potential across the market capitalization spectrum.

- Bonds and Fixed Income: Include government bonds and corporate bonds in your portfolio to add a layer of stability. During deflation, bond prices may rise, providing a hedge against falling asset prices.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without directly purchasing properties. They can provide exposure to the real estate sector and offer diversification benefits.

- Commodities: Consider investing in commodities like gold, silver, or agricultural products, which can act as a hedge against inflation and deflation.

- Regular Review and Rebalancing: Market conditions and economic scenarios can change rapidly. Therefore, it's essential to regularly review and rebalance your portfolio. As deflation progresses or economic conditions improve, certain sectors or asset classes may outperform others. Adjust your allocations to maintain your desired risk profile and maximize returns.

- Risk Management: Diversification is a powerful tool to manage risk, but it doesn't eliminate it. Always consider your risk tolerance and investment goals. During deflation, some sectors or asset classes may experience significant volatility. Ensure that your portfolio aligns with your long-term financial objectives and consider consulting a financial advisor for personalized guidance.

By following these strategies, you can navigate the challenges of a long-term deflationary environment and potentially build a resilient investment portfolio. Remember, diversification is a long-term strategy, and it may take time to see the full benefits, especially during periods of economic transition.

Unlocking Intermediate-Term Wealth: Strategies for Smart Investing

You may want to see also

Focus on Quality: Prioritize companies with strong fundamentals, robust balance sheets, and a history of resilience in economic downturns

In a long-term deflationary environment, investors should focus on quality and prioritize companies with strong fundamentals, robust balance sheets, and a proven track record of resilience during economic downturns. This approach is crucial as it helps mitigate the risks associated with deflation and economic uncertainty. Here's a detailed breakdown of why this strategy is essential and how to identify such companies:

Understanding the Impact of Deflation: Deflation can significantly impact businesses, often leading to reduced revenue and profit margins. Companies that rely heavily on discretionary spending or are highly leveraged may struggle to maintain their operations during deflationary periods. Therefore, investors should seek out businesses with a more defensive strategy, those that can maintain or even improve their performance despite economic headwinds.

Strong Fundamentals: When investing in a deflationary environment, look for companies with solid financial fundamentals. These include consistent revenue growth, a history of profitability, and a low debt-to-equity ratio. Strong fundamentals indicate a company's ability to weather economic storms and maintain its operations effectively. For instance, a company with a consistent revenue stream and a low debt load is more likely to survive and thrive during deflation, as it has the financial flexibility to adapt to changing market conditions.

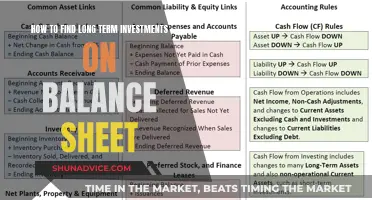

Robust Balance Sheets: A company's balance sheet is a critical indicator of its financial health and ability to manage risks. During deflation, investors should favor businesses with strong balance sheets, characterized by a high level of liquid assets, low accounts payable, and a conservative approach to debt. A robust balance sheet provides a safety net, allowing the company to navigate through challenging times without facing liquidity issues or being forced to liquidate assets at unfavorable prices.

Resilience in Downturns: Past performance is a powerful indicator of future resilience. Investors should prioritize companies that have demonstrated a history of resilience during previous economic downturns. These companies often have a deep understanding of the market, effective strategies to mitigate risks, and a strong customer base. By studying a company's performance during past recessions, investors can assess its ability to adapt and its potential to navigate through the current deflationary environment.

Long-Term Perspective: Deflationary environments often require a long-term investment strategy. Investors should be prepared to hold their positions for an extended period, allowing the companies to weather the economic storm and potentially emerge stronger. This approach requires patience and a focus on the fundamental value of the business rather than short-term market fluctuations.

In summary, when investing in a long-term deflationary environment, prioritizing quality companies with strong fundamentals, robust balance sheets, and a history of resilience is essential. This strategy provides a solid foundation for navigating economic challenges and offers the potential for long-term growth and stability.

Unveiling the Secrets: A Guide to Spotting Long-Term Investment Gems

You may want to see also

Consider Inflation-Protected Securities: Invest in Treasury Inflation-Protected Securities (TIPS) or similar instruments to hedge against inflation and protect your purchasing power

In a long-term deflationary environment, where prices are expected to fall over time, it's crucial to consider strategies that not only preserve your wealth but also potentially offer some growth. One such strategy is investing in inflation-protected securities, which can be a powerful tool to hedge against the erosion of purchasing power caused by deflation.

Treasury Inflation-Protected Securities (TIPS) are a type of US government security designed to protect investors from inflation. When you invest in TIPS, the principal value of the security adjusts to the change in the Consumer Price Index (CPI), ensuring that the value of your investment keeps pace with inflation. This is particularly important in a deflationary scenario, as it guarantees that your money will retain its buying power over time. TIPS are issued by the US Department of the Treasury and are considered a safe and reliable investment, making them an attractive option for risk-averse investors.

The mechanics of TIPS work as follows: as the CPI rises, the principal value of the security increases, and when the CPI falls, the principal value decreases. This adjustment ensures that the interest payments and the final maturity value of the security are always in line with the inflation rate. For instance, if you invest $1,000 in a TIPS with a 2% inflation protection rate, and the CPI increases by 2% over a year, your investment will grow to $1,020 at the end of that period. This growth is a direct result of the inflation adjustment, providing a hedge against deflation.

Similar inflation-protected securities are available in other countries as well, offering investors a global opportunity to protect their portfolios. These securities are typically backed by the government or a government-related entity, providing a high level of creditworthiness and safety. When considering these investments, it's essential to research the specific features of each security, including the inflation index used for adjustments, the maturity dates, and any associated fees or taxes.

By incorporating inflation-protected securities into your investment strategy, you can take a proactive approach to managing the risks associated with deflation. This strategy not only helps to preserve your purchasing power but also provides a potential source of growth, as these securities often offer a competitive interest rate compared to traditional fixed-income investments. In a deflationary environment, this combination of preservation and potential growth can be a valuable asset for long-term investors.

Maximizing Profits: A Beginner's Guide to Short-Term Rental Investing

You may want to see also

Stay Informed and Adapt: Continuously monitor economic indicators and market trends, adjusting your strategy as needed to navigate the deflationary environment effectively

In a deflationary environment, staying informed and adapting your investment strategy is crucial for long-term success. This involves a proactive approach to financial management, where you continuously monitor economic indicators and market trends to make informed decisions. Here's a detailed guide on how to navigate this unique economic climate:

Economic Indicators to Watch: Start by familiarizing yourself with key economic indicators that signal deflationary pressures. These include the Consumer Price Index (CPI), Producer Price Index (PPI), and the unemployment rate. The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. A declining CPI suggests deflation. The PPI, on the other hand, measures the average change over time in the selling prices received by domestic producers for their output. A falling PPI can indicate deflationary trends in production costs. Additionally, keep a close eye on interest rates set by central banks, as they often respond to deflationary concerns by adjusting monetary policy.

Market Trends and Adjustments: Deflationary environments can significantly impact various markets, including stocks, bonds, and commodities. During deflation, asset prices tend to decrease, and interest rates may fall. As an investor, you should be prepared to adapt your portfolio accordingly. For instance, consider the following:

- Stocks: In a deflationary environment, some sectors may perform better than others. Utilities, consumer staples, and healthcare often hold up well due to their essential nature and relatively stable pricing power. Research and invest in companies with strong market positions and a history of resilience during economic downturns.

- Bonds: Government bonds and mortgage-backed securities can be attractive in deflationary times as they offer a hedge against inflation. However, be cautious of rising interest rates, which can negatively impact bond prices.

- Commodities: Deflation can lead to lower commodity prices, affecting industries like energy, metals, and agriculture. Diversify your investments in commodities to manage risk.

Long-Term Investment Strategy: Deflationary environments often require a long-term perspective. Focus on investing in assets that have historically performed well during economic slowdowns. This may include high-quality companies with strong balance sheets, real estate investment trusts (REITs), and certain exchange-traded funds (ETFs) that provide exposure to diverse asset classes. Consider investing in index funds or ETFs that track broad market indices, as they offer diversification and can help mitigate risks associated with individual stocks.

Stay Updated and Be Flexible: Economic conditions can change rapidly, so it's essential to stay updated with the latest news and analysis. Subscribe to financial news sources, follow reputable economists and analysts, and consider using financial data platforms that provide real-time market insights. Being flexible and willing to adjust your strategy is vital. Regularly review your portfolio and be prepared to rebalance it to align with your investment goals and risk tolerance.

Risk Management and Diversification: Deflation can create opportunities for certain investments while presenting challenges for others. Effective risk management is crucial. Diversify your portfolio across asset classes, sectors, and regions to minimize the impact of deflation on any single investment. Consider using derivatives, such as options and futures, to hedge against potential losses or to speculate on market movements. However, always ensure that you understand the risks associated with these financial instruments.

By staying informed, adapting to market trends, and maintaining a long-term perspective, you can navigate the complexities of a deflationary environment and make informed investment decisions. Remember, successful investing often requires a dynamic approach, especially during economic transitions.

Unlocking Long-Term Wealth: ETFs as a Strategic Investment Strategy

You may want to see also

Frequently asked questions

Deflation occurs when the general price level of goods and services falls, often leading to a decrease in the value of money over time. In a deflationary environment, investors might worry about asset prices declining, as the purchasing power of their investments could diminish.

A common strategy is to focus on tangible assets like real estate, commodities, or precious metals. These assets often retain their value or even appreciate during deflationary periods as they provide a hedge against the falling prices of other goods and services.

Yes, some investment funds and strategies are tailored to such conditions. These may include inflation-indexed bonds, real estate investment trusts (REITs), or certain commodity-focused funds that aim to provide returns that outpace the deflation rate.

Central banks often respond to deflation by lowering interest rates to stimulate the economy. Lower interest rates can make borrowing cheaper, encouraging investment and spending. Investors should monitor these rate changes as they can impact various asset classes differently.

During deflation, industries that provide essential goods and services at stable or controlled prices may perform well. These could include utilities, consumer staples, or companies with pricing power that can adjust their prices to maintain profitability. Researching and analyzing these sectors can help investors make informed decisions.