Net foreign investment and net exports are two interconnected economic concepts that play a crucial role in understanding a country's international trade and financial position. Net foreign investment refers to the difference between the amount of capital a country receives from abroad and the amount it invests in other countries. On the other hand, net exports represent the value of a country's exports minus its imports. When a country's net foreign investment is equal to its net exports, it indicates a specific economic relationship. This equality suggests that the capital flowing into the country is offset by the capital flowing out, resulting in a balanced trade and investment scenario. This balance can have significant implications for a country's economic growth, stability, and overall financial health.

What You'll Learn

- Net Foreign Investment: The difference between investment abroad and investment received from abroad

- Net Exports: Value of exports minus imports, reflecting a country's trade balance

- Balance of Payments: Measures economic transactions, including net foreign investment and net exports

- Capital Account: Records financial transactions, such as investment flows, impacting net foreign investment

- Trade Deficit/Surplus: A country's net exports determine if it has a trade deficit or surplus

Net Foreign Investment: The difference between investment abroad and investment received from abroad

Net Foreign Investment (NFI) is a crucial concept in international finance, representing the difference between a country's investment in other countries and the investment it receives from foreign entities. It is a key indicator of a nation's economic engagement and financial flows across borders. When a country invests in foreign assets, such as purchasing stocks, bonds, or property, it is considered an outflow of NFI. Conversely, when foreign entities invest in the domestic market, it is an inflow, contributing to the country's NFI.

The concept of NFI is essential to understanding a country's economic health and its position in the global financial landscape. A positive NFI indicates that the country is a net investor, meaning it has more assets abroad than foreign assets within its borders. This can be a sign of economic strength and confidence, as it suggests the country has a surplus of capital to invest internationally. On the other hand, a negative NFI suggests the opposite; the country is a net borrower, relying on foreign investment to fund its domestic activities.

Calculating NFI involves a simple yet insightful formula: Net Foreign Investment = Outward Investment - Inward Investment. This equation highlights the net effect of a country's investment strategies. For instance, if a country invests heavily in foreign real estate and receives significant foreign direct investment (FDI) in its technology sector, the NFI would reflect this dynamic. A positive NFI in this scenario would indicate a thriving economy attracting foreign capital while also investing abroad.

The implications of NFI extend beyond individual countries and can have global economic ramifications. A country with a consistently positive NFI may contribute to global economic growth, as its investments can stimulate local economies in the recipient countries. Conversely, a persistent negative NFI could indicate a country's struggle to attract foreign investment, potentially impacting its economic development.

Understanding NFI is vital for economists, policymakers, and investors alike. It provides insights into a country's economic policies, its attractiveness to foreign investors, and the overall health of its financial system. By analyzing NFI, stakeholders can make informed decisions regarding investment strategies, trade policies, and economic development plans, ensuring a nation's financial stability and growth in the global market.

Unlocking Investment Opportunities with Cash-Out Refinancing

You may want to see also

Net Exports: Value of exports minus imports, reflecting a country's trade balance

Net exports are a crucial economic indicator that measures a country's trade balance. It is calculated by subtracting the value of imports from the value of exports. This simple yet powerful concept provides valuable insights into a nation's economic health and its position in the global market.

When a country's exports exceed its imports, it results in a positive net exports value, indicating a trade surplus. This surplus suggests that the country is a net exporter, meaning it is selling more goods and services abroad than it is purchasing from other nations. A trade surplus can be a sign of a strong economy, as it often leads to increased foreign investment and a competitive advantage in international trade. For instance, a country with a surplus might attract investors who see the country's ability to consistently generate revenue from exports as a stable and promising investment opportunity.

Conversely, if a country's imports surpass its exports, it creates a negative net exports value, or a trade deficit. This scenario implies that the country is a net importer, relying more on foreign goods and services than it produces domestically. Trade deficits can have various implications, including increased competition for domestic industries and the potential need for additional imports to meet domestic demand. However, it's important to note that trade deficits don't always indicate a negative economic outcome. They can also reflect a country's specialization in certain industries, where it focuses on producing and exporting unique or high-value goods while importing other necessary inputs.

Understanding net exports is essential for policymakers and economists as it helps in assessing a country's economic performance and making informed decisions. A consistent trade surplus or deficit can influence a country's monetary and fiscal policies, impacting interest rates, exchange rates, and even international trade agreements. For instance, a country with a persistent trade deficit might consider implementing policies to boost domestic production or attract foreign investment to reduce the deficit.

In summary, net exports provide a clear picture of a country's trade dynamics, offering insights into its economic strength, specialization, and global competitiveness. By analyzing these metrics, economists and policymakers can make strategic choices to promote economic growth, ensure a stable currency, and foster a favorable trade environment.

FBAR Filing: Navigating Foreign Investment Compliance

You may want to see also

Balance of Payments: Measures economic transactions, including net foreign investment and net exports

The Balance of Payments (BoP) is a comprehensive record of a country's international economic transactions over a specific period, typically a year. It provides a detailed breakdown of the flow of goods, services, income, and financial items between a country and the rest of the world. One of the key components of the BoP is the measurement of net foreign investment and net exports, which are crucial indicators of a country's economic health and its integration into the global economy.

Net foreign investment refers to the difference between a country's foreign direct investment (FDI) and its investment abroad. FDI is when a company or individual from one country invests in a business in another country, establishing a lasting interest in the enterprise. This can include buying a company, acquiring shares, or providing loans to foreign entities. On the other hand, investment abroad is when a domestic company or individual invests in foreign assets, such as purchasing foreign stocks or bonds. Net foreign investment is calculated by subtracting the investment abroad from the FDI, providing insight into the direction and extent of a country's capital flows.

Net exports, also known as the trade balance, represent the difference between a country's exports and imports of goods and services. Exports are the goods and services produced in a country and sold to foreign markets, while imports are the goods and services brought into the country from abroad. A positive net exports value indicates a trade surplus, meaning the country's exports exceed its imports. Conversely, a negative value signifies a trade deficit, where imports surpass exports. Net exports are essential in assessing a country's competitiveness in international trade and its overall economic performance.

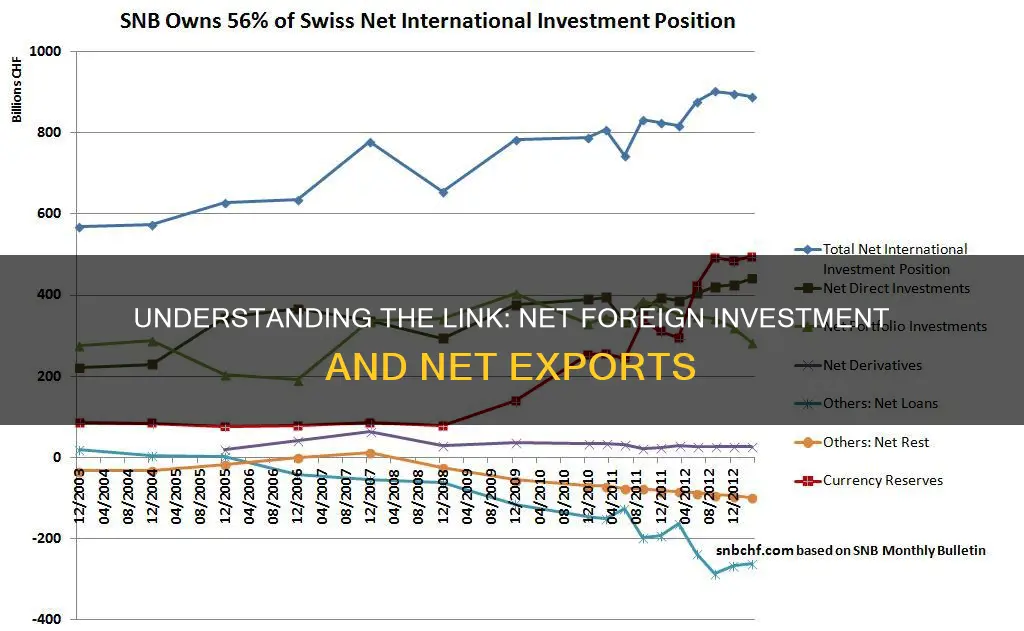

The relationship between net foreign investment and net exports is significant in understanding a country's economic dynamics. When a country attracts substantial net foreign investment, it often indicates confidence in the country's economic stability and growth prospects. This can lead to increased capital inflows, which may stimulate domestic investment, consumption, and overall economic activity. Additionally, net foreign investment can influence the value of a country's currency and its exchange rate, impacting the price competitiveness of its exports and imports.

In the context of the Balance of Payments, these measures are interconnected and provide a comprehensive view of a country's economic interactions with the rest of the world. By analyzing net foreign investment and net exports, economists and policymakers can assess a country's external financial position, identify potential economic vulnerabilities or strengths, and make informed decisions regarding trade policies, investment strategies, and monetary management. Understanding these concepts is crucial for evaluating a country's economic performance and its integration into the global marketplace.

FDI's Impact: Unlocking Economic Growth and Development

You may want to see also

Capital Account: Records financial transactions, such as investment flows, impacting net foreign investment

The Capital Account is a crucial component of a country's balance of payments, specifically focusing on financial transactions that involve the exchange of capital and financial assets between a country and the rest of the world. It plays a significant role in understanding and analyzing the impact of investment flows on a nation's net foreign investment position. When we talk about net foreign investment, we refer to the difference between the amount of capital a country receives from abroad and the amount it invests in other countries. This concept is directly linked to the Capital Account, as it records all the financial transactions that contribute to this investment flow.

In the context of international trade and finance, the Capital Account provides a detailed breakdown of various transactions. It includes investments made by residents of one country in foreign assets, such as purchasing stocks, bonds, or property in another country. Conversely, it also records the investments made by foreign entities in the domestic market. These transactions can significantly influence a country's net foreign asset position and, consequently, its overall economic stability. For instance, if a country attracts substantial foreign direct investment (FDI) in its manufacturing sector, it will be reflected in the Capital Account, impacting the net foreign investment figure.

The Capital Account also captures other financial transactions, such as portfolio investments, where investors buy and sell various financial assets, including stocks, bonds, and derivatives, across international borders. These activities can lead to rapid changes in a country's net foreign investment, especially when large institutional investors or hedge funds are involved. Moreover, the account records loans and other financial assistance provided by one country to another, further influencing the net foreign investment balance.

Understanding the Capital Account is essential for economists, policymakers, and investors alike. It provides valuable insights into a country's economic health, attractiveness to foreign investors, and its role in the global financial market. By analyzing the Capital Account, economists can assess the potential risks and benefits associated with a country's investment policies and strategies. For instance, a consistent outflow of capital from the Capital Account might indicate a need for policy adjustments to attract more foreign investment.

In summary, the Capital Account is a critical tool for tracking and analyzing financial transactions that impact a country's net foreign investment. It provides a comprehensive view of investment flows, allowing economists and policymakers to make informed decisions regarding international trade, economic development, and financial stability. By studying the Capital Account, one can gain valuable insights into the complex relationship between a country's financial transactions and its net foreign investment position.

Personal Investments: When to Take the Plunge

You may want to see also

Trade Deficit/Surplus: A country's net exports determine if it has a trade deficit or surplus

A country's trade balance is a critical indicator of its economic health and global position, and it is primarily determined by the concept of net exports. Net exports refer to the value of a country's exports minus its imports, and this figure is a key component in understanding whether a nation runs a trade deficit or surplus. When a country's exports exceed its imports, it is said to have a trade surplus, indicating that it is a net exporter. Conversely, if imports surpass exports, the country experiences a trade deficit, meaning it is a net importer.

The relationship between net foreign investment and net exports is an important aspect of this discussion. Net foreign investment represents the difference between a country's foreign direct investment (FDI) and portfolio investment. While it might seem unrelated to net exports, there is a connection. When a country attracts significant net foreign investment, it often means that foreign entities are investing more in the country's assets, businesses, or financial markets than the country is investing abroad. This can indirectly impact net exports. For instance, if foreign investors buy domestic assets, it can lead to an appreciation of the local currency, making exports more expensive and imports cheaper. As a result, the country's trade balance may be affected, potentially leading to a trade deficit or surplus.

In the context of trade, a trade deficit occurs when a country's imports exceed its exports, leading to a negative net exports figure. This situation often arises when a country heavily relies on foreign goods and services, either due to limited domestic production or a lack of comparative advantage in certain industries. Over time, persistent trade deficits can lead to a trade gap, where the cumulative effect of deficits results in a significant accumulation of foreign debt.

On the other hand, a trade surplus is achieved when a country's exports surpass its imports, resulting in a positive net exports value. This is often associated with a country's strong manufacturing base, competitive export industries, or a favorable exchange rate that makes its goods more attractive to foreign buyers. Trade surpluses can contribute to a country's economic growth, as they provide a steady stream of foreign currency, which can be used to invest in domestic infrastructure, businesses, or to service foreign debt.

Understanding the interplay between net foreign investment, net exports, and the trade balance is crucial for policymakers and economists. It helps in formulating strategies to improve a country's trade position, attract or manage foreign investment, and ensure sustainable economic growth. By analyzing these factors, governments can make informed decisions regarding trade policies, exchange rate management, and investment strategies to foster a healthy and balanced trade environment.

Leveraging Investments for Down Payments: Smart Strategies

You may want to see also

Frequently asked questions

Net foreign investment and net exports are two interconnected concepts in international trade and finance. Net foreign investment refers to the difference between the amount of capital invested by a country's residents in foreign countries and the amount of capital invested by foreign residents in the domestic country. Net exports, on the other hand, represent the difference between a country's exports and imports, indicating whether a country is a net exporter or importer.

Net foreign investment can influence a country's net exports in several ways. When a country attracts more foreign investment than it invests abroad, it can lead to an increase in the country's exports, as the invested capital may be used to produce goods and services that are then sold internationally. This, in turn, can result in a positive net exports figure, indicating that the country is a net exporter.

The capital account is a component of a country's balance of payments, which records transactions involving the purchase and sale of assets, including financial investments. Net foreign investment is a key element of the capital account. When a country's residents invest abroad, it is recorded as a negative item in the capital account, and when foreign residents invest in the domestic country, it is positive. The sum of these investments over a period gives the net foreign investment figure.

Net foreign investment and net exports are both crucial factors in determining a country's overall balance of trade. A country with a positive net foreign investment and a positive net exports figure is likely to have a favorable balance of trade, indicating that it is a net exporter and attracting foreign investment. Conversely, a negative net foreign investment and negative net exports could suggest a trade deficit, where imports exceed exports.

Yes, many countries have experienced positive net foreign investment and net exports. For instance, the United States has been a significant recipient of foreign direct investment, which has contributed to its large net exports. Similarly, countries like China and Japan have also attracted substantial foreign investment, leading to their status as major net exporters. These countries' economic policies and global trade relationships play a vital role in attracting foreign investment and maintaining positive net exports.