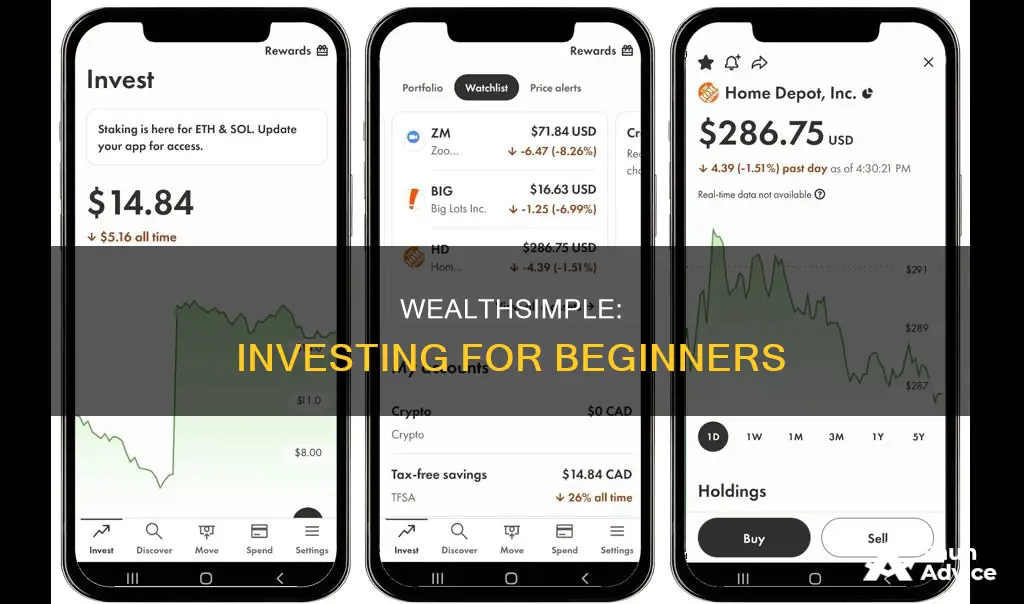

Investing is a way to make more money using your money. Wealthsimple is an automated online investment service that offers state-of-the-art technology, low fees, and personalized service. It is ideal for first-time investors or those who want to invest regularly. Wealthsimple builds portfolios of assets that are diversified across markets, designed to perform well in the long term, keep fees low, and avoid market timing. The service is supported by experts who will customize a portfolio based on your risk tolerance and goals. The in-house investment team keeps a close eye on market trends and opportunities so you don't have to.

| Characteristics | Values |

|---|---|

| Investment style | Active or passive |

| Investment platform or advisor | Trading platform/online brokerage, robo advisor, financial planner, human financial advisor, self-directed/online broker |

| Stock buying goals and risk tolerance | Short-term or long-term, low or high risk |

| Investment account | Tax-Free Savings Account (TFSA), Retirement Account (RRSP), Personal Investing/Brokerage Account, Registered Education Savings Plan (RESP) |

| Amount to invest | No minimum deposits to open an account |

| Stocks to invest in | Individual stocks, index funds, exchange-traded funds (ETFs), mutual funds, bonds |

| Order type | Market order, limit order, stop order |

| Investment plan | Diversified investments, consistent strategy |

| Investment timing | Anytime |

What You'll Learn

Understanding your risk tolerance and goals

Your risk tolerance is how much of your investment you can afford to lose. If you need money for next month's rent, you have a very low-risk tolerance. If losing your investment won't affect your life in any way, your risk tolerance is high. Your risk tolerance is often dictated by your time horizon, which is how long you plan to hold onto your investments for. If you're investing for the long term, you can generally take on more risk.

Your goals will also determine your time horizon. For example, if you're saving for retirement, your time horizon will be long. It's important to keep your risk tolerance and goals in mind when deciding how to invest.

Wealthsimple's in-house investment team will customize a portfolio to suit your risk tolerance and goals. They will consider market trends and opportunities so you don't have to. Wealthsimple offers lower fees than mutual funds, charging between 0.2% and 0.5% instead of the typical 2%.

Fidelity Investments: Sport Clips' Financial Management Partner

You may want to see also

Choosing an investment platform or advisor

No matter what you choose to do, you’re going to need an investment platform or an advisor to make the trade. Here are your three options:

Trading Platform/Online Brokerage

Online investing takes place on a trading platform, and nowadays there are quite a few to choose from, with different fees or even some that are commission-free. This means you’ll have to research each individual stock you want to purchase like Apple or Amazon. You’ll probably have to consider how many shares you want, look into the company’s history, past earnings, and its projected earnings. Then be prepared to ensure your portfolio of stocks is sufficiently diversified for you to minimize your risks—i.e. not putting all of your eggs in one basket. You’ll also have to keep an eye on the stock’s performance and decide when and if to sell your shares.

Robo Advisor

Robo advisors are basically automated investment services that will do the job of wealth managers or investment advisors by using sophisticated algorithms to help you pick stocks and create a portfolio based on your financial goals and your risk tolerance. This is called passive investing, and it is usually advisable for most of us just getting started in the investment game.

Robo advisors usually charge lower fees, since they create portfolios consisting of inexpensive exchange-traded funds (ETFs). Investing in ETFs also has the benefit of lowering your risk, which is often a high barrier of entry for newbie investors. Another advantage? Robo advisors are accessible 24/7, no appointments necessary. And since the companies operate entirely online, you can sign up to a robo advisor, deposit money, check your balance, withdraw money, etc., all from the comfort of your own home.

Financial Planner

A financial planner is the white-glove service of stocks trading, both offline and on. It’s usually the most expensive option but guarantees you’ll get the highest level of service. Simply put, a financial planner is anyone who helps you manage your money, whether that’s a stockbroker, an accountant, or a retirement specialist. The most prudent choice is a Certified Financial Planner™ (CFP®), because they have undergone testing and are legally obligated to place your interests above any other concern and cannot make commissions from managing your assets.

But again, this level of service comes at a price (although some services offer free perks like a portfolio review session). You’ll usually have to pay a flat fee, commission, and perhaps consultation fees and fees priced at the percentage of assets under management. So before you choose this route, it’s important to know exactly how much you’re paying for and whether it’s worth it for you, since fees can really eat into investment gains if you don’t plan carefully.

Robo-Investing: BlueCrest's Smart Strategy for Financial Success

You may want to see also

Determining your stock-buying goals and risk tolerance

Before you start investing, it's important to determine your stock-buying goals and risk tolerance. This involves asking yourself a few key questions:

- What are your financial goals? Are you investing for the short term or the long term?

- What is your risk tolerance? How much risk are you comfortable with taking on?

- What is your time horizon? How long are you planning to hold on to your stocks?

Let's take a closer look at each of these questions to help you make informed decisions about your investments.

Financial Goals

When determining your financial goals, it's important to be clear about what you want to achieve through investing. Are you saving for retirement, education, or a specific purchase like a house? Defining your financial goals will help you choose the right investment strategy and products. For example, if you're investing for retirement, you may have a longer time horizon and be willing to take on more risk.

Risk Tolerance

Risk tolerance refers to how much risk you are comfortable with taking on when investing. It's important to assess your risk tolerance honestly, as it will impact your investment decisions. If you have a low-risk tolerance, you may prefer more conservative investments like bonds or savings accounts. On the other hand, if you have a higher risk tolerance, you may be comfortable with more volatile investments like stocks. It's worth noting that higher-risk investments offer the potential for higher returns but also come with a greater possibility of loss.

Time Horizon

Your time horizon simply refers to how long you plan to hold on to your investments. This is closely linked to your financial goals and risk tolerance. If you're investing for the long term, such as for retirement, you may be comfortable with a higher-risk portfolio as you have more time to ride out any market fluctuations. On the other hand, if you're saving for a short-term goal, you may prefer more conservative investments to protect your capital.

In summary, determining your stock-buying goals and risk tolerance is a crucial step before investing. It's important to be clear about your financial goals, how much risk you're comfortable with, and your time horizon. This will help you make informed decisions about the types of investments that are suitable for your needs and ensure that your investment strategy is aligned with your goals.

A Beginner's Guide to Investing with Fidelity

You may want to see also

Choosing the right investment account

Once you've figured out why and what you want to invest in, it's time to choose the proper account to hold your stocks. You can usually open different kinds of investment accounts, depending on your financial needs and goals, with brokerages and robo-advisors. Whatever you do, you should definitely compare account minimums, whether the accounts charge commission for trades, and any other fees that might arise. Here are some of the most common kinds of investment accounts:

- Tax-Free Savings Account (TFSA): A TFSA is a registered investment or savings account that allows for tax-free gains. That means that any returns on your investments in that account are tax-free when you withdraw them, and you can do so at any time.

- Retirement Account (RRSP): A Registered Retirement Savings Plan (RRSP) is a retirement account that allows you to invest in stocks, bonds, and other assets. Your contributions are tax-deferred, meaning any money you contribute will be exempt from CRA taxes the year you make the deposit, and will only be taxed years down the line when you withdraw it.

- Personal Investing/Brokerage Account: A personal investing account can refer to any kind of account that holds your investments. But if it's a strictly personal one, that account simply serves your financial goals and doesn't come with benefits like the government-sponsored ones do.

- Registered Education Savings Plan (RESP): RESPs are tax-advantaged accounts designed to help Canadians save for higher education. RESP funds can be invested in countless ways, and if they are spent on higher-education-related tuition or expenses, no investment gains in the account will be subject to income taxes.

If you're still unsure about which account is right for you, you can always consult a financial advisor or a robo-advisor.

Cash as an Investment: Pros and Cons

You may want to see also

Deciding how much to invest in stocks

When deciding how much to invest in stocks, it is important to consider your financial situation and goals. Ask yourself whether you have any high-interest credit card debt and ensure you have an emergency fund in place, which financial advisors recommend should cover between six months and a year's worth of living expenses.

It is also crucial to assess your risk tolerance and time horizon. If you need money for next month's rent, your risk tolerance is low, whereas if losing your investment would not affect your life in any way, your risk tolerance is high. Your time horizon refers to how long you plan to hold onto stocks for. If you are investing for retirement, for example, your time horizon will be long.

Once you have considered these factors, you can decide on the amount you are willing and able to invest. The most successful investors are typically those who are in it for the long game, so choose an amount that you are comfortable with leaving untouched for a significant number of years. Remember that you do not need to invest a large sum to get started; many brokerages require no minimum deposits, and you can purchase ETFs that allow you to buy a small piece of many companies.

Strategies for Investing Cash Reserves: A Guide to Opportunities

You may want to see also

Frequently asked questions

Wealthsimple builds portfolios of assets that are diversified across markets and are expected to perform well over the long term. They keep fees low and don't try to time the market.

A good rule of thumb is that their riskiest portfolios earn about 4–5% returns over the rate of inflation, and less risky portfolios will earn slightly less.

The best portfolio for you is one you can stick to and keep investing in through market ups and downs. To match you with the right portfolio, they will ask you a few questions, like what you’re saving for, when you’re going to need the money, and how comfortable you are with portfolio fluctuations.

First, choose your investing style (DIY or with an advisor). Then, choose an investment platform or advisor. Next, determine your stock-buying goals and risk tolerance. After that, choose the right investment account. Then, decide how much you want to invest in stocks. Finally, decide what stocks to invest in and get started!