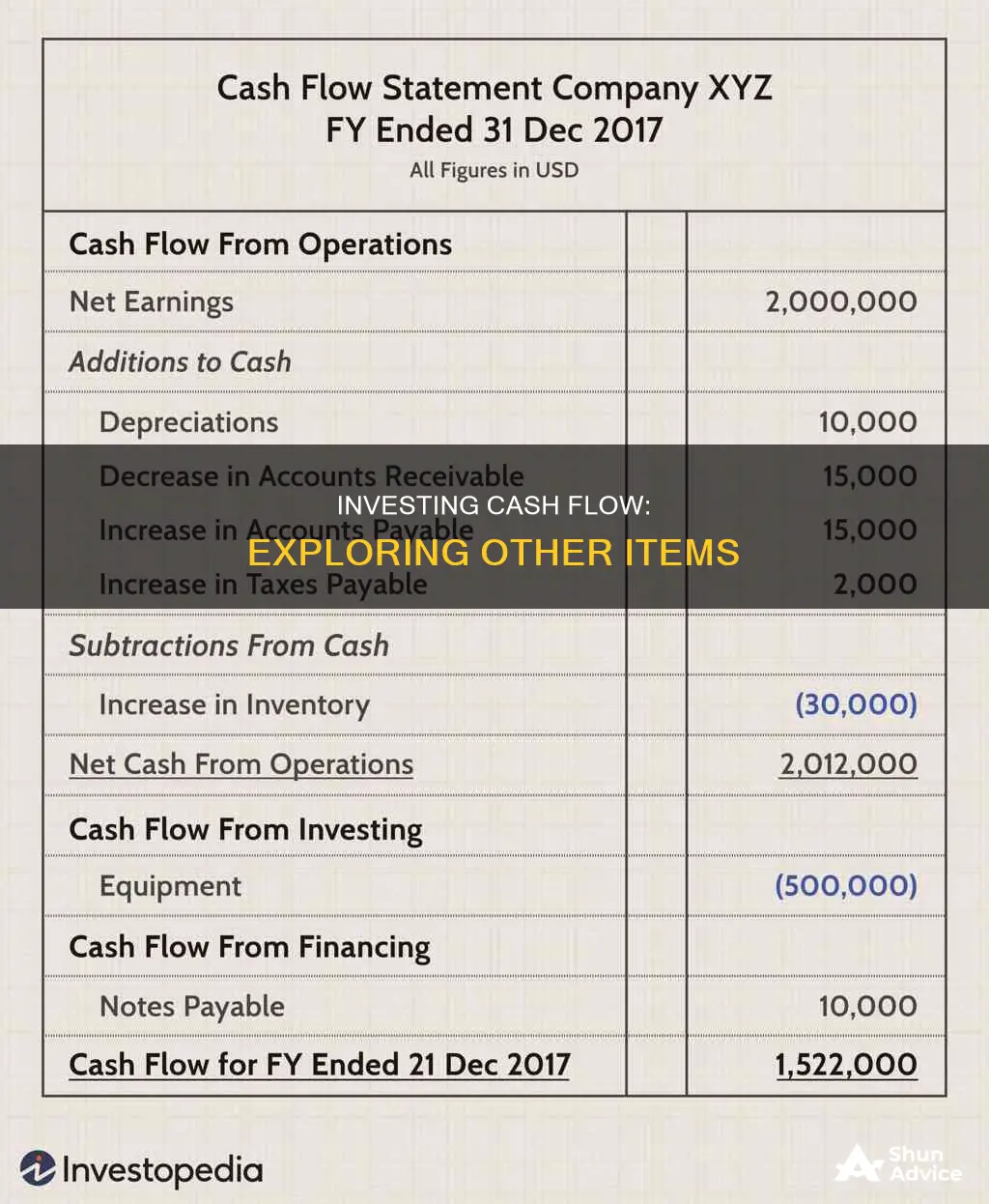

A company's cash flow statement is one of its key financial statements, and it includes three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This paragraph focuses on the second section, cash flow from investing activities (CFI), which details the cash impact of the purchase of non-current assets such as fixed assets (e.g. property, plant, and equipment) and long-term investments. A positive CFI indicates that the company is divesting its assets, while a negative CFI suggests that the company is investing heavily in its fixed asset base to generate future revenue growth. The CFI section is generally more straightforward than the cash from operations section, as its purpose is simply to track the cash inflows and outflows related to fixed assets and long-term investments across a specific period.

| Characteristics | Values |

|---|---|

| Cash Flow from Investing Activities | The section of a company's cash flow statement that displays how much money has been used in or generated from making investments during a specific time period |

| Investing Activities | Purchases of long-term assets (property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds) |

| Cash Flow from Investing Activities Example | Amazon's 2017 financial statements show that the main uses of cash for investing have been in purchasing property/equipment/software/websites, acquiring other businesses, and buying marketable securities |

| Items to Include | Proceeds from the sale of property, plant, and equipment, proceeds from the sale of marketable securities, and proceeds from the sale of other businesses |

| Items Not to Include | Interest payments or dividends, debt, equity, or other forms of financing, depreciation of capital assets, and all income and expenses related to normal business operations |

| Cash Flow from Investing Activities Formula | Cash Flow from Investing Activities = (Capital Expenditures) + (Purchase of Long-Term Investments) + (Business Acquisitions) – Divestitures |

| Positive CFI | Indicates that the company is divesting its assets, which increases the cash balance of the company (i.e. sale proceeds) |

| Negative CFI | Indicates that the company is investing heavily into its fixed asset base to generate revenue growth in the coming years |

What You'll Learn

Long-term investments

The cash flow statement offers insights into the company's financial health and operational efficiency by tracking the inflow and outflow of cash. It is important to note that negative cash flow from investing activities does not necessarily indicate poor financial health. Instead, it often signifies that the company is investing in long-term development activities, such as research and development, which are essential for the company's continued operations and future growth.

When analyzing the cash flow statement, it is crucial to consider the company's balance sheet and income statement to gain a comprehensive understanding of its financial position. The balance sheet provides information about the company's assets, liabilities, and owner's equity, while the income statement offers an overview of its revenues and expenses during a specific period.

Overall, long-term investments are a critical aspect of a company's financial strategy, and their impact on cash flow can provide valuable insights into the company's performance and future prospects.

OPay Cash Investment: Legit or Scam?

You may want to see also

Business acquisitions

The cash flow statement provides insights into a company's financial health and helps stakeholders understand its capital expenditure and investment strategies. It is important to note that negative cash flow from investing activities does not always indicate poor financial health. Instead, it may signal that the company is investing in long-term development activities, such as business acquisitions, which are crucial for the health and continued operations of the company.

Computing Net Proceeds: Investing Cash Flow Explained

You may want to see also

Proceeds from the sale of assets

When a company sells a long-term asset, the proceeds are recorded as a positive amount in the investing activities section of the cash flow statement. This is an important aspect of the cash flow statement as it provides an overview of the company's cash management and ability to generate cash.

The proceeds from the sale of assets can include the sale of physical assets, such as property, plant, and equipment, as well as the sale of investment securities, stocks, or bonds. For example, a company may sell one of its company cars and receive proceeds from the sale, which would be recorded as a positive amount in the investing activities section.

The cash flow statement also takes into account the gain or loss on the sale of the asset. If the amount received from the sale is greater than the book value or carrying value of the asset, the difference is recorded as a gain. On the other hand, if the amount received is less than the book value, the difference is recorded as a loss. This gain or loss is then shown as a deduction from the net income reported in the operating activities section of the cash flow statement.

Invest Cash, Avoid FAFSA: Strategies for Financial Aid Freedom

You may want to see also

Capital expenditures

CapEx is a financial outlay made by companies to increase the scope of their operations or add future economic benefits. These payments are recorded or capitalized on a company's balance sheet rather than expensed on the income statement.

An item is considered CapEx if it has a useful life of more than one year, or it improves the useful life of an existing capital asset. For example, purchasing a vehicle to add to a company fleet would be treated as CapEx, whereas the cost of filling up the gas tank would be an operating expense (OpEx).

CapEx is an important measure of capital investment used in the valuation of stocks. An increase in CapEx indicates that a company is investing in future operations, although it also represents a reduction in cash flow. Companies with significant CapEx are typically in a state of growth.

The CapEx metric is used in company analysis ratios, such as the cash-flow-to-CapEx ratio, which indicates a company's ability to acquire long-term assets using free cash flow. A ratio greater than 1.0 suggests that a company can fund its asset acquisitions with its operating cash flow, while a ratio less than 1.0 may indicate issues with cash inflows.

How Cash Investments Impact Owners' Equity

You may want to see also

Purchase of marketable securities

Marketable securities are financial assets that can be sold or converted to cash within a year. They are typically securities that can be bought or sold on an exchange, such as stocks, bonds, certificates of deposit, or commodities contracts. Companies can add to their bottom line by purchasing and selling marketable securities, which are often preferred to holding cash as they provide returns and generate profits.

The purchase of marketable securities is considered an investing activity in a company's cash flow statement. This statement shows the cash generated by or spent on investment activities. Investing activities can include the purchase of physical assets, investments in securities, or the sale of securities or assets.

The cash flow statement is one of the three main financial statements used by businesses, alongside the balance sheet and the income statement. It is important because it shows how a company is allocating cash for the long term. For example, a company may choose to invest cash in short-term marketable securities to boost profits.

The purchase of marketable securities will generate negative cash flow in the investing section of the cash flow statement. However, this is not necessarily an indicator of poor financial health. It may instead show that the company is investing in assets, research, or other long-term development activities that are important for the company's health and continued operations.

The balance sheet is the starting point for marketable securities, where they are noted and listed as assets. They are usually stated at fair market value as of the date of the financial statements. Marketable securities are most often designated as current assets, as they are typically intended to be held for less than a year.

The investing section of the cash flow statement will always show the cash used to purchase securities. For example, Apple's cash flow statement for the twelve months ending September 30, 2023, showed purchases of marketable securities for $29.52 billion. Despite this significant spending, Apple still had a positive cash flow from investing activity.

Liquidating US Investments: A Country's Cash Out Strategy

You may want to see also

Frequently asked questions

Investing activities include purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds).

A positive cash flow indicates a company is divesting, while a negative number indicates the company is investing heavily in its asset base to help generate growth in revenue.

A negative cash flow from investing activities is not always a bad thing. It can indicate that management is investing in the long-term health of the company.

A positive cash flow from investing activities means the company is divesting its assets, which increases the cash balance of the company (i.e. sale proceeds).