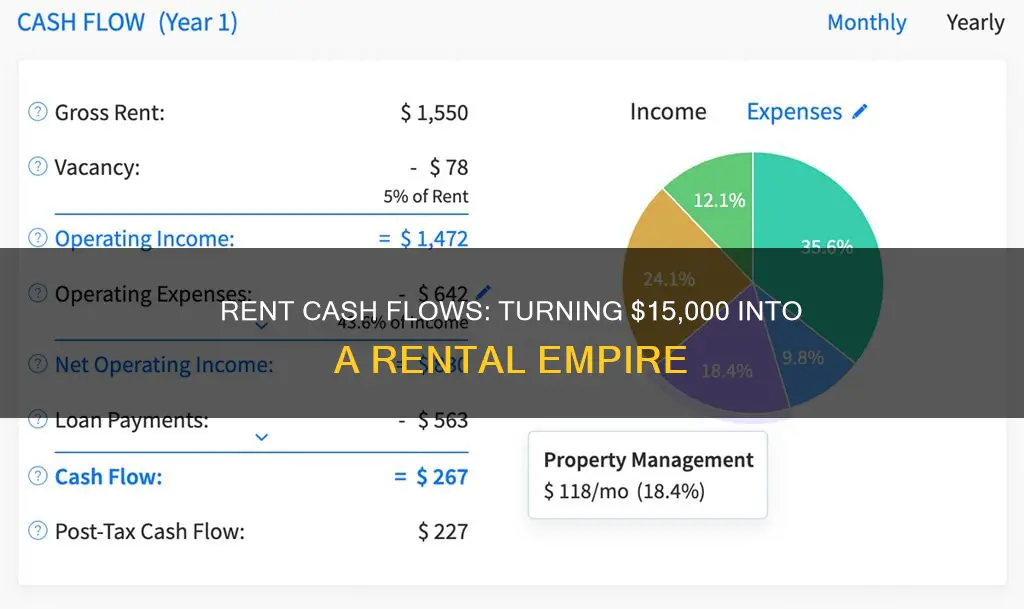

Cash flow is the difference between a business's income and expenses. In real estate, cash inflows or income could include rent and pet fees, while outflows or expenses could include taxes, maintenance costs, and other fees.

Positive cash flow is an indication that you are making more money than you are spending each month. On the other hand, negative cash flow is a sign that your rental is not currently profitable and you may need to take action.

Calculating cash flow is simple: subtract your expenses from your income. However, the items that make up the equation are complex.

To calculate cash flow for a rental property, there are four steps:

1. Estimate gross cash flow/income: Include all money that comes in throughout the year, such as gross rental income, additional income, and vacancy.

2. Forecast gross operating expenses: Include money that goes out each year as a cost of owning and operating a rental property, such as property management fees, maintenance costs, capital expenditures, and property tax.

3. Calculate net operating income (NOI) before financing: Subtract your gross income from your gross operating expenses.

4. Calculate net cash flow after debt service: Subtract debt service from your NOI.

While cash flow is a relatively easy calculation to perform, it should not be taken at face value, as there are other factors that determine the overall financial health of a property. For example, when analysing rental property cash flow, the purchase price of the property should be taken into account.

| Characteristics | Values |

|---|---|

| Definition of Cash Flow | The movement of money in and out of a business |

| Cash Inflow | Received rent and pet fees |

| Cash Outflow | Taxes, maintenance costs, and other fees |

| Positive Cash Flow | Positive when rental income exceeds expenses |

| Negative Cash Flow | Negative when expenses exceed rental income |

| Cash Flow Calculation | Cash Flow = Income – Expenses |

| Good Cash Flow | $100-$200 per unit per month |

| Gross Cash Flow | Income from rent, late fees, application fees, etc. |

| Net Cash Flow | Income after all expenses have been paid |

| ROI | ROI = Net Cash Flow / Property Cost |

| Cash-on-Cash Return | Cash-on-Cash Return = Net Cash Flow / Cash Invested |

| 1% Rule | Monthly rent should be at least 1% of property price |

| 50% Rule | Expenses are about 50% of income |

What You'll Learn

Calculating gross cash flow

Step 1: Project Effective Gross Income (EGI)

First, you need to estimate the maximum income the rental property could generate annually. This includes gross potential rent, which can be forecasted through a rental market analysis (RMA). An RMA involves comparing similar properties in the same location and condition to predict rental rates.

In addition to rent, there may be other sources of income, such as pet fees, utility reimbursements, parking fees, and administrative fees. These additional sources, although relatively small, are important to consider and should be included in the calculation.

Step 2: Account for Vacancies

Vacancies can be a significant factor affecting cash flow. It is important to factor in potential "downtime" between tenants by applying a vacancy rate based on an analysis of the property and market conditions. A standard assumption for vacancy time is 2% of gross annual rents. For example, if a property sits vacant for one month, it loses 8% of its projected annual rent, including utilities.

Step 3: Calculate Gross Cash Flow

After projecting the income and accounting for vacancies, you can calculate the gross cash flow. This is the total income collected from rents and additional services. For example, if the annual rent is $12,000, and additional income is $1,000, with a vacancy rate of 6.5% ($780), the gross cash flow would be $12,220.

Step 4: Identify Gross Expenses

There are various recurring expenses associated with owning a rental property. These may include property tax, insurance, management fees, HOA or POA dues, and maintenance and repair costs.

Step 5: Calculate Net Operating Income (NOI)

To calculate the NOI, subtract the gross expenses from the gross income. A negative NOI indicates that the property will not provide a positive cash flow based on the assumptions made.

Step 6: Consider Capital Expenses

Capital expenses are less frequent but significant costs, such as major appliance or roof replacement. It is important to budget for these expenses to avoid unexpected major repairs that could impact your cash flow.

Step 7: Calculate Cash Flow after Debt

The final step in calculating annual cash flow is to subtract your annual debt payments from the NOI. This step is crucial, especially if you are using new financing, as it helps determine how much money you can put down and spend on the property to meet your investment goals.

By following these steps, you can accurately calculate the gross cash flow of a rental property and make informed investment decisions.

Cash App Investing: FDIC Insured?

You may want to see also

Calculating net cash flow

To calculate net cash flow, you need to know your total income and your total expenses.

Step 1: Calculate Gross Income

First, calculate your gross income. This includes all money that comes in throughout the year. For rental properties, this is usually rent, but can also include additional sources of income such as pet fees, utility reimbursements, parking fees, and administrative fees (e.g. application fees, late fees, etc.).

Step 2: Calculate Gross Expenses

Next, calculate your gross expenses. This includes all the money that goes out each year as a cost of owning and operating the rental property. Some common expenses include property management fees, maintenance costs, capital expenditures, and property tax.

Step 3: Calculate Net Operating Income (NOI)

Once you have your gross income and gross expenses, subtract the expenses from the income to get your net operating income.

Step 4: Calculate Net Cash Flow

Finally, subtract your annual debt from your NOI to get your net cash flow. This is the amount of money you have left after all expenses for the property are paid.

It's important to remember that cash flow can fluctuate from month to month and year to year, and unexpected expenses can always arise. So, while it's good to aim for a positive net cash flow, it's also important to be prepared for negative cash flow periods.

Renovation: An Investment Activity in Cash Flow Statements?

You may want to see also

Rental property cash flow analysis

Steps to Calculate Rental Property Cash Flow

Step 1: Estimate Gross Cash Flow and Income

Gross cash flow includes all money received throughout the year, such as rent and additional income from sources like pet rent, appliance rent, and application fees. It's important to list all possible sources of income while being conservative in your estimates.

Step 2: Determine Gross Operating Expenses

Gross operating expenses are the costs of owning and operating the rental property. Common expenses include property management fees, maintenance costs, capital expenditures, and property taxes. It's crucial to account for all possible expenses and overestimate to ensure sufficient funds for emergencies.

Step 3: Calculate Net Operating Income (NOI) Before Financing

To calculate NOI, subtract your gross operating expenses from your gross income. Banks and private money lenders will require this information before providing financing.

Step 4: Calculate Net Cash Flow After Debt Service

After securing financing, calculate your net cash flow by subtracting debt service (monthly mortgage payment) from your NOI. Net cash flow represents the amount of money left after all expenses are paid.

Step 5: Calculate Taxable Cash Flow

To calculate taxable cash flow, make adjustments to your net cash flow by adding back any CapEx contributions and the principal part of your mortgage payment, as these are not treated as expenses by the IRS. Then, calculate depreciation expense by dividing the building value of the property (excluding land value) by the number of years over which depreciation is allowed (typically 27.5 years). Subtract this depreciation expense from your pre-tax cash flow to determine your taxable income.

Additional Considerations

When performing a rental property cash flow analysis, it's important to consider various expenses that can impact cash flow, such as vacancy rates, credit/bad debt expenses, utilities, appliance replacement, capital repairs, and landlord insurance.

Additionally, investors should be aware of the concept of "good" cash flow, which can vary depending on individual preferences and strategies. Some investors focus on a minimum return on investment (ROI), while others seek properties that meet targeted cash-on-cash returns. Calculations like the 1% Rule, the 50% Rule, and Cash-on-Cash Return can also be used to assess the potential of a rental property investment.

By following these steps and considering the various factors involved, investors can effectively perform a rental property cash flow analysis, enabling them to make informed decisions about their rental properties and ensure the success of their real estate investments.

Cash Reserves Investments: A Safe Haven for Your Money

You may want to see also

Positive vs negative cash flow

Positive cash flow is an indication that your rental income is greater than your expenses, meaning you are making more money than you are spending each month. This is the ideal situation for any rental property owner, as it allows you to build wealth and generate significant passive income.

A positive cash flow property will generate a net profit, with cash returns exceeding fixed costs and operating expenses. For example, if your rental income is $800 per month and your expenses, including water and trash collection, maintenance, taxes, and other fees, amount to $680, you will be left with a cash flow of $120 per month.

Positive cash flow is essential for running a profitable and scalable rental business. It provides the financial cushion to expand your portfolio, reinvest profits, or save for security. Additionally, it ensures you are not losing money and can cover any unexpected expenses or vacancies.

On the other hand, negative cash flow indicates that your rental income is not covering your expenses, and you may need to contribute personal funds to make up the difference. This situation can arise due to various factors, such as high vacancy rates, low rent, high operating expenses, or overpaying for the property. While some investors intentionally buy negative cash flow properties, it is generally not recommended, especially for newer investors.

To achieve positive cash flow, you can increase your rental income by reducing vacancy rates, strategically increasing rents, renovating your property, or creating additional revenue streams. Additionally, you can reduce expenses by negotiating loan terms, staying on top of maintenance, and using accounting software to identify areas where you can cut costs.

Understanding and accurately tracking your cash flow is critical to success in the real estate industry. It allows you to make informed decisions, assess the financial health of your properties, and determine if further investment is appropriate.

Land Cash Purchase: An Investment Activity?

You may want to see also

Increasing cash flow

Negotiate the purchase price

The lower the purchase price of your rental property, the less you will pay in credit and the higher your potential cash flow. Negotiate the price of the property by researching the market price and aiming to pay below that. Saving even $1,000 on the advertised price can positively impact your cash flow.

Negotiate loan terms

Monthly mortgage payments are often one of the highest expenses for rental property owners. By negotiating the terms of your loan, you can obtain better conditions and reduce expenses. Elements such as the loan rate, loan insurance rate, application fees, and early repayment penalties may be negotiable with your lender. Keep an eye on interest rates, and if they fall, consider refinancing your loan to obtain a lower rate.

Increase rent

Increasing the rent is a straightforward way to boost your income and cash flow. However, this increase must be reasonable and in line with market prices to avoid rental vacancies. Improve the comfort and appeal of your property by undertaking small-scale renovations, such as decorating or installing new equipment.

Create additional revenue streams

Think beyond just renting out the property itself. You can create other income streams by offering additional services or amenities to your tenants. For example, you could build laundry facilities, a bicycle storage area, or a wine cellar, and charge a fee for their use. Alternatively, if you have a detached garage, you could rent it out separately for an additional monthly fee.

Reduce operating costs

Identify areas where you can reduce costs without compromising the quality of your rental property. Review your utility costs and choose more efficient options, such as installing energy-efficient appliances or improving insulation. Shop around for the best prices when it comes to repairs and maintenance, as these expenses can impact your cash flow.

Attract and retain long-term tenants

Keeping your rental property occupied is crucial for maintaining cash flow. Aim to attract and retain long-term tenants by offering a well-maintained property and competitive rental rates. Conduct thorough tenant screening and background checks to find reliable tenants who are likely to stay for an extended period.

Appeal property taxes

Property taxes can impact your cash flow, especially if they increase annually while your rental charges remain the same. Keep an eye on comparable rental properties, and if you feel the increase in taxes is unjustified, you can appeal to the local government or county assessor's office.

Furnish the rental space

Furnished rental properties can command a higher monthly rate, especially for medium-term renters such as those going through a divorce or visiting the area temporarily. Furnishing the space can be an effective way to increase your cash flow, but be sure to consider the tax implications and any applicable regional tax arrangements.

Add or upgrade amenities

Undertake projects to make your rental property more attractive and competitive. During periods of vacancy, consider renovating the kitchen and bathrooms, upgrading appliances, or adding outdoor features like a parking pad or garage. These improvements may enable you to charge higher rent and increase your cash flow.

Re-evaluate your rental strategy

Depending on the location of your rental property, you may benefit from switching to a different rental strategy. For example, if your property is close to tourist attractions or convention centers, consider converting it into a short-term rental, such as an Airbnb. This could bring in higher income and improve your cash flow.

Claim tax deductions

Don't forget to take advantage of tax deductions to reduce the taxes you pay on your rental income. Research and claim deductions for expenses such as repairs, supplies, mortgage interest, property depreciation, and insurance. These deductions can significantly impact your overall cash flow.

Increase rentable space

Look for opportunities to increase the rentable space within your property. For example, you could convert a garage into an additional bedroom or finish a basement to create a separate living area. Collecting rent on these additional spaces can boost your income and turn a negative cash flow property into a profitable investment.

Understanding Cash Investing Activities: A Beginner's Guide

You may want to see also

Frequently asked questions

Cash flow is the movement of money in and out of a business. In terms of real estate, cash inflows or income could include received rent and pet fees, and outflows or expenses could include taxes, maintenance costs, and other fees.

To calculate cash flow, you subtract your expenses from your income: Cash flow = total income – total expenses.

A good cash flow for a rental property is typically considered to be positive cash flow, with a net profit of at least $100-$200 per unit per month.