Passive index fund investing is a long-term investment strategy that focuses on buying and holding a diverse portfolio of investments, with the goal of building wealth gradually over time. Passive investors seek to buy and hold investments that may steadily increase in value over time, based on historical market returns, rather than trying to beat the market. The most common type of passive investing is index investing, where investors seek to invest in a portfolio of stocks, bonds or other assets that mimic the composition of a particular market index. Passive investing has become an increasingly popular investment strategy and may help investors build wealth and achieve their long-term financial goals.

| Characteristics | Values |

|---|---|

| Type of investing | Passive |

| Investment strategy | Long-term |

| Investment objective | Build wealth by buying securities and holding them long-term |

| Risk | Lower |

| Investment options | Limited |

| Returns | May not be above market returns |

| Investment funds | Index funds, exchange-traded funds (ETFs) |

| Investment management | Less active |

| Investment costs | Lower fees, lower capital gains taxes |

What You'll Learn

Passive vs active investing

Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for the long term. It is a passive management strategy, meaning it aims to match the market rather than outperform it. Passive investing is a low-cost strategy, and it is often the preferred strategy for beginners as it is a relatively low-risk way to build wealth over time.

Active investing, on the other hand, is an investment strategy that attempts to beat the market by selecting different investments than those included in an index or by trying to time the market. Active investing is a more hands-on approach, often used by experienced investors who trade frequently. It is a form of active management, which has a higher risk/reward profile than passive investing.

Passive investing is a popular strategy, especially for those with a long-term investment horizon. According to a 2021 Gallup Investor Optimism Index, 71% of US investors surveyed said passive investing was a better strategy for long-term investors who want the best returns. Passive investing is also a good option for those who are unwilling or unable to actively monitor and adjust their portfolio.

However, active investing may be preferable for investors who want more control over their investments and are willing to take on more risk. Active investors can handpick their investments and may be able to beat the market.

Both passive and active investing strategies have their pros and cons, and the best strategy depends on an investor's circumstances, goals, risk tolerance, and financial expertise.

Strategies for Investing in Hedge Funds: A Comprehensive Guide

You may want to see also

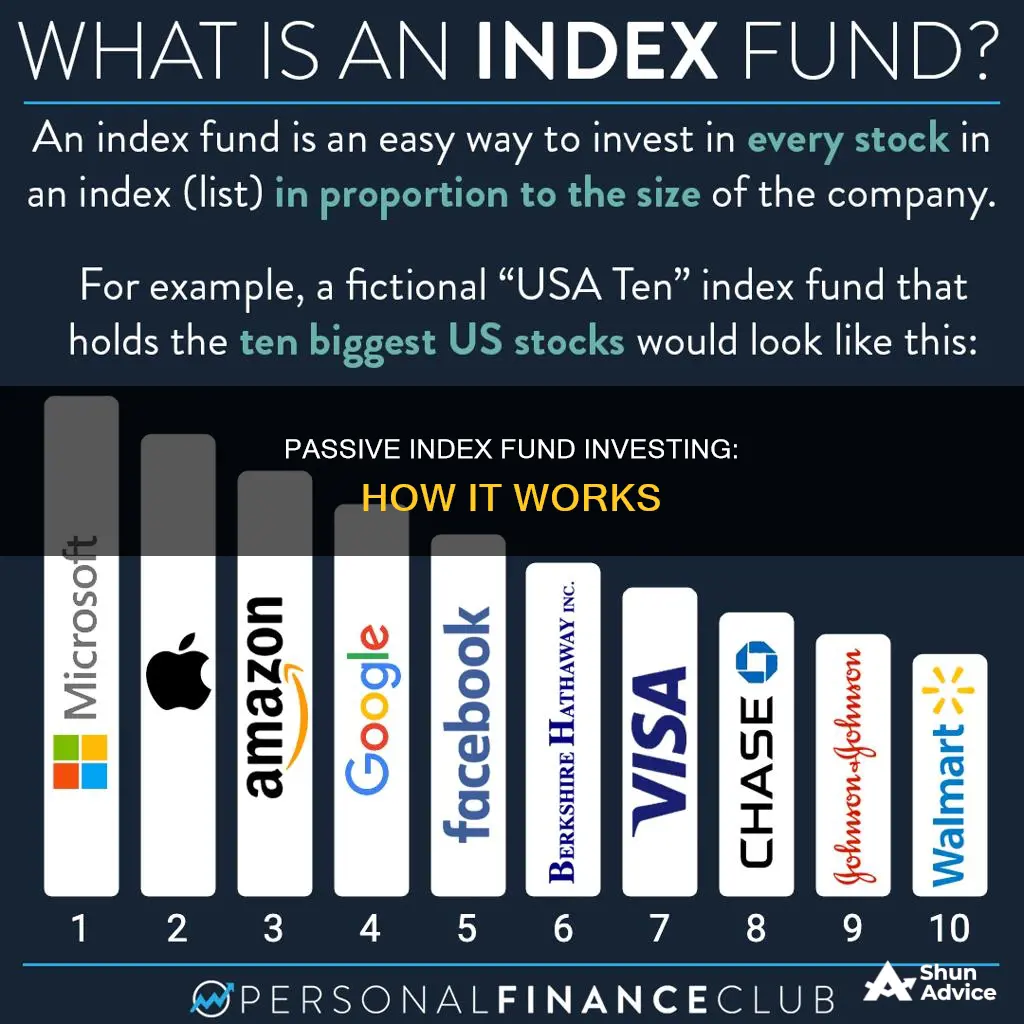

Index investing

The most common indexes tracked by index funds include the S&P 500, Dow Jones Industrial Average, Nasdaq Composite Index, and the Russell 2000 Index.

Benefits of Index Investing

- Lower fees and costs: Passive investing is typically cheaper than active investing as it involves less frequent buying and selling of investments, reducing transaction costs and management fees.

- Lower risk: Index investing provides greater diversification than investing in individual stocks, reducing risk.

- Steady returns: Index funds have historically outperformed actively managed funds over the long term.

- Lower maintenance: Passive investors do not need to constantly track the performance of their investments as they are in it for the long haul.

Considerations

When considering index investing, it is important to keep in mind:

- Limited investment options: Investors cannot handpick specific investments within an index fund and may be limited in their ability to make short-term changes to their portfolio.

- May not get above-market returns: The goal of index investing is to match the market average, so above-market returns may not be achieved.

- Periodic rebalancing: Index funds require periodic rebalancing to ensure they remain aligned with their benchmark index.

Getting Started with Index Investing

To get started with index investing, investors can open a brokerage account and purchase investment funds that follow a passive investment strategy, such as mutual funds or exchange-traded funds (ETFs) that track a specific market index.

Debt Funds: Best Investment Options for You

You may want to see also

Pros and cons of passive investing

Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for a long period. Here are some pros and cons of this approach:

Pros of Passive Investing

- Lower maintenance: Passive investing does not require constant monitoring of investment performance, as it is a long-term strategy.

- Steady returns: Passive funds have outperformed active funds in the long term.

- Lower fees: Passive investing involves less buying and selling, leading to lower expense ratios.

- Lower capital gains taxes: Holding assets for the long term results in lower taxes.

- Lower risk: Passive investing reduces risk by diversifying investments across a broad mix of asset classes and industries.

Cons of Passive Investing

- Limited investment options: Investors cannot handpick specific investments or exclude companies they believe are not worthwhile.

- May not get above-market returns: The goal of passive investing is to match the market average, not exceed it.

- Lack of flexibility: Passive funds are limited to a specific index or set of investments and cannot be easily changed.

- Potential for smaller returns: Passive funds rarely outperform their benchmarks, even during market turmoil.

Christians and Mutual Funds: Ethical Investment Considerations

You may want to see also

Passive investment funds

Passive investing is a buy-and-hold strategy, where investors seek to replicate the performance of a specific market index. The most common type of passive investing is index investing, where investors buy a basket of securities, such as stocks, bonds, or other assets, that mimic the composition of a particular market index. For example, an S&P 500 index fund will hold the stocks that make up the S&P 500 index, aiming to match its performance.

Benefits of Passive Investment Funds

- Lower fees and costs: Passive funds have lower expense ratios than actively managed funds, as they do not require extensive research and trading.

- Lower risk: Passive investing reduces risk by investing in a diverse portfolio of securities across different asset classes and industries, rather than relying on the performance of individual stocks.

- Steady returns: Passive funds aim to mirror the performance of the market, which has historically provided solid returns over the long term.

- Lower maintenance: Passive investors do not need to constantly track the performance of their investments, as they are holding for the long term.

Types of Passive Investment Funds

There are two main types of passive investment funds:

- Index Mutual Funds: These funds have been around for about 50 years and are considered more transparent, with strict rules and daily published fund holdings. Index mutual funds can only be bought or sold once per day after the market closes.

- Exchange-Traded Funds (ETFs): ETFs are similar to index mutual funds but offer more flexibility, as they can be traded throughout the day like stocks. ETFs also provide more diverse market exposures, such as ESG strategies and thematic ETFs, allowing investors to invest in specific themes like artificial intelligence or healthcare.

How to Invest in Passive Investment Funds

To invest in passive investment funds, you need to open a brokerage account with a provider that offers passive investment funds, such as mutual funds or ETFs. When choosing a platform, consider factors such as fund selection, convenience, trading costs, and impact investing options. It is also important to select the right index to track, ensuring it aligns with your investment objectives.

Gold Mutual Funds: Best Investment Options for You

You may want to see also

How to start passive investing

Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for a long time. It is a popular type of investing because it requires less maintenance, has lower fees, and can give steady returns. If you are interested in passive investing, here are the steps you can follow:

- Research and analyze index funds: First, you need to know what you want to invest in. While an S&P 500 index fund is the most popular, there are also funds for different industries, countries, and investment styles. Consider the geographic location, market sector, and market opportunity of the fund.

- Decide which index fund to buy: After finding a fund that suits your interests, compare the expenses of similar funds. Sometimes, funds based on similar indexes can have very different costs. Also, consider the tax efficiency and investment minimums of the fund.

- Purchase your index fund: You can buy the fund directly from the mutual fund company or through a broker. If you are buying a mutual fund, it is usually easier to go through a broker. If you are buying an ETF, you will need to go through a broker.

Some additional considerations when choosing an index fund include reviewing the long-run performance of the fund, the expense ratio, trading costs, fund options, and convenience. It is also important to remember that while passive investing can lower risk due to diversification, it can still carry risks and may not always provide above-market returns.

Index Funds: Choosing the Right Investment for You

You may want to see also

Frequently asked questions

Passive index fund investing is a long-term investment strategy that focuses on buying and holding a diverse portfolio of investments to match the returns of a specific broad-based market index or benchmark. The goal is to build wealth gradually over time by relying on the market to provide positive returns.

Passive index fund investing offers several benefits, including lower fees, lower risk, and steady returns. It is also a more hands-off approach, as investors do not need to actively research and choose individual stocks. Additionally, passive funds are typically cheaper than active funds as they involve less buying and selling, reducing transaction costs and management fees.

Some popular passive index funds include the Vanguard S&P 500 ETF, SPDR S&P 500 ETF Trust, and iShares Core S&P 500 ETF. These funds track broad market indexes like the S&P 500, which is composed of 500 large US companies.