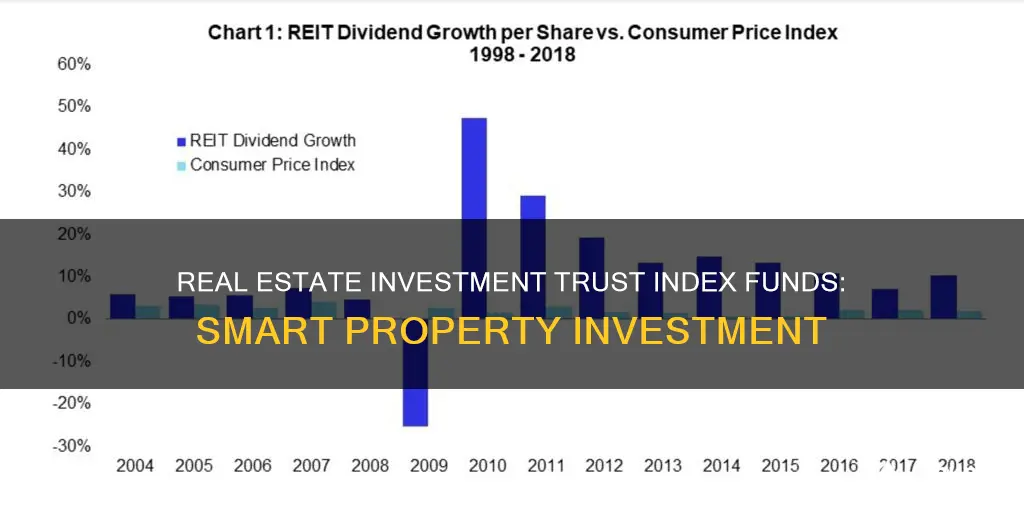

Real estate investment trusts (REITs) are companies that own, develop and manage income-producing real estate. They are traded like stocks and are required to pay out at least 90% of their taxable income to shareholders as dividends each year. There are several types of REITs, including equity REITs, mortgage REITs and hybrid REITs, which can be either publicly traded or private companies. One way to invest in REITs is through real estate investment trust index funds, which are a type of mutual fund that provides broad market access to multiple REITs and real estate stocks with low expense ratios. These funds offer investors a convenient, diversified and cost-effective way to gain exposure to the real estate sector and its potential rewards, such as dividends and capital appreciation.

| Characteristics | Values |

|---|---|

| Definition | Real estate investment trust (REIT) is a corporation, trust, or association that invests directly in income-producing real estate and is traded like a stock |

| Types | Equity REITs, Mortgage REITs, Hybrid REITs |

| Investments | REITs invest in real estate and own, operate, or finance income-producing properties |

| Payouts | REITs pay out regular dividends |

| Taxation | Firms that are incorporated as REITs can avoid paying corporate income taxes if they distribute a minimum of 90% of their taxable income back to investors |

| Liquidity | REITs tend to be more liquid than mutual fund shares |

| Diversification | REIT ETFs provide investors with a level of diversification that would be difficult to achieve otherwise |

| Management | Most REITs are managed by experts in the commercial real estate industry or are based on popular, broad-based REIT indexes |

| Cost-effectiveness | REIT ETFs, especially index funds, can be extremely cost-effective |

REITs vs. Real Estate Funds

Real estate investment trusts (REITs) and real estate funds are both ways to invest in real estate without owning physical properties. However, there are some key differences between the two.

REITs

REITs are corporations, trusts, or associations that invest directly in income-producing real estate. They are traded like stocks on major exchanges, and their prices fluctuate throughout the trading session. Most REITs are very liquid and trade under substantial volume. There are three main types of REITs: equity REITs, mortgage REITs, and hybrid REITs. Equity REITs own and operate income-producing real estate, while mortgage REITs lend money to real estate owners and operators. Hybrid REITs are a combination of the two.

REITs are required to pay out a minimum of 90% of their taxable income as dividends to shareholders each year. This provides a steady income stream for investors, who also benefit from a low barrier to entry (as little as $100), ease of trading, and a lack of property management responsibilities.

However, REIT dividends are taxed at a higher rate, and they can be very sensitive to interest rate fluctuations. REITs also tend to be undiversified, focusing on a specific property type, which can put investments at risk.

Real Estate Funds

Real estate funds are a type of mutual fund that invests primarily in securities offered by public real estate companies, including REITs. They can be actively or passively managed. Real estate funds gain value mostly through appreciation and do not usually provide short-term income. There are three types of real estate funds: REIT-ETFs, real estate mutual funds, and private real estate investment funds.

Real estate funds offer a broader asset selection and more diversification than REITs. They are also not as sensitive to the stock market as publicly-traded REITs. However, they are not traded like stocks, and share prices are only updated once a day.

Both REITs and real estate funds offer investors a way to access the real estate market without owning physical properties. REITs provide a steady income stream through dividends, while real estate funds offer broader diversification and are more suitable for long-term investors seeking appreciation. The choice between the two depends on individual preferences, risk tolerance, and investment goals.

A Guide to Investing in Hong Kong Funds

You may want to see also

Equity REITs

- Own, operate, and manage income-producing real estate

- Collect rent from tenants

- Required to distribute at least 90% of taxable income as dividends

- Can be broadly or narrowly focused in their investments

- Provide stable and predictable income

- Publicly traded on major stock exchanges

- Offer diverse portfolios of income-producing assets

Dividend Funds: When to Invest for Maximum Returns

You may want to see also

Mortgage REITs

MREITs are an essential part of the residential and commercial real estate sectors, providing liquidity and credit to the market. They invest in residential and commercial mortgages, as well as residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS).

MREITs typically fund their investments with equity and debt capital, relying on various funding sources such as common and preferred equity, repurchase agreements, structured financing, and credit facilities. They aim to profit from the net interest margin, which is the spread between the interest income on their mortgage assets and their funding costs.

While mREITs offer high dividend yields, they also come with higher risks compared to other investments, including interest rate risk, prepayment risk, credit risk, and rollover risk. These risks can impact the value of the mREIT's assets and its ability to generate returns.

MREITs are publicly traded and individuals can buy shares in an mREIT, similar to purchasing any other public stock or as part of an exchange-traded fund (ETF) or mutual fund.

Obtaining Your Mutual Fund Investment Statement: A Guide

You may want to see also

Hybrid REITs

Equity REITs own and operate income-producing real estate properties, such as apartment complexes, healthcare facilities, office buildings, and retail centres. They generate revenue primarily from rent collected on these properties. On the other hand, mortgage REITs deal with mortgage loans and mortgage-backed securities. They lend money to real estate owners and generate revenue from the interest on these loans.

The main advantages of investing in hybrid REITs include diversification, consistent income, and exposure to both the property and debt markets. However, it's important to carefully review the holdings, management team, and performance of a hybrid REIT before investing.

Launching an Investment Fund: A Guide for South Africa

You may want to see also

REIT ETFs

Real Estate Investment Trusts (REITs) are companies that own and operate real estate to generate income. Investors can purchase shares in REITs, which represent ownership of an individual real estate company, much like stocks.

REIT Exchange-Traded Funds (ETFs) are baskets of REIT stocks that are traded on an exchange, similar to a stock. They are a type of investment fund that pools investor funds to buy shares in a range of REITs. REIT ETFs are passively managed, meaning they are designed to track or mirror publicly traded real estate company indexes. They are often top-heavy, with larger REITs constituting a significant portion of the fund's assets.

There are several popular REIT ETFs available, including Vanguard Real Estate, iShares Cohen & Steers REIT, and SPDR Dow Jones REIT ETF. These REIT ETFs provide investors with a convenient and cost-effective way to invest in a wide range of real estate properties and benefit from the expertise of professional fund managers.

It is important to note that there are different types of REITs and REIT ETFs, and investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

S&P Mutual Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

A real estate investment trust is a company that owns, operates, or finances income-producing real estate and sells shares to raise capital. REITs are traded like stocks and are bought and sold on stock exchanges.

There are three main types of REITs: Equity REITs, Mortgage REITs, and Hybrid REITs. Equity REITs own and operate income-producing real estate, mortgage REITs lend money to real estate owners, and hybrid REITs are a combination of the two.

REITs offer a steady income stream through regular dividends, broad market exposure, and lower portfolio turnover. They are also highly liquid, as they are traded on major stock exchanges.

REITs have relatively high dividend taxes, potential for high management and transaction fees, and are subject to market risk and interest rate changes. They also offer limited capital appreciation as they must pay out 90% of their taxable income to shareholders.

There are several ways to invest in REITs, including purchasing shares of individual REITs on public exchanges, investing in REIT mutual funds or exchange-traded funds (ETFs), or through defined-benefit and defined-contribution plans.