Return on Investment (ROI) is a profitability ratio that measures how well an investment performs. It is a performance measure used to evaluate the efficiency or profitability of an investment or to compare the efficiency of a number of different investments. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally, multiplying it by 100. The ratio is used to compare alternative investment choices, as well as to determine if an existing investment represents an efficient use of resources.

| Characteristics | Values |

|---|---|

| Definition | Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or to compare the efficiency of a number of different investments. |

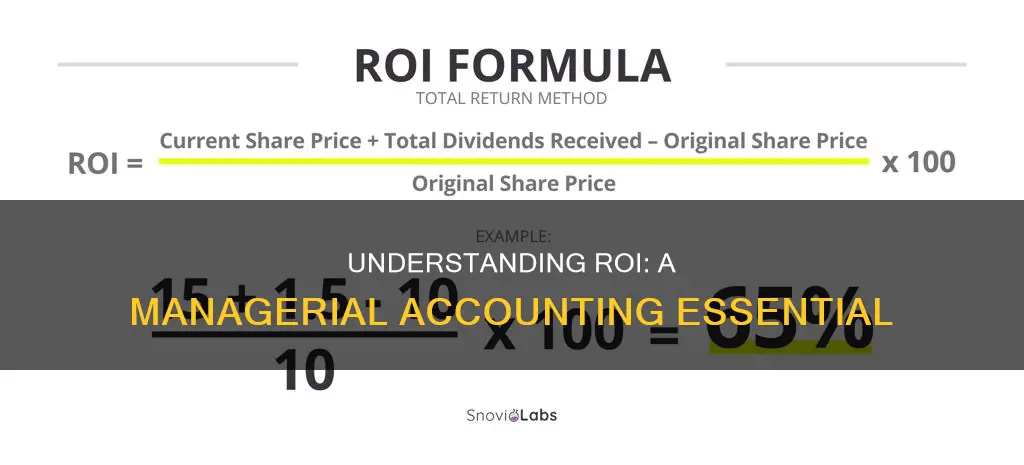

| Formula | (Current value of investment – Cost of investment) ÷ Cost of investment x 100 = ROI |

| Use cases | ROI can be used to measure the profitability of stock shares, to decide whether to purchase a business, or to evaluate the success of a real estate transaction. |

| Advantages | ROI is a popular metric because of its versatility and simplicity. It is easy to calculate and intuitively easy to understand. |

| Disadvantages | ROI does not take into account the holding period or passage of time, and so it can miss opportunity costs of investing elsewhere. It also does not account for risk. |

What You'll Learn

ROI as a performance measure

Return on Investment (ROI) is a popular metric used to evaluate the profitability and efficiency of an investment. It is a financial performance measure that is equal to the operating income divided by the average operating assets. ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay.

ROI is a widely used performance measurement tool, especially in evaluating an investment centre, which is a subunit of an organisation that has control over its own sources of revenue, the costs incurred, and assets (investments) employed. An investment centre acts like a separate company.

The use of ROI as a performance measure has several advantages. It is relatively easy to understand, and it takes into account everything for which a manager of an investment centre is responsible, including generating revenues, controlling expenses, and managing the level of assets invested. ROI is also related to return on equity (ROE), so increasing ROI can lead to greater shareholder value.

However, there are also some disadvantages and limitations to using ROI as a performance measure. Here are some of the key points to consider:

- Short-term Focus: ROI is a short-term performance measure, and using only short-term metrics can lead to a narrow focus. Companies can address this by using a mix of short-term and long-term performance measures.

- Income Manipulation: Income is subject to manipulation, especially if a manager has a short-term focus or is planning to leave the company soon. This can have negative consequences for the company in the long run.

- Inconsistent with Overall Company Performance: The use of ROI as a control system can encourage division managers to take actions that reduce company profits but show a favourable increase in division profits. This occurs when the measurement devices used in ROI control systems affect division performance inconsistently with overall company performance.

- Motivation for Suboptimal Investments: The use of ROI can motivate managers to make or reject investments that may not be in the best interests of the company. This can happen when managers focus solely on maximising their own ROI without considering the broader context.

- No Risk Component: ROI does not contain a risk component and does not indicate the probability of generating the expected return. This can lead to investors being attracted to high-ROI investments without considering the associated risks.

- No Strategic Analysis: ROI does not account for the strategic direction of a business. Management may be willing to accept a lower ROI in exchange for gaining new products, capabilities, and market share, which can improve ROI over the long term.

- Opportunity Costs: ROI does not take into account the holding period or passage of time, so it may not capture the opportunity costs of investing elsewhere.

Despite these limitations, ROI remains a widely used performance measure due to its simplicity and versatility. It provides a rudimentary gauge of an investment's profitability and can be easily calculated and interpreted for a wide range of applications.

Bitcoin Gold: Worth Your Investment?

You may want to see also

ROI calculation

Return on Investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment. ROI is usually expressed as a percentage and can be used to compare the efficiency of different investments.

ROI is calculated by dividing the benefit (or return) of an investment by the cost of the investment. This can be done in two steps: first, subtract the cost of the investment from its current value (which could be its sale price), and then divide the result by the cost of the investment.

Current value of investment - Cost of investment) ÷ Cost of investment = ROI

For example, suppose Jo invested $1,000 in Slice Pizza Corp. in 2017 and sold the shares for a total of $1,200 one year later. To calculate the ROI, you would first subtract the initial cost from the amount Jo sold the shares for: $1,200 - $1,000 = $200. Then, you would divide this amount by the initial cost: $200/$1,000 = 0.2, or 20% ROI.

While ROI is a popular metric due to its simplicity and versatility, it does have some limitations. For instance, it does not take into account the holding period of an investment, which can be an issue when comparing investment alternatives. It also does not adjust for risk, and there is no standard definition of "cost" and "gain," which can make it difficult to use properly.

Liquid Chap's Bitcoin Investment: Worth the Risk?

You may want to see also

ROI's versatility and simplicity

Return on Investment (ROI) is a versatile and simple metric that is widely used to evaluate the efficiency and profitability of an investment. Its versatility lies in its ability to be applied to various types of investments, including stock investments, business expansions, and real estate transactions. The calculation of ROI is straightforward and involves dividing the net profit or benefit of an investment by its initial cost or outlay, which can be expressed as a percentage or a ratio. This simplicity makes it a popular choice for investors and businesses when comparing different investment options and making informed decisions.

One of the key advantages of ROI is its versatility in assessing a wide range of investments. It can be applied to different types of assets, such as stocks, real estate, or business ventures. For example, an investor can calculate the ROI of purchasing shares of a company, while a business owner can use it to evaluate the potential returns of expanding into a new product line. This versatility allows for a standardised comparison of diverse investment opportunities, enabling informed decision-making.

The calculation of ROI is relatively simple and straightforward, making it accessible to a wide range of users. The formula involves subtracting the cost of an investment from its current value and then dividing the result by the initial cost. This calculation provides a percentage or ratio that represents the efficiency and profitability of the investment. The simplicity of the formula enhances its popularity and makes it a common tool for investors and businesses alike.

While ROI is a valuable metric, it is important to acknowledge its limitations. One significant drawback is its failure to consider the holding period or time value of money. This omission can make it challenging to compare investments with different time horizons accurately. Additionally, ROI does not account for opportunity costs, which are crucial when evaluating alternative investment options. Furthermore, ROI does not incorporate risk adjustment, which is an essential factor in investment decisions.

Despite these limitations, ROI remains a widely adopted metric due to its versatility and simplicity. It serves as a practical tool for investors, businesses, and analysts to assess the efficiency and profitability of various investment opportunities. However, it is essential to complement ROI with other metrics and considerations, such as risk tolerance, investment duration, and industry norms, to make well-informed decisions.

The Ultimate Guide: Invest in Bitcoin Without Brokers

You may want to see also

ROI's limitations

Return on Investment (ROI) is a profitability ratio that compares the income from an investment with the cost of the investment. ROI is a useful tool for small business owners, managers, bankers, investors, and business analysts to assess a company's financial strength and performance. However, it has certain limitations that should be considered when interpreting the data.

One limitation of ROI is that it focuses on a single period, making it a short-term performance measure. This can lead to a narrow perspective, ignoring the long-term effects of investments. To overcome this limitation, it is advisable to use ROI in conjunction with other profitability and performance measures for a more comprehensive understanding of a company's financial health.

Another limitation of ROI is that it does not account for the time value of money. The timing of cash flows is not considered in the calculation, which can impact the accuracy of the results, especially when comparing investments with different timelines. Discounted cash flow (DCF) analysis can be used to address this limitation by incorporating the time value of money.

ROI also has limitations when comparing investments of different sizes. As it measures return in percentage form, it can be challenging to compare projects, divisions, or departments with varying scales of operations. In such cases, absolute dollar amounts or other metrics may be more informative.

Additionally, ROI does not provide a complete picture of a company's financial health as it focuses solely on profitability. Other factors, such as liquidity, solvency, and operational efficiency, are not captured by ROI. A comprehensive financial analysis should include various ratios and metrics to assess different aspects of a company's performance.

Furthermore, ROI calculations can be sensitive to the choice of accounting methods and depreciation treatments. For example, using gross book value or net book value can impact the value of invested capital, affecting the resulting ROI. This limitation highlights the importance of consistent accounting practices and transparent reporting to ensure comparability between different periods and entities.

Lastly, ROI may not always align with a company's strategic goals. A high ROI might indicate effective management, but it could also suggest that a company is undercapitalized and not investing enough in its growth. Alternatively, a low ROI might indicate poor management or a conservative business approach, but it could also be the result of strategic decisions focused on long-term sustainability rather than short-term gains.

Gold Coins: A Smart Investment Move?

You may want to see also

ROI in managerial accounting

Return on Investment (ROI) is a profitability ratio that measures how well an investment performs. It is a performance measure used to evaluate the efficiency or profitability of an investment or to compare the efficiency of a number of different investments. ROI is usually presented as a percentage and can be calculated using a specific formula.

ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally, multiplying it by 100. The formula is:

Current value of investment - Cost of investment) ÷ Cost of investment = ROI

ROI is a popular metric because of its versatility and simplicity. It is relatively easy to calculate and interpret, and it is widely used as a performance measurement tool to evaluate an investment centre. An investment centre is a subunit of an organisation that has control over its own sources of revenue, the costs incurred, and assets (investments) employed.

However, there are some issues associated with ROI. Firstly, it does not take into account the holding period or passage of time, which can be a problem when comparing investment alternatives. Secondly, ROI does not adjust for risk, and there is no indication of the probability that a return will be generated in the expected amount. Additionally, ROI does not account for the strategic direction of a business, and it may not include all possible costs.

Despite these limitations, ROI is a key metric used by business analysts and managers to evaluate and rank investment alternatives and make decisions about resource allocation.

The Ultimate Guide to Investing in Bitcoin

You may want to see also

Frequently asked questions

Return on Investment (ROI) is a profitability ratio that measures how well an investment performs. ROI lets you know if the money you shell out for your business is flowing back in as revenue.

To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

ROI does not take into account the holding period or passage of time, so it can miss opportunity costs of investing elsewhere. ROI also does not contain a risk component, so there is no indication of the probability that a return will be generated in the expected amount.

ROI is a common measure of performance for managers responsible for investment centres. ROI can be used to evaluate the efficiency of an investment and to compare the efficiency of different investments.