Mutual funds are a great way to invest in a pool of stocks, bonds, and other securities that are managed by an experienced money manager. RBC offers a wide range of mutual funds to choose from, but which one is the best? In this article, we will explore the different types of RBC mutual funds, their performance, and how to choose the right one for your investment needs. We will also discuss the benefits of investing in mutual funds and why RBC is a good choice for investors. So, if you're looking to invest in mutual funds, read on to find out more about the best RBC mutual fund for you.

| Characteristics | Values |

|---|---|

| Initial Investment | $500 |

| Management | Professionally managed by a portfolio manager |

| Investment Types | Stocks, bonds, money market funds, real estate assets |

| Risk | Low |

| Returns | High |

| Access | Global capital markets |

What You'll Learn

RBC Life Science and Technology Series F

When it comes to investing, it's important to remember that there is no "one-size-fits-all" solution and the best mutual fund to invest in will depend on your individual financial goals, risk tolerance, and investment horizon. With that said, the RBC Life Science and Technology Series F is a mutual fund that offers some unique benefits.

The RBC Life Science and Technology Series F (RBF619) is designed for investors who are seeking long-term growth by investing in the high-growth potential of science and technology stocks. This fund provides exposure to a sector that has historically outperformed the broader market and is expected to continue driving innovation and economic growth. Investing in a sector-specific fund like this one can add valuable diversification to an investment portfolio.

One of the key advantages of this fund is its focus on Canadian-focused equity strategies. In fact, it has been recognised as the only Canadian-focused equity strategy to consistently outperform its category over the past five years. This is a testament to the fund's ability to navigate the dynamic and ever-evolving landscape of science and technology.

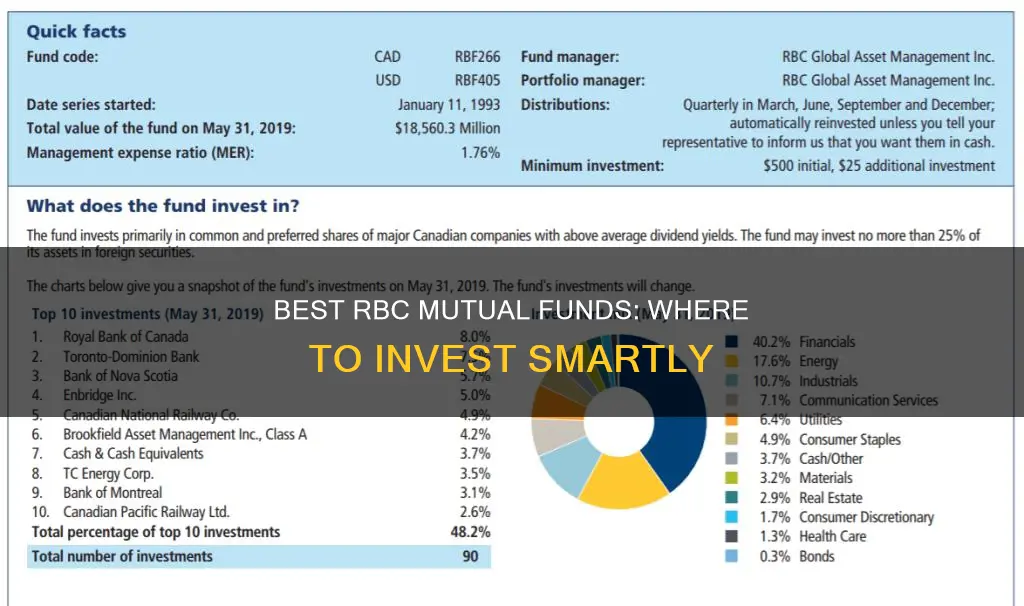

The RBC Life Science and Technology Series F is a well-established fund with a strong track record. It is managed by RBC Global Asset Management Inc. (RBC GAM), a subsidiary of the Royal Bank of Canada, which is one of the world's largest banks. RBC GAM is known for its expertise in investment management and its ability to identify high-growth sectors.

When considering investing in this or any other mutual fund, it is always recommended to consult with a financial advisor to ensure that the investment aligns with your personal financial goals and risk tolerance. Additionally, keep in mind that mutual funds are subject to market risks, and past performance does not guarantee future results.

Mutual Funds: Recession-Proof Investment Strategy?

You may want to see also

RBC Fixed Income Pools

The Pools are designed to provide Canadian investors with access to global fixed-income markets. They are constructed to align with specific risk and return profiles, and they invest in core global bonds, high-yield corporate bonds, emerging market currencies, and corporate and sovereign debt.

There are three Pools available to accommodate the risk and reward preferences of individual investors: the RBC Conservative Bond Pool, the RBC Core Bond Pool, and the RBC Core Plus Bond Pool. The Conservative Bond Pool focuses on shorter-term investment-grade Canadian bonds and modest amounts of diversified global investment-grade, high-yield, emerging market debt, and emerging market currencies. The Core Bond Pool has a focus on core global investment-grade bonds and higher-yielding assets. The Core Plus Bond Pool has increased exposure to core global bonds, high-yield corporate bonds, convertibles, emerging market currencies, and corporate and sovereign debt.

The Pools offer instant diversification across global credit and currency markets, improved consistency of fixed-income holdings across client accounts, built-in rebalancing and tactical asset allocation, and a simple low management fee of 0.40% for fee-based investors.

Invest Small, Think Big: Strategies for Meaningful Returns

You may want to see also

RBC Portfolio Solutions

Another advantage of RBC Portfolio Solutions is the convenience and simplicity they offer. With a mutual fund, you don't need to worry about making individual investment decisions or monitoring the markets. The professional money managers at RBC will handle all the investment decisions and portfolio monitoring for you. This can save you time and effort, allowing you to focus on your other financial goals and priorities.

In addition, RBC Portfolio Solutions offer something for everyone, regardless of your investment objectives and risk tolerance. Whether you are seeking growth, conservative investments, or something in between, RBC Portfolio Solutions can be tailored to meet your specific needs. You can get started with a professionally managed portfolio for an initial investment of just $500, making it accessible to a wide range of investors.

Furthermore, RBC Portfolio Solutions provide personalized advice through their MyAdvisor service. This digital service enables you to view all your investments in one place, track your goals, and connect with a live RBC advisor through video or phone at no additional cost. This personalized advice can help ensure that your investments are aligned with your financial goals and risk tolerance.

When considering RBC Portfolio Solutions, it is important to remember that all investments carry some level of risk. Mutual funds are not guaranteed, and their values can fluctuate over time. It is always recommended to consult with a financial advisor to assess whether a particular investment aligns with your financial goals, risk tolerance, and investment horizon.

Mutual Funds: Best Investment Option for Your Money

You may want to see also

RBC iShares ETFs

The RBC iShares suite offers a wide range of index, factor, quantitative, and active strategies. It includes 106 high-quality, liquid, and cost-competitive index solutions managed by BlackRock Canada, and 44 index, smart beta, and actively managed solutions managed by RBC GAM Inc. This alliance provides investors with expanded access to funds, operating expertise, and innovative solutions.

Investors can access RBC iShares ETFs through full-service advisors, discount brokerages, and robo-advice platforms, benefiting from the expanded distribution support and service model provided by the alliance. It is important to note that investing in RBC iShares ETFs, like any other investment, carries risks, and investors should carefully consider their investment objectives, level of experience, and risk appetite before investing.

Conservative Mutual Funds: Maximizing Returns, Minimizing Risk

You may want to see also

RBC Money Market Funds

Money market mutual funds are a safe and versatile investment option for those who are risk-averse. They are a type of mutual fund that primarily invests in short-term, interest-bearing instruments like Treasury Bills. Money market funds offer stable and safe sources of interest income, making them an attractive alternative to bank accounts or term deposits.

The RBC Canadian Money Market Fund is one such option. It offers higher current income than funds invested solely in short-term government securities and provides a liquid, short-term investment. The fund is managed by RBC Global Asset Management Inc. (RBC GAM), which is known for its strong performance and is owned by one of the world's largest banks.

When considering investing in RBC Money Market Funds, it is important to note that there may be management fees and expenses associated with mutual fund investments. Additionally, while money market funds are generally considered safe, there is no guarantee that the fund will maintain its net asset value per security at a constant amount, and the full amount of your investment may not be returned.

To determine if RBC Money Market Funds are the right investment for you, it is recommended to consult an expert fund manager for advice, as choosing the appropriate mutual fund can be a complex process that depends on your financial goals, risk tolerance, and investment preferences.

Small-Cap Mutual Funds: Strategies for Smart Investing

You may want to see also

Frequently asked questions

Investing in RBC mutual funds provides built-in diversification, allowing you to spread your assets across various asset classes, geographic regions, and industrial sectors, reducing risk. RBC mutual funds are also professionally managed by experienced money managers who monitor market conditions and make investment decisions on your behalf.

Choosing the right mutual fund depends on your investment goals, risk tolerance, and budget. It is recommended to work with an RBC advisor to find the investments that best meet your specific needs and objectives.

You can buy RBC mutual funds online through RBC Online Banking if you have an up-to-date Investor Profile. For non-registered mutual funds, you will need an RBC Royal Bank chequing or savings account. For mutual funds in registered accounts (TFSA, RRSP), you must have an existing registered plan and an RBC Royal Bank chequing or savings account. You can also call 1-800-463-3863 to discuss your goals and options, or visit your branch by booking an appointment.