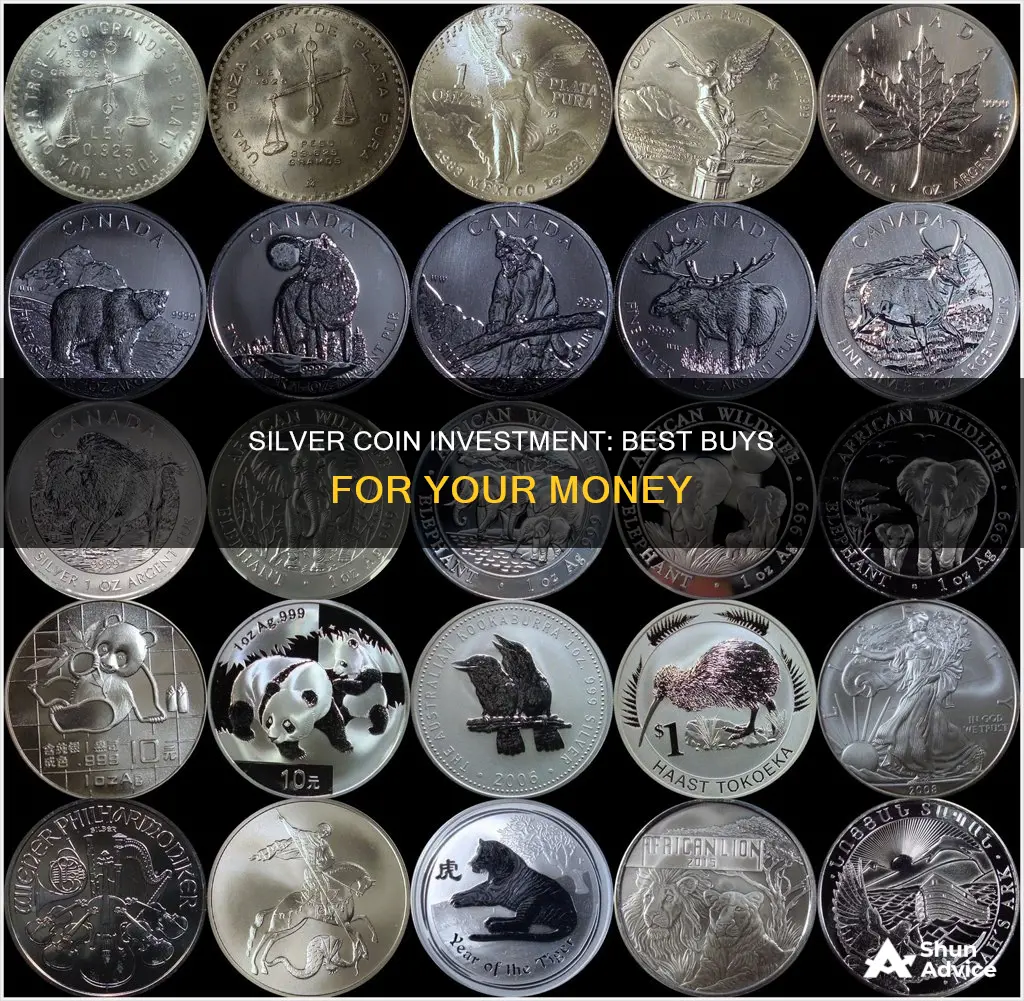

Silver has been used as currency since around 600 BCE, and its value has been maintained over time. It is a good investment option due to its affordability, versatility, and its use across industries. Silver coins are a great way to begin building an investment portfolio as they come in various finishes and designs. There are three types of silver coins: bullion, proof, and junk silver. Bullion coins are minted and stored for investment purposes, while proof coins are created with specially-treated metals and are rarer, making them valuable for collectors. Junk silver, on the other hand, consists of pre-1965 silver coins that can be melted down for their silver content. When investing in silver coins, it is important to consider factors such as recognition, liquidity, and affordability.

| Characteristics | Values |

|---|---|

| Most popular silver coin | American Silver Eagle |

| Second most popular silver coin | Canadian Silver Maple Leaf |

| Third most popular silver coin | Austrian Silver Philharmonic |

| Fourth most popular silver coin | British Silver Britannia |

| Fifth most popular silver coin | Mexican Silver Libertad |

| Sixth most popular silver coin | Somalian Silver Elephant |

| Seventh most popular silver coin | Morgan Silver Dollar |

| Eighth most popular silver coin | 90% "Junk" Silver Dimes |

| Ninth most popular silver coin | Australian Silver Kangaroo |

| Tenth most popular silver coin | Chinese Silver Panda |

Silver Bullion Coins

American Silver Eagle

The American Silver Eagle is the official investment-grade silver bullion coin of the United States Mint. It consists of 1 troy ounce of .999 fine silver and has a legal tender face value of one dollar. The American Silver Eagle is one of the most sought-after silver bullion coins in the world due to its government backing, easy recognition, and liquidity. It is also eligible for tax-sheltered investment portfolio programs such as precious metals IRA accounts.

Canadian Silver Maple Leaf

The Canadian Silver Maple Leaf is a government-issued, legal-tender coin produced by the Royal Canadian Mint. It consists of 1 troy ounce of .9999 fine silver, making it one of the finest silver dollar-sized coins globally. The coin features the iconic single maple leaf, a powerful symbol of Canada, and is known for its superior quality and recognisability.

Austrian Silver Philharmonic

The Austrian Silver Philharmonic is a rare and beautiful coin, featuring selected instruments from the Austrian Philharmonic Orchestra on one side and the Golden Hall in Vienna, the site of the orchestra's annual New Year's Day concert, on the other. It is the only silver coin denominated in euros, with a legal tender value of €1.5.

British Silver Britannia

The British Silver Britannia is a famous British silver coin, displaying a portrait of Queen Elizabeth II on the obverse and the Standing Britannia in a horse-drawn chariot on the reverse. First introduced in 1987, these coins have a high silver content of .999 fine silver and are backed by the Royal Mint, making them an excellent value with good potential for liquidity.

Mexican Silver Libertad

The Mexican Silver Libertad is one of the most famous silver bullion coins available today, struck by one of the oldest North American mints, la Casa de Moneda de Mexico. The coin consists of ..999 fine silver and comes in various sizes, including 1 ounce, 1/2 ounce, 1/4 ounce, and 1/10 ounce, making it a versatile option for any portfolio or budget. The artwork featured on the coin is both beautiful and essential to the history of Mexico, making it a sought-after addition to any coin collection.

Strategizing Your Bitcoin Investment: A Guide

You may want to see also

Silver Rounds

Rounds are an excellent value when investing because their entire value is based on the precious metal content, making them more affordable than coins. They are also available in various sizes, including fractional sizes and the standard 1 oz size, as well as larger sizes.

Some popular designs for silver rounds include the Buffalo Nickel, Morgan Dollar Silver, and Walking Liberty. The Buffalo Nickel, issued by the US Mint from 1913 to 1938, is considered one of the most beautiful coin designs ever and features a Native American male on the obverse and an American bison on the reverse. The Morgan Dollar Silver, created by George T. Morgan, was issued from 1878 to 1904 and then again in 1921 and features Lady Liberty on the obverse and a heraldic eagle on the reverse. The Walking Liberty design, created by Adolph A. Weinman in 1916, is currently seen on the American Eagle Gold Coin.

Another popular collection of silver rounds is the Cryptocurrency Collection, which features the logos of popular cryptocurrencies such as Dogecoin, Litecoin, and Ethereum. There are also unique series like the Egyptian Gods Series, Emoji Series, and Medieval Legends, which depict popular legends from medieval times.

Mark Cuban's Crypto Portfolio: His Top Investments

You may want to see also

Numismatic Coins

Examples of numismatic coins include:

- Pre-1933 $20, $10 Eagle coins

- Peace Silver Dollars

- Old US gold coins

- Franklin Mint coins

When evaluating options for buying silver, it is important to consider your primary objectives. If you are interested in coins from a historical/collecting perspective, then numismatic coins may be a good choice. However, if you are searching for a way to invest for your future, then bullion coins may be a better option.

Bullion coins are gold and silver coins purchased for one of three reasons: investment, inflation hedge, or survival. They are manufactured year-to-year and are bought primarily as an investment. Examples of bullion coins include:

- Canadian Gold and Silver Maples

- South African Krugerrands

- 90% Junk Silver (pre-1965 half-dollars, quarters, dimes, etc.)

When investing in silver coins, you have three options: bullion, proofs, and junk silver. Here is some more information on each of these options:

- Bullion coins are minted and stored for investment purposes. Their value is based on the weight of the precious metal used and is therefore variable.

- Proof coins are created with specially-treated metals and come in protective packages with certificates of authenticity. These coins are rarer and of better quality, making them valuable for collectors and investors alike.

- Junk silver is made up of silver coins minted before 1965 when U.S. currency was minted with 90% silver. While they have little value to coin collectors, junk silver coins can be melted down for their silver content.

The Bitcoin Investors: Who's Taking the Plunge?

You may want to see also

Semi-Numismatic Coins

The US and most other countries have a long history of minting gold and silver coins, which were central to the gold standard during the 19th and 20th centuries. As a result, there is a wide range of semi-numismatic options for investors and collectors interested in these types of coins.

Some examples of semi-numismatic coins in the US include the gold or silver eagle coins and the gold buffalo coin. In the UK and Europe, there is an active international market for semi-numismatic gold and silver coins produced by these countries. Examples include the Britannia, Sovereign, and the Queen's Beast coins, available in both gold and silver. Austria has the Philharmonic coins, also available in gold and silver. Canada has the Maple Leaf Coins in gold and silver, and Australia has the most options in semi-numismatic coins with the Perth Mint, including the kookaburra, koala, and Lunar coins. Mexico has the Libertad, and China has the panda series.

The standard weight for a silver coin is one troy ounce, while gold coins have many fractional sizes, usually starting at 1/10 of an ounce and going up to 1/4, 1/2, and 1 ounce due to the spot price.

Bitcoin Investment: Where Does Your Money Go?

You may want to see also

Junk Silver

Limited Risk with Notable Gains

Investing in silver, whether bullion or junk silver, has the potential to increase the value of an investor's portfolio. The value of silver is based on the silver spot price, which has recently ranged from $14 to $15 per ounce. Unlike flat currencies like the US dollar, the value of silver has remained steady and is expected to surpass the USD in terms of value. Therefore, investors believe that precious metals like silver will eventually return to their past value, making it a good investment opportunity.

Low Premiums at Face Value

Planning Ahead for the Worst

Investing in junk silver can be a hedge against economic downturns or global disasters. In the event of a global disaster, cash will eventually lose its worth, and people will return to bartering as the main means of selling and trading. Having precious metals like silver will give investors leverage in such scenarios.

Limited Supply and Upside Price Potential

Easy Identification and Liquidity

Low Upfront Investment

Chamath's Bitcoin Bet: Why I Invested

You may want to see also

Frequently asked questions

Silver is an affordable and accessible way to diversify your portfolio. It tends to hold its value over time and has been used as money for thousands of years. Silver is also commonly used across industries, especially in electronics.

There are five basic types of silver coins: bullion coins, rounds, numismatic coins, proof coins, and semi-numismatic coins. Bullion coins are made almost exclusively from precious metal and are considered investment-grade silver. Rounds are produced by private mints and are usually of good quality, but they don't have a face value or government backing. Numismatic coins are rare coins bought and sold by collectors, and their value is based on rarity, condition, and demand. Proof coins are made with high relief effects and are geared towards collectors. Semi-numismatic coins are made to be collector coins but don't yet have historical significance.

The best silver coins to buy for investment are common silver bullion coins, also known as sovereign coins. These coins are pure silver and widely recognised, ensuring high liquidity when it comes time to sell. Examples include the American Silver Eagle, Canadian Silver Maple Leaf, Austrian Silver Philharmonic, and British Silver Britannia.

Silver coins can be bought from a local coin shop or online. Online dealers often offer better pricing, even after shipping costs, due to lower overhead. When choosing a dealer, consider factors such as payment options, total costs, company size, and whether they offer a buyback policy.