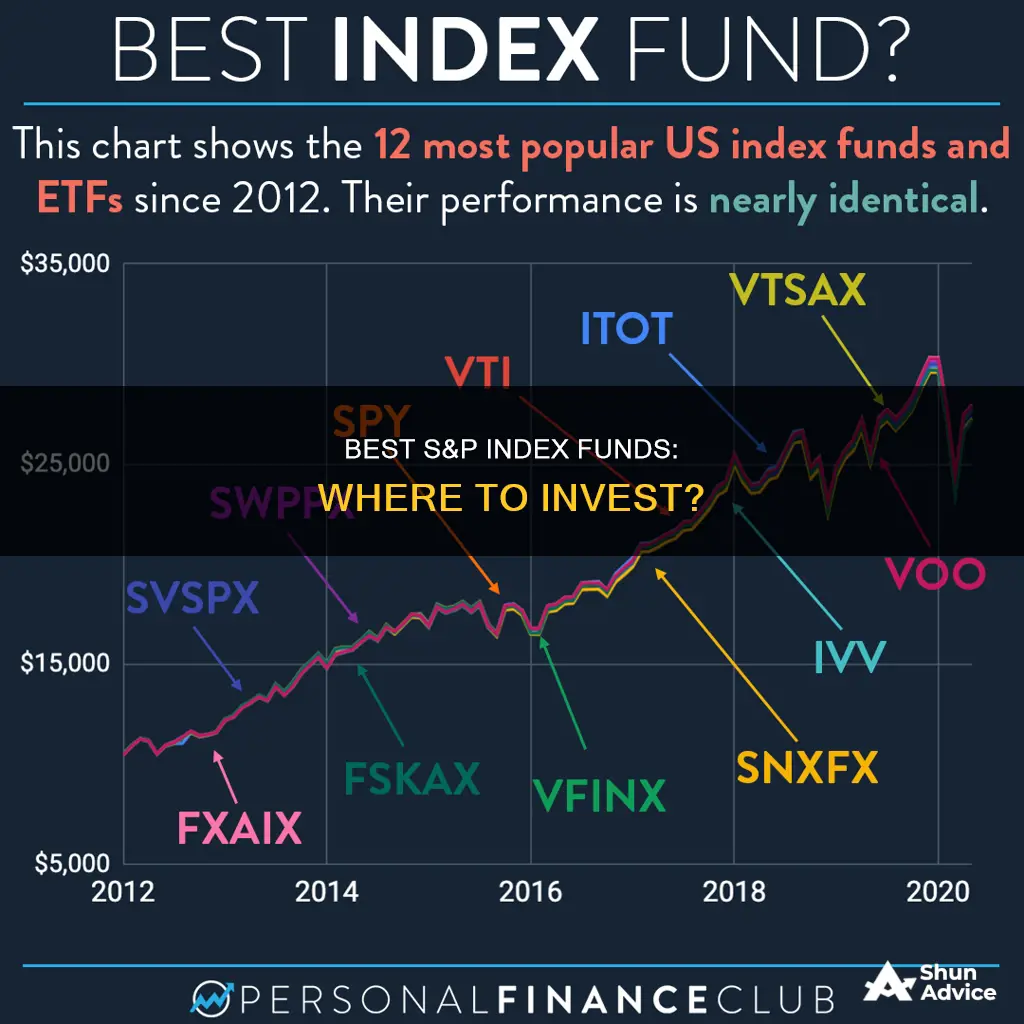

S&P 500 index funds are a popular investment choice, offering investors broad exposure to U.S. large-cap stocks across various sectors. These funds are designed to mirror the performance of the S&P 500 index, which tracks the market performance of 500 large U.S. companies. When choosing an S&P 500 index fund to invest in, it's important to consider factors such as fees, fund structure, tracking accuracy, expense ratios, minimum investment, dividend yield, and inception date. Some of the best S&P 500 index funds in the market include the Fidelity 500 Index Fund, Vanguard S&P 500 ETF, and Schwab S&P 500 Index Fund, which offer low fees and strong long-term returns.

What You'll Learn

Fidelity 500 Index Fund

The Fidelity 500 Index Fund (FXAIX) is a mutual fund that aims to provide investment results corresponding to the performance of common stocks publicly traded in the United States. It invests in common stocks included in the S&P 500 Index, a widely recognised, unmanaged index of common stock prices, representing the performance of common stocks.

The fund offers a low-cost structure, with a net expense ratio of 0.02% and no minimums on the initial investment. This makes it one of the most cost-effective ways to track the S&P 500 index of large US stocks. The absence of a minimum investment means FXAIX is accessible to a wide range of investors, including beginners.

The Fidelity 500 Index Fund has a strong track record of performance, closely mirroring the S&P 500 index. Over a five-year period, a $10,000 investment in the fund would have grown to $15,680, compared to $15,690 for the S&P 500, with the slight variation due to fees.

The fund's low expense ratio means it has slightly outperformed similar funds from competitors such as Schwab and Vanguard, and it is likely to continue to do so over the long term. This makes it a good choice for investors seeking steady, long-term investment with low fees.

The Fidelity 500 Index Fund provides a simple way to gain exposure to Wall Street and invest in large-cap stocks without having to pick individual stocks. It is a passive investment, allowing investors to match the performance of the S&P 500 without the need for active stock selection and with lower fees than actively managed funds.

Best Equity Funds: Where to Invest Smartly

You may want to see also

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO) is a popular choice for investors seeking to mirror the performance of the S&P 500 index. This exchange-traded fund (ETF) offers broad exposure to 500 large-cap U.S. stocks across various sectors, providing diversification and the potential for steady, long-term returns.

One of the key advantages of the Vanguard S&P 500 ETF is its low expense ratio of 0.03%, which is significantly lower than that of its competitors. This means that investors incur lower fees, allowing for greater returns over time. The fund has a low minimum investment of one share, which was approximately $500 as of June 18, 2024, making it accessible to a wide range of investors.

The Vanguard S&P 500 ETF closely tracks the S&P 500 index's performance, and its returns are only slightly lower due to the expense ratio. For example, a $10,000 investment in the Vanguard fund over five years would have resulted in a return of around $15,680, compared to $15,690 for the S&P 500. This negligible difference highlights the fund's ability to mirror the index's performance closely.

Vanguard's ETF is a passive investment that provides investors with returns in line with the broader market without the need to own individual stocks. The fund's performance benefits from the stringent listing criteria of the S&P 500, which includes companies with an $18 billion market capitalization and positive earnings over the past four quarters. As of 2024, some of the largest holdings in the index include Apple, Amazon, Microsoft, Nvidia, and Alphabet.

The Vanguard S&P 500 ETF is a solid choice for investors seeking a well-diversified, low-cost investment vehicle that mirrors the performance of the S&P 500 index. With its low fees and broad exposure to large U.S. companies, this ETF is a popular option for those looking for long-term investment opportunities.

Understanding Mutual Fund 'Wall Off' Strategies and Their Impact

You may want to see also

SPDR S&P 500 ETF Trust

The SPDR S&P 500 ETF Trust (SPY) is the largest S&P index fund, with about $595 billion in assets under management. While it is not the cheapest way to access the S&P 500, its widespread use often outweighs its higher expense ratio for investors looking for a familiar fund. The SPY exchange-traded fund is capitalisation-weighted, which creates some additional risk.

SPY has an expense ratio of 0.095% and a year-to-date return of 22.7%. Its net expense ratio is 0.09%. Its shares have a 52-week range of 380.65 to 513.29, and it has total net assets of $483.744 billion.

SPDR Exchange-Traded Funds (ETFs) give you wide access to diverse investment opportunities. ETFs are generally more liquid than index funds, trading throughout the day like stocks on the exchange.

Investing in Your 20s: Index Funds for Early Investors

You may want to see also

Schwab S&P 500 Index Fund

The Schwab S&P 500 Index Fund (SWPPX) is a mutual fund that aims to track the total return of the S&P 500 Index, a benchmark index that includes 500 of the largest U.S. public companies, representing about 80% of the total U.S. stock market capitalisation.

The fund is a straightforward, low-cost investment option with no minimum investment required. It provides access to 500 leading U.S. companies, including some of the most well-known U.S.-based businesses such as Apple, Microsoft, and Amazon.

With an expense ratio of 0.02%, the Schwab S&P 500 Index Fund is one of the cheapest options available for investors seeking to replicate the performance of the S&P 500. This low-cost structure, combined with no minimum investment, makes it an attractive option for a wide range of investors.

The fund has a solid long-term performance track record, with annualised returns of about 9-10% historically. For example, a $10,000 investment made five years ago would have grown to approximately $15,690 by the end of 2023.

The Schwab S&P 500 Index Fund is a good choice for investors seeking broad exposure to the U.S. stock market and wanting to replicate the performance of the S&P 500 at a low cost. It is a well-established fund with a long history, having been incepted in May 1997.

When compared to other S&P 500 index funds, the Schwab fund stands out for its low fees and no minimum investment requirement, making it a competitive option for those seeking to mirror the performance of the S&P 500 index.

UK Funds: Your Investing Journey Simplified

You may want to see also

Vanguard Russell 2000 ETF

When considering the best S&P index funds to invest in, one option to explore is the Vanguard Russell 2000 ETF (VTWO). This exchange-traded fund (ETF) is designed to track the performance of the Russell 2000 Index, which is a stock market index that comprises 2000 small-cap stocks. Small-cap stocks are shares of publicly traded companies with relatively small market capitalisations.

Investing in the Vanguard Russell 2000 ETF offers exposure to a diverse range of small-cap companies across various sectors. Small-cap stocks tend to have higher growth potential than large-cap stocks, but they also come with higher risks. This ETF provides a convenient and cost-effective way to invest in this particular segment of the stock market.

One of the key advantages of the Vanguard Russell 2000 ETF is its low expense ratio, which means that the fund has relatively low management fees compared to other similar funds. This can result in slightly higher returns over time, as a smaller proportion of the fund's assets are used to cover management expenses. Additionally, the ETF structure allows investors to buy and sell shares throughout the trading day, providing greater flexibility and liquidity compared to traditional mutual funds.

It's important to note that investing in small-cap stocks through the Vanguard Russell 2000 ETF or any other similar fund carries a higher level of risk compared to investing in large-cap stocks. Small-cap companies may be more vulnerable to market fluctuations and economic downturns, and they may not have the same established track record as larger, more established companies.

When considering any investment, it's always advisable to conduct thorough research and carefully evaluate your financial goals, risk tolerance, and investment horizon. Diversification and cost-efficiency are important factors to keep in mind when constructing a well-balanced investment portfolio.

Equity Income Funds: Worth the Investment Risk?

You may want to see also

Frequently asked questions

An S&P 500 index fund tracks the S&P 500, a market index made up of about 500 large US companies. Index funds aim to mirror a particular market index, so an S&P 500 index fund will likely perform similarly to how the overall market index performs.

Some of the best S&P 500 index funds on the market in terms of costs and minimums include:

- Vanguard 500 Index Fund - Admiral Shares (VFIAX)

- Schwab S&P 500 Index Fund (SWPPX)

- Fidelity Zero Large Cap Index (FNILX)

- Fidelity 500 Index Fund (FXAIX)

- T. Rowe Price Equity Index 500 Fund (PREIX)

The best S&P 500 index funds overall include:

- SPDR S&P 500 ETF Trust (SPY)

- Vanguard S&P 500 ETF (VOO)

- iShares Core S&P 500 ETF (IVV)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

S&P 500 index funds are popular because they can instantly diversify a portfolio. With a single asset, you are invested in 500 of the largest companies in the US, covering many types of industries and sectors.

Investing in multiple S&P 500 index funds will not necessarily further diversify your portfolio. You could consider exploring index funds that cover other market indexes, such as the Dow Jones or Nasdaq, to further diversify your portfolio.