Hedge funds are alternative investment funds that pool money from accredited investors and invest in a wide range of assets, including stocks, derivatives, currencies, property, and even cryptocurrency. They are designed to generate returns regardless of market performance and typically employ aggressive, risky strategies like leveraging and short-selling to achieve above-average returns. With their focus on absolute returns and the use of hedging, arbitrage, and leverage, hedge funds seek positive annual returns, limited value swings, and capital preservation.

| Characteristics | Values |

|---|---|

| Definition | A pool of money that is invested in stocks and other assets |

| Investor Type | Institutional investors, wealthy individuals |

| Investment Type | Non-traditional assets, high-risk assets, derivatives, short selling, debt and equity securities, commodities, currencies, real estate, corporate equities, bonds, foreign exchange, futures, options, swaps, forwards |

| Investment Goal | To make a profit, regardless of whether the market is up or down |

| Fees | Management fees (2%), Performance fees (20%) |

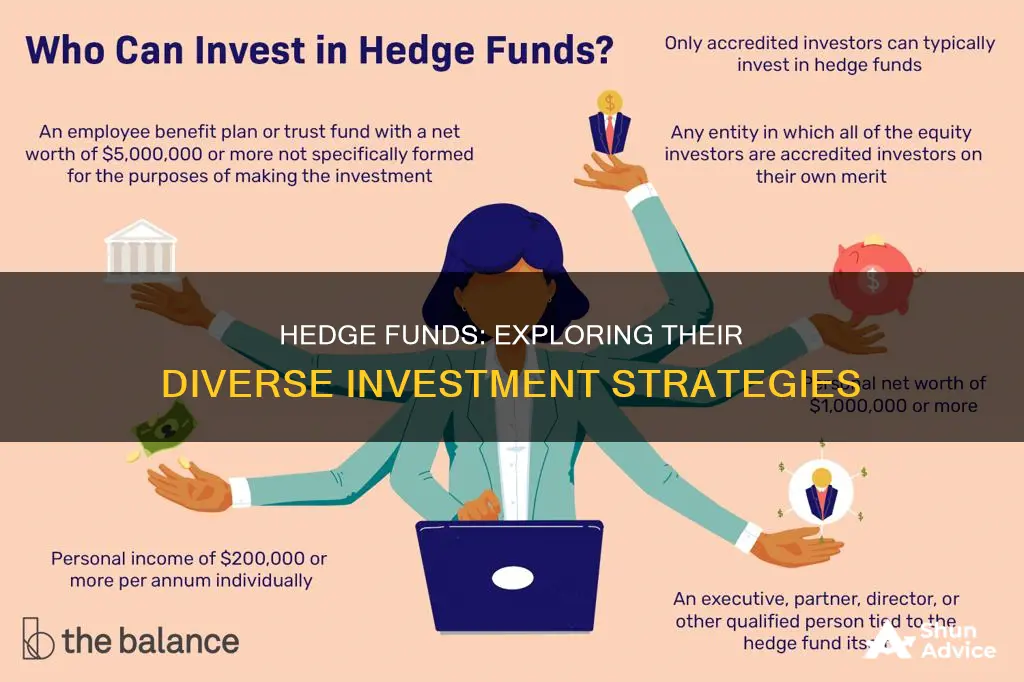

| Investor Requirements | Accredited investors, high net worth, high income |

| Fund Structure | Open-end funds |

| Fund Manager Incentive | Fund managers invest their own capital in the fund |

What You'll Learn

Property

Hedge funds are increasingly investing in real estate, with nearly 40% of them currently doing so. Real estate hedge funds are a popular type of investment that involves pooling capital from numerous investors before investing in some form of real estate. Hedge funds are similar to mutual funds but tend to take on more risk.

There are two main ways in which a hedge fund manager can choose to invest in real estate: through a Real Estate Investment Trust (REIT) or through the acquisition of properties.

A REIT is a corporate entity that invests exclusively in real estate and is given a tax exemption for doing so. In return, REITs are required to pay out at least 90% of their income as dividends. Hedge funds can invest in the publicly-traded stock of existing real estate companies, mainly REITs. This is the most common method of investing via a real estate hedge fund.

The other way a real estate hedge fund can invest is through the acquisition of actual properties, generally underperforming ones, at low rates. These properties can be purchased in one specific region or globally, but they tend to be up for sale due to a lack of liquidity on the part of the seller.

Some key players in the real estate hedge fund market include Angelo, Gordon & Company, Cerberus Real Estate Capital Management, Cliffwood Partners LLC, and The Praedium Group.

Tax-Efficient Fund Investing: Strategies for Smart Returns

You may want to see also

Currency

Hedge funds' ability to invest in currencies offers them the opportunity to diversify their portfolios, reduce risk, and potentially generate higher returns. The flexibility to invest across different markets and asset classes, including currencies, is a key characteristic of hedge funds.

Additionally, hedge funds have the advantage of employing aggressive and non-traditional investment strategies. They can utilise derivatives, leverage, and short-selling techniques to maximise returns and mitigate risks associated with currency investments.

By investing in currencies, hedge funds can take advantage of global market opportunities and fluctuations in exchange rates to achieve their investment goals.

Index Funds: Diversified Investment Options?

You may want to see also

Cryptocurrency

A cryptocurrency hedge fund is a partnership that aims to generate large short-term profits by investing in various cryptocurrencies. These funds are even more volatile than traditional hedge funds due to the inherent volatility of the underlying crypto assets. As a result, investors in these funds need to be cautious and only risk capital they can afford to lose.

The average crypto fund returned more than 128% in 2020, a significant increase from 30% in 2019. The most commonly traded cryptocurrencies among hedge funds are Bitcoin (92%) and Ethereum (67%), followed by Litecoin, Chainlink, and Polkadot. About half of the crypto hedge funds also trade derivatives, and a third invest directly through spot investments or passive funds.

The appeal of crypto hedge funds lies in their potential for high returns and the desire to gain exposure to a new value-creation ecosystem. However, it's important to note that not all cryptocurrencies are equal, and due to their novelty and lack of regulation, new tokens are constantly emerging. Therefore, investors should be cautious and conduct thorough research before investing in crypto hedge funds.

When considering investing in crypto hedge funds, it is crucial to understand the associated risks. Both hedge funds and crypto are considered riskier than average investments, and combining them almost doubles the risk. While there is a potential for significant gains, there is also the possibility of losing all your money very quickly. Therefore, investors should only allocate capital they can afford to lose and thoroughly educate themselves on the risks involved.

In summary, cryptocurrency hedge funds offer the potential for high short-term returns but come with substantial risks. Investors should carefully evaluate their investment goals, risk tolerance, and conduct thorough due diligence before allocating capital to these funds.

Retirement Fund Investment: Choosing the Right Option

You may want to see also

Derivatives

One common hedge fund strategy is the long/short equity strategy, which involves taking long and short positions in equity and equity derivative securities. Funds using this strategy employ a range of fundamental and quantitative techniques to make investment decisions. They tend to invest primarily in publicly traded equity and their derivatives and are usually long-biased. Long/short funds also tend to have more permissive lock-ups, gates, and other withdrawal terms due to the ease of liquidating positions.

Another strategy that involves derivatives is arbitrage, which seeks to exploit observable price differences between closely related investments by simultaneously purchasing and selling investments. Arbitrage strategies can include swap-spread arbitrage, yield curve arbitrage, and capital structure arbitrage. Fixed-income arbitrage, for example, seeks to exploit pricing differences in fixed-income securities by taking various opposing positions in inefficiently priced bonds or their derivatives.

Relative value arbitrage, or pairs trading, involves taking advantage of perceived price discrepancies between highly correlated investments, including stocks, options, commodities, and currencies. This strategy carries a high risk and requires extensive expertise.

Overall, derivatives play an important role in hedge fund investment strategies, allowing funds to gain indirect exposure to underlying assets and providing flexibility in their investment approaches.

Smart Strategies for Investing $5K in Mutual Funds

You may want to see also

Corporate equities

Equity hedge funds, also known as equity hedges, balance long and short positions in the public markets to drive higher returns and reduce risk. This strategy, known as a long/short hedge fund strategy, was popularised by Alfred Winslow Jones, the founder of the world's first hedge fund in 1949. Jones combined long-term stock investing with short-selling and leverage to hedge against potential losses.

There are three popular subcategories of equity hedge funds: market neutral, long-short, and short-long. Market neutral funds invest the same amount of capital in offsetting long and short positions, resulting in a portfolio with zero or near-zero net market exposure. Long-short funds take long positions in securities expected to rise in value and short positions in securities expected to fall, insulating the portfolio from market volatility. Short-long funds, on the other hand, focus on short positions with some long positions, allowing them to profit from falling markets.

Equity hedge funds aim to profit from market movements and reduce risk by balancing their positions. By investing in corporate equities, they can take advantage of price fluctuations and generate returns. The use of derivatives and leverage further enhances their ability to amplify gains and protect against losses.

Overall, corporate equities play a significant role in the strategies employed by hedge funds. By utilising long and short positions, hedge funds seek to maximise returns while managing risk effectively.

Vanda Global Fund: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

Hedge funds are alternative investment funds that pool money from investors and invest it with the intent of making a profit. They are typically managed by institutional investors who use a wide range of non-traditional investment strategies with the primary goal of mitigating risk.

Hedge funds can invest in a range of assets including land, real estate, stocks, derivatives, and currencies. They tend to use more uncommon trading techniques such as derivatives, short selling, and leveraging.

Some well-known hedge funds include Bridgewater Associates, Renaissance Technologies, and AQR Capital Management.

Hedge funds make money by charging management fees and collecting performance fees. The typical fee structure is the 2-and-20 rule, which includes a 2% management fee and a 20% performance fee.

Hedge funds are subject to less regulation than mutual funds and other investment vehicles. In the United States, they are regulated and supervised by the Securities and Exchange Commission (SEC) and other government agencies.