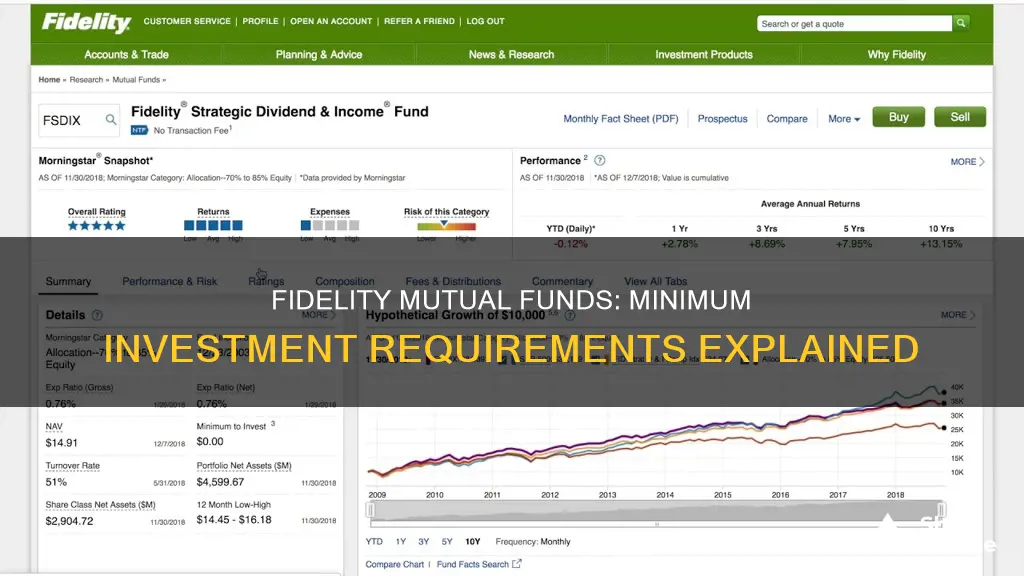

Fidelity is a world leader in mutual funds with a rich history, global research capabilities, and a dedication to innovation. The company offers a wide range of mutual fund options with different investment minimums. While some of their funds have minimum investment requirements, Fidelity also offers several mutual funds with $0 minimums, making mutual fund investing accessible to all investors. These funds include the Fidelity ZERO Large Cap Index Fund (FNILX), the Fidelity ZERO Extended Market Index Fund (FZIPX), the Fidelity ZERO Total Market Index Fund (FZROX), and the Fidelity ZERO International Index Fund (FZILX). With no minimums to open an account, no account fees for retail brokerage accounts, and 24/7 live customer service, Fidelity provides a highly competitive offering in the market.

| Characteristics | Values |

|---|---|

| Minimum investment | $0 |

| Number of no-transaction-fee mutual funds | Over 3,300 |

What You'll Learn

Fidelity's mutual funds have no minimum investment requirements

Fidelity's zero minimum investment requirement is a significant advantage for beginning investors, as it allows them to diversify their portfolio without needing a large amount of capital. It also enables investors to buy into multiple funds, rather than putting their entire account balance into just one fund.

In addition to having no minimum investment requirements, Fidelity's mutual funds also offer other benefits, such as lower management fees, tax efficiency, and reduced portfolio turnover. The company has over 70 years of experience in the business and is a world leader in mutual funds, with a rich history, global research capabilities, and a dedication to innovation.

Fidelity's extensive resources, including a global network of nearly 400 research professionals and one of the largest research departments in the industry, allow its fund managers to identify investment opportunities that others may miss. The company offers a wide range of mutual funds covering all asset classes, from domestic equity to specialized sectors, enabling investors to find the right mix of funds to achieve their strategic investment goals.

With its zero minimum investment requirement and extensive range of fund offerings, Fidelity makes it easy and accessible for investors to get started with mutual funds and build a diversified portfolio.

Index Funds: Free Investing and Smart Money Moves

You may want to see also

Fidelity's mutual funds have no expense ratio

When it comes to investing, fees are an important consideration. Fidelity is committed to providing value to its customers and introduced zero expense ratio index mutual funds. The following funds have a 0% expense ratio and no minimum investment amount:

- Fidelity® ZERO Large Cap Index Fund (FNILX)

- Fidelity® ZERO Extended Market Index Fund (FZIPX)

- Fidelity® ZERO Total Market Index Fund (FZROX)

- Fidelity® ZERO International Index Fund (FZILX)

The expense ratio of a fund is the annual fee that investors pay, which covers the costs of fund management, such as security selection, trading costs, accounting, reporting, investment research, and investor communications. While these fees may seem small, they can add up over time and impact your overall returns.

Fidelity's zero expense ratio funds offer a unique opportunity to build a retirement portfolio with minimal fees. Additionally, these funds provide exposure to a broad range of large-capitalization, mid- to small-capitalization, publicly traded companies, and foreign developed and emerging stocks.

It's important to note that while low fees are generally preferable, they should be evaluated in the context of your investment objectives and the value you derive from the investment. Some funds with higher fees may offer access to more complex or less accessible investments, such as commodities or international securities.

When considering any investment, it's crucial to assess all relevant factors, including fund fees, features, and objectives. It's also essential to remember that investing involves risk, and the value of your investments can fluctuate over time.

Thematic Funds: Diversify Your Portfolio, Invest in the Future

You may want to see also

Fidelity's mutual funds have no account fees

Fidelity's no-account-fee policy is part of its commitment to providing value to its customers. The company also offers zero expense ratio index funds, lower expenses than comparable funds at Vanguard, and a large selection of no-transaction-fee funds.

Fidelity's mutual funds cover all asset classes, from domestic equity to specialized sectors, giving investors a wide range of options to achieve their strategic investment goals. The company's extensive resources, including a global network of nearly 400 research professionals and one of the largest research departments in the industry, allow its fund managers to identify investment opportunities that others may miss.

Fidelity's mutual funds also provide investors with access to a diverse range of investment strategies, including sustainable and thematic investing. Sustainable investing enables investors to align their investments with environmental, social, or governance (ESG) factors, while thematic investing allows investors to focus on long-term trends or themes that they believe in.

In addition to its extensive investment options and research capabilities, Fidelity also offers educational resources and customer support through various channels, including a network of over 200 branches, phone, chat, email, and social media.

With its no-account-fee policy, Fidelity makes it easier for investors to access its wide range of investment options and take advantage of its industry-leading research and educational resources.

Best Vanguard Funds for Your Roth IRA

You may want to see also

Fidelity's mutual funds have no account minimums

Fidelity's no-minimum investment funds include the Fidelity ZERO Large Cap Index Fund (FNILX), the Fidelity ZERO Extended Market Index Fund (FZIPX), the Fidelity ZERO Total Market Index Fund (FZROX), and the Fidelity ZERO International Index Fund (FZILX). These funds also have a 0% expense ratio.

Fidelity's commitment to providing value is evident in its offering of zero expense ratio index funds and zero minimum investment requirements. This means investors can get started with Fidelity's mutual funds without needing a large sum of money.

In addition to its own funds, Fidelity also offers its customers access to over 10,000 mutual funds from other companies through its FundsNetwork. This extensive selection of funds allows investors to explore a wide range of investment options and build a diversified portfolio that aligns with their strategic investment goals.

Fidelity's mutual funds provide investors with a practical and cost-efficient way to build a diversified portfolio. The company's zero minimum investment requirement makes it easy for anyone to get started with mutual fund investing, and its broad selection of funds ensures that investors can find the right mix of funds to achieve their financial goals.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

Fidelity's mutual funds have no account fees for retail brokerage accounts

Fidelity's mutual funds offer a wide range of investment choices, including stocks, bonds, ETFs, options, and precious metals. The company also provides investors with access to advanced trading platforms, tools, and research to help them make informed investment decisions.

In addition to having no account fees, Fidelity's mutual funds also offer zero expense ratio index funds. These funds have no expense ratio and no minimum investment requirement, which can save customers a significant amount of money.

Fidelity's mutual funds provide investors with a variety of benefits, including a large selection of no-transaction-fee funds, low costs, excellent customer support, and educational resources for investors of all levels. The company's strong reputation and extensive offerings make it a popular choice for those looking to invest in mutual funds.

Co-Invest Funds: Higher Returns, Lower Risk?

You may want to see also

Frequently asked questions

Fidelity offers several mutual funds that have $0 minimums. However, some Fidelity mutual funds have minimum investment requirements.

A minimum investment is the smallest dollar or share quantity that an investor can purchase when investing in a specific security, fund, or opportunity.

Examples of mutual funds with low or no minimum investment include the Charles Schwab Corporation (SCHW), which offers a broad market index fund and target-date funds with no minimum initial purchase. Dodge & Cox mutual funds require a minimum of $2,500, while many Vanguard mutual funds need $3,000 to get started.

Yes, some companies and funds have lower initial purchase amounts for IRA accounts. For example, the T. Rowe Price New Era Fund (PRNEX) requires a $2,5000 minimum initial purchase for its mutual funds held in non-retirement accounts but only $1,000 for retirement accounts like IRAs.