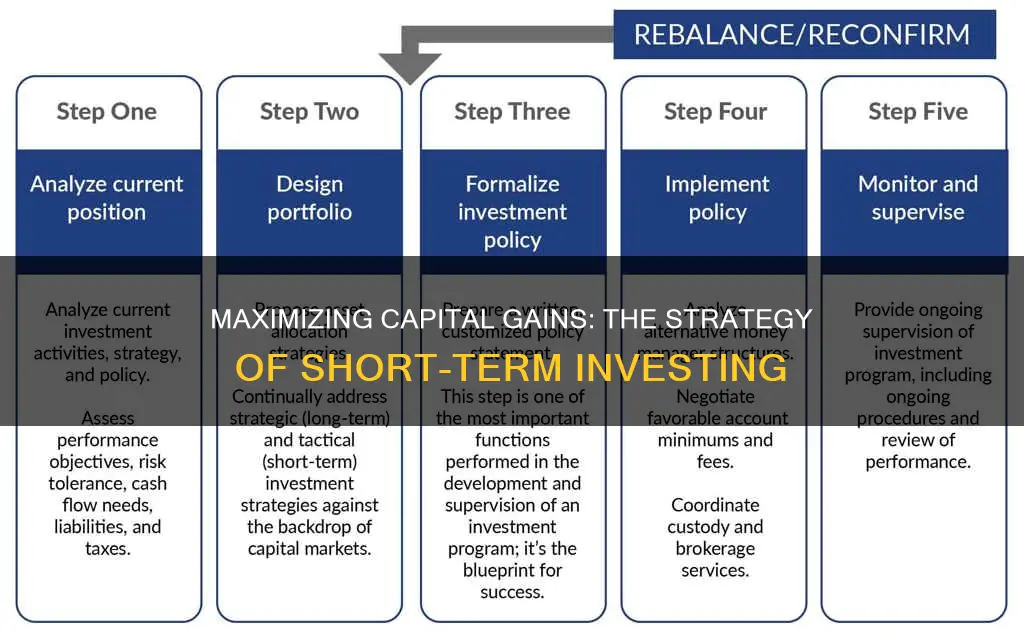

Short-term investing is a strategy that focuses on capital gains and quick returns within a relatively short period, typically a few months to a few years. This approach is often employed by investors seeking to capitalize on market fluctuations, take advantage of short-term opportunities, or manage risk by diversifying their portfolios. The primary purpose of short-term investing is to generate income and profits in the near term, allowing investors to potentially increase their wealth faster than through long-term investments. It involves a more active trading approach, where investors buy and sell assets frequently to take advantage of market trends and price movements. This strategy requires careful analysis and a keen understanding of market dynamics to make informed decisions and manage risks effectively.

What You'll Learn

- Capital Preservation: Protecting principal through low-risk strategies

- Liquidity: Ensuring easy access to funds for immediate needs

- Market Timing: Profiting from short-term price fluctuations and trends

- Risk Management: Mitigating potential losses with conservative investments

- Tax Efficiency: Optimizing returns through strategic tax-advantaged investment choices

Capital Preservation: Protecting principal through low-risk strategies

Capital preservation is a fundamental concept in investing, especially for those seeking to safeguard their principal amount while still aiming for growth. It involves implementing strategies that minimize the risk of losing capital, ensuring that investors' money remains intact or grows at a steady, manageable pace. This approach is particularly appealing to risk-averse investors who prioritize capital safety over aggressive returns.

The primary goal of capital preservation is to protect the initial investment, often referred to as the principal. This is achieved through various low-risk investment vehicles and strategies. One common method is to invest in assets that are considered less volatile, such as government bonds, treasury bills, or high-quality corporate bonds. These securities typically offer lower returns but provide a more stable investment environment, reducing the risk of significant losses. For instance, government bonds are backed by the full faith and credit of a government, making them a relatively safe investment option.

Another strategy for capital preservation is to invest in money market funds or short-term bond funds. These funds primarily invest in short-term, highly liquid assets, ensuring that the capital is readily accessible and less exposed to market fluctuations. Money market funds often provide a stable return with minimal risk, making them an attractive choice for those seeking to preserve capital. Additionally, investors can consider investing in large-cap stocks, which are generally less volatile compared to smaller-cap stocks, thus providing a more secure environment for capital preservation.

Diversification is a key component of capital preservation. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of any single investment's performance on their overall portfolio. This approach helps to mitigate risk and ensures that the portfolio remains balanced, even during market downturns. For example, a well-diversified portfolio might include a mix of stocks, bonds, real estate, and commodities, each contributing to the overall stability of the investment.

In summary, capital preservation is about safeguarding the investor's principal through careful selection of low-risk investment options. It involves a strategic approach to investing, focusing on assets that provide stability and minimal risk. By employing these strategies, investors can protect their capital while still participating in the market, allowing for potential growth over the long term. This method is particularly suitable for those who prefer a more conservative investment approach, prioritizing capital safety and long-term wealth preservation.

Balancing Act: Merging Short-Term Gains with Long-Term Wealth Creation

You may want to see also

Liquidity: Ensuring easy access to funds for immediate needs

Liquidity is a critical aspect of short-term investing, as it ensures that investors can quickly access their funds when needed. In the realm of short-term investments, liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. This is particularly important for investors who seek to meet immediate financial obligations or take advantage of unexpected opportunities.

One of the primary purposes of short-term investing is to provide a safety net for investors. By holding highly liquid assets, investors can quickly respond to financial emergencies or unexpected expenses. For example, if an investor needs to cover a sudden medical bill or a home repair, having liquid assets ensures they can do so without selling off long-term investments at potentially unfavorable prices. This aspect of liquidity is especially valuable for risk-averse investors who prioritize capital preservation and quick access to funds.

In addition to providing financial security, liquidity enables investors to take advantage of short-term market opportunities. Short-term investors often seek to capitalize on market fluctuations, news events, or economic trends that can arise rapidly. For instance, if a company announces a significant contract win, short-term investors with liquid assets can quickly buy into the stock to benefit from the anticipated price increase. Similarly, during a market downturn, investors with liquid funds can take advantage of lower prices by buying stocks or other assets with the potential for quick recovery.

To ensure high liquidity, short-term investors typically focus on assets that are easily convertible into cash. Common examples include money market funds, treasury bills, certificates of deposit (CDs), and certain exchange-traded funds (ETFs). These assets are highly liquid because they are backed by strong credit ratings and can be redeemed or sold quickly without significant loss of value. Additionally, investors can maintain a portion of their portfolio in cash or cash equivalents to ensure they have immediate access to funds when needed.

In summary, liquidity is a vital component of short-term investing, allowing investors to meet immediate financial needs and take advantage of short-term market opportunities. By holding highly liquid assets, investors can quickly access their funds, ensuring financial security and the ability to respond to unexpected events or market trends. Understanding and managing liquidity is essential for short-term investors to achieve their financial goals while maintaining control over their capital.

Decades of Dedication: Unlocking the True Potential of Long-Term Investing

You may want to see also

Market Timing: Profiting from short-term price fluctuations and trends

Market timing is a strategy that focuses on capitalizing on short-term price movements and trends in financial markets. It involves making quick decisions to buy and sell assets within a short period, aiming to profit from the short-term price fluctuations that occur in the market. This approach is particularly attractive to investors who believe they can predict and capitalize on market trends, especially in volatile environments.

The core idea behind market timing is to identify and act on short-term opportunities that may not be apparent in the long term. It requires a keen understanding of market dynamics, technical analysis, and often a high level of confidence in one's ability to time the market. Investors employing this strategy often use various tools and techniques, such as charts, indicators, and news analysis, to make informed decisions. For instance, they might look for patterns in price charts, such as head and shoulders or double tops/bottoms, to anticipate potential price reversals or breakouts.

One of the key challenges of market timing is the inherent risk involved. Short-term price movements can be highly unpredictable, and trying to time the market can lead to significant losses if the market behaves differently than anticipated. Therefore, successful market timers often employ risk management techniques, such as setting stop-loss orders to limit potential losses and diversifying their portfolios to mitigate the impact of any single trade.

Additionally, market timing strategies often require a high level of discipline and emotional control. Traders must make quick decisions, and emotions like fear or greed can significantly impact performance. Successful market timers often develop strict trading rules and stick to them, ensuring that their decisions are based on predefined criteria rather than impulsive reactions to market events.

In summary, market timing is a short-term investing strategy that aims to profit from short-term price movements and trends. It requires a deep understanding of market dynamics, technical analysis, and disciplined decision-making. While it offers the potential for significant gains, it also carries substantial risks, making it a complex and challenging strategy for investors to master.

Bid-Ask Spread: A Long-Term Investing Perspective

You may want to see also

Risk Management: Mitigating potential losses with conservative investments

Understanding the purpose of short-term investing is crucial for anyone looking to manage their financial portfolio effectively. Short-term investing refers to the strategy of holding investments for a relatively brief period, typically ranging from a few days to a few years. The primary goal is to capitalize on short-term market fluctuations and price movements, aiming to generate quick returns rather than long-term wealth accumulation. This approach is particularly attractive to investors seeking to maximize their gains in a short time frame.

When it comes to risk management, short-term investing often takes a more conservative approach. Conservative investments are designed to preserve capital and provide a stable return while minimizing potential losses. This strategy is especially important for risk-averse investors who want to protect their assets and avoid significant financial setbacks. By adopting a conservative stance, investors can ensure that their short-term gains are not offset by substantial losses.

One key aspect of risk management in short-term investing is diversification. Diversification involves spreading investments across various assets, sectors, and industries to reduce the impact of any single investment's performance on the overall portfolio. By diversifying, investors can mitigate the risks associated with market volatility and individual security performance. For example, holding a mix of stocks, bonds, and commodities can provide a safety net during market downturns, as different asset classes may react differently to economic changes.

Another essential tool for risk management is regular portfolio rebalancing. This process involves periodically adjusting the allocation of assets within an investment portfolio to maintain the desired risk level. Over time, certain investments may outperform others, causing the portfolio's composition to deviate from the original target. Rebalancing helps investors stay on track with their investment strategy, ensuring that their portfolio remains aligned with their risk tolerance and financial goals.

Additionally, short-term investors often focus on low-risk investment vehicles. These may include money market funds, certificates of deposit (CDs), and government bonds. Such investments typically offer higher liquidity and lower volatility compared to stocks or mutual funds. By choosing these conservative options, investors can minimize the risk of permanent capital loss and maintain a more stable investment environment.

In summary, short-term investing serves the purpose of capitalizing on market opportunities while managing risks effectively. Conservative investments play a vital role in this strategy by preserving capital and providing stability. Through diversification, rebalancing, and the selection of low-risk assets, investors can mitigate potential losses and ensure that their short-term gains contribute to a well-rounded and secure financial portfolio. This approach allows investors to navigate market fluctuations with confidence, making it an essential consideration for anyone looking to optimize their investment strategy.

Understanding Investment: A Key Economic Driver

You may want to see also

Tax Efficiency: Optimizing returns through strategic tax-advantaged investment choices

Tax efficiency is a critical aspect of short-term investing, as it directly impacts the overall returns on your investments. The primary goal of short-term investing is to maximize gains within a relatively short time frame, often a few months to a couple of years. This approach requires a strategic mindset, especially when considering the tax implications of various investment choices. By optimizing your investment strategy with tax efficiency in mind, you can potentially enhance your returns and make the most of your short-term investment goals.

One key strategy to achieve tax efficiency is to take advantage of tax-advantaged investment vehicles. For instance, individual retirement accounts (IRAs) offer significant tax benefits. Contributions to traditional IRAs may be tax-deductible, providing an immediate tax benefit. Additionally, earnings within an IRA grow tax-free until withdrawal, allowing your investments to compound over time without incurring annual tax liabilities. This is particularly advantageous for short-term investors as it enables them to focus on capital appreciation rather than being burdened by annual tax payments.

Another approach to consider is the utilization of tax-efficient exchange-traded funds (ETFs). ETFs often have lower expense ratios compared to mutual funds and can provide broad market exposure. When held for less than a year, ETFs can be treated as short-term capital gains, which are typically taxed at a lower rate than long-term gains. This strategy allows investors to benefit from the diversification and low costs of ETFs while minimizing tax obligations.

Furthermore, understanding the tax implications of different investment types is essential. For example, investments in real estate or certain types of bonds may offer tax advantages. Real estate investment trusts (REITs) provide a way to invest in real estate without the complexities of direct ownership. REIT dividends are often exempt from federal income tax, and you can deduct the amount you paid for the REIT as a real estate tax deduction. Similarly, certain municipal bonds offer tax-free income, making them an attractive option for investors seeking tax-efficient income streams.

In summary, tax efficiency is a powerful tool for short-term investors to optimize their returns. By utilizing tax-advantaged accounts, such as IRAs, and taking advantage of tax-efficient investment vehicles like ETFs and specific bond investments, investors can minimize their tax liabilities and potentially increase their overall gains. Strategic tax planning is an essential component of a successful short-term investment strategy, ensuring that your hard-earned money works harder for you.

Mastering Short-Term Investments: Reporting Tips for Balance Sheets

You may want to see also

Frequently asked questions

Short-term investing focuses on capital appreciation and income generation over a relatively short period, typically less than a year. The main objective is to take advantage of market opportunities, such as price fluctuations or short-term trends, to maximize returns in a brief timeframe.

Short-term investing differs from long-term investing in terms of investment horizons and strategies. Long-term investors aim to build wealth over an extended period, often years or decades, focusing on fundamental analysis and holding investments for the long haul. In contrast, short-term investors prioritize quick gains, closely monitoring market news and making frequent trades to capitalize on short-term market movements.

Short-term investing offers several advantages, including the ability to react swiftly to market changes, take advantage of short-term trends, and potentially generate higher returns in a shorter period. It can be suitable for investors who prefer more active management, have a higher risk tolerance, or seek to diversify their portfolios by including various investment vehicles.

Yes, short-term investing carries certain risks. Frequent trading can lead to higher transaction costs and potential tax implications. Short-term market fluctuations can result in significant losses if the investor times the market incorrectly. Additionally, short-term strategies may not align with long-term financial goals, and investors should carefully consider their risk tolerance and investment objectives before adopting a short-term approach.