When considering long-term investments, the duration of 10 years is a significant milestone. It represents a substantial period during which an investment can mature and grow, offering a unique opportunity for wealth accumulation. This timeframe allows for the potential to witness market trends, economic cycles, and the impact of various factors that can influence the performance of an investment. Understanding the implications of a 10-year investment horizon is crucial for investors, as it enables them to make informed decisions and assess the risks and rewards associated with their financial goals.

What You'll Learn

- Historical Perspective: Long-term investments have evolved over centuries, with 10 years being a relatively short horizon

- Market Volatility: 10 years may not fully capture market cycles, which can significantly impact investment returns

- Risk Management: Diversification and risk mitigation strategies are crucial for long-term success, even over a decade

- Compounding Growth: 10 years can yield substantial growth through compounding, especially in high-performing investments

- Liquidity Considerations: 10 years may limit liquidity, requiring careful planning to access funds without penalties

Historical Perspective: Long-term investments have evolved over centuries, with 10 years being a relatively short horizon

The concept of long-term investments has a rich historical context, and it's fascinating to trace its evolution. Over centuries, the investment landscape has undergone significant transformations, and the idea of what constitutes a long-term investment has changed accordingly. In the early days of finance, long-term investments were often associated with land ownership and real estate. Ancient civilizations like the Romans and Egyptians understood the value of holding assets for extended periods, sometimes even for generations. For instance, the Roman Empire was known for its extensive landholdings, which were considered long-term investments, providing a steady income and a hedge against inflation. This approach was in stark contrast to the short-term trading strategies prevalent in today's markets.

As financial systems evolved, so did the definition of long-term investments. The 19th and 20th centuries saw the rise of stock markets and the emergence of modern investment strategies. During this period, long-term investments were often associated with buying and holding stocks for extended periods, allowing investors to benefit from the growth of companies over time. This strategy was popularized by legendary investors like Benjamin Graham, who advocated for a buy-and-hold approach, emphasizing the power of compounding returns over long periods.

However, the financial world has also witnessed the impact of short-term market dynamics, which has led to a shift in perspectives. In recent decades, with the advent of high-frequency trading and the influence of short-term market sentiment, the traditional long-term investment horizon has been challenged. The rise of index funds and exchange-traded funds (ETFs) has further contributed to this shift, as these investment vehicles often have shorter-term goals, aiming to track market indices over a few years.

Despite these changes, it is essential to recognize that a 10-year investment horizon is still considered relatively short in the grand scheme of financial history. When compared to the centuries-old practice of land ownership or the long-term holding of stocks, a 10-year investment is indeed a shorter-term strategy. This perspective highlights the dynamic nature of the investment world and how our understanding of long-term investments has evolved, adapting to market changes and technological advancements.

In conclusion, the historical perspective on long-term investments reveals a journey from ancient landholdings to modern stock market strategies. While 10 years may seem like a long-term commitment in today's fast-paced markets, it is a relatively short horizon when compared to historical standards. This understanding is crucial for investors to appreciate the long-term value of their investments and make informed decisions that align with their financial goals.

Unlock Short-Term Gains: A Beginner's Guide to Treasury Bills

You may want to see also

Market Volatility: 10 years may not fully capture market cycles, which can significantly impact investment returns

The concept of a 10-year investment horizon is often used as a benchmark for long-term investing, but it may not fully account for the dynamic nature of financial markets. Market volatility, the rapid and significant fluctuations in asset prices, can have a substantial impact on investment returns over this period. While a 10-year investment strategy might provide a stable foundation, the market's inherent unpredictability can lead to substantial variations in performance.

Volatility is an essential aspect of the financial markets, and it can be influenced by various factors such as economic cycles, geopolitical events, and shifts in investor sentiment. For instance, during economic downturns, markets tend to experience heightened volatility, with asset prices dropping rapidly. Conversely, in periods of economic growth, markets can surge, creating a volatile environment. This volatility can result in significant short-term fluctuations in investment values, which may not be fully reflected in a 10-year investment plan.

A 10-year investment period might not capture the full spectrum of market cycles, including both bull and bear markets. Bull markets, characterized by rising asset prices, can lead to substantial gains, while bear markets, marked by declining prices, can result in significant losses. Investors who are not prepared for these market shifts may find their long-term strategy disrupted, especially if they are not actively managing their portfolio.

To navigate market volatility effectively, investors should consider a more dynamic approach. This could involve regularly reviewing and rebalancing their portfolio to align with their risk tolerance and investment goals. Diversification is also key; spreading investments across various asset classes and sectors can help mitigate the impact of volatility. Additionally, staying informed about market trends and economic indicators can provide valuable insights for making timely investment decisions.

In summary, while a 10-year investment horizon is a useful framework, it is essential to recognize the limitations it may have in capturing market volatility. Investors should be prepared to adapt their strategies, manage risk, and make informed decisions to optimize their long-term investment returns in the face of market fluctuations. Understanding and addressing volatility is a critical aspect of successful long-term investing.

Long-Term Investments: Financing or Investing? Unlocking the Strategy

You may want to see also

Risk Management: Diversification and risk mitigation strategies are crucial for long-term success, even over a decade

In the realm of long-term investments, a period of 10 years is indeed a significant commitment, and it underscores the importance of a robust risk management strategy. Diversification and risk mitigation are essential tools to navigate the inherent uncertainties of the financial markets and ensure a successful outcome over this extended horizon. Here's an exploration of why these strategies are indispensable:

Diversification: A Strategic Approach

Diversification is a cornerstone of risk management, especially in long-term investments. It involves spreading your capital across various assets, sectors, and geographic regions to minimize the impact of any single investment's performance on your overall portfolio. By diversifying, you reduce the concentration risk, which is the potential for significant losses if a particular investment underperforms. For instance, if you invest solely in technology stocks, a downturn in the tech sector could severely affect your portfolio. However, by allocating your investments to include a mix of stocks, bonds, real estate, and commodities, you create a safety net. If one asset class underperforms, others may compensate, leading to a more stable and potentially higher return over the decade.

Risk Mitigation: Proactive Measures

Risk mitigation goes beyond diversification and involves actively managing and reducing potential risks. This strategy is about anticipating and addressing risks before they materialize. For long-term investments, this could mean implementing stop-loss orders to limit potential losses, regularly reviewing and adjusting your portfolio to align with your risk tolerance, and staying informed about market trends and economic factors that could impact your investments. For example, if you have a significant portion of your portfolio in a particular industry, monitoring industry-specific risks and having a contingency plan can be beneficial. This might include diversifying into related sectors or having a predetermined strategy to rebalance your portfolio if certain risks materialize.

Long-Term Perspective and Market Dynamics

A 10-year investment timeframe allows for the smooth operation of market dynamics and economic cycles. Diversification and risk mitigation strategies enable investors to weather these cycles. Over a decade, markets can experience bull runs, recessions, and various economic shifts. A well-diversified portfolio can provide stability during market downturns, ensuring that your long-term goals remain on track. Additionally, risk mitigation strategies, such as regular portfolio reviews, enable investors to adapt to changing market conditions, ensuring that their risk exposure remains aligned with their investment objectives.

In summary, for long-term investments, especially over a decade, risk management through diversification and risk mitigation is paramount. These strategies provide a buffer against market volatility and unexpected events, ensuring that your investments remain on course. By adopting a diversified approach and proactively managing risks, investors can build a robust portfolio capable of withstanding the test of time and market fluctuations. This holistic approach to risk management is essential for achieving financial goals and maintaining confidence in your investment journey.

Unveiling the Secrets: How Short-Term Investments Are Manipulated

You may want to see also

Compounding Growth: 10 years can yield substantial growth through compounding, especially in high-performing investments

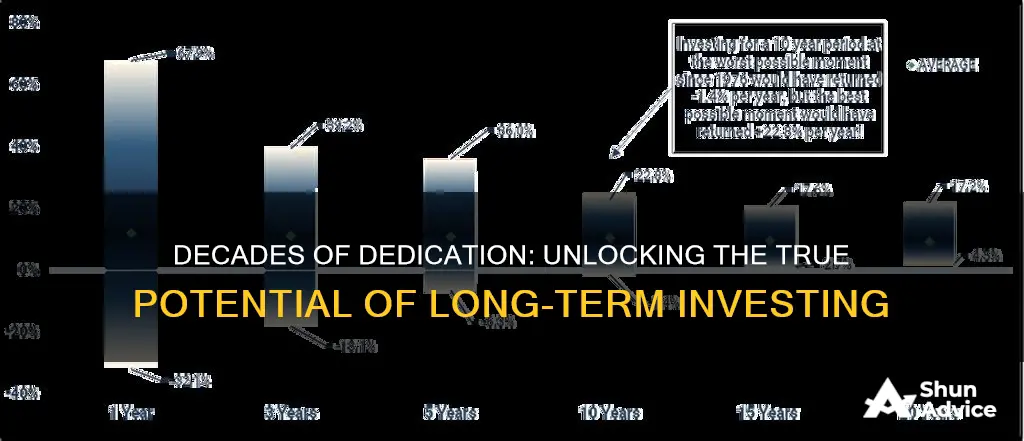

The concept of long-term investing is often associated with holding investments for an extended period, typically a decade or more. While the idea of a 10-year investment horizon might seem daunting, it can be a powerful strategy for building wealth and achieving financial goals. One of the key advantages of a long-term investment approach is the potential for substantial growth through compounding.

Compounding is the process by which an investment's earnings generate additional returns, which, in turn, earn more returns, and so on. This exponential growth can significantly boost the value of your investment over time. For instance, consider an investment that yields an annual return of 10%. After the first year, your investment grows by 10%. In the second year, it grows by 10% of the new total, resulting in a 20% overall increase. This compounding effect continues, with each subsequent year's return being a percentage of the previous year's growth. Over a 10-year period, this can lead to remarkable growth, especially in high-performing investments.

High-performing investments, such as those in the stock market, real estate, or certain mutual funds, have the potential to generate significant returns. When these investments are held for a decade, the power of compounding becomes even more evident. For example, if you invest $10,000 in a high-growth stock fund with an average annual return of 15%, your investment could grow to over $30,000 in 10 years. The compounding effect accelerates the growth, making it a substantial return on your initial investment.

It's important to note that not all investments are created equal, and the potential for growth varies. Some investments may offer higher returns but also come with increased risk. Diversification is a key strategy to manage risk while still benefiting from long-term growth. By spreading your investments across different asset classes and sectors, you can minimize the impact of any single investment's performance on your overall portfolio.

In summary, a 10-year investment horizon provides an opportunity to harness the power of compounding, especially in high-performing investments. This strategy allows your wealth to grow exponentially, making it a valuable tool for long-term financial success. While it may require patience and a long-term perspective, the potential rewards can be significant, providing a solid foundation for achieving your financial objectives.

Gold Investing: Strategies for Short-Term Profits

You may want to see also

Liquidity Considerations: 10 years may limit liquidity, requiring careful planning to access funds without penalties

When considering a 10-year investment, one of the critical factors to evaluate is liquidity. Liquidity refers to the ease with which an asset can be converted into cash without significant loss of value. In the context of a 10-year investment, it's important to recognize that such a long-term commitment may limit your access to funds, potentially impacting your financial flexibility.

Over a decade, market conditions and personal circumstances can change dramatically. What might have been a suitable investment at the start could become less appealing or even illiquid as the years progress. For instance, certain assets like real estate or private equity investments may take a substantial amount of time and effort to sell, and even then, the sale might not occur at a price that aligns with your initial investment. This lack of liquidity can be a significant drawback, especially if you need to access your funds for unexpected expenses or other financial obligations.

Careful planning is essential to mitigate the risks associated with limited liquidity. Here are some strategies to consider:

- Diversification: Spread your investments across various asset classes to ensure a balanced portfolio. This diversification can include a mix of stocks, bonds, real estate, and other assets, each with different liquidity characteristics. By diversifying, you reduce the impact of any single investment's illiquidity on your overall financial position.

- Emergency Fund: Maintain a separate emergency fund that is easily accessible and liquid. This fund should cover at least six to twelve months' worth of living expenses, providing a safety net in case of unforeseen events or the need to access funds quickly.

- Regular Review: Periodically review your investment portfolio and assess the liquidity of each holding. Market conditions change, and what was once a liquid asset might become less so over time. Regular reviews help identify investments that may require adjustments to maintain a balanced approach.

- Consider Liquid Alternatives: Explore investment options that offer higher liquidity, such as exchange-traded funds (ETFs) or mutual funds. These vehicles often provide diversification and can be bought or sold more frequently, providing a degree of flexibility.

By implementing these strategies, investors can navigate the challenge of limited liquidity over a 10-year period. It's crucial to strike a balance between long-term investment goals and the need for accessible funds, ensuring that your financial plan remains robust and adaptable to changing circumstances.

Maximize Your $100K: Short-Term Investment Strategies for Quick Wins

You may want to see also

Frequently asked questions

A long-term investment is typically an investment strategy that involves holding assets for an extended period, often years or even decades. This approach is common for retirement planning, wealth accumulation, and achieving financial goals.

Yes, 10 years is generally accepted as a minimum threshold for a long-term investment strategy. It provides enough time to weather market volatility and economic cycles, allowing for potential growth and compounding returns. This duration is often associated with investing in stocks, bonds, real estate, or other assets with long-term value appreciation potential.

A 10-year investment period offers several advantages. Firstly, it allows investors to take advantage of compound interest, where returns are reinvested to generate additional returns over time. Secondly, it provides an opportunity to ride out short-term market fluctuations and focus on the long-term trend. This strategy is often recommended for younger investors who can afford to take on more risk and have a longer time horizon to benefit from potential market growth.