Savings, investment, and productivity are interconnected and influence each other in several ways. Savings refers to storing money safely for future use, often in low-risk accounts, while investment involves risking money in financial instruments like stocks and bonds to achieve higher returns. Saving is essential for building an emergency fund and meeting short-term financial goals, while investing helps achieve long-term goals like retirement and buying a house.

The relationship between savings and investment is critical for economic growth. Savings provide the capital for investment, and economies with higher savings rates can take advantage of investment opportunities, leading to faster growth. Investment in infrastructure, education, and health can boost productivity and income, while investment in plants and machinery is crucial for technological progress.

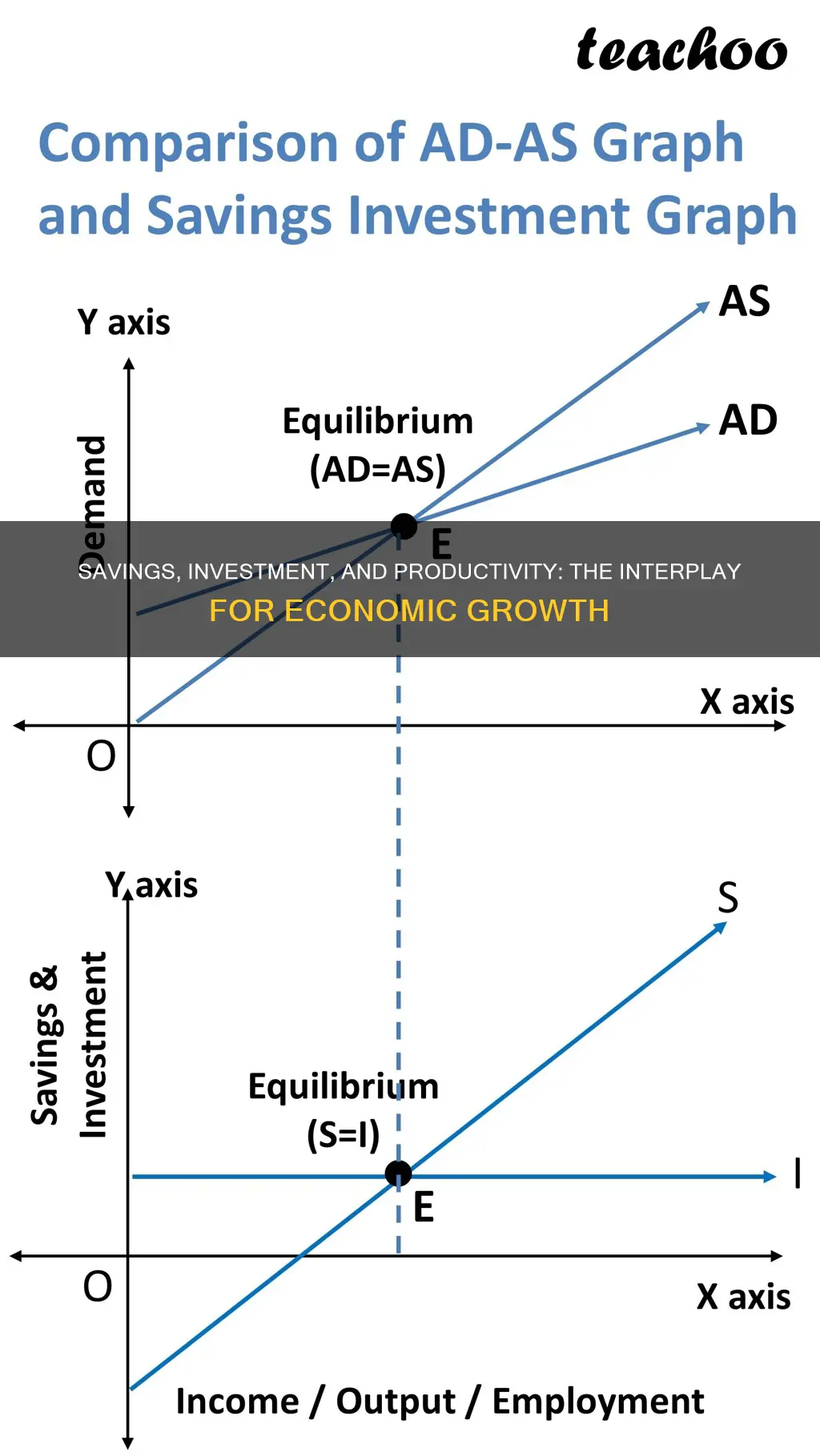

Additionally, the level of savings and investment affects the interest rate and growth rate of an economy. Higher savings lead to higher investment, which increases the capital stock and results in greater output growth. The interest rate, influenced by the level of investment, also impacts savings behaviour.

Overall, the relationship between savings, investment, and productivity is complex and dynamic, with each component influencing the others in a continuous cycle of economic activity.

| Characteristics | Values |

|---|---|

| Savings | Putting money in the bank, buying stocks, or contributing to a pension plan |

| Investment | Buying assets such as stocks, bonds, mutual funds, or real estate |

| Productivity | A measure of performance that compares the output of a product with the input required to produce it |

| Relationship between savings and investment | Savings is the source of funding for investment |

| Relationship between investment and productivity | Investment in plants, machinery, and technology increases labor productivity |

| Relationship between savings and productivity | Savings contribute to higher investment and productivity |

What You'll Learn

Saving for development

The Relationship Between Savings, Investment, and Productivity

Savings and investment are distinct but interconnected concepts. Saving refers to setting aside money for future use, often in a low-risk account, to build an emergency fund or achieve short-term financial goals. On the other hand, investing involves allocating money to financial instruments, such as stocks, bonds, or real estate, with the expectation of earning returns over the long term.

The correlation between savings and economic growth has been well established. Countries with higher savings rates tend to experience faster economic growth as savings provide the necessary capital for investments. This capital accumulation creates greater opportunities for production and productivity by providing additional income streams. Therefore, promoting domestic savings is crucial, especially in developing countries, as it enables investment in the most productive practices.

The Impact of Savings on Investment and Productivity

A key reason to save more is to invest more. Economies with higher savings rates can take advantage of investment opportunities, leading to faster economic growth. For example, investing in education and health can boost productivity and income, while investing in plants and machinery is crucial for technological progress. Additionally, investment in infrastructure, including transport, telecommunications, energy, and water, is essential for removing bottlenecks that hinder growth potential.

The relationship between savings and investment is dynamic. An increase in savings can lead to higher investment, which, in turn, contributes to economic growth. This growth creates a positive feedback loop, as higher incomes lead to higher savings, further fuelling investment. However, it is important to note that this relationship is not always linear, and other factors, such as interest rates, can influence investment decisions.

The Role of Savings in Development

Saving plays a vital role in economic development, especially in the context of developing countries. By increasing domestic savings, countries can reduce their dependence on foreign investment and decrease the risks associated with volatile foreign direct investment. Additionally, higher savings rates provide a sustainable long-term financing base for investments, reducing vulnerability to external factors.

Moreover, savings contribute to economic growth by providing the necessary capital for investments in production and innovation. This, in turn, leads to higher productivity, as more efficient processes and technologies are adopted. Therefore, promoting savings is crucial for developing countries to achieve sustainable economic development and improve the well-being of their citizens.

Strategies for Saving for Development

To effectively save for development, countries can implement various strategies:

- Encourage financial education: Governments and central banks can play a pivotal role in promoting financial education, especially among the youth. This can help individuals make informed decisions about saving and investing, leading to higher savings rates.

- Foster a competitive banking system: Developing countries should aim for a well-organized, competitive, and flexible banking system. This can increase trust in the banking sector, encouraging individuals to save more.

- Offer diverse saving options: Providing diverse saving options, such as savings accounts, money market accounts, and certificates of deposit, can cater to different financial goals and risk tolerances, making it more appealing for individuals to save.

- Implement policies to boost savings: Governments can introduce policies that incentivize saving, such as tax breaks or matching contributions for certain savings vehicles. Additionally, promoting retirement savings plans, such as 401(k) accounts, can encourage long-term savings.

- Reduce barriers to lending: Developing countries often face limitations in lending, especially for businesses investing in modern production lines and technologies. By reducing these barriers, countries can promote investment and, consequently, economic growth.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

Savings and economic growth

Savings and investments are critical elements of personal finance and are essential to ensure financial security and a bright future. While the terms are sometimes used interchangeably, it is important to note that they are very different. Saving money means storing it safely so that it is available when we need it and has a low risk of losing value. On the other hand, investment comes with risk but also the potential for higher returns.

Saving is an excellent way to meet short-term financial goals and prepare for unexpected situations. By putting money aside regularly, individuals can build up a cushion to help them through tough times. Savings are generally low-risk, meaning the money is safe, but the interest rates received are also low. Savings can be held in savings accounts, money market accounts, or certificates of deposit (CDs) that earn interest over time.

Investing, on the other hand, is a way to grow money over time by putting it into financial instruments such as stocks, bonds, and mutual funds. It is a way to reach long-term financial goals, such as saving for college, a down payment on a house, or retirement. Investing always involves some level of risk and there is no guarantee of making money or even getting back the initial investment. However, diversification across several holdings can help reduce this risk.

The relationship between savings, investment, and productivity is a crucial one. Firstly, savings are essential for investment. The more an economy saves, the more it can invest in productive activities, which leads to faster economic growth. For example, investing in education and health can boost growth by increasing people's productivity and income. Additionally, investing in infrastructure is critical for maintaining and expanding a country's productive structure.

Furthermore, the level of savings and investment is influenced by the real interest rate. A higher interest rate encourages people to save more as they can obtain greater future consumption by sacrificing current consumption. This increase in savings, in turn, leads to higher investment and economic growth, assuming a constant marginal product of capital. However, very high levels of savings may cause a reduction in the savings-to-output ratio as the wealth effect comes into play.

In conclusion, savings and investment are key drivers of economic growth. Savings provide the funds necessary for investment, which increases productivity and income. Additionally, the level of savings and investment is influenced by interest rates, with higher interest rates generally leading to higher savings and investment. Therefore, policies that encourage savings and investment can play a crucial role in a country's economic development.

Saving and Investing: Biblical Principles for Financial Wisdom

You may want to see also

Investment and national saving

The relationship between investment and national saving is a critical aspect of a country's economic growth and development. Here are some key insights on this topic:

The Role of Investment

Investment plays a crucial role in driving economic growth. It involves allocating resources towards productive activities, such as purchasing new machinery, expanding infrastructure, or funding research and development. These investments contribute to enhancing a country's productive capacity, leading to increased output and economic growth.

The Link Between Investment and National Saving

National saving refers to the collective savings of a country's citizens, businesses, and government. These savings can be channelled into investments, either directly or through financial institutions. A country with higher national savings has more resources available for investment, which can then stimulate economic growth.

Impact on Productivity and Income

Investment in education, health, infrastructure, and technology can significantly impact productivity and income levels. For example, investing in education and health can lead to a more skilled and healthy workforce, increasing overall productivity. Similarly, investing in infrastructure, such as transportation and telecommunications, can reduce bottlenecks and improve efficiency, further boosting productivity.

Short-term and Long-term Effects

Investment has both short-term and long-term effects on economic growth. In the short to medium term, investment boosts aggregate demand, leading to increased economic activity. In the long term, investment triggers technological advancements, induces higher productive capacity, and fosters resource allocation towards more productive sectors, resulting in sustained economic growth.

Financing Investment

National saving and foreign investment are the primary sources of financing for investment. However, relying solely on foreign investment can be risky due to potential volatility in international financial markets. Therefore, it is crucial to encourage national saving to fund domestic investment and reduce dependence on external sources.

Policy Recommendations

To promote investment and national saving, governments should implement consistent policies that encourage both. For example, providing tax incentives for savings and investments or creating favourable conditions for infrastructure development can help boost national saving and investment rates. Additionally, improving financial literacy and encouraging savings from an early age can contribute to higher national saving rates.

In conclusion, the relationship between investment and national saving is crucial for economic growth. By understanding this relationship and implementing appropriate policies, countries can harness the potential of investment to drive productivity, income, and long-term economic development.

Maximizing Small Savings: Smart Strategies for Investing Wisely

You may want to see also

The impact of savings on economic growth

Savings have a significant impact on economic growth, particularly in developing countries. Savings stimulate investment, production, and employment, generating sustainable economic growth. Countries with higher savings rates tend to experience faster economic growth as capital accumulation creates greater opportunities for production and productivity by providing additional income streams.

For instance, in the case of Kosovo, an increase in savings contributed to the country's overall economic growth. The data from 2010 to 2017 revealed that deposits positively impacted Kosovo's economic growth, with a positive correlation between savings and economic growth. Similarly, the United Nations Conference on Trade and Development emphasizes that increasing savings is the main factor in boosting in-country capital, recommending that developing countries prioritize programs promoting domestic savings to invest in the most productive practices.

The relationship between savings and economic growth is further supported by various studies. Solow, McKinnon, and Shaw highlighted the importance of savings in economic growth, arguing that larger savings lead to higher investments and increased production. Sajid and Sarfraz used the correctional correction technique and correction vector and concluded that there is a long-term interrelationship between saving and GDP. Additionally, Anoruo and Ahmad's study determined the existence of a "long-run relationship between economic growth and the growth rate of savings."

Furthermore, savings can help reduce a country's dependence on foreign direct investment, decreasing the risks associated with volatile foreign investment. Higher savings rates also contribute to greater investments, resulting in higher GDP growth. This is particularly evident in developing countries, where the primary source of financial capital comes from savings deposited in commercial banks.

In summary, savings play a crucial role in a country's economic growth, especially in developing nations. By stimulating investment, production, and employment, savings contribute to sustainable economic growth. Higher savings rates enable greater capital accumulation, leading to increased opportunities for production and productivity. Additionally, savings can reduce a country's reliance on foreign investment and promote financial stability.

Life Cycle Theory: Savings and Investment Strategies Explored

You may want to see also

Saving, investment and growth under perfect efficiency

The relationship between savings, investment, and productivity is a complex one, and understanding it is crucial for economic growth and development. In this discussion, we will explore the concept of "perfect efficiency" and its implications for savings, investment, and economic growth. We will also examine various factors that influence this relationship and how they contribute to economic growth.

Perfect efficiency in an economy occurs when the private and social marginal products of capital are the same for each type of capital, and the aggregate stock of capital is allocated optimally among the different types of capital. In other words, the economy maximises output with no waste. Under perfect efficiency, the real rate of interest and the common marginal productivity of capital are equal. As the stock of capital increases over time due to savings and investment, the marginal productivity curves may shift, causing the real interest rate to change. However, since aggregate investment involves expanding various types of capital in optimal proportions, the real interest rate may remain unchanged.

The assumption of perfect efficiency simplifies the analysis by allowing us to assume that the growth of knowledge and technology is sufficient to avoid diminishing returns, even with a fixed natural resource base. For example, as long as new and improved farming methods are continually invented, the employment of increased human and physical capital on a given stock of land can continue to be productive.

The relationship between investment and the real interest rate is critical in understanding economic growth. In a perfectly efficient economy, the equilibrium level of investment is determined by people's choices regarding savings, which, in turn, depend on factors such as the real interest rate. When the real interest rate is low, people may not feel incentivised to save, as the additional future consumption seems less attractive compared to current consumption. However, as the real interest rate rises, people become more inclined to save, as they can obtain greater future consumption by sacrificing some current consumption. This positive relationship between saving and the real interest rate is illustrated by the r0S curve in Figure 2.

As the real interest rate continues to rise, the existing level of savings generates higher future consumption, increasing people's wealth. This wealth effect influences their consumption behaviour, as they may now desire more of both current and future consumption. Consequently, the ratio of savings to income may decline due to increased current consumption, even with higher wealth. Therefore, the increase in savings due to the higher interest rate is partially offset by the increase in consumption resulting from the wealth effect. This dynamic is reflected in the backward-bending portion of the r0S curve in Figure 2.

The growth rate of real output in a perfectly efficient economy can be determined using the equation: g = ΔY/Y = me S/Y, where me is the marginal product of capital when it is efficiently allocated, and g is the growth rate of output. This equation demonstrates that output growth is directly proportional to the fraction of income that is saved.

However, it is important to recognise that perfect efficiency is an idealised assumption, and in reality, economies may face imperfect efficiency due to various factors. These factors include the inability of inventors to capture the full social returns to their innovations, the presence of public goods that are challenging to monetise, and institutional factors such as patent laws and government restrictions. By addressing these factors and striving for greater efficiency, economies can maximise their growth potential and achieve sustained development.

In conclusion, understanding the relationship between savings, investment, and productivity under perfect efficiency provides valuable insights into economic growth. While real-world economies may not achieve perfect efficiency, striving for greater efficiency can lead to increased savings, investment, and ultimately, higher economic growth.

Maximizing Your Savings Account: A Guide to Smart Investing

You may want to see also

Frequently asked questions

Saving is setting aside money for emergencies or future purchases, with the money being accessible quickly and with little to no risk. Investing, on the other hand, is buying assets such as stocks, bonds, or real estate, with the expectation of making money, and is usually done to achieve long-term goals.

Savings and investments are important for productivity as they provide the capital needed to invest in productive assets. This can include investing in education and health, which boosts productivity by increasing people's skills and income, or investing in plants and machinery to incorporate technological progress.

Savings and investments can impact economic growth by increasing aggregate demand and supply. Higher investment can trigger technological changes, induce higher productive capacity, and foster resource allocation towards higher productivity sectors. Additionally, a higher savings rate can lead to higher investment, which can accelerate economic growth.