The life cycle savings and investment theory, also known as the life-cycle hypothesis (LCH), is an economic theory that describes how individuals' spending and saving habits change over their lifetime. The theory was developed in the 1950s by economists Franco Modigliani and Richard Brumberg, and it posits that people plan their spending throughout their lives, taking into account their future income. The LCH suggests that individuals borrow when their income is low, such as during their youth, and save when their income is high, such as during their prime working years, to maintain a consistent level of consumption. This theory has implications for both personal finance and economic forecasting, providing guidance for financial decisions and helping to explain varying rates of savings and economic growth.

What You'll Learn

Spending and saving habits over a lifetime

The life-cycle savings and investment theory, also known as the life-cycle hypothesis (LCH), addresses the spending and saving habits of individuals over their lifetimes. The theory suggests that people aim to maintain a relatively consistent level of consumption throughout their lives by borrowing when their income is low, typically during their youth, and saving when their income is high, usually during their middle age. This results in a hump-shaped pattern of wealth accumulation, with low savings during youth and old age, and higher savings during the prime working years.

The LCH was developed in the 1950s by economists Franco Modigliani and his student Richard Brumberg. Modigliani observed the variable relationship between income increases and economic growth, noting that it was challenging to predict how changes in income would translate to changes in consumer spending and savings. This led to the creation of the LCH, which provided a framework for understanding how spending and saving habits change as individuals move through different life stages.

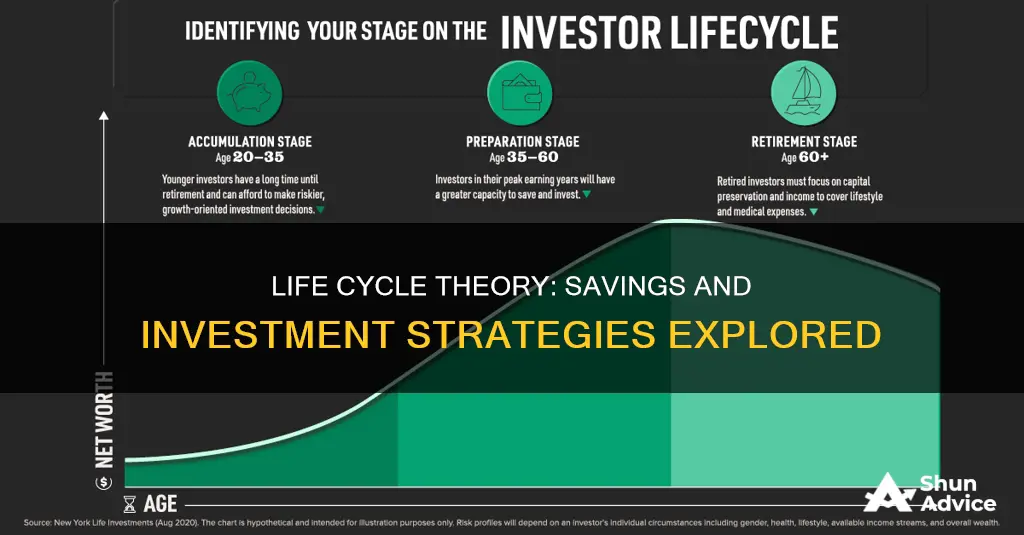

The theory identifies four key phases in an individual's financial life cycle: consumption, accumulation, consolidation, and spending. During the consumption phase, which lasts from birth until high school graduation, individuals have no income and rely on their parents or caretakers to provide for their needs. In the accumulation phase, as individuals enter the workforce, they start to earn an income but often accumulate debt, such as student loans, mortgages, or consumer debt. The consolidation phase is when individuals' incomes increase, allowing them to pay off their debts and save more aggressively for retirement. Finally, in the spending phase, retirees dip into their savings to support themselves.

While the LCH provides a general framework, individual experiences can vary significantly. For example, some individuals may inherit income or work in family businesses, while others may have different spending patterns based on family size or life expectancy. Additionally, the theory assumes that individuals deplete their wealth during old age, but in reality, people may pass on their wealth to children or be unwilling to spend all their savings.

Despite these criticisms and variations, the LCH remains a fundamental concept in economic analysis and personal financial planning. It helps individuals understand how their income and expenses may change over time and make more informed decisions about debt, savings, and retirement planning.

Smart Saving and Investing Strategies for Your Kids' Future

You may want to see also

Borrowing when income is low

The LCH assumes that individuals plan their spending over their lifetime, taking future income into account. This means that when their income is low, typically during their youth, people will borrow money, assuming that their future income will enable them to pay it off. This is known as the accumulation phase, where individuals are starting to establish a household and family, and may have student loans, car loans, rent, or mortgages to pay off.

The theory suggests that people try to maintain a consistent level of consumption throughout their lives, and so when they are young, they may take on debt, and when they are older and in their prime earning years, they save more. This is often in preparation for retirement, a time when income may decrease, and individuals will rely on their savings.

The LCH theory has been criticised for not taking into account certain variables, such as family size, increased life spans, and inheritances. However, it is still considered an important part of modern economic theory and has largely replaced Keynesian economic thinking about spending and saving patterns.

The theory provides a framework for individuals to think about their income and expenses over time and make financial decisions accordingly. For example, focusing on finding the best interest rates when borrowing during the early career, or shifting to paying off debt instead of continuing to borrow when income increases.

Savings and Planned Investments: What's the Difference?

You may want to see also

Saving when income is high

The life-cycle savings and investment theory, also known as the life-cycle hypothesis (LCH), addresses the concept of saving when income is high. This theory, developed by economists Franco Modigliani and Richard Brumberg in the 1950s, posits that individuals plan their spending throughout their lifetimes, taking into account their future income.

One of the key implications of the LCH is that it identifies the prime earning years of an individual's life, typically in middle age, as the ideal time to save aggressively. This is because, during this period, income is generally at its highest, providing an opportunity to save for retirement and maintain a consistent level of consumption in the future.

The theory suggests that individuals should aim to smooth their consumption throughout their lifetime by saving when their income is high. This approach helps to ensure that even during retirement, when income may decrease, individuals can continue to maintain their standard of living by drawing on their savings.

In the context of personal finance, the life-cycle theory provides valuable insights into how income and expenses may change over time. It encourages individuals to find the best interest rates when borrowing during the early stages of their careers and to prioritise paying off debt as their income increases. While early retirement savings are ideal, the theory acknowledges that middle age often provides the greatest capacity for building a substantial retirement fund.

Overall, the life-cycle savings and investment theory highlights the importance of saving when income is high to ensure financial stability and a consistent standard of living throughout an individual's lifetime.

Labor-Saving Equipment: Worth the Investment for Automotive Division?

You may want to see also

Accumulating wealth during working life

The Life-Cycle Hypothesis (LCH) is an economic theory that describes how people spend and save money over their lifetimes. The theory was developed in the early 1950s by economists Franco Modigliani and Richard Brumberg. It suggests that individuals aim to maintain a consistent level of consumption throughout their lives, borrowing when their income is low (usually during their youth) and saving when their income is high (generally during middle age). This results in a hump-shaped pattern of wealth accumulation, with lower savings during youth and old age, and higher savings during middle age.

The LCH suggests that individuals in their working lives should focus on saving for the future while also paying off existing debt. This can be achieved by seeking out the best interest rates on debt and utilising financial tools such as retirement savings plans. Modigliani and Brumberg's theory highlights the importance of planning for the future, assuming that individuals will take into account their future income when making financial decisions. This may involve making sacrifices in the present to ensure a more stable financial future.

It is worth noting that the LCH has received some criticism over the years. One critique is that it does not adequately address family size, which can significantly impact spending and saving habits. Additionally, the theory does not take into account increased life expectancy, which can alter the length of each phase and potentially influence consumption patterns. Despite these criticisms, the LCH remains a significant concept in economic analysis and personal financial planning. It provides a framework for individuals to make informed decisions about their savings and investments during their working lives, helping them to achieve their financial goals and maintain financial stability.

Transferring Your Investment HSA to Savings: A Step-by-Step Guide

You may want to see also

Spending savings in retirement

The life-cycle theory, also known as the life-cycle hypothesis (LCH), is an economic theory that describes the spending and saving habits of people over their lifetime. The theory states that individuals plan their spending over their lifetime, taking into account their future income.

The spending phase of the life-cycle theory, also known as the "dissaving" or "disinvestment" phase", is when individuals retire and dip into their savings to support themselves. This is the phase where retirees must make a psychological shift from saving to spending, which can be challenging for many.

Understand the Psychological Challenges

Recognise that it can be emotionally difficult to start spending your savings after years of diligent saving. This is a common challenge that many retirees face. Changing your mindset is crucial. Remind yourself that your savings are meant to help you live well in retirement.

Create a Retirement Spending Plan

Work with a financial advisor to create a personalised retirement withdrawal strategy. Consider factors such as your expected expenses, income sources, and investment strategies. Ask yourself: "How much can I spend each year without jeopardising my savings?" A common guideline suggests withdrawing about 4% of your savings annually, but this may vary depending on your unique circumstances.

Prioritise and Allocate Resources

Determine your priorities and allocate your resources accordingly. Consider your essential expenses, such as housing, food, and healthcare, and plan for anticipated one-time expenses, such as a major vacation or buying a car. Assess your fixed income sources, such as Social Security or pension payments, and decide on the order in which you will tap into your retirement accounts.

Be Flexible and Adapt to Change

Your retirement spending plan should be flexible enough to accommodate different needs at various times. For example, you may want to withdraw more in a particular year to fulfil a long-cherished goal, such as travel. Additionally, be prepared for unpredictable factors like market performance, life expectancy, and health issues, which may impact your spending decisions.

Seek Professional Advice

Consider consulting a fee-only financial fiduciary adviser, especially if you feel overwhelmed by the choices and options available to you. They can provide valuable guidance and help you strategise how to manage and use your money effectively during retirement.

Remember, the life-cycle theory recognises that individual experiences can vary significantly. Therefore, it is essential to tailor your spending and saving strategies to your unique circumstances, priorities, and goals.

Investing My Daughter's Savings: Strategies for Long-Term Growth

You may want to see also

Frequently asked questions

The life cycle savings and investment theory, also known as the life-cycle hypothesis (LCH), is an economic theory that describes how people's spending and saving habits change over their lifetime.

The life cycle theory can be divided into the following phases: consumption, accumulation, consolidation, spending, and gifting. During the consumption phase, individuals have no income and rely on their parents or caretakers for financial support. In the accumulation phase, people start earning an income, often accumulating debt in the process. The consolidation phase is when income increases, allowing individuals to pay off debt and save for retirement. The spending phase occurs during retirement, when people dip into their savings. Finally, in the gifting phase, any remaining assets are distributed to heirs or charities after an individual's death.

While the life cycle theory was developed for economic forecasting, it can also guide individuals in planning their finances. For example, understanding that debt is common early in one's career can prompt individuals to seek the best interest rates. As income increases, the focus can shift to paying off debt and saving for retirement.

The life cycle theory has important implications for economic analysis and policy. It suggests that the savings ratio depends on the growth rate of income rather than the total level of income. In a growing economy, each new generation will have higher consumption expectations, leading to higher savings rates among prime-age workers.

The life cycle theory was developed by economists Franco Modigliani and his student Richard Brumberg in the early 1950s. Modigliani was researching how increases in income affect economic growth and noticed the variability in consumer spending and savings habits. This led him to propose the life cycle theory, which explains how spending and saving behaviours change over an individual's lifetime.