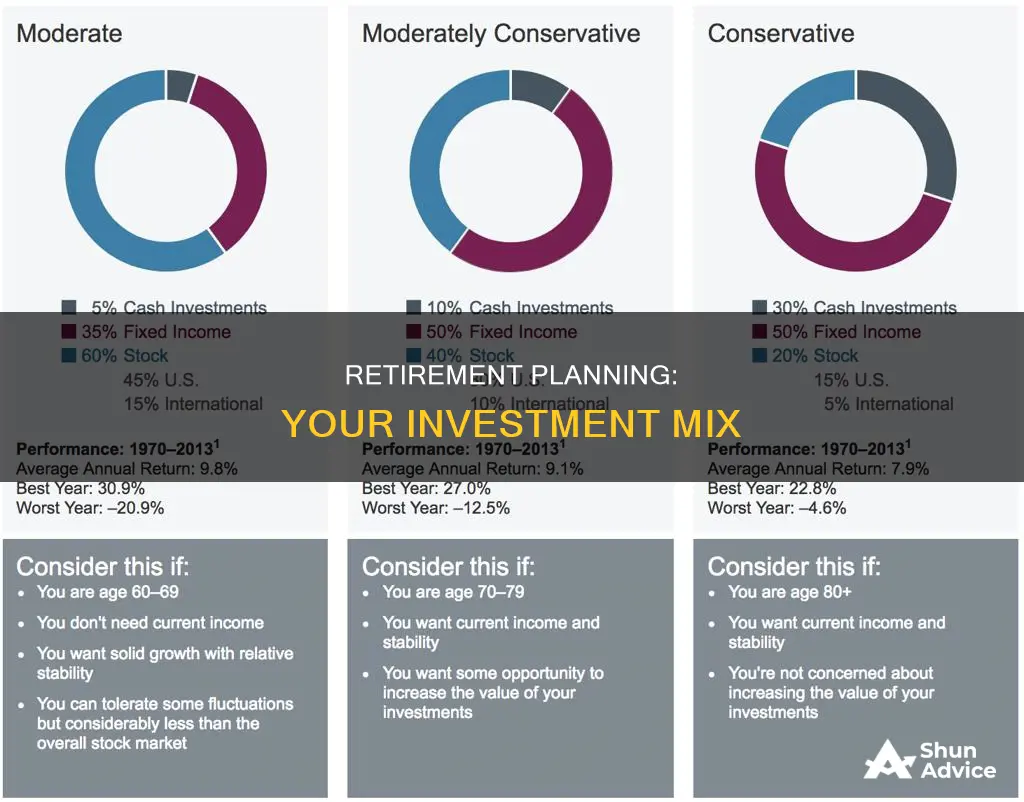

The right mix of investments for retirement is a highly personal matter, depending on your age, income, financial goals, and risk tolerance. However, there are some general principles to consider when structuring your retirement portfolio.

Firstly, it's important to set aside enough cash to supplement your annual income from various sources, such as annuities, pensions, and Social Security. This cash reserve can be held in a safe, liquid account, like an interest-bearing bank account. Additionally, creating a short-term reserve equivalent to a few years' worth of living expenses is recommended. This reserve can be invested in short-term bonds or other fixed-income investments.

With these basics in place, the remainder of your portfolio can be invested in a mix of stocks, bonds, and cash investments. The specific allocation will depend on your unique circumstances. Generally, younger investors can afford to take on more risk by investing in stocks, which have the potential for higher returns but come with higher volatility. As you approach retirement, shifting towards more conservative investments like bonds and certificates of deposit (CDs) can help protect your portfolio from market downturns.

It's also important to consider your retirement timeline and how long you anticipate your retirement funds needing to last. Even after retiring, your portfolio should continue to include growth-oriented positions to counter the effects of inflation and ensure your savings last for decades.

Retirement planning is a complex and highly individualized process. Consulting with a financial advisor can help you create a plan that aligns with your specific goals and circumstances.

What You'll Learn

How much time until retirement?

Knowing how much time you have until retirement is crucial for planning your financial strategy. This knowledge will help you decide on the right mix of investments, ensuring a comfortable retirement.

Retirement countdown calculators are a useful tool to determine the exact number of days until your retirement. By inputting today's date and your planned retirement date, you can calculate the time remaining, whether it's years, months, or days. This information is essential for creating a well-thought-out retirement strategy.

For example, if today is July 15, 2024, and you plan to retire on January 1, 2030, you have approximately 6 years and 5 months until retirement. This timeframe will guide your financial decisions and investment choices.

It's important to note that retirement planning should also consider factors such as your current age, financial stability, and future plans. Consulting a financial advisor and calculating your projected expenses will help you make a well-informed decision about your investment mix.

Now, let's discuss the right mix of investments for retirement, taking into account the time you have until retirement.

Faux Fur: Sustainable Luxury

You may want to see also

How much risk can you take?

When it comes to investing for retirement, there are several components to risk that you should understand. These include risk tolerance, risk capacity, and required risk. Knowing your comfort level with risk can help you avoid emotional investing mistakes, such as chasing performance or abandoning your strategy during short-term market declines.

Risk Tolerance

Risk tolerance describes your emotional comfort with risk. Typically, your financial advisor will ask you to complete a questionnaire to gauge how you might react to risk in different situations. Some people can easily ignore the day-to-day changes in their account balance that sometimes come with more aggressive investments, while others lie awake at night fretting about what their investments will do. Choose a level of risk you know you can live with.

Risk Capacity

Risk capacity is your ability to handle risk. Your investment time horizon is often the biggest determining factor. If you're younger, you have a longer time to make up for potential declines and can handle more volatility. If you're retired, you're probably less financially able to handle stock market declines. If there's little or no gap between your expected spending and income in retirement, your risk capacity is high. If there's a wide gap, your capacity to withstand investment losses and your ability to take investment risk is low.

Required Risk

Required risk describes how much risk you may need to take to reach your goals. In general, the higher the return needed, the more potential risk you'll have to take.

To determine how much risk you can take, consider the following:

- Time Horizon: If you're not planning to retire for decades, you have more time to ride out temporary downturns in your account balance, so you can afford to take on more risk in the hopes of getting higher returns. As you get closer to retirement, you might want to reduce your risk level, as you won't have as much time to wait for the market to recover from a downturn. However, be careful not to be too conservative, as your account still needs to continue growing to last you through retirement.

- Comfort with Risk: Choose a level of risk you can comfortably live with. If you're constantly worrying about your investment decisions, it won't be good for your well-being and probably won't be enjoyable either.

- Financial Circumstances: Your financial circumstances may justify taking some reasonable chances or reducing your risk profile. If you anticipate your income to grow considerably over the coming years, you may want to raise your risk threshold.

- Goals and Risk Required to Achieve Them: There may be a gap between how much risk you're comfortable taking and how much you need to take to achieve your goals. This is where you'll need to make important decisions, and a financial advisor can help you navigate this.

- Other Considerations: Think about any worries you have about the stock market, the type of lifestyle you want, and your ideal retirement age and plans. These factors will help determine your perspective on certain investments and your overall retirement strategy.

Smart Places to Invest $10K

You may want to see also

Plan for growth

Retirement funds are designed to help investors increase the value of their investments over long periods of time. When you're young, you can take on more risk in the hopes of getting higher returns. As you get older, you may want to move your holdings into more conservative sectors.

If you're not planning to retire for decades, you have plenty of time to recover from any market downturns. So you can afford to take on more risk in the hopes of getting higher returns. Stocks, growth stocks in particular, are such an investment. From 1926 to 2022, large-cap stocks averaged 10.1% growth per year. Small-cap stocks averaged 11.8%.

Retirement plans are designed to help investors increase the value of their investments over long periods. Growth instruments such as stocks and real estate typically form the nucleus of most successful retirement portfolios during the growth phase.

If you're getting close to retirement, you won't have as much time to wait for the market to bounce back if it hits a rough patch. In this case, you might be better off in an asset mix with lower risk.

Regardless of age, portfolio diversification can help you maintain more stable and reliable investment returns. Diversification refers to incorporating distinct asset types and investment vehicles to limit the effects of risk and negative performance of any one asset.

Even retirement portfolios that are largely geared toward capital preservation and income generation often maintain a small percentage of equity holdings to provide some growth potential and a hedge against inflation.

It is vital to have at least a portion of your retirement savings grow faster than the rate of inflation, which is the rate at which prices rise over time. Investments that grow more than the inflation rate can counteract the erosion of purchasing power that results from inflation.

As you approach retirement age, your risk tolerance often changes, and you may need to focus less on growth (equities) and more on capital preservation and income (fixed-income securities).

Regression Analysis: Predicting Investment Returns

You may want to see also

Set aside one year's cash

It's important to have a solid financial plan for your retirement, and a key part of that is ensuring you have sufficient cash reserves. Setting aside one year's worth of cash can be a wise strategy for a number of reasons. Firstly, it provides a safety net and peace of mind. Having a substantial cash reserve means you are prepared for any unexpected expenses or financial emergencies that may arise. This is especially important when you are no longer earning a regular income. It can help cover costs such as medical bills, home repairs, or other unforeseen events without having to dip into your retirement investments prematurely.

Setting aside a year's cash also offers flexibility and opportunities. It enables you to take advantage of investment opportunities that may arise, such as buying stocks or other assets at a discount during market downturns. Additionally, if you've retired early and are not yet eligible for Medicare, having this cash buffer can help cover your health insurance costs until you reach eligibility. This strategy ensures that you are not forced to sell investments at a loss or incur early withdrawal penalties just to cover your everyday living expenses.

Building up this cash reserve takes discipline and time. Start by assessing your annual expenses, including essentials like housing, utilities, food, transportation, and insurance, as well as any discretionary spending. Then, set a goal to save this amount, ideally in a high-yield savings account or a money market account, which will provide some return on your cash while keeping it liquid and easily accessible. If you are still working, you can contribute a set amount from each paycheck to build up this fund. If you are already retired, you may need to allocate a larger portion of your investment returns or pension payments to reach this goal.

It's important to note that while having one year's cash set aside is a solid starting point, the specific amount you should aim for will depend on your personal circumstances. Those with more stable and predictable expenses may feel comfortable with a slightly smaller cushion, while those with variable expenses or who desire a higher level of security may prefer to aim for a larger reserve. Additionally, if you have other sources of guaranteed income, such as a defined-benefit pension or rental income, you may not need to set aside a full year's worth of cash.

Stock Market: Invest Now or Later?

You may want to see also

Create a short-term reserve

Creating a short-term reserve is an important step in structuring your retirement portfolio. This reserve acts as a safety net, ensuring you have easy access to funds during retirement without having to tap into more volatile investments or sell depressed assets during a market downturn. Here's how you can create a solid short-term reserve:

Determine the Amount

Start by calculating two to four years' worth of living expenses, taking into account your regular income sources such as annuities, pensions, Social Security, and rental income. This will give you an idea of the target amount you should aim for in your short-term reserve.

Choose the Right Investments

When it comes to short-term reserves, you want to focus on high-quality, low-risk investments that offer liquidity and stable returns. Here are some options to consider:

- Short-term Bonds or Bond Funds: These are fixed-income investments that mature within a short timeframe, typically within a few months to a few years. They provide a steady income stream and are relatively low-risk.

- Certificate of Deposits (CDs): CDs are offered by banks and tend to offer higher interest rates compared to regular savings accounts. They "lock up" your cash for a specific period, usually ranging from a few months to five years.

- Money Market Accounts: These accounts provide higher returns than traditional savings accounts and are FDIC-insured. They are highly liquid, allowing you easy access to your funds.

- Short-term Bond Ladder: This strategy involves investing in multiple bonds or CDs with staggered maturity dates. This approach ensures a regular income stream and allows you to take advantage of varying interest rates.

- Government Bonds and Treasury Bills: These are considered low-risk investments and are highly liquid. They are backed by the government and typically have maturities of one year or less.

Manage and Replenish

Once you've established your short-term reserve, remember to manage and replenish it periodically. You can use the interest income and proceeds from this reserve to cover any withdrawals or expenses. By doing so, you ensure that your short-term reserve remains robust and can continue to support your retirement needs.

Creating a short-term reserve is a crucial step in retirement planning, providing you with financial security and peace of mind. It ensures that you have readily accessible funds to cover your living expenses without having to rely solely on riskier investments or selling assets at a loss during market downturns.

Investments: Spend, Save, or Grow?

You may want to see also

Frequently asked questions

The right asset mix for you should balance your retirement timeline and your comfort with risk. If you're getting close to retirement, you might want to opt for an asset mix with lower risk. However, be careful not to be too conservative as your account needs to continue growing enough to last you through several decades of retirement.

Risk capacity is a practical measure, dictated by assets, sources of retirement income and spending. Risk tolerance is psychological, reflecting your emotional ability to handle losses without selling in a panic. When allocating retirement assets, investors need to keep an eye on both.

You should shift toward more conservative investments once you retire since you no longer have an active income to replace losses. However, you will need this money for decades, so don't completely abandon your growth-oriented positions.