Norway's sovereign wealth fund, also known as the Government Pension Fund Global, is the world's largest fund of its kind. As of November 2024, it held over $1.74 trillion in assets, or over $325,000 per Norwegian citizen. The fund's value was also stated to be over 19 trillion kroner as of November 2024. The fund's aim is to ensure the long-term management of revenue from Norway's oil and gas resources, benefiting both current and future generations.

What You'll Learn

The Norwegian Investment Fund's value

The Norwegian Investment Fund, also known as the Government Pension Fund Global, is the world's largest single sovereign wealth fund. As of November 2024, it was valued at over US$1.74 trillion in assets, or over 19 trillion kroner. This equates to over US$325,000 per Norwegian citizen.

The fund's value has grown significantly over the years. In 2011, it was the largest pension fund in the world, valued at US$1 trillion. By 2017, it had risen to US$1.3 trillion, and in 2023, it reached a record profit of 2.22 trillion kroner (US$213 billion).

The fund's value is derived from Norway's oil and gas revenue, with the fund holding stakes in over 8,500-9,000 companies across 70-71 countries. Its most valuable company stakes include Microsoft, Apple, Nvidia, and Novo Nordisk.

The fund's investment strategy involves spreading investments across most markets, countries, and currencies to achieve broad exposure to global growth and value creation, while also ensuring good risk diversification. Most of the fund is invested in equities, with additional investments in bonds, real estate, and renewable energy infrastructure.

Global and Domestic Funds: Where to Invest?

You may want to see also

The fund's asset allocation

The Government Pension Fund Global, also known as the Oil Fund, is the world's largest single sovereign wealth fund in terms of total assets under management. As of November 2024, it had over US$1.74 trillion in assets, or over 19 trillion kroner. The fund's value translates to over US$325,000 per Norwegian citizen.

The fund's assets are spread across most markets, countries, and currencies to achieve broad exposure to global growth and value creation, and to ensure good risk diversification. Most of the fund is invested in equities, which are ownership interests in companies. Another part is invested in bonds, which are a type of loan to governments and companies, and a final slice is invested in real estate and renewable energy infrastructure.

At the end of 2023, 70.9% of the fund's assets were allocated to equities, up from 69.8% in 2022. Bonds declined to 27.1% from 27.5%, unlisted real estate fell to 1.9% from 2.7%, and renewable infrastructure held steady at 0.1% of investments.

Tech stocks contributed half of the fund's return in 2023, driven by a business breakthrough for artificial intelligence, an improvement in the general economic outlook, and expectations for lower interest rates. The fund's most valuable company stakes were in Microsoft, Apple, and Nvidia. The most valuable non-tech stock was pharmaceutical company Novo Nordisk.

The fund's return on equity investments was 21.3% in 2023, fixed income investments gained 6.1%, unlisted real estate returned -12.4%, and unlisted renewable energy infrastructure returned 3.7%.

The fund's market value is affected by investment returns, capital inflow and withdrawals, and exchange rate movements. Since 1998, the fund has generated an annual return of 6.30%, or 10,070 billion kroner.

Investing in Vanguard: Target Retirement Funds Explained

You may want to see also

The fund's performance

The Norwegian Government Pension Fund Global, also known as the Oil Fund, is the world's largest single sovereign wealth fund in terms of total assets under management. As of November 2024, it had over US$1.74 trillion in assets, or over 19 trillion kroner, translating to over US$325,000 per Norwegian citizen.

The fund's investments are spread across most markets, countries, and currencies, with a focus on achieving broad exposure to global growth and value creation, as well as ensuring good risk diversification. As of 2024, the fund has a small stake in about 9,000 companies worldwide, including well-known names such as Apple, Nestlé, Microsoft, and Samsung. The fund's assets are primarily allocated to equities, which make up around 70% of its investments, with the rest invested in bonds, real estate, and renewable energy infrastructure.

The fund's investment strategy has evolved over time, with a growing focus on environmental, social, and governance (ESG) considerations. The fund has set net-zero emissions targets for the companies in its portfolio, in line with the Paris Agreement, and has excluded several companies on ethical grounds, such as those involved in tobacco production, arms production, and human rights violations.

The Norwegian Government Pension Fund Global has a mandate to invest the surplus revenues of the country's petroleum sector for the benefit of current and future generations. The fund's performance has been closely tied to the volatile oil and gas sector, and it has navigated the challenges of fluctuating oil prices and the transition to renewable energy. The fund's size and influence have made it a hot political issue in Norway, with debates around the use of petroleum revenues, the level of exposure to the stock market, and the ethical implications of its investments.

Tulsa Real Estate Fund: A Smart Investment Strategy

You may want to see also

The fund's ethical exclusions

The Norwegian Government Pension Fund Global, also known as the Oil Fund, is the world's largest single sovereign wealth fund in terms of total assets under management. As of November 2024, it had over US$1.74 trillion in assets, translating to over US$325,000 per Norwegian citizen.

The fund's ethical guidelines are strictly enforced, and many companies are excluded on these grounds. The Norwegian Pension Fund cannot invest money in companies that directly or indirectly contribute to killing, torture, deprivation of freedom, or other violations of human rights in conflict situations or wars. While it may invest in some arms-producing companies, the production of certain weapons, such as nuclear arms, is prohibited.

To support the ethical screening process, the Council on Ethics works with RepRisk ESG Business Intelligence, a global research firm specialising in environmental, social, and governance (ESG) risk data. RepRisk monitors the companies in the fund's portfolio for issues such as severe human rights violations, child labour, forced labour, violations of individual rights in conflict areas, gross environmental degradation, and corruption.

In January 2010, the Ministry of Finance announced the exclusion of 17 tobacco companies from the fund, resulting in a total divestment of $2 billion (NOK 14.2 billion), the largest in the fund's history at that time.

In March 2014, due to domestic and international pressure, the parliament appointed a panel to investigate the fund's coal assets in line with its ethical investment mandate. As a result, the fund divested from 53 coal companies worldwide, including 16 in the US and 13 in India, reducing the total value of its coal holdings by 5% to $9.7 billion.

In 2019, the Ministry of Finance recommended divesting from oil and gas exploration and production holdings, leading to the fund selling off over $10 billion in stocks from companies using too many fossil fuels.

The following are notable examples of companies that have been excluded from the Government Pension Fund of Norway due to activities in breach of ethical guidelines:

- Africa Israel Investments: Involved in developing settlements in occupied Palestinian territory, violating international humanitarian law.

- Alliance One International, Inc.: Production of tobacco.

- Alliant Techsystems Inc.: Production of components for cluster munitions.

- British American Tobacco BHD and Plc.: Production of tobacco.

- Duke Energy and subsidiaries: Risk of severe environmental damage.

- Freeport-McMoRan Copper & Gold Inc.: Serious environmental damage and human rights violations.

- General Dynamics Corporation: Production of components for cluster munitions.

- Honeywell International Inc.: Simulations of nuclear explosions.

- Imperial Tobacco Group Plc.: Production of tobacco.

- Lockheed Martin Corp.: Production of components for cluster munitions.

- Northrop Grumman Corp.: Maintenance of ICBMs for the U.S. Air Force.

- Philip Morris International Inc. and Philip Morris ČR a.s. (a subsidiary): Production of tobacco.

- Potash Corporation of Saskatchewan: Production of phosphate in the occupied territories of Western Sahara.

- Wal-Mart Stores Inc.: Breach of human rights, labour rights, and severe environmental damage.

- Vedanta Resources Plc.: Environmental and human rights abuses.

Best Stable Investment Funds: Long-Term Growth Strategies

You may want to see also

The fund's investment strategy

The Government Pension Fund Global (GPFG) is Norway's sovereign wealth fund and the world's largest single sovereign wealth fund in terms of total assets under management. As of November 2024, it had over US$1.74 trillion in assets, with a market value of over 19 trillion kroner.

Diversification

The GPFG invests across most markets, countries, and currencies to achieve broad exposure to global growth and value creation. The fund holds a small stake in about 9,000 companies worldwide, including well-known names such as Apple, Nestlé, Microsoft, and Samsung. On average, it holds 1.5% of all the world's listed companies, making it a significant player in the global investment landscape.

Equities

Most of the fund is invested in equities, which are ownership interests in companies. Equities typically offer the potential for higher returns and are a key driver of portfolio growth. As of 2023, nearly 71% of the fund was invested in equities.

Fixed Income

Another portion of the fund is invested in bonds, which are a type of loan to governments and companies. Fixed-income investments provide a steady stream of interest income and help diversify the portfolio. In 2023, fixed-income investments accounted for 27.1% of the fund's assets.

Real Estate

A small but significant part of the fund is invested in unlisted real estate. While this segment experienced a negative year in 2023 due to rising interest rates and subdued demand, it still plays a role in diversifying the fund's investments.

Renewable Energy Infrastructure

The fund has also allocated a small portion, about 0.1%, to unlisted renewable energy infrastructure. This investment reflects the fund's commitment to environmental considerations and its push for net-zero emissions across its portfolio by 2050.

Private Equity

In 2024, the fund considered adding private equity investments to its portfolio, allocating up to $70 billion. This proposal was based on the argument that it would provide more investment opportunities and help the fund benefit from a larger share of global value creation.

Ethical and Environmental Considerations

The GPFG has also gained attention for its ethical and environmental investment guidelines. It has excluded companies involved in activities that violate international humanitarian law, produce tobacco, or contribute to human rights violations. Additionally, the fund is pushing the companies in its portfolio to reach net-zero emissions, in line with the Paris Agreement.

The GPFG's investment strategy aims to balance growth, diversification, and ethical considerations to ensure the fund's long-term sustainability and benefit for current and future generations.

A Beginner's Guide to Mutual Fund Investing with Small Capital

You may want to see also

Frequently asked questions

As of November 2024, the fund's value was over 19 trillion kroner, or over US$1.74 trillion.

This translates to over US$325,000 per Norwegian citizen.

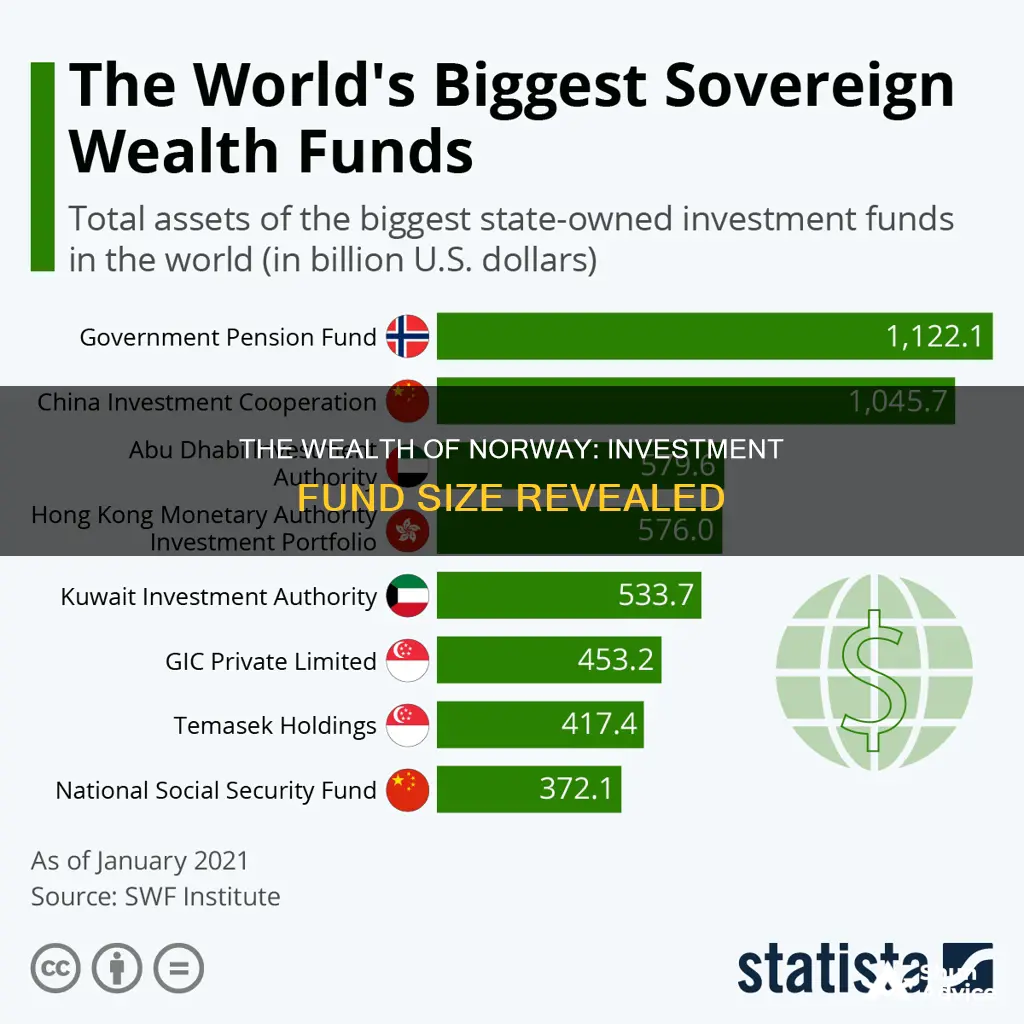

The Norwegian Investment Fund is the world's largest single sovereign wealth fund in terms of total assets under management.

The fund has a small stake in about 9,000 companies worldwide.

The fund's most valuable company stakes are in Microsoft, Apple, and Nvidia.