Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. Each fund is designed to manage risk while helping to grow your retirement savings. The minimum investment per Target Retirement Fund is $1,000. These funds are ideal for investors who prefer a hands-off approach to their investing. They offer investors the benefit of diversification, the simplicity of one-stop shopping for a blend of equities and fixed-income securities, and the convenience of automatic asset allocation rebalancing.

| Characteristics | Values |

|---|---|

| Minimum Investment | $1,000 |

| Investment Approach | One-fund |

| Investment Allocation | Stocks, bonds, and short-term reserves |

| Investment Management | Gradual adjustment to a conservative investment mix as the target date approaches |

| Investment Risk | Less risk through diversification |

| Rebalancing | Automatic |

| Expense Ratio | 0.08% |

What You'll Learn

How to choose a Vanguard Target Retirement Fund

When choosing a Vanguard Target Retirement Fund, there are several factors to consider. Firstly, these funds are designed for investors who want a hands-off approach to investing for retirement. Vanguard's target-date funds do the research and selection of securities, as well as rebalancing, so investors don't have to.

Investment Horizon

The target retirement fund you choose should align with your planned retirement year. Vanguard offers funds with target dates ranging from 2020 to 2070, typically in five-year increments. Select the fund closest to your planned retirement year. If you haven't decided on a retirement year, you can use your full Social Security retirement age (65-67) as a guideline.

Investment Mix

Each target retirement fund has a different mix of stocks, bonds, and short-term reserves. The investment mix becomes more conservative as the target date approaches. If you want a more aggressive investment strategy, choose a fund with a later target date. Conversely, if you prefer a more conservative approach, opt for a fund with an earlier target date.

Risk Tolerance

Consider your risk tolerance when choosing a fund. Generally, the further away the target date, the more aggressive the investment mix, and vice versa. If you have a higher risk tolerance, you may prefer a fund with a higher allocation of stocks. If you have a lower risk tolerance or prefer a more conservative approach as you approach retirement, look for funds with a higher proportion of bonds.

Expense Ratio

Vanguard's target retirement funds have a low average expense ratio of 0.08%, which is significantly lower than the industry average. However, it's important to note that expense ratios can vary across different funds, so be sure to review the fees associated with the specific fund you're considering.

Minimum Investment

Vanguard's target retirement funds typically have a minimum investment requirement of $1,000. Ensure that you meet this requirement before choosing a fund.

Performance and Returns

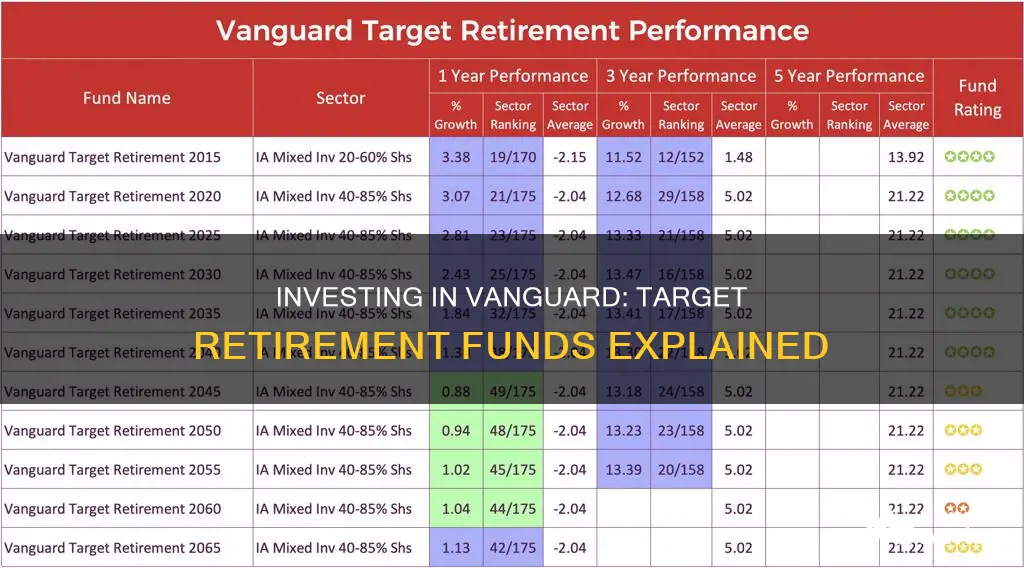

Review the historical performance and returns of the target retirement funds you're considering. Look at metrics like the average annual return and compare the performance over similar time periods.

In summary, when choosing a Vanguard Target Retirement Fund, consider your planned retirement year, your risk tolerance, the fund's investment mix, expense ratio, minimum investment requirements, and historical performance. Remember to review your asset mix periodically to ensure it aligns with your goals and risk tolerance.

Corporations' Hesitance Towards Mutual Funds: Exploring the Why

You may want to see also

The benefits of a one-fund approach

Vanguard Target Retirement Funds offer a straightforward, one-stop solution to the complex problem of how to invest successfully for retirement.

A single Target Retirement Fund can serve as a complete, diversified retirement portfolio. Each fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. This gives investors access to thousands of U.S. and international stocks and bonds.

The one-fund approach is ideal for investors who prefer a hands-off approach to their investing. It offers the benefit of diversification, the simplicity of one-stop shopping, and the convenience of automatic asset allocation rebalancing.

Vanguard target-date funds do the research, selection, and rebalancing of securities so investors don't have to. They start with an allocation that favours stocks in the early years of an investor's long-term time horizon, and then gradually rebalance in favour of less risky securities, such as bonds and short-term reserves, as the investor progresses through their career.

The one-fund approach is also cost-effective. The average Vanguard Target Retirement Fund expense ratio is 82% less than the industry average, meaning more money stays in your account working for you.

Utility Index Funds: When to Invest for Maximum Returns

You may want to see also

How Vanguard's funds change over time

Vanguard Target Retirement Funds are designed to adapt to an investor's changing needs over time. These funds are tailored to investors who want a diversified retirement portfolio but don't want to manage the rebalancing themselves. The funds' asset mix and investment strategies evolve as the investor moves through their career and closer to retirement.

When an investor is decades away from retirement, a Vanguard Target Retirement Fund will favour stocks, with an allocation of approximately 90% stocks and 10% bonds. This aggressive approach allows for higher-risk investments that offer the opportunity for high returns. For example, the Vanguard Target Retirement 2055 Fund, designed for investors retiring around 2055, has 89.63% of its assets allocated to stocks.

As the investor progresses through their career, the fund gradually rebalances its asset allocation towards less risky investments, such as bonds and short-term reserves. This self-adjusting mix becomes more conservative as the retirement date approaches. For instance, the Vanguard Target Retirement 2025 Fund, closer to its target date, has a large allocation of bonds, which are considered less risky compared to stocks.

The glide path is a key concept in understanding how Vanguard Target Retirement Funds change over time. It illustrates the transition from a mix heavily weighted in stocks to one predominantly weighted in bonds and short-term reserves over an investor's life. This transition is smooth and gradual, ensuring that investors have more stocks in their portfolio during their working years and more bonds and reserves in retirement.

It's important to note that while the fund's asset mix becomes more conservative over time, the stock portion of the fund's asset mix never completely disappears, even after retirement. Additionally, investors can choose a fund with a later target date if they prefer a more aggressive approach or select a fund with an earlier target date for a more conservative strategy.

HOA Fund Investment Strategies: A Guide to Smart Investing

You may want to see also

The importance of reviewing your asset mix

Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. Each fund is designed to manage risk while helping to grow your retirement savings. The funds' managers gradually shift each fund's asset allocation to fewer stocks and more bonds, so the fund becomes more conservative as you get closer to retirement. This is done to match your goals and risk tolerance.

Your personal situation could change over time, so it is important to review your asset mix regularly to ensure your portfolio matches your goals and risk tolerance. For example, if you are just starting your career, you might have an allocation that aggressively seeks growth and high returns. As your career progresses, your target retirement funds will rebalance allocations of assets to focus on less risky securities and protect your capital.

Your investment goal, time frame for needing the money, and risk tolerance should determine your target asset mix. Each asset class—stocks, bonds, and cash—plays a different role in a balanced portfolio. Stocks are generally riskier than bonds, and bonds are generally riskier than cash. Your target asset allocation should contain a percentage of stocks, bonds, and cash that adds up to 100%. For example, a portfolio with 90% stocks and 10% bonds exposes you to more risk but also the opportunity for more returns than a portfolio with 60% stocks and 40% bonds.

Different funds with the same target date can have different asset allocations in stocks and bonds. Make sure the fund that interests you has an asset allocation that matches your tolerance for risk and need for growth.

Best Funds to Maximize Your 401k Returns

You may want to see also

How to invest in a Vanguard Target Retirement Fund

A Vanguard Target Retirement Fund is a ready-made portfolio that simplifies the often complex problem of how to invest for retirement. Each fund is designed to manage risk while helping to grow your retirement savings. The minimum investment per Target Retirement Fund is $1,000.

Each fund gives you access to thousands of U.S. and international stocks and bonds, providing a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. Vanguard's investment professionals manage each fund, gradually adjusting its investment mix to become more conservative as the target date approaches.

The year in a Target Retirement Fund's name is its target date—the year in which Vanguard expects an investor in the fund to retire and leave the workforce. To choose a fund, simply select the Target Retirement fund closest to when you want to retire. You are not required to choose the fund that matches your projected retirement year. You can also choose a fund with a later target date if you’d prefer a more aggressive investment mix, or an earlier target date for a more conservative mix.

Funds start with an allocation that favors stocks in the early years of an investor's long-term time horizon. That means an allocation of approximately 90% stocks and 10% bonds. As an investor progresses through their career, Vanguard gradually rebalances its target retirement fund's asset allocation in favor of less risky securities, such as bonds and short-term reserves.

The Vanguard Target Retirement 2025 Fund (VTTVX), for example, has a target date that ranges from 2021 to 2025. Because the fund is very close to its target date, its portfolio has a large number of bond holdings, which tend to be less risky when compared to stocks. In particular, the fund invests in various Vanguard equity and bond funds, resulting in a 31.80% allocation of domestic stocks, a 21.30% allocation of international stocks, a 28.60% allocation of U.S. corporate and Treasury bonds, and a 12.40% allocation of international bonds. The fund also has a 5.90% allocation of short-term inflation-protected securities.

Vanguard Target Retirement Funds come with an average expense ratio of 0.08%. According to Vanguard, the industry average is 0.44% to 0.48%.

Mutual Funds: Diversify Your Investments, Secure Your Future

You may want to see also

Frequently asked questions

A Vanguard Target Retirement Fund is a ready-made portfolio that makes investing for retirement simple. You choose a fund based on when you plan to retire and the fund does the rest. Each fund aims to balance taking the risks needed to grow your wealth, while also taking steps to preserve your retirement savings.

You pick the Target Retirement Fund closest to your planned retirement date or within 5 years after that, then you just let it run. The fund will automatically keep it to the right balance of shares and bonds, depending on how far you are from retirement.

Target retirement funds may be ideal for investors who prefer a hands-off approach to their investing. They offer investors the benefit of diversification, the simplicity of one-stop shopping for a blend of equities and fixed-income securities, and the convenience of automatic asset allocation rebalancing.