Vanguard Short-Term Investments is a carefully curated investment fund designed to provide investors with a safe and accessible way to access short-term opportunities in the financial markets. This fund is specifically tailored for those seeking a balanced approach to investing, offering a combination of capital preservation and potential for growth. By focusing on short-term investments, it aims to provide a stable and flexible investment option, making it an attractive choice for investors who want to diversify their portfolios without committing to long-term commitments.

What You'll Learn

- Overview: Vanguard Short-Term Investment Fund offers a liquid, low-cost way to invest in short-term debt securities

- Objectives: To provide capital preservation and income through short-term investments with low volatility

- Strategy: Invests primarily in short-term debt securities, aiming for principal protection and regular income

- Risk Factors: Market risk, interest rate risk, credit risk, and liquidity risk are key considerations

- Performance: Historical performance data and comparative analysis with similar funds are available for review

Overview: Vanguard Short-Term Investment Fund offers a liquid, low-cost way to invest in short-term debt securities

Vanguard Short-Term Investment Fund is a mutual fund designed to provide investors with a liquid and cost-effective means of accessing the short-term debt securities market. This fund is an excellent choice for those seeking a safe and stable investment option with a focus on short-term debt, which typically includes government bonds, commercial paper, and other money market instruments. The primary objective of this fund is to offer a diversified portfolio of short-term debt securities, providing investors with a stable and secure investment opportunity.

The Vanguard Short-Term Investment Fund is known for its low expense ratio, which is a significant advantage for investors. Lower costs mean that more of the fund's returns go directly to the investors, resulting in higher overall returns over time. This fund is particularly appealing to those who prefer a more hands-off approach to investing, as it is designed to be highly liquid, allowing investors to access their funds quickly and easily without incurring significant penalties.

One of the key benefits of this fund is its ability to provide a stable income stream. Short-term debt securities typically offer lower risk compared to longer-term investments, making this fund an attractive option for risk-averse investors. The fund's focus on short-term debt also means that it can quickly adapt to changing market conditions, providing investors with a more dynamic and responsive investment strategy.

In terms of investment strategy, the Vanguard Short-Term Investment Fund employs a buy-and-hold approach, aiming to maintain a consistent portfolio composition. This strategy is designed to minimize the impact of market volatility and provide a steady return over time. The fund's portfolio is actively managed, ensuring that the investment team can make informed decisions to optimize returns while maintaining the fund's low-cost structure.

For investors, this fund offers a simple and effective way to diversify their portfolio and take advantage of the short-term debt market's stability. With its low costs, liquidity, and focus on low-risk securities, the Vanguard Short-Term Investment Fund is an excellent choice for those seeking a safe and accessible investment option. This fund is particularly suitable for conservative investors, retirement planners, and those looking for a stable and secure investment with a low-cost structure.

Unraveling the Tangibility of Long-Term Investments

You may want to see also

Objectives: To provide capital preservation and income through short-term investments with low volatility

Vanguard Short-Term Investments is a carefully crafted investment strategy designed to offer investors a balanced approach to capital preservation and income generation. This strategy primarily focuses on short-term opportunities, aiming to provide a stable and secure investment experience with minimal volatility. By adopting a short-term perspective, Vanguard aims to capitalize on the potential benefits of short-duration investments while mitigating the risks associated with longer-term market fluctuations.

The primary objective of this investment approach is to ensure that investors' capital remains intact while also generating a steady income stream. Capital preservation is a critical aspect, especially for risk-averse investors who prioritize safeguarding their funds. Vanguard's strategy involves a meticulous selection process of short-term investments, which can include a variety of assets such as government bonds, money market instruments, and high-quality corporate securities with short-term maturities.

In terms of income generation, Vanguard Short-Term Investments seeks to provide a consistent return through a combination of interest income and capital appreciation. The strategy involves a careful analysis of market conditions and economic trends to identify short-term investment opportunities that offer both safety and profitability. By diversifying across various short-term assets, the fund aims to provide a stable income flow, ensuring that investors can meet their financial goals without exposing their capital to undue risk.

Low volatility is a key feature of this investment approach, which is particularly attractive to investors who prefer a more conservative strategy. Vanguard's short-term investments are selected based on their ability to maintain principal value and provide a stable return, even during periods of market uncertainty. This focus on low volatility helps to minimize potential losses and ensure that investors' capital remains secure.

In summary, Vanguard Short-Term Investments is a well-structured strategy that caters to investors seeking a balanced approach to capital preservation and income. By focusing on short-term opportunities, this investment approach aims to provide a secure and stable experience, making it an attractive option for those who prioritize capital safety and steady returns. This strategy's meticulous selection process and emphasis on low volatility contribute to its appeal for investors with varying risk tolerances.

Polkadot's Potential: A Long-Term Investment Strategy

You may want to see also

Strategy: Invests primarily in short-term debt securities, aiming for principal protection and regular income

Vanguard Short-Term Investments is a carefully constructed investment strategy that focuses on the short-term debt securities market. This strategy is designed to provide investors with a safe and stable investment option, offering both principal protection and regular income. By primarily investing in short-term debt securities, the fund aims to minimize risk while still providing a competitive return.

The strategy's primary objective is to ensure the preservation of the investor's principal amount. Short-term debt securities, such as money market funds, treasury bills, and commercial paper, typically have maturities of less than one year. This short-term focus allows the fund to maintain a high level of liquidity, ensuring that investors can access their funds quickly if needed. Additionally, these securities are generally considered low-risk, making them an attractive option for risk-averse investors.

Regular income generation is another key feature of this investment strategy. Short-term debt securities often offer a steady stream of interest payments, providing investors with a consistent source of income. The fund's portfolio is actively managed to maximize these income opportunities while maintaining the principal's safety. This approach is particularly appealing to investors seeking a stable and predictable investment with a regular cash flow component.

The Vanguard Short-Term Investments strategy is well-suited for various investor profiles. It is an excellent choice for conservative investors who prioritize capital preservation and seek a low-risk investment. Additionally, it can be a valuable component of a diversified portfolio, providing a stable and income-generating asset class. This strategy is particularly relevant for those approaching retirement or seeking a safe haven for their savings, as it offers a balance between safety and potential returns.

In summary, Vanguard Short-Term Investments is a strategic approach to investing in short-term debt securities, emphasizing principal protection and regular income. This strategy caters to investors seeking a safe and stable investment option, providing a competitive return while minimizing risk. With its focus on short-term securities, the fund offers liquidity, low risk, and a consistent income stream, making it an attractive choice for various investment goals.

Understanding Investment Liabilities: A Comprehensive Guide for Investors

You may want to see also

Risk Factors: Market risk, interest rate risk, credit risk, and liquidity risk are key considerations

When considering Vanguard Short-Term Investments, it's crucial to understand the various risk factors associated with these funds. These investments, designed for conservative, short-term goals, are not without their potential pitfalls. Here's an overview of the key risks to consider:

Market Risk: This is the inherent risk associated with any investment in the stock market. Vanguard Short-Term Investments primarily hold short-term debt securities, which are generally considered less volatile than stocks. However, market risk still exists, especially in the short-term. Fluctuations in the market can impact the value of these investments, and investors may experience losses if the market takes an unexpected turn. The fund's performance is tied to the overall market, and while it aims to minimize volatility, it is not entirely immune to market-wide trends.

Interest Rate Risk: Interest rates play a significant role in the performance of short-term investments. When interest rates rise, the value of existing bonds and securities can fall. This is because new bonds issued at higher rates make older, lower-rate securities less attractive. Vanguard Short-Term Investments, being focused on short-term debt, may be particularly sensitive to interest rate changes. Investors should be aware that rising rates could negatively impact the fund's net asset value (NAV) and, consequently, the returns for investors.

Credit Risk: Credit risk refers to the possibility of default by the issuer of a security. While Vanguard Short-Term Investments primarily invest in high-quality, short-term debt, there is still a degree of credit risk involved. The fund may hold securities issued by governments, government-related entities, or corporations with varying credit ratings. Investors should consider the creditworthiness of the issuers to assess the potential impact of default on their investments. While the fund aims to minimize credit risk, it is not entirely absent.

Liquidity Risk: This risk pertains to the ease of converting an investment into cash without significant loss in value. Vanguard Short-Term Investments are designed to provide liquidity, allowing investors to access their funds relatively quickly. However, liquidity risk can still arise, especially during periods of market stress or economic downturns. Investors should be mindful of potential delays or reduced access to their funds, which could impact their ability to meet short-term financial obligations.

Understanding these risk factors is essential for investors to make informed decisions about Vanguard Short-Term Investments. While these funds offer a relatively safe and stable investment option, they are not without potential drawbacks. Investors should carefully consider their risk tolerance, investment goals, and the current economic environment before committing their capital.

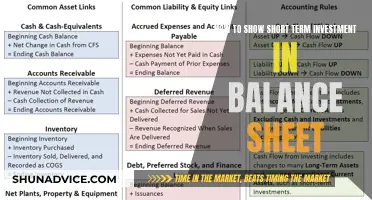

Unveiling the Tricks: How Short-Term Investments Are Manipulated

You may want to see also

Performance: Historical performance data and comparative analysis with similar funds are available for review

When considering Vanguard Short-Term Investments, it's crucial to delve into the historical performance data to understand how the fund has fared over time. This information is typically available on the Vanguard website or through financial advisors. Historical performance is a key indicator of a fund's past success and can provide insights into its potential future performance. Investors often use this data to gauge the consistency and volatility of the fund's returns.

The performance data will usually include metrics such as total returns, net asset value (NAV) growth, and year-to-date performance. These figures can help investors understand the fund's overall growth and how it has navigated market conditions. For instance, a consistent positive total return over several years could indicate a well-managed fund with a strong track record.

In addition to historical performance, a comparative analysis with similar funds is essential. This analysis allows investors to benchmark Vanguard Short-Term Investments against other short-term bond funds or money market funds. By comparing key performance indicators such as yield, expense ratios, and risk-adjusted returns, investors can assess the fund's competitive position in the market. This comparative approach helps in understanding whether the fund is outperforming or underperforming its peers.

Financial analysts often use statistical tools to measure and compare performance, ensuring a comprehensive evaluation. This includes calculating metrics like the Sharpe ratio, which measures risk-adjusted return, and the Sortino ratio, which focuses on downside risk. These ratios provide a more nuanced understanding of the fund's performance and can help investors make informed decisions.

Reviewing the historical performance and comparative analysis of Vanguard Short-Term Investments is a critical step in the investment process. It empowers investors to make informed choices, ensuring their investments align with their financial goals and risk tolerance. This due diligence can contribute to a more successful and satisfying investment journey.

Understanding the Power of Compound Interest: Another Term for Exponential Investment Growth

You may want to see also

Frequently asked questions

Vanguard Short-Term Investments is a low-cost, diversified portfolio of short-term money market instruments offered by Vanguard, a leading investment management company. It is designed to provide investors with a safe and liquid investment option, offering a small amount of income while preserving capital.

This investment fund invests in a range of high-quality, short-term debt securities, such as government bonds, commercial paper, and repurchase agreements. By holding these securities, the fund aims to provide a stable and secure investment, allowing investors to access their money quickly without taking on excessive risk.

Investors can benefit from the following advantages:

- Liquidity: It provides easy access to funds, making it suitable for emergency savings or short-term goals.

- Low Risk: The fund is designed to be a safe haven for investors, offering a secure place to park money temporarily.

- Diversification: By investing in various short-term securities, the fund reduces risk and provides a stable investment option.

- Low Costs: Vanguard is known for its low expense ratios, ensuring investors' money works harder for them.

Vanguard Short-Term Investments is ideal for conservative investors seeking a safe and liquid investment option. It is particularly suitable for individuals with short-term financial goals, emergency funds, or those who prefer a more conservative approach to investing. The fund's low-risk nature makes it a popular choice for risk-averse investors.