Liabilities in the context of investment refer to the financial obligations or debts that an individual or entity assumes, which can impact their financial health and investment strategies. Understanding what constitutes a liability is crucial for investors as it helps assess risk, cash flow, and overall financial stability. Liabilities can take various forms, such as loans, mortgages, credit card debt, or accounts payable, and they play a significant role in shaping an investor's financial decisions and risk management approach.

What You'll Learn

- Definition: A liability is an obligation or debt that an entity owes to others

- Impact on Balance Sheet: Liabilities reduce a company's net worth and equity

- Types: Common liabilities include accounts payable, loans, and bonds payable

- Risk Management: Effective management of liabilities is crucial for financial stability

- Liquidity: Assessing the liquidity of liabilities is essential for assessing financial health

Definition: A liability is an obligation or debt that an entity owes to others

A liability is a fundamental concept in finance and investment, representing a financial obligation or debt that an individual, business, or entity is required to pay or settle. In the context of investments, understanding liabilities is crucial as it directly impacts an entity's financial health and stability. When an entity incurs a liability, it essentially enters into a commitment to fulfill a financial obligation in the future, which could be a payment to a creditor, a repayment of a loan, or any other form of financial responsibility.

In the investment world, liabilities are often associated with various financial instruments and transactions. For instance, when an investor purchases a bond, they are essentially lending money to the issuer (the entity that borrows the money). The bond represents a liability for the issuer, as they are obligated to repay the principal amount (the loan) along with interest over a specified period. Similarly, when a company takes out a loan from a bank, the loan agreement creates a liability for the company, as they must make regular payments to the bank to repay the principal and interest.

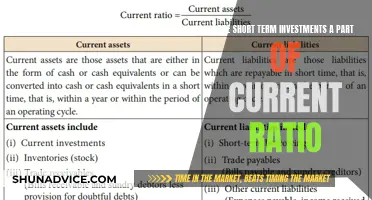

Liabilities can be categorized into different types, including current liabilities and long-term liabilities. Current liabilities are those that are due within one year or the operating cycle of the entity, whichever is longer. These include short-term debts, accounts payable, and accrued expenses. Long-term liabilities, on the other hand, are obligations that extend beyond one year and may include long-term loans, bonds payable, and deferred tax liabilities. Understanding the nature and timing of these liabilities is essential for investors and analysts to assess the financial stability and risk profile of an investment.

In investment analysis, the concept of liabilities is used to evaluate the financial health and creditworthiness of entities. Investors and analysts examine the liability structure of companies to assess their ability to meet financial obligations. A well-managed liability structure, where short-term liabilities are covered by current assets, indicates a healthy financial position. However, excessive or poorly managed liabilities can lead to financial distress, especially during economic downturns or when interest rates rise.

Moreover, liabilities play a significant role in financial modeling and valuation. Investors use financial models to predict future cash flows, which are influenced by the entity's liability profile. By analyzing the impact of different scenarios on liabilities, investors can make informed decisions about the risk and potential returns of an investment. For example, a company with a high level of long-term debt may face challenges in the event of a recession, as interest payments become more burdensome.

In summary, a liability is a critical aspect of investment analysis, representing a financial obligation that an entity must fulfill. Understanding the nature and implications of liabilities is essential for investors to assess financial health, manage risk, and make informed investment decisions. By considering the various types of liabilities and their impact on cash flows, investors can navigate the complexities of the financial markets and build robust investment strategies.

Unlocking Long-Term Care: A Guide to Strategic Investment in Facilities

You may want to see also

Impact on Balance Sheet: Liabilities reduce a company's net worth and equity

When discussing the impact of liabilities on a company's financial health, it's crucial to understand the role they play in shaping the balance sheet. Liabilities are essentially the financial obligations or debts that a company owes to others. These can include loans, accounts payable, bonds, and various other forms of debt. On the balance sheet, liabilities are a critical component, providing a snapshot of a company's financial obligations at a specific point in time.

The primary effect of liabilities is their impact on a company's net worth and equity. Net worth, often referred to as shareholders' equity, represents the residual value that would be left if a company's assets were sold and its liabilities were paid off. When a company incurs liabilities, it reduces its net worth because the debt must be repaid, often with interest, over time. This reduction in net worth can have several implications. Firstly, it may indicate that the company is not utilizing its assets efficiently or that it has taken on excessive debt. Investors and creditors closely monitor this metric to assess the financial health and stability of the company.

In the context of the balance sheet, liabilities are typically presented in the left side of the equation, with assets on the right. This arrangement reflects the fundamental principle that assets are financed through a combination of equity and liabilities. For instance, if a company purchases new equipment, it might do so by taking a loan (a liability) or using its own retained earnings (equity). The acquisition of assets through debt financing increases the company's liabilities and, consequently, reduces its net worth.

The relationship between liabilities and equity is particularly important for long-term financial planning. Companies with a high ratio of liabilities to equity may face challenges in attracting new investments or securing loans, as it indicates a higher level of financial risk. Investors often prefer companies with a more balanced approach to financing, where debt is used strategically to enhance returns while maintaining a healthy equity position.

In summary, liabilities have a direct and significant impact on a company's balance sheet. They reduce a company's net worth and equity, which are essential indicators of financial health and stability. Understanding this relationship is vital for investors, creditors, and company management, as it influences decision-making regarding capital structure, investment strategies, and overall financial management.

Dividends: A Long-Term Investment Strategy?

You may want to see also

Types: Common liabilities include accounts payable, loans, and bonds payable

When considering investments, understanding the concept of liabilities is crucial. Liabilities are essentially financial obligations or debts that a company or individual must pay off in the future. These obligations can be short-term or long-term and are a significant aspect of a company's financial health and stability.

One of the most common types of liabilities is accounts payable. This refers to the money a company owes to its suppliers or vendors for goods or services purchased on credit. Accounts payable are typically short-term debts and are usually settled within a year. For example, if a company buys raw materials from a supplier and pays for them 30 days after the purchase, the supplier's account will be considered an account payable until the payment is made.

Loans are another common liability. When a company takes out a loan from a bank or financial institution, it becomes a liability on the company's balance sheet. This includes both short-term and long-term loans, such as lines of credit, term loans, and mortgages. Loans often have interest payments associated with them, which are also considered liabilities until the principal and interest are fully paid off.

Bonds payable are a type of long-term liability where a company issues bonds to investors as a form of debt financing. Bondholders are essentially lending money to the company, and in return, the company agrees to pay interest (coupon payments) at regular intervals and repay the principal amount when the bond matures. Bonds are a more complex form of liability and can have varying terms and interest rates.

These three types of liabilities are fundamental to understanding a company's financial obligations. Accounts payable represent short-term debts, loans provide funding for various purposes, and bonds payable are long-term commitments to bondholders. Investors and creditors closely monitor these liabilities to assess a company's financial stability and its ability to meet its financial obligations.

Debt Issuance: A Strategic Investment or Financial Move?

You may want to see also

Risk Management: Effective management of liabilities is crucial for financial stability

Liabilities are an essential aspect of investment and financial management, representing obligations or debts that an individual or entity owes to others. Understanding and effectively managing these liabilities is crucial for maintaining financial stability and achieving long-term investment goals. When it comes to risk management, the effective management of liabilities plays a pivotal role in safeguarding financial well-being.

In the context of investments, liabilities can take various forms, such as loans, mortgages, bonds, or other financial obligations. For instance, when an investor purchases a bond, they essentially lend money to the issuer, making the bond a liability on the investor's balance sheet. Similarly, a mortgage taken to buy a property is a significant liability, as it represents a long-term debt that needs to be repaid over time. These examples highlight the importance of recognizing and accounting for liabilities in investment decisions.

Effective risk management involves a comprehensive approach to identifying, assessing, and mitigating potential risks associated with liabilities. This process begins with a thorough understanding of one's financial obligations. Investors should carefully analyze their assets, income sources, and cash flow to determine their capacity to meet these liabilities. By assessing the potential impact of each liability, investors can make informed decisions about their investment strategies. For instance, a high-interest loan might carry more risk than a low-interest mortgage, and this knowledge can guide investment choices.

One key aspect of managing liabilities is diversification. Diversifying investments can help reduce the overall risk by spreading it across various asset classes and sectors. By allocating funds to different types of investments, investors can minimize the impact of any single liability on their financial portfolio. Additionally, regular reviews and adjustments of investment portfolios are essential to ensure that liabilities are managed effectively. As market conditions and personal circumstances change, investors should periodically reassess their liabilities and make necessary modifications to their strategies.

In summary, effective management of liabilities is a critical component of risk management in investments. It involves understanding the nature of financial obligations, assessing their impact, and implementing strategies to mitigate potential risks. By taking a proactive approach to liability management, investors can enhance their financial stability and make more informed decisions, ultimately leading to a more secure and successful investment journey. This process empowers individuals to navigate the complexities of the financial market with confidence and a well-defined risk management strategy.

Prepaid Insurance: A Long-Term Strategy or Short-Term Gain?

You may want to see also

Liquidity: Assessing the liquidity of liabilities is essential for assessing financial health

Liquidity is a critical aspect of financial health, especially when it comes to assessing the investment landscape. It refers to the ease and speed with which an asset or liability can be converted into cash without significant loss of value. In the context of investments, understanding the liquidity of liabilities is crucial for several reasons. Firstly, it provides insight into an entity's ability to meet its short-term financial obligations. Liabilities that are highly liquid can be quickly converted into cash, ensuring that the entity can fulfill its financial commitments without delay or penalty. This is particularly important for businesses and investors, as it directly impacts their ability to manage cash flow and maintain financial stability.

When assessing the liquidity of liabilities, investors should consider the following factors. Firstly, the time it takes to convert a liability into cash is a key indicator. Short-term liabilities, such as accounts payable or short-term loans, are generally more liquid as they can be settled within a year or less. These liabilities are often essential for maintaining day-to-day operations and ensuring smooth cash flow. On the other hand, long-term liabilities, like bonds or long-term loans, may have longer maturity periods and are less liquid, requiring more time to convert into cash.

Another important aspect is the impact of market conditions on liquidity. During economic downturns or periods of financial stress, the liquidity of certain liabilities can be affected. For instance, certain assets or securities may become illiquid, making it challenging to sell them quickly without incurring losses. Investors should be aware of these potential risks and consider the broader market environment when evaluating the liquidity of their investments.

Furthermore, the assessment of liquidity should also consider the entity's overall financial health and risk profile. A company with a strong balance sheet and diverse revenue streams may have more liquid liabilities compared to one with a high level of debt or a concentrated revenue model. This is because a robust financial position often translates to more options for converting liabilities into cash without significant disruption to operations.

In summary, assessing the liquidity of liabilities is a vital step in evaluating financial health and making informed investment decisions. It enables investors to understand the entity's ability to manage short-term obligations, navigate market conditions, and maintain overall financial stability. By carefully analyzing liquidity, investors can make more strategic choices, ensuring their investments are well-protected and aligned with their financial goals.

Egypt-China Investment Deal: Unlocking Africa's Future

You may want to see also

Frequently asked questions

In the financial world, a liability refers to an obligation or debt that an individual or entity owes to another party. In investments, liabilities can be financial instruments or commitments that require future payments or actions. For example, when you invest in a bond, the bond issuer becomes your liability, as you are obligated to receive regular interest payments and eventually repay the principal amount.

Liabilities can significantly influence investment decisions and strategies. Investors often aim to manage their exposure to liabilities by diversifying their portfolios. This involves balancing assets and liabilities to minimize risk. For instance, an investor might hold a mix of low-risk assets and some high-risk investments to hedge against potential losses from liabilities.

A personal loan taken for an investment opportunity can be considered a liability. If an individual borrows money to purchase stocks or real estate, the loan represents a debt that needs to be repaid with interest. This liability can impact an investor's cash flow and overall financial health, especially if the investment doesn't perform as expected.

Liabilities directly impact an investor's net worth, which is the value of their assets minus their liabilities. A higher amount of liabilities will decrease net worth, while paying off debts can improve it. For instance, if an investor has a substantial mortgage on an investment property, it will be counted as a liability, affecting the overall net worth calculation.

Managing investment liabilities involves careful planning and risk management. Diversification is a common strategy, as mentioned earlier. Additionally, investors can consider liability insurance to protect their assets. Regularly reviewing and reassessing investments is crucial to ensure that liabilities are managed effectively and in line with financial goals.