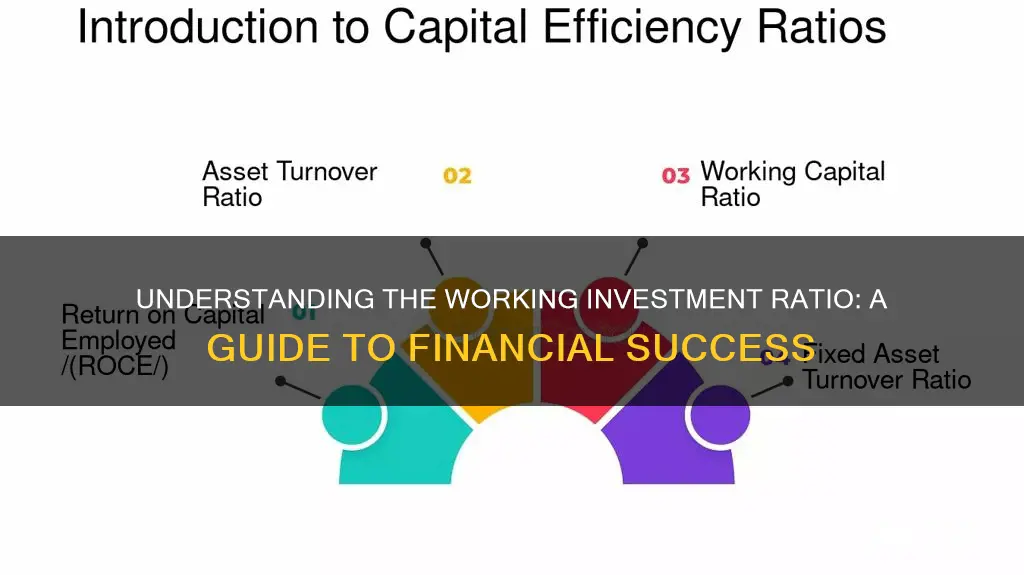

The working investment ratio is a crucial metric in finance that measures the efficiency of a company's investments. It evaluates how effectively a business utilizes its investments to generate revenue and is calculated by dividing the net income by the total amount of invested capital. This ratio provides valuable insights into a company's ability to manage its resources and can be used to compare the performance of different companies or to track the performance of a single company over time. Understanding this ratio is essential for investors and analysts as it helps assess the profitability and financial health of a business.

What You'll Learn

- Return on Investment (ROI): Measures profit or loss from investment relative to its cost

- Net Present Value (NPV): Calculates the present value of future cash flows to assess investment viability

- Internal Rate of Return (IRR): Identifies the discount rate at which the net present value of cash flows is zero

- Payback Period: Determines the time required for investment cash flows to cover the initial investment cost

- Profit Margin: Represents the percentage of revenue that a company keeps as profit after accounting for costs

Return on Investment (ROI): Measures profit or loss from investment relative to its cost

Return on Investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment. It is a simple and widely used metric that provides a clear picture of how well an investment has performed in relation to its cost. ROI is calculated by dividing the net profit or loss of an investment by the initial cost of that investment. The formula is as follows:

ROI = (Net Profit / Initial Investment) * 100

This calculation allows investors to compare the profitability of different investments or to assess the performance of a single investment over time. A higher ROI indicates that the investment has generated a greater return relative to its initial cost, suggesting that the investment was successful. Conversely, a lower ROI or a negative ROI suggests that the investment may not have been as profitable as expected.

For example, if an investor purchases a piece of equipment for $10,000 and sells it after a year for $12,000, the net profit is $2,000. Using the ROI formula, the return on this investment would be:

ROI = ($2,000 / $10,000) * 100 = 20%

This means that for every dollar invested, the investor received a return of 20 cents. A 20% ROI is considered a good return in many investment contexts, indicating that the investment was profitable and outperformed the initial investment.

ROI is a valuable tool for investors, business owners, and financial analysts as it provides a standardized way to compare investments and make informed decisions. It helps in identifying the most profitable ventures, evaluating the success of marketing campaigns, or assessing the efficiency of business operations. By analyzing ROI, stakeholders can make strategic choices, optimize resource allocation, and maximize the potential for positive financial outcomes.

In summary, ROI is a critical metric for assessing investment performance, providing a clear and concise way to understand the profitability of an investment. It enables investors to make data-driven decisions and encourages a more efficient allocation of resources in the business world.

Utilities: Invest or Avoid?

You may want to see also

Net Present Value (NPV): Calculates the present value of future cash flows to assess investment viability

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment by calculating the present value of all future cash flows generated by the investment. It is a powerful tool for assessing the viability of an investment opportunity and is widely used in capital budgeting and investment analysis. The NPV method takes into account the time value of money, which means that cash flows received in the future are worth less than the same amount received today. By discounting future cash flows to their present value, NPV provides a clear indication of whether an investment will generate value over its lifetime.

The calculation of NPV involves several steps. First, you need to estimate the future cash flows that the investment will generate. These cash flows can be either incoming payments or outgoing cash outflows. It is important to consider both positive and negative cash flows, as well as their timing. Next, you determine the appropriate discount rate, which represents the minimum rate of return that could be earned on an investment of equal risk and maturity. This discount rate is typically based on the company's weighted average cost of capital (WACC). The present value of each cash flow is then calculated by dividing the cash flow by one plus the discount rate, raised to the power of the period in which the cash flow occurs. These present values are summed to arrive at the NPV.

A positive NPV indicates that the investment is expected to generate a return greater than the required discount rate, suggesting that the investment is financially viable and will lead to value creation. Conversely, a negative NPV suggests that the investment's future cash flows, when discounted, are insufficient to cover the initial investment, and thus, the investment may not be profitable. NPV analysis is particularly useful when comparing multiple investment options, as it provides a standardized way to evaluate their potential returns.

It is important to note that NPV is just one aspect of investment analysis and should not be the sole criterion for decision-making. Other factors, such as the investment's strategic fit, market demand, and competitive landscape, should also be considered. Additionally, NPV calculations can be sensitive to changes in discount rates and cash flow estimates, so it is crucial to conduct thorough research and analysis to ensure accurate results.

In summary, Net Present Value (NPV) is a valuable tool for investors and financial analysts to assess the viability of an investment by considering the present value of future cash flows. It provides a clear quantitative measure of an investment's potential profitability and helps in making informed decisions regarding capital allocation. Understanding NPV and its application can significantly contribute to effective investment strategies.

Second Home, Smart Investment: Strategies for Success

You may want to see also

Internal Rate of Return (IRR): Identifies the discount rate at which the net present value of cash flows is zero

The Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of an investment. It is a crucial concept in capital budgeting and investment analysis, providing a clear indication of the potential success of a project or investment. The IRR identifies the discount rate at which the net present value (NPV) of a project's cash flows is zero. In simpler terms, it is the rate at which the investment's future cash inflows, when discounted back to the present, equal the initial investment cost.

When calculating IRR, the goal is to find the discount rate that makes the NPV equal to zero. This rate represents the project's expected annualized rate of return, assuming the cash flows are reinvested at the same rate. For instance, if a project has an IRR of 15%, it means that the project's cash flows, when discounted at 15%, result in a net present value of zero, indicating that the project's expected annual return equals the cost of capital.

The IRR method is particularly useful for comparing mutually exclusive projects, as it provides a single rate that summarizes the project's profitability. Projects with higher IRRs are generally preferred, as they offer a higher rate of return for the same level of investment. However, it's important to note that IRR has some limitations. It does not consider the scale of the investment, and projects with different investment sizes may have different IRRs, even if they generate the same NPV.

Additionally, IRR can provide multiple rates for a single project, especially for projects with non-conventional cash flows. This is because the IRR method assumes that cash flows are reinvested at the IRR, which may not always be the case. In such situations, the Net Present Value (NPV) method becomes more appropriate, as it provides a single value for the project's profitability.

In summary, the Internal Rate of Return (IRR) is a powerful tool for assessing investment opportunities, offering a clear measure of the project's profitability. By identifying the discount rate at which the NPV is zero, IRR provides valuable insights into the expected rate of return and helps investors make informed decisions regarding their capital allocation. Understanding IRR is essential for financial analysts and investors to evaluate and compare different investment options effectively.

The Professional Wardrobe: Investment Bankers' Office Attire

You may want to see also

Payback Period: Determines the time required for investment cash flows to cover the initial investment cost

The Payback Period is a financial metric used to evaluate the time it takes for an investment to generate enough cash flow to cover its initial cost. It is a simple and intuitive method to assess the liquidity and risk associated with an investment. This ratio is particularly useful for investors and analysts who want a quick understanding of how long it will take for an investment to start generating returns that can cover its initial expenditure.

In essence, the Payback Period determines the time horizon within which an investment's cash inflows can be expected to equal the cash outflow (the initial investment). It is calculated by dividing the initial investment amount by the annual cash inflow generated by the investment. For example, if a company invests $100,000 in a project and expects annual cash inflows of $20,000, the payback period would be 5 years ($100,000 / $20,000 = 5).

This metric is valuable because it provides a quick assessment of the investment's liquidity and the time required to recover the initial capital. A shorter payback period is generally preferred as it indicates a faster return on investment and a lower risk of losing the initial capital. However, it's important to note that the Payback Period does not consider the time value of money, which means it doesn't account for the potential future benefits of the investment.

To calculate the Payback Period, you need to know the initial investment amount and the expected annual cash inflows. These figures can be derived from financial projections or historical data. Once you have these values, you can simply divide the initial investment by the annual cash inflow to determine the payback period.

While the Payback Period is a useful tool for initial investment analysis, it should not be the sole factor in decision-making. Other financial metrics, such as the Internal Rate of Return (IRR) and Net Present Value (NPV), provide a more comprehensive evaluation of an investment's profitability and risk. These metrics consider the time value of money and can help investors make more informed decisions, especially when comparing multiple investment opportunities.

Investment Firms' Library: Essential Reads for Financial Success

You may want to see also

Profit Margin: Represents the percentage of revenue that a company keeps as profit after accounting for costs

Profit margin is a crucial financial metric that provides insight into a company's profitability and efficiency. It represents the percentage of revenue that a company retains as profit after deducting all expenses. This metric is an essential indicator of a company's financial health and performance, as it directly reflects the ability to generate profits from sales.

To calculate the profit margin, you need to determine the net income or profit and then divide it by the total revenue. Net income is calculated by subtracting all expenses, including cost of goods sold, operating expenses, taxes, and other costs, from the total revenue. The formula is: Profit Margin = (Net Income / Total Revenue) * 100. For example, if a company generates $100,000 in revenue and has a net income of $20,000, the profit margin would be 20%.

A higher profit margin indicates that a company is more efficient in its operations and better at controlling costs. It means that a larger portion of the revenue is converted into profit. Investors and analysts often use this metric to compare companies within the same industry, as it provides a standardized way to assess profitability. A higher profit margin compared to industry averages can be an attractive sign for investors, suggesting that the company has a competitive advantage or is managing its operations effectively.

However, it's important to note that profit margin should be analyzed in conjunction with other financial ratios and metrics. Different industries have varying profit margins due to inherent cost structures and market dynamics. For instance, a retail company might have a lower profit margin due to high inventory costs and competition, while a software company could have a higher margin due to lower production costs.

Understanding profit margin is essential for businesses to make informed decisions about pricing strategies, cost-cutting measures, and overall financial management. It also helps in identifying areas where a company can improve its profitability and competitiveness in the market. By regularly monitoring and analyzing profit margins, companies can ensure they are on a sustainable growth path and make adjustments to optimize their financial performance.

Boat Blues: Navigating the Murky Waters of Marine Investment

You may want to see also

Frequently asked questions

The working investment ratio, also known as the investment-to-capital ratio or capital intensity, is a financial metric that measures the efficiency of a company's investment in its assets. It indicates how much capital is required to generate a certain level of investment or revenue. This ratio is particularly useful for investors and analysts to assess a company's ability to manage its resources and generate returns.

The formula for calculating the working investment ratio is: Working Investment Ratio = Total Assets / Total Investment. Total Assets refer to the company's total assets, including both tangible and intangible assets. Total Investment is the amount of capital or funds invested in the business. By dividing the total assets by the total investment, you can determine the efficiency of the company's asset utilization.

This ratio is important for several reasons. Firstly, it provides insights into a company's financial health and efficiency. A low working investment ratio might indicate that the company is not utilizing its assets effectively, while a high ratio could suggest efficient resource management. Secondly, it helps investors compare companies within the same industry, allowing them to identify businesses with better asset utilization. This ratio is also useful for management to make informed decisions about capital allocation and investment strategies.