Private investment firms play a crucial role in the global economy by providing capital to businesses and individuals, often with the goal of generating significant returns on their investments. These firms operate in a complex and dynamic environment, leveraging their expertise and resources to identify and capitalize on investment opportunities. They work by sourcing deals, conducting thorough due diligence, and structuring transactions to meet the needs of their investors and the companies they back. This process involves a range of activities, from initial deal sourcing and evaluation to final investment decisions and ongoing support for the companies in which they invest. Understanding the inner workings of these firms is essential for investors and entrepreneurs alike, as it sheds light on the mechanisms through which capital is allocated and growth is fostered in the business world.

What You'll Learn

- Investment Strategies: Private firms employ various strategies like buyouts, growth capital, and venture capital

- Deal Sourcing: They identify and source deals through networks, research, and industry connections

- Due Diligence: Rigorous process to evaluate companies, including financial, legal, and operational assessments

- Portfolio Management: Active management of investments to maximize returns and mitigate risks

- Exit Strategies: Plans for selling investments, including IPOs, M&A, or secondary market transactions

Investment Strategies: Private firms employ various strategies like buyouts, growth capital, and venture capital

Private investment firms play a crucial role in the global economy by providing capital to businesses and entrepreneurs, often with the goal of generating significant returns on their investments. These firms employ a range of investment strategies to achieve their financial objectives, each tailored to specific market conditions and the unique needs of their clients. Here's an overview of some of the key strategies they utilize:

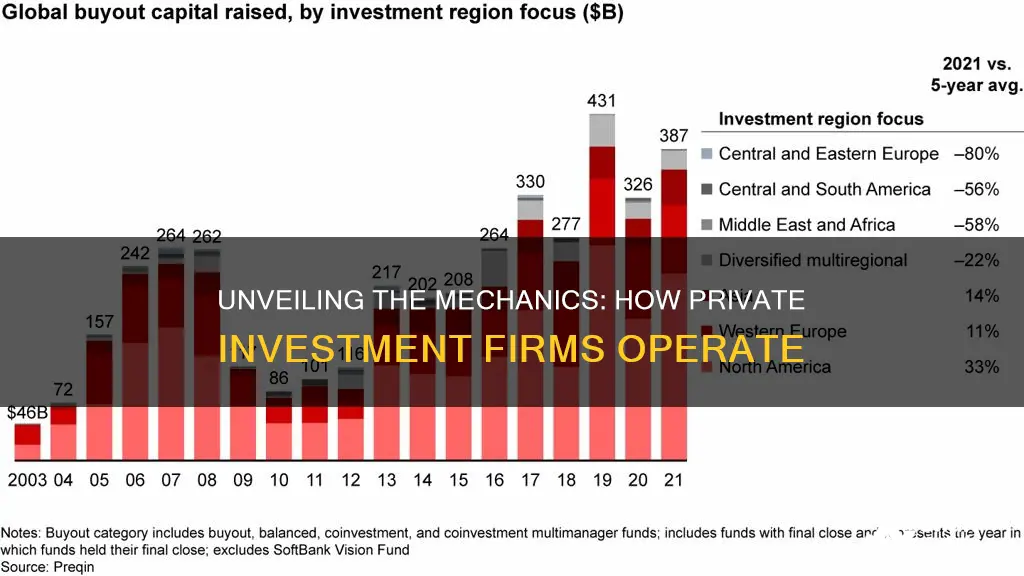

Buyout Strategy: This is one of the most well-known approaches used by private investment firms. In a buyout, the firm acquires a company, often from its current owners, with the aim of improving its performance and then selling it for a profit. Buyouts typically involve taking a company private, removing it from the public market, and then restructuring it to enhance its value. Private equity firms often focus on specific industries or sectors, such as healthcare, technology, or manufacturing, and may seek to acquire businesses with strong growth potential but that are undervalued or in need of strategic improvements. The process involves due diligence, negotiating purchase terms, and sometimes, restructuring the company's operations to increase efficiency and profitability. After a certain period, the firm may sell the company to realize gains, often through an initial public offering (IPO) or a sale to another investor.

Growth Capital Investments: Private investment firms also provide growth capital to existing businesses, particularly those with strong market positions and growth potential. These investments are made to support the expansion of a company, such as funding new product development, market penetration, or international expansion. Growth capital firms often work closely with the company's management team to identify and execute strategic initiatives. They may provide financial advice, operational expertise, and industry connections to help the business achieve its growth objectives. This strategy is particularly attractive to private firms as it allows them to invest in companies with a proven track record while also benefiting from the potential for substantial returns as the business grows.

Venture Capital: Venture capital is a high-risk, high-reward strategy where private investment firms invest in early-stage companies, often startups, with significant growth potential. These firms typically focus on industries like technology, life sciences, and clean energy, where innovation and disruption are common. Venture capitalists seek to identify and support companies with unique ideas, strong founding teams, and a clear path to market success. They provide capital in exchange for equity, taking on a significant ownership stake in the company. The goal is to help the startup grow rapidly, often through aggressive market penetration and product development, and then exit the investment by selling the company to a larger corporation or taking it public. This strategy requires a deep understanding of emerging markets and a willingness to take calculated risks.

These investment strategies allow private firms to cater to diverse client needs, from providing much-needed capital to startups to restructuring and growing established businesses. Each strategy has its own set of risks and rewards, and private investment firms must carefully assess market trends, industry dynamics, and the specific characteristics of the companies they invest in to make informed decisions. The success of these strategies often relies on the firm's ability to identify undervalued assets, provide strategic guidance, and execute timely exits to maximize returns for their investors.

US Risks Falling Behind in AI Race: Time to Invest and Innovate

You may want to see also

Deal Sourcing: They identify and source deals through networks, research, and industry connections

Private investment firms play a crucial role in the financial landscape, primarily by sourcing and acquiring deals that align with their investment strategies. This process, known as deal sourcing, is a multifaceted and strategic endeavor. Here's an overview of how these firms identify and secure potential investments:

Networking and Industry Connections: Deal sourcing often begins with a strong network of contacts. Private investment professionals cultivate relationships with industry experts, entrepreneurs, and other investors. These connections provide valuable insights and tips about potential deals. For instance, an investment firm might attend industry conferences, join relevant associations, or participate in networking events to gather information. By building a robust network, they can stay ahead of the curve and gain access to opportunities that might not be publicly available.

Research and Due Diligence: Thorough research is a cornerstone of deal sourcing. Investment firms employ dedicated research teams to analyze market trends, study industry developments, and identify sectors or companies with growth potential. This research can involve analyzing financial data, studying company performance, and assessing market dynamics. Due diligence is a critical part of this process, ensuring that the investment firm understands the risks and rewards associated with a potential deal. They may also engage in secondary research, such as studying comparable companies or transactions, to gain a comprehensive understanding.

Information Sources: Private investment firms utilize various information sources to gather deal intelligence. These include financial databases, industry reports, news articles, and proprietary research. For instance, they might subscribe to financial data providers, such as Bloomberg or Reuters, to access real-time market data and financial news. Additionally, they may employ data analytics tools to identify patterns and trends in the market, helping them make informed decisions. Industry-specific publications and reports are also valuable resources, offering insights into emerging trends and potential investment opportunities.

Cold Calling and Outreach: In some cases, private investment firms take a proactive approach by cold-calling or reaching out to potential targets. This method involves identifying companies or projects that align with their investment criteria and directly contacting the relevant parties. While this approach may be more challenging, it can lead to unique and exclusive deals. Investment professionals often have a keen eye for identifying undervalued assets or companies with untapped potential, and they may use their industry knowledge to make compelling cases for investment.

Partnerships and Joint Ventures: Another strategy for deal sourcing is forming partnerships or joint ventures with other entities. Private investment firms might collaborate with entrepreneurs, industry peers, or even larger corporations to identify and develop investment opportunities. This collaborative approach can provide access to deals that might not be available through traditional means. By combining resources and expertise, these firms can enhance their deal-sourcing capabilities and create value for their investors.

Invest More, Gain More

You may want to see also

Due Diligence: Rigorous process to evaluate companies, including financial, legal, and operational assessments

The process of due diligence is a critical aspect of private investment firms' operations, serving as a comprehensive evaluation to assess the viability and potential of target companies. This meticulous process involves a thorough examination of various facets, including financial, legal, and operational aspects, to ensure that the investment decision is well-informed and aligned with the firm's objectives.

Financial due diligence is a cornerstone of the process, aiming to scrutinize a company's financial health and performance. This entails a detailed review of financial statements, including income statements, balance sheets, and cash flow statements, to identify trends, patterns, and potential risks. Investors delve into historical financial data, comparing it against industry benchmarks to gauge the company's financial stability and growth prospects. They may also assess the company's revenue streams, profitability, and financial ratios to make informed decisions.

Legal due diligence is another vital component, focusing on the legal framework surrounding the company. This includes examining contracts, agreements, and legal documents to identify any potential liabilities, disputes, or regulatory compliance issues. Private investment firms scrutinize the company's legal structure, ownership, and governance to ensure transparency and mitigate legal risks. They may also review intellectual property rights, employment contracts, and environmental regulations to ensure the company's legal standing is robust.

Operational due diligence involves assessing the efficiency, effectiveness, and sustainability of a company's operations. This includes evaluating management capabilities, organizational structure, and business processes. Investors may conduct site visits, interview key personnel, and analyze operational data to understand the company's day-to-day activities and strategic initiatives. The goal is to identify operational strengths, weaknesses, and potential areas for improvement, ensuring the company's operations are optimized and aligned with its strategic goals.

The due diligence process is a rigorous and time-intensive endeavor, requiring a multidisciplinary team of experts. It involves a systematic approach to information gathering, analysis, and evaluation, ensuring that all relevant factors are considered. Private investment firms often engage external consultants, such as financial advisors, legal experts, and industry analysts, to provide specialized insights and ensure a comprehensive assessment. This collaborative effort aims to mitigate risks, identify value creation opportunities, and make well-informed investment decisions.

Home Sweet Home Investment: Exploring the Solid Financial Benefits of Buying a House

You may want to see also

Portfolio Management: Active management of investments to maximize returns and mitigate risks

Private investment firms play a crucial role in the financial landscape, offering a range of services that cater to various investment needs. These firms are typically non-bank financial institutions that provide alternative investment opportunities to high-net-worth individuals, institutions, and accredited investors. The primary focus of private investment firms is to offer tailored investment solutions, often with a more personalized and flexible approach compared to traditional financial institutions.

Portfolio management is at the heart of their operations, where active management strategies are employed to optimize investment returns while effectively managing risks. This process involves a comprehensive understanding of the client's financial goals, risk tolerance, and investment preferences. Private investment firms often have a team of experienced professionals, including portfolio managers, analysts, and researchers, who work collaboratively to make informed investment decisions.

The active management approach involves a dynamic and proactive strategy. Portfolio managers closely monitor market trends, economic indicators, and industry-specific news to identify potential investment opportunities. They aim to build diversified portfolios by carefully selecting assets, including stocks, bonds, real estate, and alternative investments, to achieve a balance between risk and return. This process requires constant research, analysis, and decision-making, ensuring that the portfolio is adjusted regularly to align with the client's objectives.

One of the key advantages of private investment firms is their ability to provide customized solutions. They can offer tailored strategies for different investment horizons, risk appetites, and financial goals. For instance, a firm might design a portfolio with a higher allocation of growth-oriented stocks for long-term investors seeking substantial capital appreciation. Alternatively, they may suggest a more conservative approach with a focus on income generation for risk-averse investors. This level of customization is a significant differentiator from traditional mutual funds or exchange-traded funds (ETFs), which often follow a standardized investment strategy.

Additionally, private investment firms often have access to exclusive investment opportunities that may not be readily available to the general public. This includes private placements, venture capital investments, and real estate deals, which can offer higher potential returns but also carry increased risks. By carefully assessing and managing these risks, portfolio managers can help clients navigate these alternative investments while maintaining a balanced and diversified portfolio. Effective risk management is crucial to ensure the long-term success and stability of the investment strategy.

Maximizing Your Insulation Investment: Understanding Simple Payback

You may want to see also

Exit Strategies: Plans for selling investments, including IPOs, M&A, or secondary market transactions

Private investment firms, often referred to as private equity firms, play a crucial role in the global financial landscape by providing capital to companies, often in the form of leveraged buyouts, growth capital, or recapitalizations. These firms typically operate with a long-term investment horizon, aiming to generate substantial returns for their investors through strategic investments and subsequent exits. The exit strategies employed by private investment firms are diverse and carefully planned to ensure a successful realization of their investments.

One common exit strategy is the Initial Public Offering (IPO). This involves taking a privately held company public by listing it on a stock exchange. By doing so, the private investment firm can sell a portion of its stake to the public, providing an opportunity to realize gains and attract new investors. IPOs are carefully timed to ensure the company's stock is priced attractively, and they often require a well-crafted marketing and communication strategy to generate investor interest. This strategy is particularly appealing for technology and growth-oriented companies, as it allows for a large-scale exit and provides liquidity to both the firm and its investors.

Mergers and Acquisitions (M&A) are another popular exit strategy. Private investment firms often seek to create value by merging their portfolio companies with other entities or acquiring complementary businesses. This approach can lead to significant growth and expansion, and it may involve a sale to another private equity firm, a strategic buyer, or even a public company. M&A activities can be complex and require careful negotiation and due diligence to ensure a successful transaction. The firm's expertise in industry knowledge and network of potential buyers can be leveraged to achieve a favorable outcome.

Secondary market transactions are a more direct approach to exiting investments. In this strategy, private investment firms sell their stakes in portfolio companies to other investors, such as institutional funds or high-net-worth individuals. Secondary market transactions can provide liquidity to the firm and its investors, allowing for a faster realization of returns. These transactions often require a well-established network and a thorough understanding of the market to ensure a smooth process.

The choice of exit strategy depends on various factors, including the industry, company stage, market conditions, and the investment firm's goals. Private investment firms often employ a combination of these strategies to maximize returns and create value. A well-defined exit strategy is a critical component of the investment process, ensuring that the firm can successfully navigate the complexities of selling its investments and providing a positive return to its investors.

Diamond Investment: A Sparkling Guide to Buying Diamonds

You may want to see also

Frequently asked questions

A private investment firm, also known as a private equity firm, is a type of financial institution that focuses on investing in and managing the assets of private companies. These firms typically deal with large, complex investments and aim to generate significant returns for their investors.

Private investment firms raise capital by attracting investors, often through private equity funds. These funds can be structured as limited partnerships, where the firm acts as the general partner and investors as limited partners. The firm then pools the capital from multiple investors to make investments and generate profits.

Private investment firms invest in a wide range of industries and sectors, including technology, healthcare, consumer goods, and financial services. They often seek to acquire controlling stakes in companies, provide strategic advice, and help improve operational efficiency. These firms may also invest in distressed companies or those in need of restructuring.

Returns are generated through various strategies, including operational improvements, cost-cutting measures, and strategic decisions. Private equity firms often aim to increase the value of their investments by implementing management changes, expanding market reach, or selling the company at a higher price through an initial public offering (IPO) or merger.

The investment process involves several stages. Firstly, the firm identifies and evaluates potential investment opportunities through research, network, and deal flow. Secondly, they conduct thorough due diligence to analyze the company's financial health, management, and market position. If the firm decides to invest, they negotiate the terms and structure of the deal. Post-investment, the firm actively manages and monitors the portfolio company to ensure growth and achieve their investment objectives.