There are many factors to consider when creating an investment strategy, and the best strategy will differ from person to person. A good investment strategy should help you meet your financial goals and increase your wealth while maintaining a level of risk that you're comfortable with. When creating an investment strategy, it's important to first have a clear understanding of your investment goals and then create a strategy to achieve them. Other factors to consider include your timeline, risk tolerance, and investment options. It's also crucial to regularly review and adjust your strategy as your goals evolve and market conditions change.

| Characteristics | Values |

|---|---|

| Investment goals | Wealth creation, children's education, building a dream home, planning a world tour, generation of regular income, capital preservation, retirement, etc. |

| Investment horizon | Short-term or long-term |

| Risk tolerance | Low or high |

| Investment style | Passive or active |

| Investment vehicles | Stocks, bonds, mutual funds, ETFs, index funds, robo-advisors, target-date funds, etc. |

| Risk management | Diversification, hedging, etc. |

| Taxes | Tax-efficient investing, tax loss harvesting, etc. |

| Costs | Dividends, management fees, etc. |

What You'll Learn

- Risk tolerance: How much risk are you comfortable with Knowing your tolerance can help you make investment decisions that align with your comfort zone

- Long-term perspective: Investing is a long-term game, and it's important to approach it with patience and a focus on potential growth over time

- Tax efficiency: Understand the tax implications of your investments to minimise their impact and keep more of your returns

- Diversification: Spread your investments across different asset classes to reduce the risk of significant losses and smooth out market fluctuations

- Investment goals: Define your financial objectives to give your investments purpose and direction

Risk tolerance: How much risk are you comfortable with? Knowing your tolerance can help you make investment decisions that align with your comfort zone

Risk tolerance is a crucial factor in successful investing. It refers to an investor's ability to handle potential losses when making investment decisions. In other words, it is the amount of market volatility and loss an investor is willing to accept. Knowing your risk tolerance is essential for crafting an investment strategy that aligns with your financial objectives and comfort level.

- Investment Goals: Start by asking yourself why you are investing. Common goals include saving for retirement, paying for education, or achieving financial independence. Understanding your investment goals will help you determine how much risk you are willing to take.

- Time Horizon: The time horizon refers to the duration an investor plans to hold an investment. Generally, a longer time horizon allows for more risk-taking, as there is more time to recover from potential losses. Conversely, a shorter time horizon may require a more conservative approach to avoid significant losses.

- Comfort with Short-Term Loss: Investments can fluctuate in the short term. Consider how comfortable you are with short-term losses and whether you can absorb them without selling your investments prematurely.

- Non-Invested Savings: It is important to have savings set aside in liquid accounts to cover emergencies. However, if you are keeping a large portion of your savings in cash due to risk aversion, you may be missing out on investment opportunities.

- Tracking Frequency: Consider how often you plan to track your investments. If the idea of frequent tracking makes you anxious, it may indicate a lower risk tolerance. On the other hand, if you are excited about actively tracking and looking for new opportunities, you may be more comfortable with higher risk.

By understanding your risk tolerance, you can make investment decisions that align with your comfort zone. For example, if you have a low-risk tolerance, you may opt for more conservative investments such as government securities, bonds, or savings-focused options. On the other hand, if you have a higher-risk tolerance, you may be open to investing in more volatile assets such as stocks or growth companies.

Remember, risk tolerance is unique to each individual and can change over time. It is influenced by factors such as age, income, financial goals, and personal disposition. It is important to periodically reassess your risk tolerance and adjust your investment strategy accordingly.

Savings and Investments: Equation for Financial Success

You may want to see also

Long-term perspective: Investing is a long-term game, and it's important to approach it with patience and a focus on potential growth over time

Long-Term Perspective: A Crucial Component of a Unique Investment Strategy

When it comes to investing, adopting a long-term perspective is paramount. This entails recognising that investing is a marathon, not a sprint, and that short-term volatility is a normal part of the investment journey. Here are some key considerations for investors who want to incorporate a long-term perspective into their unique investment strategy:

Avoid Short-Term Thinking:

Embrace the "buy-and-hold" mentality instead of trying to profit from quick trades. Focus on finding solid investments that offer long-term growth potential. This approach aligns with the strategy of renowned investor Warren Buffett, who is known for his long-term investing horizon.

Patience and Discipline:

Exercising patience and discipline is crucial when adopting a long-term perspective. Ignore the "noise" of short-term market fluctuations and stick to your investment strategy. This includes continuing to invest during market downturns, which can be achieved through dollar-cost averaging—investing a set amount periodically, regardless of market conditions.

Ignore "Hot Tips":

Resist the temptation to act on stock tips, no matter how enticing they may seem. Conduct your own thorough research and analysis before investing in any company. This ensures that your investment decisions are based on sound fundamentals rather than speculation.

Focus on the Big Picture:

Don't get too caught up in short-term price movements. Instead, track the long-term trajectory of your investments. Have confidence in the larger story and potential of your investments, even during periods of volatility.

Long-Term Growth Potential:

When evaluating investments, consider their future growth potential rather than obsessing over past performance. Assess a company's fundamentals, market position, and growth prospects to identify investments with strong long-term prospects.

Riding Out Market Volatility:

Understand that market volatility is inevitable, and don't let short-term dips deter you. Bear markets, or significant market declines, typically last for shorter periods than subsequent rising markets. Trying to time the market is futile, so focus on staying invested and riding out the bumps.

Tax Efficiency:

While taxes are important to consider, they shouldn't drive your investment decisions. Long-term capital gains taxes are generally lower than short-term rates, so focus on making sound investment choices rather than trying to minimise taxes.

Consistency and Automation:

Consistency is key to long-term investing success. Automate your contributions by setting up a monthly investment plan. This helps you stay disciplined and can lead to significant wealth accumulation over time, as demonstrated by the power of compound growth.

Risk Profile and Asset Allocation:

Understand your risk profile, including your risk tolerance and investment goals. This will guide your asset allocation, determining the proportion of stocks, bonds, and other assets in your portfolio. A longer time horizon and higher risk tolerance may lead to a higher allocation of stocks, while a more conservative investor might favour bonds.

Diversification:

Diversification is essential to long-term investing success. Spread your investments across different asset classes, sectors, and geographies to reduce overall portfolio volatility. This helps protect your portfolio during market downturns and can enhance long-term growth potential.

By incorporating these considerations into your investment strategy, you can approach investing with patience and a focus on potential growth over time. Remember, long-term investing is a journey that requires discipline, a clear strategy, and the ability to withstand short-term market fluctuations.

Managing External Municipal Investment Managers: Strategies for Success

You may want to see also

Tax efficiency: Understand the tax implications of your investments to minimise their impact and keep more of your returns

Understanding the tax implications of your investments is crucial for minimising their impact on your returns. Here are some essential insights to help you navigate tax efficiency in your investment strategy:

Understand the Taxation of Investment Income:

Taxation of investment income can include interest, dividends, and capital gains. Interest and unqualified dividends are typically taxed at ordinary income rates. However, qualified dividends may benefit from lower long-term capital gains tax rates. When selling investments, taxes are usually due on any gains, calculated by subtracting the cost basis (usually the amount you paid) from the sale price. Keep in mind that losses can offset gains and reduce your taxable income.

Explore Tax-Advantaged Accounts:

Consider utilising tax-advantaged accounts like IRAs and 401(k)s to optimise your tax situation. These accounts offer tax benefits, such as tax deductions on contributions or tax-free withdrawals in retirement. For example, traditional retirement accounts allow tax deductions on contributions, while Roth accounts offer tax-free withdrawals, including investment gains, in retirement.

Be Mindful of Special Tax Treatments:

Certain investments may have special tax treatments. For instance, municipal bonds are typically exempt from federal taxes but may be subject to state taxes, depending on the state. Additionally, some investments can trigger special taxes, such as the Alternative Minimum Tax (AMT) or the Net Investment Income Tax (NIIT), which adds a 3.8% surtax on certain investment sales for high-income individuals.

Understand Short-Term vs. Long-Term Capital Gains:

The duration of your investments impacts their taxation. Short-term capital gains, resulting from selling assets held for a year or less, are generally taxed at ordinary income rates. In contrast, long-term capital gains, from selling assets held for more than a year, often benefit from reduced tax rates. For 2024, long-term capital gains tax rates range from 0% to 20%, depending on your taxable income.

Offset Capital Gains with Capital Losses:

If your investments incur losses, you can use those capital losses to offset your capital gains and reduce your tax liability. Any remaining capital losses after offsetting gains can also be used to reduce your ordinary income, up to a limit of $3,000 per year.

Consider Tax-Free and Tax-Deferred Investment Options:

Investing in tax-free or tax-deferred accounts, such as 401(k)s, Roth IRA accounts, and 529 college savings plans, can significantly reduce your tax burden. These accounts allow your investments to grow tax-free or tax-deferred, minimising immediate capital gains taxes.

Stay Informed and Consult Experts:

Stay informed about tax laws and regulations to make informed investment decisions. Consult tax experts or financial advisors to help you navigate the complexities of investment taxation and optimise your tax efficiency. They can guide you in understanding the tax forms provided by your brokerage firm and ensure accurate reporting of your investment income.

Investment Managers: Crafting Your Portfolio for Success

You may want to see also

Diversification: Spread your investments across different asset classes to reduce the risk of significant losses and smooth out market fluctuations

Diversification is a crucial investment strategy, and a well-diversified portfolio is a key to long-term investment success. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, real estate, commodities, and cash. This reduces the risk of significant losses and helps to smooth out market fluctuations, providing more consistent returns over time.

When diversifying your portfolio, it's important to consider the following:

- Asset classes: Include a mix of asset classes such as stocks, bonds, cash and cash equivalents, and real assets (property and commodities). A diversified portfolio will typically include at least two asset classes.

- Correlation: Consider the correlation between different securities or asset classes. If you own multiple investments that are positively correlated, they are likely to move up or down together, reducing the effectiveness of diversification.

- Geographic regions: Invest in both domestic and international markets, including developed and emerging economies. This can provide global diversification and reduce the impact of country-specific risks.

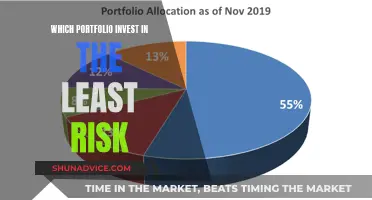

- Risk tolerance: Your risk tolerance will influence your asset allocation. Aggressive investors with a high-risk tolerance may allocate 90% of their portfolio to stocks and 10% to bonds, while conservative investors may opt for a 50/50 split.

- Time horizon: Your investment timeframe will also impact your asset allocation. Longer time horizons allow for a higher percentage of stocks, while shorter time horizons may require a more conservative approach.

- Regular rebalancing: Over time, market movements will cause your asset allocation to drift. It's important to rebalance your portfolio periodically to maintain your intended allocation and control risks.

By diversifying your portfolio, you can reduce the impact of negative performance in specific investments or market segments and enhance your overall investment results. Diversification does not guarantee returns or protect against all losses, but it can help mitigate certain risks and provide a more stable path towards achieving your financial goals.

Investing Now: A Smart Move or Risky Gamble?

You may want to see also

Investment goals: Define your financial objectives to give your investments purpose and direction

Setting clear financial goals is the first step in crafting your investment strategy. This means defining your objectives, whether that's saving for retirement, buying a home, or funding your child's education. Having clear goals gives your investments purpose and direction, helping you stay focused and make decisions that align with your plan.

When setting your financial goals, consider the following:

- Time horizon: Ask yourself, "What is my time horizon?" In other words, when will you need the money? Are you investing for the long term (e.g., retirement) or short term (e.g., buying a house in the next few years)? The longer your time horizon, the more risk you may be able to take on, as you have more time to recover from potential losses.

- Risk tolerance: How comfortable are you with the potential ups and downs of investing? Knowing your risk tolerance will help you strike a balance between safety and growth. Are you risk-averse, preferring to avoid potential losses, or a risk-seeker, willing to take on more significant chances for potential gains?

- Liquidity needs: Liquidity refers to how quickly an investment can be converted into cash. Consider your short-term and overall liquidity needs. If you have upcoming major expenses, such as college tuition, you may need more liquid investments.

- Investment goals: Once you understand your financial goals and the above factors, you can think about how your investments can help you achieve those goals. Consider the three key investment goals: growth, income, and stability. Growth refers to increasing the value of your investments. Income involves generating periodic payments of interest or dividends. Stability focuses on preserving your capital, ensuring your investment doesn't lose value.

Remember, your investment strategy should be tailored to your unique circumstances and goals. Regularly review and adjust your strategy as your objectives evolve, your risk tolerance changes, and market conditions shift. Flexibility is key to achieving your financial goals while staying within your comfort zone.

Media Investment Management: Optimizing Ad Spend for Maximum Returns

You may want to see also

Frequently asked questions

An investment strategy is a set of principles that guides your portfolio decisions. It is designed to help you achieve your financial goals and ensure that your investment portfolio aligns with your risk appetite, investment horizon, and expected returns.

To create an investment strategy, consider your risk appetite, investment horizon, and financial goals. You can also seek advice from financial advisors to maximise returns and minimise risk.

Key factors include your age, financial goals, lifestyle, financial situation, personal situation, expected returns, and life insurance needs.

Periodically review your investment strategy to ensure it aligns with your financial goals and performance expectations. If your investment portfolio is performing as expected and your returns match your goals, your strategy is likely effective.

An investment strategy helps grow your wealth by balancing risk and reward. It enables you to distribute risks, minimise losses, and invest in assets with growth potential.