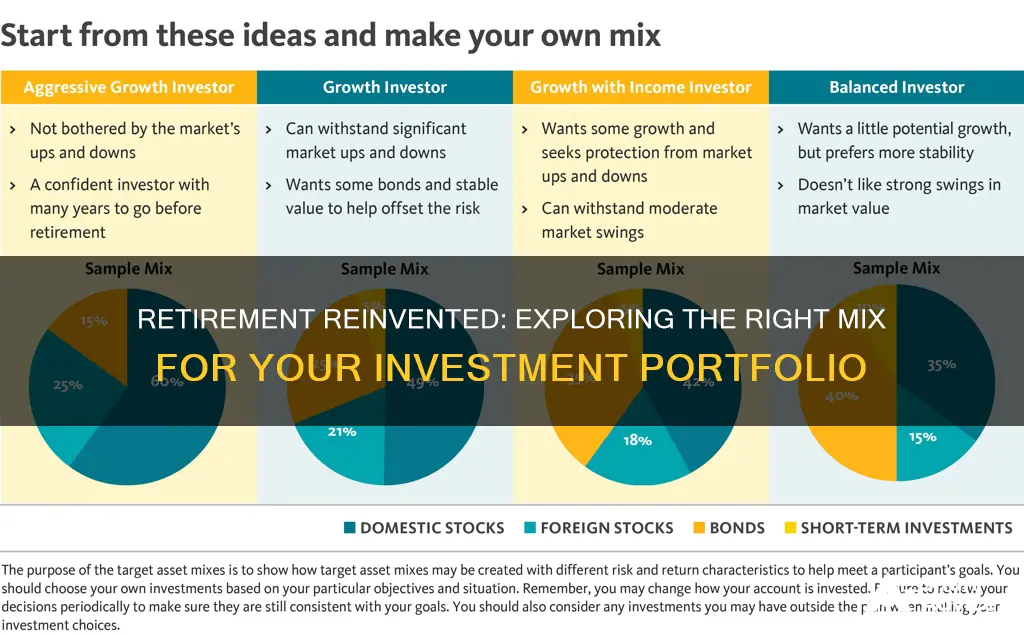

When it comes to investing after retirement, there are a few key considerations to keep in mind. Firstly, it's important to plan for the long term, as retirement could last 30 years or more. Secondly, choosing the right mix of investments, also known as a portfolio allocation, is crucial. This mix should be tailored to your personal financial goals, risk tolerance, and time horizon. While it's generally recommended to shift towards more conservative investments in retirement, it's important to strike a balance as you will still need growth to ensure your money lasts for decades to come.

- Set clear goals and be prepared to adjust them over time. Consider your life expectancy and desired lifestyle in retirement, which will impact your spending needs.

- Allocate your assets to manage your risk. As a general rule, be more aggressive with higher-risk investments when you're younger, and shift towards more conservative assets as you approach retirement.

- Plan for growth based on your spending needs. Retirement advisors often recommend replacing about 75% of your pre-retirement income. This means balancing growth-oriented investments with conservative assets to meet your financial goals while minimising risk.

What You'll Learn

Save more, increase equity holdings

Saving more and increasing equity holdings are two ways to improve your financial position in retirement. Here are some strategies to achieve this:

Save More

- Start saving early: The earlier you start saving for retirement, the more you can take advantage of the power of compounding over several decades.

- Set a savings target: Aim to save 15% of your annual income, including any employer-matched contributions, to reach an ideal retirement savings goal.

- Make steady progress: Even if you can't save 15% right away, start with what you can and gradually increase your savings rate over time. Many employer-sponsored plans allow automated contribution increases.

- Maximize tax benefits: Take advantage of tax-deferred retirement accounts, such as 401(k)s and IRAs, to reduce your taxable income and maximize the tax benefits of your savings.

- Automate your savings: Consider automating your contributions to retirement accounts so that a portion of your income is automatically saved each month.

- Take advantage of life changes: Life events such as paying off student loans or getting married can provide opportunities to accelerate your savings by redirecting funds towards retirement.

- Build an emergency fund: Maintain an emergency fund that can cover three to six months' worth of expenses at all ages. This will help keep your financial goals on track and provide peace of mind.

- Supplement with taxable accounts: In addition to tax-deferred retirement accounts, consider saving in taxable accounts to provide flexibility and improve tax diversification.

Increase Equity Holdings

- Focus on growth potential: Stocks provide the highest growth potential over the long term, outperforming bonds and cash. Maintaining exposure to stocks is crucial to keep up with inflation, especially during retirement.

- Shift towards more conservative investments gradually: As you approach retirement, gradually reduce your holdings in risky funds and move towards safer investments. This shift should be gradual, as you still want a large portion of your portfolio in equities to counter inflation.

- Diversify your equity holdings: Invest in a variety of equity types, such as large-cap, mid-cap, and small-cap stocks, to balance risk and return. Diversification can help you capture returns from multiple investment types while protecting your portfolio from downturns in any one asset class.

- Consider alternative investments: Include alternative investments such as precious metals, derivatives, or real estate to further reduce portfolio volatility and generate returns during idle periods for traditional asset classes.

- Monitor and rebalance your portfolio: Regularly review the performance of your investments and rebalance as needed to maintain your desired asset allocation. This is especially important as you transition from a growth-focused portfolio to one focused on income and capital preservation.

Tithing on Investments: To Give or Not to Give?

You may want to see also

The role of bonds

Bonds are an essential part of a retirement portfolio. While they might not provide the same level of financial gains as stocks, they serve several key functions.

Firstly, bonds offer stability. They are less likely to lose money than stocks, so having a mix of both in your portfolio can reduce potential losses during stock market downturns. Bonds are also less volatile than stocks, which makes them safer for retirees who shouldn't take too much risk with their investments.

Secondly, bonds provide a regular income. They pay interest at regular intervals, helping to generate a steady, predictable income stream. This is particularly beneficial for retirees who are no longer receiving a regular employment paycheck.

Thirdly, bonds offer security. U.S. Treasury bonds, in particular, are considered the safest and most liquid investments after cash. Short-term bonds are a good option for parking emergency funds or money that will be needed in the near future.

Additionally, certain types of bonds offer tax advantages. Some bonds provide tax-free income, which can be beneficial for investors in high tax brackets.

When it comes to retirement planning, investors tend to shift towards bonds as they get closer to retirement. This shift is based on the idea that bonds are less risky than stocks due to their lower volatility. However, recent research suggests that bonds may be riskier than previously thought over the long term, which is often 30 years or more for retirees.

Bonds can be purchased individually or through investment vehicles like mutual funds and exchange-traded funds (ETFs). They can be bought directly from the Treasury Department or through the secondary bond market.

It's important to note that while bonds provide a steady rate of interest, they may offer a lower overall return compared to other investments like equities. Additionally, bonds are subject to inflation risk, which can erode the value of the interest income.

When deciding whether to invest in bonds, it's crucial to consider your financial goals, risk tolerance, time horizon, and long-term objectives. While bonds offer stability and security, they may not be ideal for those seeking high returns or long-term growth.

Mortgage or Invest: Where Should Your Money Go?

You may want to see also

Bucket and barbell approaches

Bucket Approach

The bucket approach to retirement income is a simple, flexible, and easy-to-implement strategy that helps investors create a steady paycheck for life. The basic idea is to separate assets according to when they will be spent, creating a cash cushion for the early years of retirement while maximising the rest over a longer period.

The bucket strategy was first developed in 1985 by wealth manager Harold Evensky as a "now versus later" approach, dividing an investor's retirement savings into two segments: a cash bucket to meet five years' worth of living expenses, and an investment bucket for longer-term growth. Over time, financial advisors have adopted the idea of multiple savings pools to meet different needs or time periods during retirement. The number of buckets, what they represent, and what they are called may differ from one investment firm to another. Some advisors prefer three buckets, while others may use four or five.

For example, Joe Schoenhardt of Infinity Financial Concepts in Chicago employs a five-bucket method:

- The first bucket contains cash to cover the first three years of retirement expenses.

- The second bucket contains very conservative assets as they are "up next".

- The third bucket is focused on growth and income investments.

- The fourth bucket is centred on domestic growth.

- The fifth bucket contains global growth and small-cap investments, which are relatively riskier.

Each bucket is designed to meet different needs or time periods, providing confidence that short-term needs will be met and reducing worries about market volatility.

Barbell Approach

The barbell approach is an investment theory that advocates for balancing benefit and potential danger by investing in both high-risk and no-risk commodities while ignoring options in between. This strategy is particularly useful when interest rates are rising.

In practice, the barbell method is often used for bond portfolios. The biggest threat for investors who purchase high-quality bonds is missing out on the opportunity to buy a bond with a higher return. If an investment is tied up in a long-term bond, the investor cannot transfer that money to a higher-yielding bond that becomes available later. On the other hand, short-term bonds have lower interest rates but are redeemed sooner.

Therefore, the barbell strategy suggests mixing short-term and long-term bonds when investing in fixed income. This enables investors to take advantage of better-paying bonds that may become available while also enjoying the higher yields associated with long-term bonds.

When implementing the barbell strategy, investors should pair two types of assets that are very different in terms of risk. For example, 90% of one's assets could be invested in extremely safe instruments like treasury bills, while the remaining 10% could be used for speculative bets with high payoff potential. This variation of the barbell strategy limits the maximum loss while providing exposure to significant gains.

The Smart Money Move: Pay Off Debt, Then Invest

You may want to see also

Certificates of Deposit

CDs are considered one of the safest savings options. A CD bought through a federally insured bank is insured up to $250,000. The Federal Deposit Insurance Corp. (FDIC) insures bank accounts, and the National Credit Union Administration (NCUA) insures credit union accounts.

CDs are a safer and more conservative investment than stocks and bonds, but they offer a lower opportunity for growth. They are a good option if you want to save for a specific goal, such as a vacation, a new home, or a car. They can also be used as an emergency fund that earns a guaranteed return.

CDs are available at banks, credit unions, and brokerages. The interest rates on CDs are usually fixed, but there are also variable-rate CDs that could earn a higher return if rates rise. The term of a CD can range from 3 months to 10 years.

When opening a CD, it is important to consider the interest rate, term, principal, and financial institution. It is also important to understand the early withdrawal penalties and how the CD will be taxed.

Overall, CDs can be a good option for those who want to earn a higher interest rate than a savings account but are not comfortable with the risks associated with stocks and bonds.

Shares: Investing for Growth and Income

You may want to see also

Stocks and funds

When you are younger, you can take more risk with your investments as you have more time to recover from any losses. For example, in your 20s and 30s, you might opt for an asset allocation of 80% stocks and 20% bonds. As you get older, you might want to shift to more stable, lower-earning funds like bonds and cash.

During retirement, it is recommended to continue investing in stocks to benefit from their growth potential. However, as retirees may need to access their assets for income, they are more susceptible to short-term risks. Therefore, it is important to also have more exposure to bonds and cash. A common allocation for retirees is a 60/40 portfolio, with 60% in stocks and 40% in bonds. Within the stock portion, it is recommended to have a mix of value, growth, and dividend-paying stocks to balance potential capital appreciation and income generation.

It is also important to note that investing in a variety of asset classes provides diversification in your portfolio, which can help protect you from losing all your money if one asset class experiences a loss.

Rethink's AI Appeal to Investors

You may want to see also

Frequently asked questions

This depends on your age and risk tolerance. Generally, younger investors can afford to take on more risk for higher returns, while older investors may want to adopt a more conservative strategy to preserve their capital.

Stocks are volatile but offer the best growth potential. Experts recommend retirees maintain some exposure to stocks to hedge against inflation. The exact percentage will depend on your age, risk tolerance, and spending needs.

Bonds are a lower-risk option than stocks and can act as a ballast during market downturns. They are also a good option for short-term income. However, in the current era of low interest rates, they may not provide the returns retirees need to keep up with inflation.

Other options include certificates of deposit (CDs), cash, annuities, and alternative investments like precious metals or private investments. The right mix will depend on your financial goals, risk tolerance, and time horizon.