When preparing a balance sheet, the order in which long-term investments are listed is crucial for providing a clear and accurate financial snapshot. This section of the balance sheet offers insights into a company's long-term financial commitments and assets. The order in which these investments are presented can impact how stakeholders, including investors and creditors, perceive the company's financial health and stability. Understanding the appropriate sequence for listing long-term investments is essential for effective financial reporting and analysis.

What You'll Learn

- Historical Cost: Investments are recorded at their original purchase price

- Fair Value: Adjustments for market fluctuations are made regularly

- Impairment Testing: Regular assessments to identify potential losses

- Tax Implications: Consideration of tax laws for investment gains/losses

- Disclosure Requirements: Clear presentation of investment details in financial statements

Historical Cost: Investments are recorded at their original purchase price

When it comes to presenting long-term investments on a balance sheet, one of the most common methods is to record them at their historical cost. This approach is based on the principle of conservatism in accounting, which emphasizes the importance of being cautious and conservative in financial reporting. By using the historical cost, companies can provide a more accurate representation of their financial position and the value of their investments over time.

The historical cost of an investment refers to the amount originally paid to acquire the asset. This includes the purchase price, any additional costs directly attributable to the acquisition, and any costs incurred to bring the investment into its present condition. For example, if a company buys shares in a publicly traded company for $100,000, the historical cost of these shares would be $100,000. This cost remains fixed and is not adjusted for market fluctuations or changes in the investment's value.

Recording investments at historical cost has several implications. Firstly, it provides a stable and consistent basis for comparison over time. This is particularly useful for investors and analysts who want to track the performance and value of a company's investment portfolio. By using historical cost, they can assess the return on investment and make informed decisions about buy or sell decisions. Secondly, this method ensures that the balance sheet reflects the initial investment amount, which can be crucial for financial reporting and compliance purposes.

However, it's important to note that the historical cost method may not always provide a true and fair view of the investment's value. Market conditions and economic factors can significantly impact the investment's worth, which may differ from its historical cost. In such cases, companies might consider using alternative valuation methods, such as fair value or market value, to provide a more up-to-date and accurate representation of their investments.

In summary, recording long-term investments at their historical cost is a widely accepted practice in accounting. It ensures that the balance sheet reflects the original investment amount, providing a stable basis for financial reporting and analysis. While this method has its advantages, it's essential to consider other valuation techniques to stay aligned with market realities and make informed investment decisions.

Understanding Short-Term Investments: Key Traits and Strategies

You may want to see also

Fair Value: Adjustments for market fluctuations are made regularly

When it comes to presenting long-term investments on a balance sheet, the concept of fair value is crucial, especially when market fluctuations are a regular occurrence. Fair value adjustments are an essential practice to ensure that the financial statements accurately reflect the current market conditions and the true worth of these investments. This process involves regularly re-evaluating the investments to account for any changes in market prices or other relevant factors.

Market fluctuations can significantly impact the value of long-term investments, such as stocks, bonds, or real estate. For instance, if a company holds a portfolio of stocks, the market value of these stocks can vary daily based on supply and demand, economic news, and investor sentiment. Similarly, real estate investments may experience value changes due to location-specific factors, market trends, and property condition. Therefore, it is imperative to adjust the recorded value of these investments to reflect the current fair value.

The process of adjusting for market fluctuations typically involves a review of recent sales data, comparable market transactions, and other relevant indicators. For instance, if a company owns a piece of commercial real estate, a recent sale of a similar property in the same market can provide valuable insight into the current fair value. By comparing the sale price of the comparable property with the company's own investment, an adjustment can be made to bring the recorded value closer to the market reality.

Regular adjustments for market fluctuations are essential for several reasons. Firstly, they provide a more accurate representation of the company's financial position, which is crucial for stakeholders, investors, and creditors. Accurate fair value measurements help in making informed decisions regarding the company's investments and overall financial health. Secondly, these adjustments can impact various financial ratios and metrics, such as return on investment, debt-to-equity ratio, and net worth, ensuring that the financial statements remain reliable and transparent.

In summary, fair value adjustments for market fluctuations are a critical aspect of maintaining the integrity of financial statements, especially for long-term investments. Regular re-evaluations ensure that the recorded values accurately reflect the current market conditions, providing a more reliable basis for decision-making and financial reporting. Companies should establish robust processes to monitor and adjust these investments, ensuring compliance with accounting standards and best practices.

Master Long-Term Investing: A Comprehensive Guide to Building Wealth

You may want to see also

Impairment Testing: Regular assessments to identify potential losses

Impairment testing is a critical process that ensures the financial health and accuracy of a company's long-term investments. It involves a systematic approach to identifying and assessing potential losses that may arise from these investments. This process is essential for maintaining the integrity of a company's financial statements and is a key component of financial reporting.

The primary goal of impairment testing is to recognize and quantify any losses that have occurred or are likely to occur in the future. This is particularly important for long-term investments, as they can be subject to various risks and uncertainties over an extended period. By conducting regular assessments, companies can ensure that their financial statements reflect the true value and potential risks associated with these investments.

Here's a step-by-step guide to implementing effective impairment testing:

- Identify the Investment: Start by clearly defining the long-term investment in question. This includes understanding the nature of the investment, such as whether it is a financial asset, an equity investment, or a fixed asset. Each type of investment may have specific impairment criteria and testing methods.

- Analyze Market and Credit Risks: Evaluate the market and credit risks associated with the investment. Market risk refers to potential losses due to changes in market conditions, such as price fluctuations or economic downturns. Credit risk is the possibility of default or financial distress by the investee. Assess the likelihood and potential impact of these risks on the investment's value.

- Perform Impairment Assessments: Conduct regular impairment assessments to identify any losses. This typically involves comparing the investment's carrying amount (the recorded value on the balance sheet) with its recoverable amount, which is the higher of its fair value less costs to sell or its value in use. If the carrying amount exceeds the recoverable amount, an impairment loss is recognized.

- Use Appropriate Testing Methods: Depending on the type of investment, different testing methods can be employed. For example, for financial assets, companies may use the expected loss method, which estimates losses based on historical data and current market conditions. For long-term investments in equity securities, a comparison of the investment's fair value with its purchase price might be used.

- Document and Report: Maintain detailed documentation of the impairment testing process, including the assumptions made and the methods used. If an impairment loss is identified, it should be reported in the financial statements, impacting the investment's value and potentially affecting the company's overall financial performance.

Regular impairment testing is a proactive approach to financial management, allowing companies to make informed decisions and take appropriate actions to mitigate potential losses. It ensures that the company's financial statements provide a true and fair view of its long-term investments, helping stakeholders make better-informed choices.

Decoding the Mystery: What 'MER' Means in Investment Jargon

You may want to see also

Tax Implications: Consideration of tax laws for investment gains/losses

When it comes to the tax implications of long-term investments, understanding the tax laws and their application is crucial for investors and businesses alike. The order in which long-term investments are listed on a balance sheet can have significant tax consequences, especially when it comes to recognizing gains or losses. Here's a detailed breakdown of the considerations:

Capital Gains Tax: One of the primary tax implications is the treatment of capital gains. Long-term capital gains, which are profits from the sale of assets held for more than a year, are typically taxed at a lower rate than ordinary income. The tax rate for long-term capital gains varies depending on the investor's income level and filing status. When listing investments on the balance sheet, it is essential to consider the tax implications of any potential gains. For instance, if an investor sells a long-term investment at a profit, the gain must be reported as income, and the tax liability should be calculated accordingly. Properly categorizing and valuing these investments can ensure accurate tax reporting and compliance.

Tax Deductions and Losses: On the other hand, investors may also consider the tax benefits of long-term losses. When an investment is sold at a loss, it can be used to offset capital gains, reducing the overall tax burden. Additionally, certain tax deductions may be available for investment-related expenses, such as brokerage fees or interest on investment loans. These deductions can help minimize the taxable income from investment activities. It is important to keep detailed records of investment transactions and expenses to support any tax claims and ensure compliance with tax regulations.

Tax Treatment of Investment Income: Another aspect to consider is the tax treatment of investment income, such as dividends, interest, or rental income. These sources of income may be subject to different tax rates and rules. For example, qualified dividends and long-term capital gains are often taxed at lower rates, while ordinary dividends are taxed as ordinary income. Understanding these distinctions is vital for proper tax planning and reporting. Investors should also be aware of any tax credits or incentives available for specific types of investments, as these can further impact the overall tax liability.

Tax Reporting and Compliance: Accurate tax reporting is essential to avoid penalties and legal issues. When listing long-term investments on the balance sheet, investors should ensure that the investments are valued correctly and that any transactions or changes in value are properly documented. This includes keeping records of purchase and sale dates, prices, and any relevant documentation. Proper tax planning and consultation with a tax professional can help investors navigate the complex tax laws and ensure compliance, especially when dealing with multiple investments and different tax jurisdictions.

In summary, the tax implications of long-term investments are a critical consideration when determining the order of listing on a balance sheet. Investors must be mindful of capital gains tax, tax deductions for losses, the treatment of investment income, and the importance of accurate tax reporting. By understanding these tax laws and their application, investors can make informed decisions, optimize their tax strategies, and ensure compliance with the tax authorities.

Decoding the Mystery: What Does DB Stand For in Investing?

You may want to see also

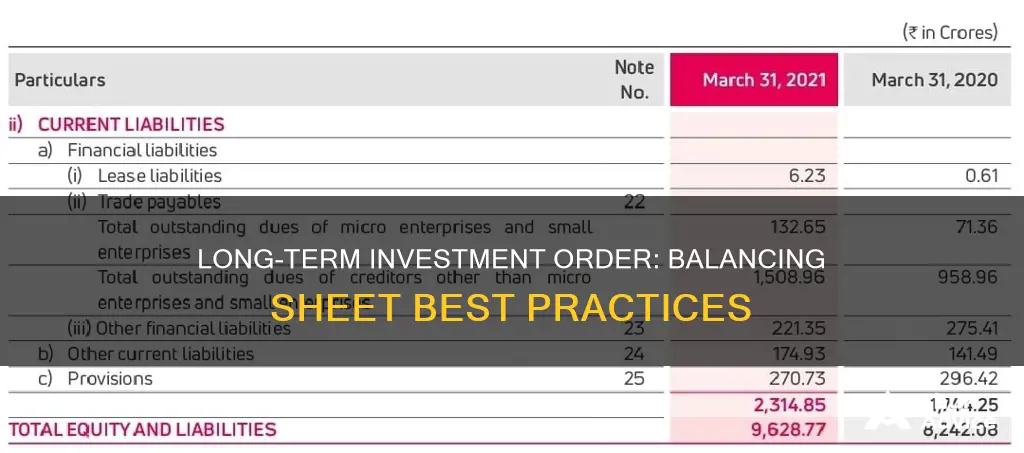

Disclosure Requirements: Clear presentation of investment details in financial statements

When it comes to presenting long-term investments on a balance sheet, the order of listing can vary depending on the accounting standards and the specific circumstances of the company. However, the primary goal is to provide a clear and transparent view of the company's financial position, ensuring that investors and stakeholders can easily understand the composition of the company's assets. Here are some key considerations and guidelines for disclosing investment details in financial statements:

Standardized Approach: Many accounting frameworks, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), provide guidelines for the presentation of financial statements. These standards often specify the order in which items should be listed on the balance sheet. For long-term investments, this typically includes a separate line item or sub-category under the 'Assets' section. The order might be based on the liquidity or maturity of the investments, with more liquid investments appearing before less liquid ones.

Liquidity and Classification: The order of listing should reflect the liquidity and classification of the investments. Liquid investments, such as marketable securities, should be presented before less liquid investments like equity securities or long-term debt investments. This order ensures that users of the financial statements can quickly identify the most easily convertible assets. For instance, under GAAP, marketable securities are reported at fair value, while other investments are classified based on their intended holding period.

Specificity and Detail: Financial statements should provide specific details about each investment category. This includes the cost or carrying amount, any unrealized gains or losses, and the fair value of the investments. For instance, if a company has both equity and debt investments, it should disclose the fair value of each type separately. This level of detail allows users to assess the overall investment portfolio's performance and risk exposure.

Consistency and Comparability: Consistency in the presentation of investment details is crucial for financial reporting. Companies should maintain a consistent approach across different reporting periods to ensure comparability. If a company changes its accounting policies or methods for classifying investments, it must disclose these changes and their impact on the financial statements. This transparency helps investors analyze trends and make informed decisions.

Additional Disclosures: Depending on the complexity of the investment portfolio, companies may need to provide additional disclosures. This could include information about the investment's maturity dates, potential risks, and any significant events or transactions related to the investments. For instance, if a company has significant investments in a single industry or country, it should disclose the concentration risk and its potential impact on the financial position.

By following these disclosure requirements, companies can ensure that their financial statements accurately represent their long-term investment portfolio. Clear presentation and detailed disclosures enable investors to make informed decisions, assess the company's financial health, and understand the potential risks and opportunities associated with its investments.

Maximize Returns: Strategies for Short-Term, High-Yield Investing

You may want to see also

Frequently asked questions

The most widely accepted practice is to list long-term investments in the order of their maturity or expected realization. This means that investments with the earliest maturity date or those that are most likely to be sold or converted into cash in the near future should be listed first.

When investments have varying maturity periods, the balance sheet typically arranges them in descending order of maturity. This ensures that the most liquid investments are at the top, providing a clear picture of the company's short-term financial resources.

Yes, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) provide guidelines in their accounting standards. These standards suggest that investments should be classified and presented based on their level of liquidity and the company's intent to hold them for a specific period.

In such cases, the balance sheet may list the investments by class, providing a detailed breakdown. Each class should be presented separately, and the order within each class can be based on the specific characteristics of the investments, such as risk, yield, or other relevant factors.

The order of listing long-term investments is crucial for financial reporting as it affects the presentation of the company's financial position. It ensures that stakeholders can quickly identify the most liquid assets and make informed decisions about the company's financial health and liquidity.