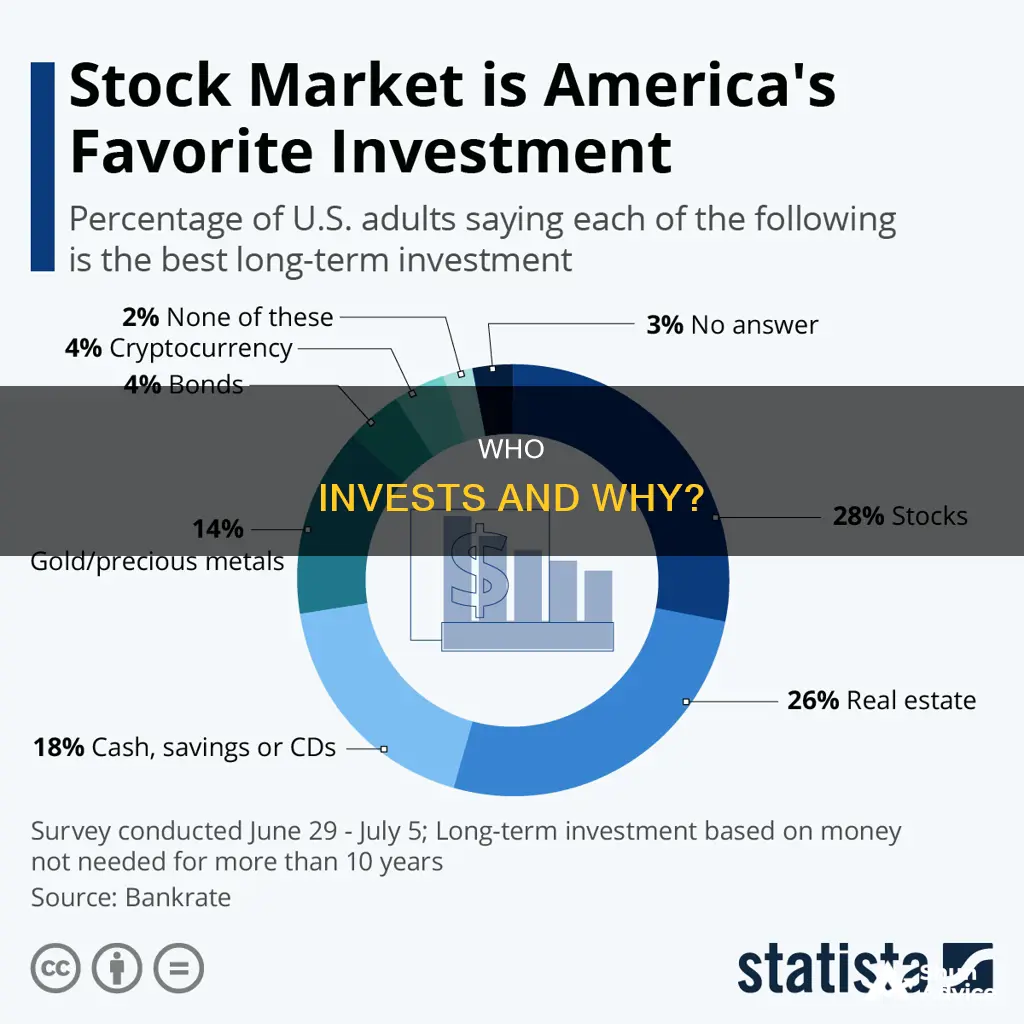

In 2023, 61% of adults in the United States invested in the stock market, according to Gallup. This is up from 56% in 2021 and 55% in 2020, and is the highest it has been since 2008. The percentage of people who invest varies depending on demographic factors such as income, education, age, marital status, and race. For example, in 2023, 84% of adults in households earning $100,000 or more owned stocks, compared to 29% of those earning less than $40,000. Stock ownership is also correlated with age, with 58% of families with a head of household aged 45-54 investing in the stock market, compared to 47% for those over 75.

| Characteristics | Values |

|---|---|

| Percentage of US families invested in the stock market in 2019 | 53% |

| Percentage of US families that directly owned stock in 2019 | 15% |

| Percentage of families in the top 10% of the income distribution that owned stock in 2019 | 92% |

| Percentage of families in the bottom 20% of income earners that held stock in some form in 2019 | 15% |

| Percentage of families in the middle quintile that owned stock in 2019 | 56% |

| Percentage of families with a head of household aged 45 to 54 that owned stock in 2019 | 58% |

| Percentage of people 75 or older that owned stock in 2019 | 47% |

| Percentage of people under 35 that owned stock in 2019 | 48% |

| Percentage of US adults that invested in the stock market in 2023 | 61% |

| Percentage of US adults that own stock in 2023 | 61% |

| Percentage of US adults that own stock in 2024 | 62% |

| Percentage of US families that held stock in 2022 | 58% |

| Percentage of US families that directly held stock in 2022 | 21% |

What You'll Learn

61% of US adults invested in the stock market in 2023

In 2023, 61% of US adults invested in the stock market. This figure has remained steady over the last few years, but it is still below the levels before the Great Recession, when it peaked in 2007 at 65%. The percentage of adults investing in the stock market has been on an upward trajectory since 2013, when it reached a low of 52%.

The way people invest in the stock market has changed over the years. People who buy stock on their own become direct owners, but most people invest indirectly through mutual funds, index funds, or retirement accounts such as a 401(k). In 2019, only 15% of US families directly owned stock, while 53% owned stock in some form, including indirect ownership. This is a shift from 1989, when 17% of families directly owned stock, and 32% owned stock in some form.

Stock ownership is strongly correlated with household income, formal education, age, marital status, and race. In 2023, 84% of adults in households earning $100,000 or more and about 80% of college graduates and postgraduates owned stock, while only 29% of those in households earning less than $40,000 owned stock. There are also racial disparities in stock ownership, with 61% of white, non-Hispanic families owning stock in 2019 compared to 34% of Black families and 24% of Hispanic families.

Investing in People: A Guide

You may want to see also

Stock ownership is strongly correlated with income

The disparity in stock ownership between high and low-income households has been increasing over time. In 2019, 53% of families were invested in the stock market, with only 15% of families in the bottom 20% of income earners holding stock in some form, while 92% of families in the top 10% of the income distribution owned stock. The share of families with direct stock holdings has also decreased over time, falling from 17% in 1989 to 15% in 2019. This decrease has been driven by a shift towards indirect investment methods such as mutual funds and retirement plans.

The correlation between stock ownership and income is also influenced by factors such as race and education. For example, in 2019, 61% of white, non-Hispanic families owned some form of stock, compared to only 34% for Black families and 24% for Hispanic families. Additionally, the percentage of stock ownership is higher among college graduates and postgraduates, with around eight in 10 holding stocks.

The income disparity in stock ownership has important implications for wealth distribution and financial stability. With higher-income households owning a disproportionate share of the stock market, they have greater opportunities for wealth accumulation and are more exposed to the risks and rewards of stock market fluctuations. On the other hand, lower-income households have fewer opportunities to build wealth through stock investments and are more reliant on other forms of investment or savings.

Analyzing Investment Opportunities: Strategies for Success

You may want to see also

Stock ownership averaged 62% between 2001 and 2008

Stock ownership in the United States averaged 62% between 2001 and 2008. This was the highest level of stock ownership in the country, with the rate falling after the 2007-2009 recession and remaining at a reduced level until 2023.

The rate of stock ownership is influenced by various factors, including household income, education, age, marital status, and race. Income appears to be one of the most significant factors affecting stock ownership. In 2023, 84% of adults in households earning $100,000 or more owned stocks, while only 29% of those in households earning less than $40,000 did so. Similarly, in 2019, 92% of families in the top 10% of income earners owned stocks, compared to 15% of families in the bottom 20%.

Stock ownership is also correlated with age, with older Americans being more likely to own stocks. In 2023, 63% of adults aged 65 and older owned stocks, compared to 41% of young adults. This is partly due to higher stock ownership rates among the baby boomer generation, who have continued to hold stocks as they aged.

Marital status and education also play a role in stock ownership rates. In 2023, married Americans were more likely to own stocks than unmarried individuals, and about eight in ten college graduates or postgraduates owned stocks.

It is worth noting that the way people acquire stocks has evolved over time. While in 1989, 17% of US families directly owned stocks, this number had decreased to 15% in 2019. Instead, indirect investment through mutual funds, retirement plans, and other avenues has become more prevalent, contributing to the overall increase in stock ownership.

Whataburger: A Texas Treasure

You may want to see also

The top 1% of wealthy Americans own 49% of stocks

While 61% of U.S. adults, or about 158 million Americans, invest in the stock market, the distribution of stocks is unequal. The top 1% of wealthy Americans own nearly half of all stocks, worth $19.73 trillion. In contrast, the bottom 50% of U.S. adults hold only 1% of stocks, valued at $41 billion. This disparity highlights the stock market's role in exacerbating wealth inequality.

The concentration of wealth in the hands of the top 1% is further evident when examining the broader top 10% of wealthy Americans, who collectively hold 86.9% of stocks, valued at $34.7 trillion. This group has benefited significantly from the stock market, which has been the primary driver of wealth creation and inequality during the Covid-19 pandemic. The total wealth of the top 1% has reached a record high, with stocks contributing to nearly 70% of their wealth gains.

The wealth gap is also evident along racial lines. White Americans own 88.8% of stocks, while Black Americans and Hispanic Americans own a disproportionately smaller share of 0.7% and 0.6%, respectively. This disparity is even more striking when considering that Black Americans make up 13.8% of the population, and Hispanic Americans represent 18.9%.

The stock market's role in wealth creation and inequality is significant. The surge in stock prices has a "wealth effect," boosting consumer confidence and spending, particularly among high-income households. However, this also highlights the economy's vulnerability to stock market fluctuations. While the stock market's gains primarily benefit the wealthy, any decline could have a more widespread impact.

Despite the growing number of new investors during the pandemic, the gains and wealth created by the stock market remain concentrated among the top 1%. This disparity underscores the challenge of wealth inequality in the United States, where the stock market plays a pivotal role in shaping the economic landscape.

Investing: Lessons and Strategies

You may want to see also

Only 15% of US families directly owned stock in 2019

In 2019, 53% of US families were invested in the stock market in some form, according to the Federal Reserve's Survey of Consumer Finances. This is a notable increase from 32% in 1989. However, only 15% of US families directly owned stock in 2019, a decrease from 17% in 1989. This means that most families who owned stock in 2019 did so indirectly, through avenues such as mutual funds, index funds, or retirement plans.

The decline in direct stock ownership can be attributed to the increasing popularity of indirect investment options. Innovations such as the Internal Revenue Service rules allowing 401(k) contributions to be deducted from paychecks, the development of exchange-traded funds, and the creation of Roth IRA accounts have made it easier for individuals to invest indirectly.

Income and net worth play a significant role in stock ownership. Families with higher incomes and net worth are more likely to own stock and purchase more of it. In 2019, 92% of families in the top 10% of the income distribution owned stock, while only 15% of families in the bottom 20% held stock in some form. The gaps are even more pronounced when it comes to direct stock ownership, with only 5% of families in the bottom quintile holding stocks directly compared to 44% in the top 10%.

Additionally, race and ethnicity also impact stock ownership rates. In 2019, 61% of white, non-Hispanic families owned some form of stock, compared to 34% for Black families and 24% for Hispanic families. The median stock value owned by Black and Hispanic families was $15,000, while it was nearly $51,000 for non-Hispanic white families.

While the stock market can be a valuable tool for building wealth, it is important to note that direct stock ownership has been declining, and the distribution of stock ownership is uneven across income, racial, and ethnic groups.

Green Investments: Improving Our Environment

You may want to see also

Frequently asked questions

The percentage of people actively investing in the stock market varies depending on the demographic group. Overall, about 61% of U.S. adults or 158 million Americans invest in the stock market as of 2023. This number has been steadily increasing over the years, up from 56% in 2021 and 55% in 2020.

Stock ownership is strongly correlated with income, with 84% of adults in households earning $100,000 or more owning stocks, compared to 29% in households earning less than $40,000. Stock ownership is also influenced by education, age, marital status, and race.

People can invest in the stock market directly by purchasing individual stocks or indirectly through mutual funds, index funds, or retirement accounts like 401(k)s. According to the Federal Reserve, 58% of U.S. families held stock in 2022, while only 21% directly held stock.