Index funds are a popular investment choice for those seeking a low-cost, diversified portfolio. They are a type of mutual fund or exchange-traded fund (ETF) that tracks a stock market index, such as the S&P 500 or the Dow Jones Industrial Average. By investing in an index fund, individuals can gain exposure to a broad range of stocks with the potential for long-term returns that typically beat actively managed accounts.

One of the key advantages of index funds is their passive management strategy. Unlike actively managed funds, index funds aim to mirror the performance of a specific index by purchasing stocks of every company listed on that index. This means they don't require fund managers to actively decide which investments to buy or sell, resulting in lower fees for investors.

When considering investing in index funds, it's important to research and analyze different funds based on factors such as company size, geography, business sector, market opportunities, and expenses. Additionally, individuals should determine their investment goals and risk tolerance before deciding where and how much to invest.

Index funds offer a convenient and cost-effective way to invest in the stock market, providing diversification and potential long-term returns. However, it's important to remember that there are still risks associated with any investment, and individuals should carefully consider their financial situation before making any investment decisions.

What You'll Learn

What is a total market index fund?

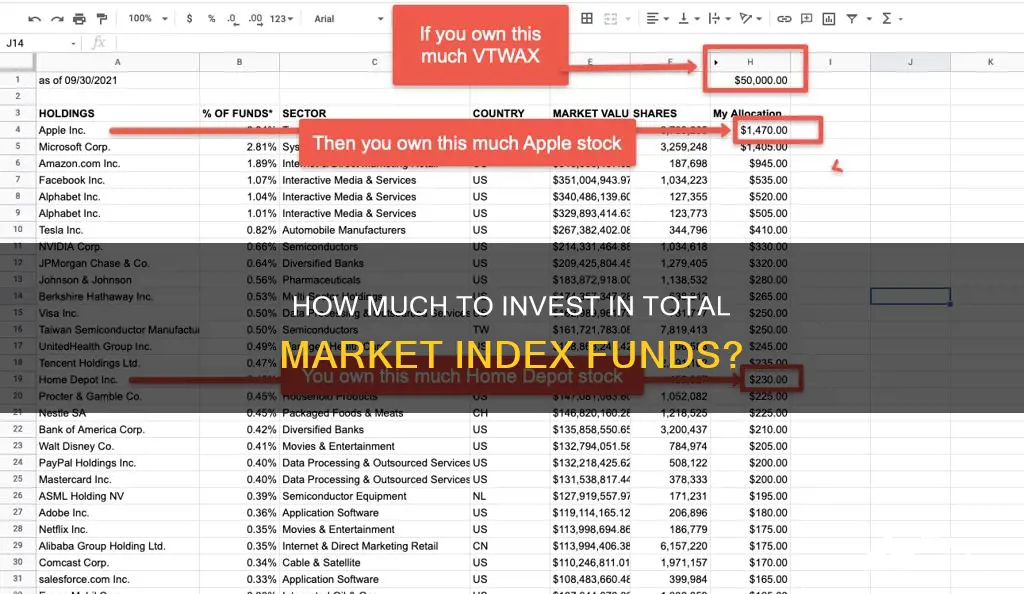

A total market index fund is a mutual fund or exchange-traded fund (ETF) that tracks an index representing the entire stock market of a country or region. These funds aim to duplicate the returns of the entire stock market by holding stocks from companies of all sizes, from small-cap to mid-cap to large-cap. This provides investors with an easy way to add extensive diversification to their portfolios.

Total market index funds typically follow broad equity indexes like the Dow Jones U.S. Total Stock Market Index, the CRSP US Total Market Index, the Russell 3000, or the Wilshire 5000 Total Market Index. These indexes use a sampling of stocks from the entire available universe of stocks in a country or region to create an approximation of the entire stock market.

Some total market index funds, like the Fidelity ZERO Total Market Index Fund (FZROX), track proprietary indexes to avoid licensing fees. The FZROX, for example, tracks the Fidelity U.S. Total Investable Market Index and charges no annual expense ratio.

While total market index funds aim to replicate their benchmark indexes, they are not always exact duplicates. Some funds own a representative cross-section of their benchmark, and weightings may differ between the fund and the benchmark. Additionally, some funds don't own all the securities in their benchmark, and some hold securities that their benchmarks do not.

Total market index funds are a popular investment choice due to their low fees and broad diversification. By investing in these funds, individuals can benefit from a country's or region's economic growth without having to select specific companies to invest in.

SBI Mutual Funds: Safe Investment Option?

You may want to see also

What are the pros and cons of investing in total market index funds?

The percentage of investment in total market index funds depends on an individual's investing goals, current financial circumstances, and risk tolerance. It is always recommended to consult a financial advisor to determine the most suitable allocation. Now, let's explore the advantages and disadvantages of investing in total market index funds.

Pros of Total Market Index Funds:

- Diversification: Total market index funds offer broad diversification across market capitalisations and investment styles. By investing in a single security, you gain exposure to a wide range of stocks and sectors, reducing the risk of loss from concentration in a specific company or sector.

- Low Fees: These funds are known for their low expense ratios, meaning you pay minimal fees relative to the amount invested.

- Minimal Research Required: Since these funds aim to match the overall stock market performance, you don't need to spend time researching individual sectors or companies.

- Long-Term Equity Returns: By investing in a total market fund, you can achieve the long-term stock market returns of the specific region, as long as you remain invested.

- Geographic Exposure: These funds provide an easy way to quickly add geographic exposure to your investment portfolio.

- Simplicity: Total market index funds are straightforward to invest in, as you can buy and sell them like any other stock or ETF.

- Low Cost: Total market index funds are often passively managed, meaning fund managers do not aim to beat the market, resulting in lower costs.

Cons of Total Market Index Funds:

- Limited Growth: Your returns are tied to the overall stock market performance, and choosing different total market funds is unlikely to significantly impact your returns.

- Drawbacks of Broad Diversification: The broad diversification of these funds may cause you to miss out on significant gains in specific sectors or segments of the market. If small-cap stocks outperform, for example, a total market fund is likely to lag in returns.

- Discipline Challenge: Investing in total market index funds can be boring, and it may be challenging to stick to the strategy when other areas are performing better.

- No Downside Protection: Total market index funds do not hold low-volatility assets or bonds, so they cannot cushion the impact of a declining stock market.

- Lack of Control: You don't have control over security selection in an index fund, as the fund manager decides which securities are held within the fund.

- Market Performance Limitation: The best return a total stock market index fund can provide is that of the broader market. It cannot outperform the market.

- Volatility: Stock indexes, and by extension, index funds, can experience significant volatility, as seen in 2020.

- Limited Flexibility: Index funds are restricted to established investment styles and sectors due to their lack of flexibility.

- Inability to Duplicate Top Fund Managers: Index funds cannot replicate the approaches of the most successful fund managers, and certain investment strategies may not be available through ETFs.

In summary, total market index funds offer broad diversification, low fees, and simplicity but may provide limited growth potential and lack the flexibility to adapt to market conditions or duplicate top fund managers' strategies. It is essential to consider your investment goals and risk tolerance before investing and always consult a financial advisor for personalised advice.

Smart Strategies for Investing in Low-Cost Mutual Funds

You may want to see also

What are some top-performing total stock market index funds?

Total stock market index funds are a great way for investors to access a broadly diversified portfolio of stocks at a very low cost. Here are some of the top-performing total stock market index funds:

Vanguard Total Stock Market Index Admiral Shares (VTSAX)

With total net assets of $1.6 trillion, this fund seeks to track the investment results of the CRSP US Total Market Index. It is designed to provide investors with exposure to the entire US equity market, including small, mid-sized, and large companies. The fund's goal is to provide low-cost, broad exposure to the equity markets by investing in companies that primarily trade on the New York Stock Exchange (NYSE) and NASDAQ. VTSAX had a one-year return of 25.61% and an expense ratio of 0.04% as of June 20, 2024. The investment minimum for this fund is $3,000.

Schwab Total Stock Market Index (SWTSX)

The Schwab Total Stock Market Index tracks the total return of the entire US equity market as measured by the Dow Jones US Total Stock Market Index. It is designed to be a comprehensive blend of large, small, and mid-sized corporations. This fund has assets under management of $23.2 billion and a one-year return of 29.33% as of June 20, 2024. It has an expense ratio of 0.03% and no investment minimum.

IShares Russell 3000 ETF (IWV)

The iShares Russell 3000 ETF by BlackRock Inc. is an exchange-traded fund (ETF) that tracks the performance of the Russell 3000 Index, which measures the investment results of the broad US equity market. It has assets under management of $13.7 billion and a one-year return of 29.17% as of June 20, 2024. The expense ratio for this fund is 0.20% and there is no investment minimum.

Wilshire 5000 Index Investment Fund (WFIVX)

The Wilshire 5000 Index Investment Fund is a mutual fund that tracks the investment results of the Wilshire 5000 Index, a capitalization-weighted index of the market value of all actively traded US-headquartered stocks. The fund typically holds more than 3,000 stocks and has assets under management of $260 million. As of June 20, 2024, it had a one-year return of 23.79% and an expense ratio of 0.60%. The investment minimum for this fund is $1,000.

Fidelity Total Market Index Fund (FSKAX)

This fund aims to generate a return that corresponds to the total return on a broad range of US stocks and typically has about 80% of its assets invested in stocks included in the Dow Jones US Total Stock Market Index. It had a year-to-date performance of 15.8% and a historical performance (5-year annual) of 14.1%. The expense ratio for this fund is 0.015%.

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF seeks to track the performance of the CRSP US Total Market Index and invests in large-, mid-, and small-cap companies across the value and growth styles. It had a year-to-date performance of 15.8% and a historical performance (5-year annual) of 14.1%. The expense ratio for this fund is 0.03%.

Schwab US Broad Market ETF (SCHB)

This fund's goal is to track the total return of the Dow Jones US Broad Stock Market Index, which includes companies across the market-cap spectrum. It had a year-to-date performance of 15.8% and a historical performance (5-year annual) of 14.1%. The expense ratio is 0.03%.

IShares Core S&P Total US Stock Market ETF (ITOT)

This fund seeks to track the performance of the S&P Total Market Index and currently holds more than 2,500 securities. It had a year-to-date performance of 15.7% and a historical performance (5-year annual) of 14.1%. The expense ratio for this fund is 0.03%.

SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM)

This fund seeks to match the total return of the S&P Composite 1500 Index, which represents about 90% of the investable US equity market. It had a year-to-date performance of 16.4% and a historical performance (5-year annual) of 14.6%. The expense ratio is 0.03%.

Tudor Funds: A Guide to Investing in Their Success

You may want to see also

How do I invest in an index fund?

Index funds are a great investment for building wealth over the long term. Here is a step-by-step guide on how to invest in an index fund:

- Have a goal for your index funds: Before investing, it is important to know what you want your money to do for you. Index funds are ideal if you are looking to let your money grow slowly over time, especially if you are saving for retirement.

- Research index funds: There are hundreds of indexes you can track using index funds. Some common benchmarks for index funds include the S&P 500, the Dow Jones Industrial Average, the Nasdaq Composite, the Russell 2000 Index, and the Wilshire 5000 Total Market Index. You can also find index funds that focus on specific sectors or types of stocks, such as consumer goods, technology, or health-related businesses.

- Pick your index funds: When choosing an index fund, consider the fund's investment objective, costs, and whether it fits your investment goals. Look for a fund with low costs and ensure that it tracks the performance of the index you want to follow closely.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage. Consider factors such as fund selection, convenience, trading costs, and impact investing when choosing a provider. Some brokers offer commission-free options and no-transaction-fee mutual funds.

- Open an investment account: To purchase shares of an index fund, you will need to open an investment account. A brokerage account, individual retirement account (IRA), or Roth IRA will all work. Compare different brokers and consider their fund selection, fees, and user-friendliness before opening an account.

- Buy shares of the index fund: Once you have selected a broker and opened an account, you can use the money you have transferred into your investment account to buy shares in the index funds you have chosen. You may be able to select a fixed dollar amount to spend or choose a number of shares to purchase.

- Keep an eye on your index funds: Index funds are passive investments, but that doesn't mean you should completely ignore them. Monitor the fund's performance and make sure it is mirroring the underlying index. Also, watch out for increasing fees or expenses that may impact your returns over time.

Smaller Companies, Bigger Returns: Franklin India Smaller Companies Fund

You may want to see also

How do I choose the best index fund?

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. Here are some steps to help you choose the best index fund:

- Have a goal for your index funds: Before investing, it is important to know what you want your money to do for you. If you are looking to let your money grow slowly over time, index funds may be a great investment for your portfolio.

- Research index funds: When investigating an index fund, consider factors such as company size and capitalization, geography, business sector or industry, asset type, and market opportunities.

- Pick your index funds: Choose an index fund based on cost. Low costs are one of the biggest selling points of index funds, as they are cheap to run because they are automated to follow shifts in value in an index.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage. Consider factors such as fund selection, convenience, trading costs, impact investing, and commission-free options.

- Keep an eye on your index funds: Index funds should mirror the performance of the underlying index. Check the index fund's returns on the mutual fund quote page to ensure it is doing its job. Also, watch out for fees that may stack up over time.

Some of the best total market index funds include:

- Vanguard Total Stock Market Index Fund (VTSAX): Tracks the CRSP U.S. Total Market Index and provides investors with exposure to the entire U.S. equity market, including small, mid-sized, and large companies. It has a 0.04% expense ratio and a $3,000 investment minimum.

- Schwab Total Stock Market Index Fund (SWTSX): Tracks the Dow Jones U.S. Total Stock Market Index and has a 0.03% expense ratio and no investment minimum.

- IShares US Stock Market Index Fund (BASMX): Tracks the Russell 3000 Index and strives to cover the entire domestic stock market. It has a higher expense ratio compared to other options but still less than half of its Morningstar category's group average. It also has a $1,000 minimum investment.

- Fidelity Total Market Index Fund (FSKAX): Tracks the Dow Jones U.S. Total Stock Market Index and owns roughly 4,000 stocks. It has a very low expense ratio and is well-diversified.

The S&P Fund: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

A total market index fund is a mutual fund or exchange-traded fund (ETF) that tracks an index focused on virtually the entire stock market of a country or region. Total market funds hold companies across the market-cap spectrum, allowing investors to earn the return of the overall stock market.

There are several benefits of investing in total market index funds, including diversification, low fees, and long-term equity returns. Through one security, investors can achieve broad diversification across market caps and investment styles. Total market index funds are also relatively easy to find with very low expense ratios, meaning investors will likely pay just a few dollars for every $10,000 invested.

When choosing a total market index fund, it is important to consider factors such as the fund's expenses, taxes, and investment minimums. Compare the expenses of different funds that track similar indexes, as costs can vary significantly. Mutual funds tend to be less tax-efficient than ETFs, and many mutual funds have a minimum investment amount of a few thousand dollars.

The amount you should invest in a total market index fund depends on your individual financial goals and risk tolerance. It is generally recommended to have a diversified portfolio that includes a mix of asset classes and investment strategies. Consider speaking with a financial advisor to determine the appropriate allocation for your specific situation.