The cost of hiring a financial advisor varies depending on the fee structure they use. Most financial advisors charge based on a percentage of the total assets they manage for you, which is often around 1% per year. This can range from 0.25% to 1% and sometimes higher. Some financial advisors charge a flat hourly or annual fee instead, which can range from $200 to $400 an hour or $2,000 to $7,500 a year.

Robo-advisors, or computer-based investment services, typically charge lower fees of between 0.25% to 0.50% but may not offer the same level of personalisation and financial planning as traditional advisors.

| Characteristics | Values |

|---|---|

| Percentage of assets under management | 0.25% to 1% per year |

| Flat annual fee | $2,000 to $7,500 |

| Hourly rate | $200 to $400 |

| Fixed fee for a financial plan | $1,000 to $3,000 |

| Mutual fund sales loads | 3% to 6% of your investment |

What You'll Learn

Percentage of assets under management

The percentage of assets under management (AUM) is a common fee structure used by financial advisors. This typically ranges from 0.25% to 1% per year, with robo-advisors usually charging at the lower end of the spectrum.

The percentage fee often follows a tiered schedule, with the rate decreasing as the level of assets increases. For example, a client with $10,000 invested who pays a 0.5% management fee will pay $50 a year, while a client with $100,000 invested will pay $500.

Some advisors may also offer a flat fee for specific services, such as the creation of a financial plan, which can range from $1,000 to $3,000. Others may charge an hourly rate, typically between $200 and $400 an hour.

It's important to note that the fee structure used by a financial advisor can vary, and it's essential to understand the fees and services included before agreeing to work with an advisor.

Fees, Funds and You: The Cost of Investing

You may want to see also

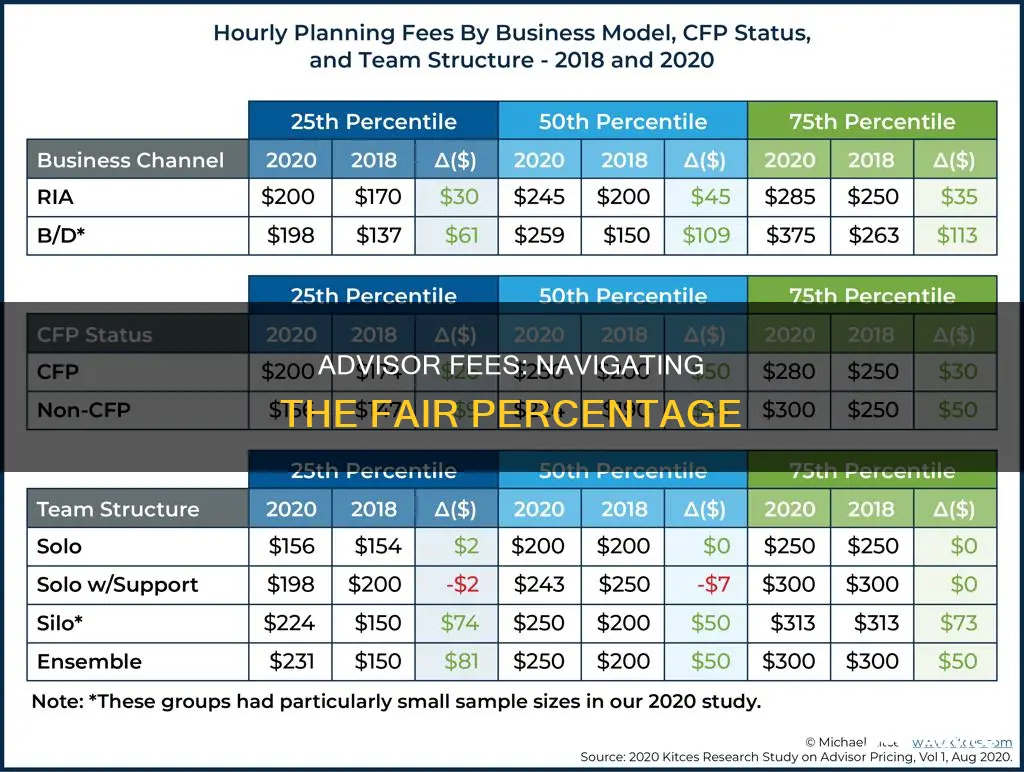

Hourly rate

The hourly rate for investment advisors varies depending on the advisor's experience and expertise. Some advisors charge a flat fee for their services, which can range from $2,000 to $7,500 per year. This typically includes comprehensive financial planning and investment management services. However, the hourly rate for investment advisors can start from $100 per hour and go up to $400 or more for more experienced advisors.

For example, an advisor charging a $2,500 retainer fee at a rate of $250 per hour would provide 10 hours of planning services for the year. Each additional hour would then be billed at the regular hourly rate. It is important to understand the services provided and the expected number of hours to be billed before engaging an hourly fee advisor.

Hourly fee advisors may offer full-service management of your investment portfolio, or they may only provide guidance and leave the money management and investing decisions to you. If you require more hands-on management of your investments, an advisor with a different fee structure may be more suitable.

It is worth noting that some advisors may be open to negotiating their fees, especially if you are bringing a larger number of assets or require fewer services than what they typically provide.

Chinese Investors: Where They Put Their Money

You may want to see also

Flat fee

Flat-fee financial advisors charge a fixed rate for their services, which is often paid annually, quarterly, or monthly. This rate is usually based on the services provided and the advisor's expertise, and it is typically billed directly to the client. Flat-fee structures are often used by fee-only advisors, meaning they do not accept commissions from financial product sales. This helps to reduce conflicts of interest and promote transparency.

There are various types of flat-fee arrangements. Some advisors charge a fixed fee for ongoing investment management, which is not based on the amount you have invested but rather an annual rate. For example, you might pay $6,000 per year ($1,500 per quarter) for investment management.

Another type of flat-fee arrangement is a one-time fee for a time-limited project or engagement, such as a retirement projection or a single meeting with an advisor. This type of arrangement can cost a few hundred dollars to $6,500.

Ongoing flat-fee arrangements involve annual, monthly, or quarterly charges for financial planning services, typically as part of a long-term relationship. These arrangements can be ended by the client at any time (but this should be verified before signing on). The cost of these services can vary significantly, from $1,000 to $10,000 per year or more, depending on the scope and complexity of the financial plan and the advisor's expertise.

Some flat-fee advisors offer a combination of services, such as ongoing investment management and financial planning for a flat annual rate. The specific services included in the flat fee will vary depending on the advisor and the client's needs.

Flat-fee structures can provide several potential benefits. They aim to create a more direct link between the fee charged and the services provided, reducing problems related to asset-based charges. Flat fees can also reduce conflicts of interest, as advisors are not incentivized by asset management amounts and may be more objective in their recommendations. Additionally, flat fees provide predictability and transparency for both advisors and clients.

Smart Ways to Invest $30,000

You may want to see also

Commission

One of the main criticisms of commission-based advisors is whether they keep the investor's best interests at heart when offering a particular investment. The incentive structure may encourage advisors to engage their clients in active trading or sell products that do not benefit the client. The practice of excessive buying and selling of securities in a client's account is called churning and is considered unethical.

A report by the White House Council of Economic Advisors in 2015 estimated that conflicted investment advice costs savers about $17 billion each year.

- Upfront sales fees

- Loads on mutual funds

- Commissions from annuities or other insurance products

- Surrender charges on annuities

- Trailing commissions, where the client pays a fee for each year they own an investment

Guaranteed Returns: Exploring the 5% Club

You may want to see also

Performance-based fees

Performance fees have pros and cons. On the one hand, they incentivize investment managers to earn their clients the most money possible. On the other hand, they may also encourage advisors to take unnecessary risks with their clients' money in the hope of a big payday.

Performance fees are charged in addition to management fees, which are calculated as a percentage of the total assets held under management. Management fees will increase if your investments increase in value.

If you are considering working with a financial advisor, it is important to ask about the types of fees they charge and how they are calculated.

The Mortgage and Investment Balancing Act: Dave Ramsey's Take

You may want to see also

Frequently asked questions

The average fee for an investment advisor is around 1% of assets under management (AUM) annually.

Investment advisors can charge a fixed-rate fee, an asset-based fee, an hourly fee, a commission-based fee, or a performance-based fee.

If you have over $1 million in assets, you may be able to save money by switching to a flat fee.

Yes, you may want to consider a robo-advisor, which is an automated software platform that provides investment advice. Robo-advisors typically charge lower fees than human advisors, but they may not be able to offer the same level of personalisation and service.

It is important to understand the advisor's fee structure and what services are included in that fee. You should also ask about their credentials and certifications, and whether they are a fiduciary, which means they are legally and ethically bound to act in your best interests.