This paragraph introduces the topic of calculating the rate of interest compounded continuously for an investment:

To determine the rate of interest compounded continuously for an investment, we need to delve into the concept of continuous compounding. This method calculates the interest accrued over time by considering the continuous growth of the investment. By understanding the factors influencing continuous compounding, we can accurately assess the true rate of return earned by the investment.

What You'll Learn

- Investment Growth: Calculate the final amount after continuous compounding

- Interest Rate: Determine the rate that led to the investment's growth

- Time Period: Understand the duration of the investment

- Principal Amount: Identify the initial value of the investment

- Compound Interest Formula: Apply the formula to find the interest rate

Investment Growth: Calculate the final amount after continuous compounding

To calculate the final amount of an investment after continuous compounding, you need to understand the concept of continuous compounding and how it differs from regular compounding. Continuous compounding means that interest is calculated and added to the principal amount infinitely often, resulting in a slightly higher final amount compared to regular compounding.

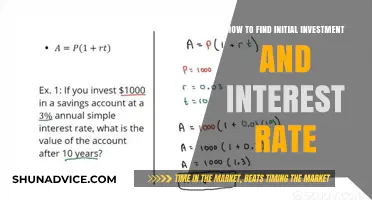

The formula to calculate the final amount (A) after continuous compounding is:

A = P * e^(rt)

Where:

- A is the final amount.

- P is the principal amount (initial investment).

- E is the base of the natural logarithm, approximately equal to 2.71828.

- R is the annual interest rate (as a decimal).

- T is the time the money is invested for, in years.

Here's a step-by-step guide to calculating the final amount:

- Identify the values: Start by gathering the necessary information. You'll need the initial investment amount (P), the annual interest rate (r), and the time period (t) in years. Ensure that the interest rate is in decimal form (e.g., 5% would be 0.05).

- Apply the formula: Plug the values into the formula. For example, if you invest $1000 at an annual interest rate of 4% for 3 years, the calculation would be: A = 1000 * e^(0.04 * 3).

- Calculate the result: Perform the calculation to find the final amount. Using the previous example, A = 1000 * e^0.12 ≈ 1105.17. So, after 3 years, the investment would grow to approximately $1105.17.

It's important to note that continuous compounding can lead to significant growth over time, especially with higher interest rates. This method is often used in financial modeling and can provide a more accurate representation of investment growth when compared to regular compounding periods.

Uncover the Allure of Alternative Investments: Beyond the Ordinary

You may want to see also

Interest Rate: Determine the rate that led to the investment's growth

To determine the interest rate that led to the growth of an investment, we need to analyze the investment's performance over time. This involves understanding the concept of continuous compounding, which is a method of calculating interest that assumes interest is compounded at every moment in time. Here's a step-by-step guide to finding the interest rate:

First, let's assume we have an investment with an initial principal amount, denoted as 'P'. After a certain period, the investment grows to a final amount, 'A'. The formula for continuous compounding is given by:

A = Pe^(rt)

Where:

- A is the final amount after interest.

- P is the principal amount (initial investment).

- E is the base of the natural logarithm (approximately 2.71828).

- R is the annual interest rate (in decimal form).

- T is the time the money is invested for, in years.

To find the interest rate 'r', we need to rearrange the formula and solve for 'r'. Taking the natural logarithm (ln) of both sides of the equation:

Ln(A/P) = rt

Now, we can isolate 'r':

R = (ln(A/P)) / t

This equation allows us to calculate the interest rate 'r' that corresponds to the given final amount 'A', initial principal 'P', and investment time 't'. By plugging in the values specific to the investment in question, we can determine the exact rate of interest that led to its growth.

For example, if an investment grew from $5000 to $8000 over 5 years, you would use the formula with these values:

R = (ln(8000/5000)) / 5

Calculating this will give you the interest rate in decimal form, which can then be expressed as a percentage to understand the investment's growth rate.

Remember, this method assumes continuous compounding, which is a common practice in finance to provide an accurate estimate of the true interest rate over time.

Unlocking Fixed Returns: Exploring Investment Options with Guaranteed Interest

You may want to see also

Time Period: Understand the duration of the investment

Understanding the time period of an investment is crucial in determining its overall performance and the rate of interest it has earned. The duration of an investment refers to the length of time it was held, and this information is essential for investors to assess the potential returns and risks associated with their investments.

When evaluating an investment, the time period provides context to the interest rate calculations. For instance, if an investor wants to know the rate of interest compounded continuously, they need to know the duration to calculate the correct amount. Continuous compounding interest is calculated using the formula: A = Pe^(rt), where A is the final amount, P is the principal amount, e is the base of the natural logarithm, r is the annual interest rate, and t is the time in years. Here, the time period (t) is a critical factor.

To understand the investment's duration, investors should consider the start and end dates of the investment period. This information can be found in the investment statement or financial records. For example, if an investor purchased a bond on January 1, 2020, and sold it on December 31, 2022, the duration of the investment would be 2 years and 11 months. This duration is essential for calculating the continuous compounding interest rate accurately.

Additionally, the time period can also be used to analyze the investment's performance over different periods. Investors can compare the returns from one investment period to another, helping them make informed decisions about future investments. By understanding the duration, investors can better assess the impact of interest rates and market conditions on their investments.

In summary, the time period of an investment is a critical piece of information for investors to calculate the rate of interest compounded continuously. It provides the necessary duration to perform accurate calculations and allows investors to evaluate the investment's performance over different time frames. Knowing the investment's start and end dates enables investors to make informed choices and understand the true value of their investments.

Unlocking Simple Interest: A Guide to Structuring Investment Deals

You may want to see also

Principal Amount: Identify the initial value of the investment

The first step in understanding the performance of an investment is to identify the principal amount, which is the initial value of the investment. This figure is crucial as it represents the starting point for calculating the interest earned. When dealing with investments, the principal amount is the initial sum of money invested or lent, and it forms the basis for all subsequent calculations.

To find the principal amount, you need to gather information about the investment. This could include documents such as investment statements, bank records, or any other relevant financial documents. Look for details such as the initial deposit, loan amount, or the total sum invested. For example, if you invested $5,000 in a savings account, the principal amount would be $5,000.

In some cases, the principal amount might be referred to as the 'initial investment' or 'starting capital'. It is essential to have a clear understanding of this value to accurately calculate the interest earned over time. Without this initial figure, it becomes challenging to determine the actual return on investment.

Once you have identified the principal amount, you can then proceed to calculate the interest earned using the formula for continuous compounding. This formula takes into account the interest rate, time, and the principal amount to determine the final value of the investment. By inputting the known values, you can solve for the interest rate, which will provide an understanding of the investment's performance.

Remember, the principal amount is a critical piece of information that sets the foundation for analyzing investment growth and performance. It is the starting point from which all other calculations and comparisons can be made.

Unlocking Monthly Interest: Top Investment Strategies for Consistent Returns

You may want to see also

Compound Interest Formula: Apply the formula to find the interest rate

The concept of compound interest is a powerful tool for understanding the growth of investments over time. When an investment earns interest, not only does it accumulate the initial principal amount, but it also generates interest on the interest earned, leading to exponential growth. This is where the compound interest formula comes into play, allowing you to calculate the interest rate and understand the potential returns.

The formula for compound interest is a fundamental mathematical equation that can be applied to various financial scenarios. It is given by:

A = P(1 + r/n)^(nt)

Where:

- A is the future value of the investment/loan, including interest.

- P is the principal investment amount (the initial deposit or loan amount).

- R is the annual interest rate (decimal).

- N is the number of times that interest is compounded per year.

- T is the number of years the money is invested or borrowed for.

To find the interest rate (r) using this formula, you need to rearrange it to solve for r. Here's a step-by-step guide:

- Start with the formula: A = P(1 + r/n)^(nt).

- Divide both sides by P to isolate the term inside the parentheses: A/P = (1 + r/n)^(nt).

- Take the natural logarithm (ln) of both sides to bring the exponent down: ln(A/P) = ln((1 + r/n)^(nt)).

- Apply the logarithm power rule: ln(A/P) = nt * ln(1 + r/n).

- Now, divide both sides by nt to solve for r: r = (ln(A/P) / nt) * n.

- Simplify the equation: r = (ln(A/P) / t).

By substituting the known values of A, P, n, and t into this equation, you can calculate the interest rate earned on an investment. This formula is particularly useful when dealing with continuous compounding, where the interest is calculated and added to the principal at every moment, providing a more accurate representation of the investment's growth over time.

For example, if you have an investment with a future value of $12,000, an initial principal of $10,000, and it was compounded continuously over 5 years, you can use the formula to find the interest rate. This process involves plugging in the values and solving for r, which will give you the rate of interest that led to this growth.

Unraveling the Magic: How Investments Generate Interest

You may want to see also

Frequently asked questions

To determine the rate of continuous compounding interest, you can use the formula: A = P * e^(rt), where A is the amount of money accumulated after n years, including interest, P is the principal amount (initial investment), e is the base of the natural logarithm (approximately 2.71828), r is the annual interest rate (in decimal), and t is the time the money is invested for in years.

In that case, you can rearrange the formula to solve for 'r'. The formula becomes: r = (ln(A/P)) / t, where ln represents the natural logarithm. This equation will give you the annual interest rate as a decimal.

Yes, this formula is applicable for continuous compounding over any period. You simply need to know the initial investment amount, the final amount after the investment period, and the duration of the investment.