When it comes to structuring a simple interest investment deal, there are a few key considerations to keep in mind. Firstly, it's important to understand the basics of simple interest, which refers to the straightforward crediting of cash flows associated with an investment or deposit. The formula for calculating simple interest is A = P(1 + rt), where A represents the total accrued amount, P is the principal amount of money invested, r is the interest rate per period, and t is the number of periods. Secondly, the type of investment deal needs to be determined, whether it's debt investment, equity investment, or convertible debt. Equity investment, for example, involves an investor buying a piece of ownership in the business, entitling them to a percentage of future profits. Proper structuring also involves drafting a comprehensive investment agreement that outlines bylaws, interests, profits, equity stakes, and other pertinent details. Finally, it's crucial to seek legal advice to ensure that the rights and interests of all parties involved are protected, especially when dealing with startups or investments from friends and family, as these can come with their own set of advantages and challenges.

How to Structure a Simple Interest Investment Deal

| Characteristics | Values |

|---|---|

| Type of investment | Debt investment, equity investment or convertible debt |

| Interest | Simple interest is straightforward and predictable, but may not always offer the best deal |

| Investment agreement | Should explain bylaws, interests, profits, equity stakes, and other necessary details |

| Investment source | Friends and family can offer competitive interest rates and flexible repayment plans, but may cause relationship strain |

| Legal considerations | Both parties should seek the advice of experienced legal counsel to ensure their rights and interests are protected |

What You'll Learn

Drafting an investment agreement

When drafting an investment agreement, it's important to consider the type of investment deal you want to structure. There are three main ways investors can provide funding to your small business: debt investment, equity investment or convertible debt. With equity investment, an investor will buy an ownership stake in your business. For example, an investor might provide $100,000 in cash for a 10% ownership stake, meaning they will receive 10% of whatever profits you make.

When structuring an investment deal, it's important to draft an agreement that explains bylaws, interests, profits, equity stakes, and other necessary details. The agreement should also outline the regulatory compliance that will be required.

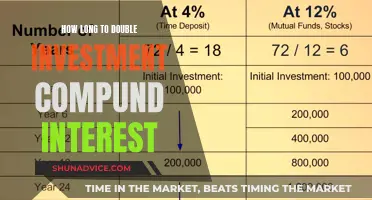

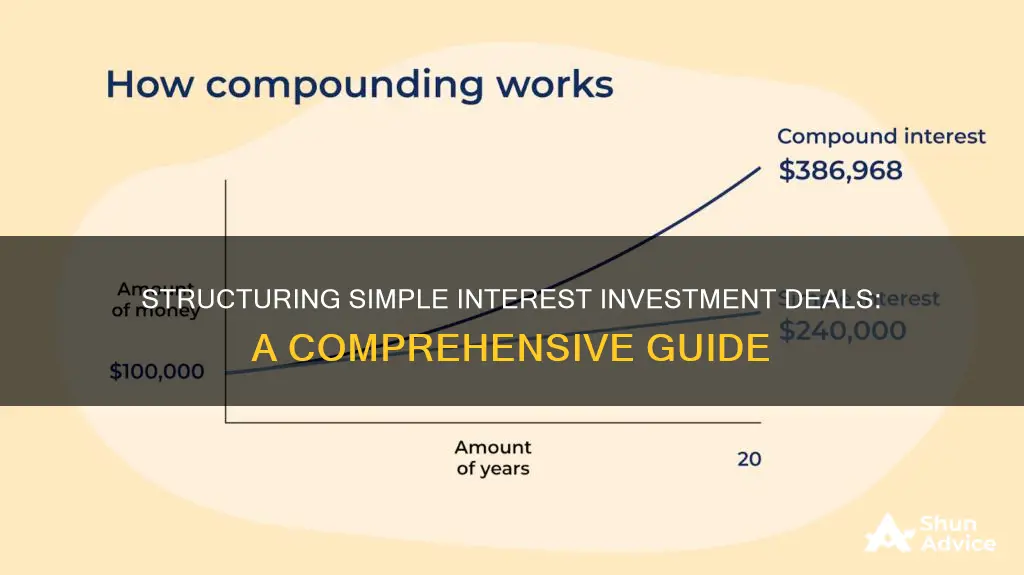

It's also worth noting that simple interest refers to the straightforward crediting of cash flows associated with some investment or deposit. For instance, 1% annual simple interest would credit $1 for every $100 invested, year after year. However, simple interest does not take into account the power of compounding, or interest-on-interest, where after the first year the 1% would actually be earned on the $101 balance—adding up to $1.01.

Before entering into any investment deal, it is critical that both parties seek the advice of experienced legal counsel to ensure that all of their rights and interests are protected. The stage, size and industry of your business, as well as how much you are seeking to raise and the time frame will all factor into the deal structure.

Invest Wisely: Utilize UK Compound Interest

You may want to see also

Friends and family lending

However, there are some potential drawbacks to this approach. Money may change relationships between friends and family. Indebted family members may start exerting power and control over the borrower. The investor may start criticising your business decisions and any business spending. The casual relationship between family and friends can become strained in this shift of power.

To avoid this, it is important to properly structure the investment deal. This means drafting an investment agreement that explains bylaws, interests, profits, equity stakes, and other necessary details. It is critical that both parties seek the advice of experienced legal counsel to ensure that all of their rights and interests are protected.

There are three main ways investors can provide funding to your small business: debt investment, equity investment or convertible debt. With equity investment, an investor will buy a “piece of the pie,” or ownership stake in your business. For instance, an investor might provide $100,000 in cash for a 10% ownership stake, meaning they will receive 10% of whatever profits you make down the road. When calculating the interest on this investment, you can use the simple interest formula: A = P(1 + rt). A = total accrued, P = the principal amount of money (e.g. to be invested), r = interest rate per period, t = number of periods.

Understanding the Correlation Between Interest Rates and Investments

You may want to see also

Debt investment

Debt investing has long been the business of large banks, but new investment opportunities have made this a more mainstream option that’s permitted even small-time investors to get in on the game. Debt investors seek to profit from financing costs accepted by individuals and businesses willing to pay financing fees to obtain immediate access to cash.

Vanguard's Fixed Interest Investments: What Are Your Options?

You may want to see also

Equity investment

When structuring a simple interest investment deal, there are several factors to consider. The type of investment, the stage, size and industry of the business, the amount of funding required, and the time frame will all impact the deal structure.

Before entering into any investment deal, it is crucial to seek legal advice to protect the rights and interests of all parties involved. The type of entity the business is will determine the securities that can be offered to investors and the regulatory compliance required. A properly structured investment agreement should outline bylaws, interests, profits, equity stakes, and other pertinent details.

Friends and family can be a source of investment, offering competitive interest rates and flexible repayment plans. However, it is important to consider the potential impact on relationships. Money can change dynamics, and investors may exert power or criticise business decisions.

Simple interest refers to the straightforward crediting of cash flows associated with an investment or deposit. For example, 1% annual simple interest would credit $1 for every $100 invested each year. It does not account for compounding interest, where the interest is earned on the new balance, resulting in slightly higher returns.

Investing During a Fed Interest Rate Cut: A Guide

You may want to see also

Regulatory compliance

Before entering into any investment deal, it is critical that both parties seek the advice of experienced legal counsel to ensure that all of their rights and interests are protected. This is especially important when dealing with friends and family, who may be able to offer more flexible solutions than peer-to-peer websites, angel investments, venture capitalists, and bank loans, but who may also exert power and control over the borrower.

The structure of an investment deal will also depend on the stage, size and industry of the business, as well as how much money is being raised and the time frame. There are three main ways investors can provide funding: debt investment, equity investment or convertible debt. With equity investment, the investor will buy an ownership stake in the business and will receive a percentage of the profits.

It is important to draft an investment agreement that explains bylaws, interests, profits, equity stakes, and other necessary details. This will help to ensure that the deal is structured fairly and that both parties understand their rights and obligations.

Unleashing the Power of Uninterrupted Compound Interest: A Guide

You may want to see also

Frequently asked questions

A simple interest investment deal is one where the interest is calculated as a straightforward crediting of cash flows associated with some investment or deposit. For example, 1% annual simple interest would credit $1 for every $100 invested, year after year.

Simple interest investment deals are often more flexible than other types of investment deals, such as peer-to-peer websites, angel investments, venture capitalists, and bank loans, which often have stricter legal requirements.

Simple interest investment deals do not take into account the power of compounding, or interest-on-interest, where after the first year the interest would actually be earned on the new balance.

Simple interest investment deals can be offered by friends and family, who can offer investments easily, at competitive interest rates, and with a more reasonable repayment plan. However, it is important to note that money may change relationships between friends and family.

The legal considerations involved in structuring any investment deal, including a simple interest investment deal, are complex and numerous. It is critical that both parties seek the advice of experienced legal counsel to ensure that all of their rights and interests are protected.