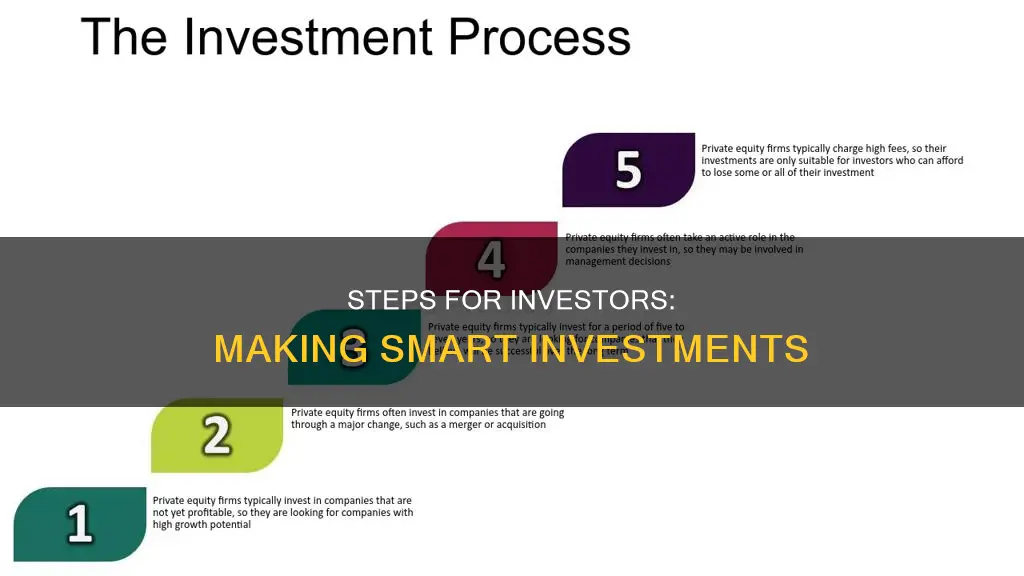

Investing is a strategic approach to secure financial stability and build wealth. It involves a systematic process that, when followed diligently, can yield fruitful results over time. Here are the steps an investor should follow to make an investment:

- Set financial goals: Define your short-term and long-term financial objectives, such as purchasing a car, saving for retirement, or funding a child's education. These goals will guide your investment strategies and provide direction.

- Assess risk tolerance: Understand your comfort level with market uncertainties and fluctuations in the value of your investments. Are you conservative, moderate, or aggressive in your risk appetite?

- Create a budget and emergency fund: Start with disciplined budgeting and build an emergency fund to safeguard your investments from unexpected events.

- Diversify your investment portfolio: Spread your investments across different asset classes, such as stocks, bonds, mutual funds, and real estate. This mitigates risks and ensures a resilient portfolio.

- Conduct research and analysis: Stay updated on economic indicators, market trends, and company financial health to make informed investment decisions.

- Make informed investment decisions: Seek advice from financial experts and continuously monitor your investment performance to ensure it aligns with your goals.

- Regularly review and rebalance your portfolio: Periodically adjust your investment strategies and asset allocation to maintain the desired risk and return levels and adapt to changing circumstances.

What You'll Learn

Define your financial goals

Defining your financial goals is the cornerstone of any successful investment journey. It is imperative to establish both short-term and long-term goals, such as purchasing a car or planning for retirement, and to clearly outline them to provide direction for your investment strategies. This involves determining your investment purpose, timelines, wealth targets, and risk tolerance.

Firstly, you should decide what you are investing for. Are you seeking capital growth, or do you want to generate income? Clarifying your investment purpose will shape how you invest and what you invest in.

Secondly, consider your timelines. Are you planning for the short term or the long term? For instance, investing for retirement typically involves a longer time horizon, allowing for greater potential returns.

Thirdly, outline your wealth target. How much money do you need to achieve your goals? This will help you determine how much you can afford to invest and what kind of returns you need to achieve.

Finally, assess your risk tolerance. Understand your comfort level with market uncertainties and fluctuations in the value of your investments. Are you conservative, moderate, or aggressive in your risk appetite? This will influence the level of risk you are willing to take and the types of investments you choose.

By meticulously setting your financial goals and considering the above factors, you will create a roadmap to guide your investment strategies and ensure that your investments align with your aspirations.

Understanding the Private Equity Investment Cycle

You may want to see also

Assess your risk tolerance

Before investing, it's crucial to assess your risk tolerance, which refers to your ability to withstand fluctuations in the value of your investments. This involves evaluating your comfort level with market uncertainties and understanding your psychological and financial resilience. Are you conservative, moderate, or aggressive in your risk appetite? By assessing your risk tolerance, you can tailor your investment portfolio to align with your temperament and financial goals.

- Risk and Return Trade-off: Understand the relationship between risk and return. Higher-risk investments offer the potential for greater returns but also carry a higher chance of loss. Consider your comfort level with taking on risk and your ability to withstand potential losses.

- Time Horizon: The amount of time you plan to invest for can impact your risk tolerance. If you have a long-term investment horizon, you may be more comfortable taking on higher risks, as you have more time to recover from potential losses.

- Financial Situation: Assess your financial stability and ability to absorb losses. If you have a stable income and sufficient emergency funds, you may have a higher risk tolerance.

- Investment Knowledge and Experience: Consider your level of knowledge and experience in investing. If you are a beginner, you may want to start with a more conservative approach until you gain more experience and confidence.

- Diversification: Diversifying your investment portfolio can help manage risk. By spreading your investments across different asset classes, sectors, and industries, you can reduce the impact of losses in any single investment.

- Risk Capacity and Risk Tolerance: Distinguish between your risk capacity and risk tolerance. Risk capacity is the amount of risk you can financially afford to take, while risk tolerance is your emotional and psychological ability to handle risk. You may have the capacity to take on more risk, but your tolerance may be lower, or vice versa.

- Seek Professional Advice: If you are unsure about your risk tolerance, consider seeking advice from a financial professional. They can help you assess your risk profile and provide guidance on investment options that align with your comfort level.

Remember, assessing your risk tolerance is an important step in creating an investment plan that suits your needs and goals. It ensures that your investments align with your temperament and financial situation, allowing you to make more informed and confident decisions.

Large Cap vs Global Equity: Where to Invest?

You may want to see also

Create a budget and emergency fund

Creating a budget and an emergency fund is an important step in the investment process. It involves disciplined budgeting and building a safety net to protect your investments in the event of unforeseen circumstances. Here are some key considerations:

Track Income and Expenses

Budgeting helps you understand your financial situation by tracking your income and expenses. This allows you to allocate surplus funds towards your investments while ensuring that you can still meet your essential needs and obligations.

Build an Emergency Fund

An emergency fund is a crucial component of financial planning. It serves as a safety net, providing financial security and peace of mind. Ideally, you should aim to save enough to cover at least three to six months' worth of living expenses. This fund can help you navigate unexpected events, such as medical emergencies, sudden job loss, or other financial setbacks. By having an emergency fund in place, you reduce the likelihood of having to liquidate your investments prematurely or make impulsive financial decisions during challenging times.

Prioritise Savings

When creating your budget, prioritise building your emergency fund. Set aside a fixed amount from each paycheck or income source until you reach your target savings amount. Automating your savings by setting up regular transfers to a dedicated savings account can help you stay disciplined and consistent.

Reduce Non-essential Expenses

Review your budget to identify areas where you can cut back on non-essential expenses. For example, you might consider cooking at home more often instead of dining out frequently or cutting back on discretionary purchases. Redirect the money you save into your emergency fund or investments.

Stay Motivated

Building an emergency fund takes time and commitment. To stay motivated, remind yourself of the purpose behind your savings. Visualise the sense of security and peace of mind that will come from having a financial cushion. Consider setting short-term savings goals and rewarding yourself for reaching milestones along the way.

Be Prepared for Emergencies

Once you have built your emergency fund, make sure you can easily access it when needed. Keep your emergency fund in a savings account that is separate from your everyday spending account. Ensure you can quickly transfer or withdraw funds when necessary without incurring penalties or fees.

In summary, creating a budget and an emergency fund is a foundational step for investors. It provides financial discipline, ensures that you have the resources to navigate unexpected events, and protects your long-term investments. By following these steps, you can build a strong financial foundation that supports your investment journey.

Understanding Portfolio Investment Partnerships: A Comprehensive Guide

You may want to see also

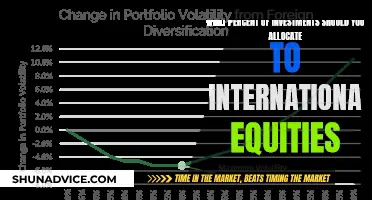

Diversify your portfolio

Diversifying your portfolio is a golden rule of investing. It is a strategy that mitigates risks by reducing the impact of poor performance in any single investment.

Diversification is achieved by spreading your investments across different asset classes, such as stocks, bonds, mutual funds, and real estate. This ensures that a downturn in one sector doesn't devastate your entire portfolio. For instance, when stocks underperform, bonds might flourish, maintaining overall stability.

Diversification also aligns investments with risk tolerance and financial goals, ensuring a resilient portfolio. By not putting all your financial resources into one category, you safeguard your investments, enhancing your chances of steady, long-term growth.

- Don't put all your eggs in one basket: This is a common saying in the investing world, and for good reason. Putting all your money into one investment or business can be disastrous if that venture fails. Instead, spread your holdings across several stocks and, ideally, across various market sectors and asset types.

- Consider your risk tolerance: Understand your risk tolerance and assess your comfort level with market uncertainties. Are you conservative, moderate, or aggressive in your risk appetite? By knowing your risk tolerance, you can tailor your investment portfolio accordingly.

- Mix assets: Established investors often build a portfolio that is a mixture of assets such as stocks, bonds, cash, and property. This diversification helps to reduce the overall risk.

- Invest in funds: If you are a first-time investor, consider investing in funds, which pool your money in a ready-made, diversified portfolio. This is an easy way to get exposure to a variety of investments without having to pick them all yourself.

- Understand the market: Stay updated on economic indicators and market dynamics to anticipate trends. This will help you identify promising opportunities and make prudent choices.

- Seek expert advice: If you are unsure about how to diversify your portfolio, consider seeking advice from financial experts. They can provide nuanced insights tailored to your specific needs and help you develop a strategy that aligns with your risk tolerance and financial goals.

Remember, diversification is a key principle of successful investing. By following the above tips, you can enhance the resilience of your portfolio and improve your chances of achieving your financial goals.

Invest Small, Profit Big: Strategies for Maximum Returns

You may want to see also

Conduct research and analysis

Conducting research and analysis is a critical step in the investment process, enabling investors to make informed decisions and navigate the ever-changing market landscape. Here are some detailed guidelines on how to conduct thorough research and analysis before making investment choices:

- Fundamental Analysis: This involves delving into a company's financial health by examining its financial statements, revenue, profitability, and growth prospects. Analyse key financial ratios, assess the management's competency, and evaluate the competitive advantage of the company within its industry.

- Technical Analysis: Technical analysis focuses on studying market trends, economic indicators, and historical data. It helps investors identify patterns, anticipate market trends, and make data-driven decisions. Utilise charts, graphs, and technical indicators to identify entry and exit points for investments.

- Stay Informed: Stay updated on economic indicators, market dynamics, and industry-specific news. Monitor macro-economic factors such as interest rates, inflation, and geopolitical events that can impact the market. Follow reputable financial news sources and consider using financial market data platforms to access real-time information.

- Risk Assessment: Understand the risks associated with different investment avenues. Evaluate the risk-reward profile of each investment opportunity. Consider factors such as volatility, industry dynamics, and the financial health of the company or asset you intend to invest in.

- Competitor Analysis: Analyse competitors within the same industry or sector. Compare financial performance, market share, and growth strategies. This analysis will help you identify potential investment opportunities or risks that may impact your chosen investment.

- Industry Analysis: Develop a deep understanding of the industry in which you intend to invest. Assess the industry's growth prospects, regulatory environment, and technological advancements. Identify industries with favourable tailwinds and those that may be facing headwinds.

- Due Diligence: Conduct thorough due diligence on the companies or assets you are considering for investment. Review financial reports, analyse management decisions, assess the competitive landscape, and evaluate the company's governance and sustainability practices.

- Information Sources: Utilise a variety of information sources to make informed decisions. Consult financial reports, industry research, news sources, and seek insights from financial advisors or experts in the field. Cross-reference information from multiple sources to ensure accuracy and minimise the risk of making impulsive decisions.

- Continuous Monitoring: Stay vigilant by continuously monitoring your investments and the market. Regularly review the performance of your investments against your goals. Adapt your investment strategy as market conditions change or as your life goals evolve.

By conducting comprehensive research and analysis, investors can identify promising opportunities, mitigate risks, and make prudent investment decisions that pave the way for sustainable financial growth.

Smart Ways to Multiply Your 2000 INR Investment in India

You may want to see also

Frequently asked questions

The first step is to understand your financial goals and risk tolerance. You should also be aware of the risks involved in investing and decide whether it aligns with your personal circumstances.

The amount you invest depends on your financial situation, investment goals, and the timeline for these goals. For example, if you are investing for retirement, it is recommended that you invest 10-15% of your income each year.

This depends on your goals. For retirement, you could choose a 401(k) plan or an individual retirement account (IRA). For education savings, a 529 plan is a good option. A brokerage account is a good choice if you want more control over your investments.

Your investment strategy will depend on your saving goals, the amount of money you need, and your timeline. If your goal is long-term, you can invest mostly in stocks. For short-term goals, you are better off keeping your money in a low-risk investment portfolio or an online savings account.