There are many reasons why people are hesitant to invest, and it often comes down to fear and a lack of understanding. The media, for example, can stoke fears with misleading headlines, and people may believe that keeping money in a bank is less risky than investing. This is a common misconception, as cash is actually the riskiest asset due to inflation. Social media, friends, and family can also influence people's fears about investing. Additionally, some people may be waiting for the perfect time to invest, but in reality, there is never a perfect time, and those who procrastinate often miss out on potential gains.

Other barriers to investing include being in debt, lacking an emergency fund, saving for a home, and major life events such as the loss of a spouse. It is crucial to address these issues and create a financial plan before investing. People should also be cautious of investing heavily in individual stocks or their employer's stock due to the high risk involved.

| Characteristics | Values |

|---|---|

| Fear | Fear generated by the media, family, and friends |

| Lack of knowledge | Misunderstanding of investing and speculation |

| Procrastination | Waiting for the perfect time to invest |

| Debt | Student loans, credit cards, car loans |

| Emergency fund | Lack of emergency savings |

| Saving for a home | Saving for a down payment |

| Loss of spouse | Death or divorce |

| Major life events | Job loss, medical events |

| High-interest credit card debt | |

| Lack of diversification | Investing heavily in employer's stock or individual stock |

What You'll Learn

Fear generated by the media, family, and friends

Fear is one of the biggest barriers that prevent people from investing. The media, family, and friends can all contribute to this fear, often unintentionally, and sometimes with good intentions.

The Media

The media plays a significant role in shaping public opinion and perceptions, and this includes perceptions about investing. Media outlets often use fear-inducing headlines and sensationalism to attract viewers, readers, or listeners. This can create a perception that investing is riskier than it actually is, especially for those who don't fully understand investing. As a result, some people may be discouraged from investing and choose to keep their money in a bank account, which, in the long run, could lead to losing money due to inflation.

Social Media

The rise of social media has added another layer of complexity to this issue. With the constant stream of information and updates, it's easy to feel overwhelmed and fall prey to the fear of missing out (FOMO). This fear can lead to impulsive decisions, such as following investment trends without proper research, which can have detrimental consequences.

Family and Friends

The influence of family and friends can also impact an individual's perception of investing. Hearing about negative experiences or receiving unsolicited advice can create or reinforce a fear of investing. Additionally, some people may feel pressured to follow the investment decisions of their peers, which can lead to herd mentality and potentially costly mistakes.

It's important to recognize that while the media, family, and friends can provide valuable information and perspectives, it's essential to make informed and rational investment decisions based on one's own research and financial goals. Diversifying one's portfolio and setting clear investment strategies can help mitigate some of the fears generated by these external factors.

While fear is a powerful emotion that can deter people from investing, understanding its sources and learning how to manage it effectively can empower individuals to make more confident and successful investment choices.

Inheriting Wealth: How to Invest

You may want to see also

Lack of financial knowledge

A lack of financial knowledge is one of the biggest barriers to investing. Many people don't understand investing and may wrongly believe that keeping their money in a bank is less risky than investing it. This misconception is perpetuated by the media, which often presents investing as a risky and unpredictable endeavour.

Financial literacy is crucial to making informed investment decisions. It empowers individuals to evaluate their financial goals, risk tolerance, and the various investment options available to them. By understanding the basics of investing, individuals can make more confident and strategic choices. This includes knowing the difference between short-term and long-term investments, the potential risks and rewards of different asset classes, and how to build a diversified portfolio that aligns with their goals.

For example, individuals with a long-term investment horizon, such as saving for retirement, are likely to benefit from investing in asset categories with greater risk, like stocks or mutual funds. On the other hand, investing solely in cash or cash equivalents may be more suitable for short-term financial goals, although it carries the risk of inflation eroding returns over time.

Additionally, a lack of financial knowledge can lead to poor decision-making during market downturns. It's important for investors to understand that market volatility is a normal part of investing and that a long-term perspective is crucial. Reacting emotionally to market downturns, such as selling investments at their lowest point, can lock in losses and hinder portfolio recovery.

Financial education can also help individuals identify and avoid common investment pitfalls. For instance, understanding the importance of diversification can prevent them from putting all their eggs in one basket, such as investing heavily in their employer's stock or a single stock. Diversification helps to reduce risk and smoothen the impact of market fluctuations on their portfolio.

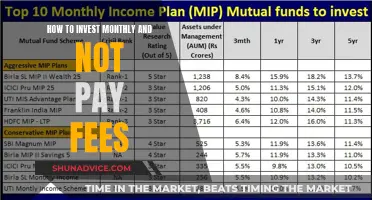

Furthermore, a basic understanding of investment fees and costs can help individuals make more informed choices. For example, knowing about employer-sponsored retirement plans and the potential for "free money" through employer matching contributions can be a significant advantage for long-term financial planning.

In summary, a lack of financial knowledge can hinder individuals from investing effectively. By educating themselves about investing, individuals can make more informed decisions, better manage their risk, and ultimately work towards achieving their financial goals.

Young Investors: Where to Begin?

You may want to see also

Debt

The type of debt can vary, from student loans to credit cards and car loans, all of which diminish an individual's capacity to invest. Moreover, debt often carries interest, increasing the overall financial burden. High-interest debt, such as credit cards, can be particularly detrimental to long-term financial health.

For those with disposable income, debt repayment should be a priority. Focusing on clearing high-interest debt first can alleviate the strain on finances and free up money for investing. It is worth noting that some debt instruments, like mortgages, can offer tax benefits, making them more manageable.

Businesses also grapple with debt financing, which can be essential for growth but carries risks. Small and new businesses, in particular, may struggle with debt financing due to inconsistent cash flow and the burden of interest payments.

Invest in Cars: Buyer's Guide

You may want to see also

Lack of emergency funds

A lack of emergency funds can be a significant barrier to investing. Here are some reasons why:

- Unexpected expenses: Life is unpredictable, and emergency funds are crucial to covering unforeseen costs such as medical bills, car repairs, or even emergency pet surgery. Building an emergency fund ensures you have financial cushioning when unexpected expenses arise.

- Market volatility: Investing emergency funds in volatile assets like stocks or real estate can be risky. If you need to liquidate these investments quickly to cover an emergency expense, you may be forced to sell at a loss. It's essential to maintain liquidity and accessibility for emergency funds.

- Tax consequences: Investing emergency funds in taxable brokerage accounts can trigger tax implications when you sell assets and realise gains. Short-term capital gains tax, typically equivalent to regular income tax rates, applies to profits from assets held for a year or less.

- Peace of mind: Investing without an emergency fund can be stressful, especially during market downturns or economic uncertainty. Knowing you have a cushion of easily accessible funds can provide peace of mind and reduce financial worries.

- Financial security: Emergency funds are a vital component of financial security and resilience. They help you maintain financial stability during challenging times, such as job loss or income reduction, by covering essential expenses.

- Opportunity cost: Investing emergency funds may seem tempting, especially with inflation eroding the value of cash. However, the potential for higher returns also comes with the risk of losing your initial investment. Preserving your emergency funds in a savings account ensures you have a reliable source of funds when needed.

Investments: Top Ten Picks

You may want to see also

Saving for a home

Understand the Costs Involved:

The first step is to understand the costs associated with buying a home. These typically include:

- Down Payment: Typically ranging from 5% to 20% of the purchase price. FHA loans for lower-income earners may require as little as 3.5% down, while conventional loans usually require at least 3-5%.

- Closing Costs: Amounting to about 2-6% of the total loan amount, these are the costs associated with completing the sale, including state and local regulations and taxes.

- Moving Expenses: Depending on the distance and the amount of belongings, moving costs can vary from $900 for a local move to over $10,000 for long-distance moves.

- Create a Budget:

To effectively save for these costs, creating a budget is essential. Here are some steps to follow:

- Calculate Monthly Income: Determine your monthly take-home pay, including any income from a spouse or partner who will contribute to the down payment.

- Factor in Recurring Expenses: Note down necessary expenses like rent, student loans, groceries, and utilities. Also, consider non-essential spending on entertainment and restaurants.

- Identify Areas to Cut Back: Look for expenses you can reduce or eliminate. For example, cutting back on impulse shopping, subscription services, or eating out can free up significant funds for your savings.

- Reduce Expenses and Increase Income:

Consider the following strategies to reduce expenses and boost your savings:

- Downsize and Live Below Your Means: Downsizing can significantly contribute to your savings. Moving to a cheaper apartment or getting a roommate can substantially lower your rent.

- Cut Unnecessary Spending: Reduce expenses on dining out, switch to generic-brand groceries, replace vacations with staycations, and cancel unnecessary streaming services or gym memberships.

- Pick Up a Side Hustle: Driving for ridesharing companies, freelancing, or selling products online can all supplement your income and accelerate your savings.

- Save Bonuses and Raises: Instead of increasing your standard of living when you get a raise or bonus, allocate that extra income towards your down payment fund.

- Automate Your Savings:

Set up an automatic withdrawal from your paycheck or bank account to transfer funds directly into a separate savings account dedicated to your home purchase. This ensures that you save consistently and reduces the temptation to spend the money elsewhere.

Explore Down Payment Assistance:

Research down payment assistance programs and grants offered by your state or local government. These programs can provide significant financial support, especially for first-time homebuyers.

Remember, saving for a home requires discipline and a clear financial plan. By following these steps and staying focused on your goal, you'll be well on your way to achieving your dream of homeownership.

Retirement Account: Investing Beyond $5500

You may want to see also

Frequently asked questions

People may be hesitant to invest due to fear generated by the media, family, and friends. Additionally, a lack of understanding of investing may lead to the misconception that keeping money in a bank is less risky than investing.

It is recommended to pause investing if you are in debt, do not have an emergency fund, are saving up for a home, or are dealing with a major life event such as the loss of a spouse.

It is important to evaluate your comfort with taking on risk and create a financial roadmap. Diversifying your investments and taking advantage of "free money" from employers, such as matching contributions, are also recommended.