With interest rates at their highest since the 2007-09 financial crisis, bond yields are at their highest in years. This has led to a surge in investor interest in bonds. But what type of bond fund should you invest in now?

Bonds are debt securities that entitle the holder to receive interest payments. They are considered a safer investment than stocks, as they are less volatile and carry less risk. Bonds are also a good way to diversify your portfolio.

There are several types of bond funds to choose from, including corporate, municipal, and treasury bonds, as well as bond exchange-traded funds (ETFs). When deciding which type of bond fund to invest in, it's important to consider factors such as duration, credit quality, and geography.

For example, longer-duration bond ETFs offer more upside potential when rates fall but carry greater downside risk if rates rise. On the other hand, shorter-duration bond ETFs provide more stability but may sacrifice some upside potential. Credit quality is also important, as lower-quality bonds tend to offer higher yields but come with increased default risk.

Additionally, investors can choose from a variety of geographic options, as many different governments issue debt to fund their needs. International bonds, particularly from emerging markets, can offer higher yields but may also come with increased risks such as currency fluctuations and geopolitical instability.

Ultimately, the type of bond fund that is right for you will depend on your investment objectives, risk tolerance, and time horizon. It's important to do your research and carefully consider the pros and cons of each option before making a decision.

| Characteristics | Values |

|---|---|

| Interest rate sensitivity | Longer-duration bond funds are more sensitive to interest rate changes. |

| Risk | Longer-duration bond funds come with greater downside risk. |

| Upside potential | Longer-duration bond funds offer more upside potential when rates fall. |

| Stability | Shorter-duration bond funds provide more stability. |

| Upside potential trade-off | Shorter-duration bond funds sacrifice some upside potential for reduced sensitivity to rate changes. |

| Credit risk | U.S. Treasury bond funds are known for their stability. |

| Yield | Junk bond funds offer higher yields but come with increased credit risk. |

| Geography | International bond funds, particularly from emerging markets, provide opportunities for diversification. |

| Interest rate regimes | International bond funds expose you to other interest rate regimes. |

| Economic environments | International bond funds expose you to other economic environments. |

| Yield trade-off | International bond funds may offer higher yields in exchange for greater risks. |

| Risks | International bond funds carry risks such as currency fluctuations and geopolitical instability. |

What You'll Learn

Corporate bonds

There are several types of corporate bonds:

- Fixed-rate bonds are the most common. They have a predetermined interest yield that remains constant throughout the bond's term.

- Floating-rate bonds have variable interest rates that change based on benchmarks such as the U.S. Treasury rate. These are usually issued by companies considered below investment grade, or junk bonds.

- Zero-coupon bonds do not come with interest payments. Instead, investors pay below the face value and receive the full value at maturity.

- Convertible bonds give companies the option to pay investors with common stock instead of cash when the bond matures.

When investing in corporate bonds, it is important to consider credit ratings, interest rates, and diversification. Credit ratings provide an indication of the bond's creditworthiness, with AAA being the highest rating. Generally, the lower the credit rating, the higher the interest rate offered to compensate for the increased risk.

In terms of interest rates, longer-term corporate bonds tend to have higher interest rates than shorter-term bonds. It is also worth noting that individual corporate bonds typically require a minimum investment of $1,000, which may make building a diversified portfolio challenging for some investors. An alternative is to invest in a bond fund, which allows for a smaller minimum investment but comes with additional fees and expenses.

When considering whether to invest in corporate bonds, it is essential to weigh the benefits and drawbacks. The biggest advantage of corporate bonds is their stability, as they tend to hold their value across different economic environments as long as the issuing company remains in good financial shape. On the other hand, this stability comes at the cost of lower long-term returns compared to stocks. Additionally, there may be tax implications when holding corporate bonds in a taxable account, as the interest is typically taxable.

Overall, corporate bonds can be a good option for investors seeking stable stores of value for wealth they plan to use within the next five years or less. They are also ideal for those approaching financial goals, as they provide capital preservation and reduced risk compared to the volatility of the stock market.

The Best Time to Invest in Funds: Morning or Evening?

You may want to see also

Municipal bonds

However, municipal bonds do carry interest rate risk. If your money is tied up for 10 or 20 years and interest rates rise, you will be stuck with a poor-performing bond that has lost value.

Additionally, while municipal bonds are exempt from federal taxes, there may be state or local taxes to pay. If you receive Social Security, your bond interest will count towards your adjusted gross income, potentially increasing the amount of tax you owe.

When considering municipal bonds, investors should compare the yields of taxable investment-grade and government bonds using the tax-equivalent-yield formula:

Tax Equivalent Yield = Tax-Free Yield / (1 – Tax Rate).

In general, higher-income investors are likely to benefit more from municipal bonds than those in other tax brackets.

Smart 401k Investing: Choosing the Right Funds for You

You may want to see also

Treasury bonds

T-bonds are traded in a highly liquid secondary market, known as the fixed-income market or the bond market. They are sold at a minimum denomination of $100 and pay semi-annual interest payments until maturity, at which point the owner is also paid a par amount equal to the principal. The interest received is only taxed at the federal level.

T-bonds can be purchased directly from the U.S. Treasury via TreasuryDirect.gov, where you can set up an account and bid at regularly held auctions. The minimum purchase is $100, although the face value of T-bonds is $1,000. They can also be bought from private financial services firms, such as banks or brokerage firms, which may set their own minimum buy-in.

T-bond auctions are held four times a year, and there are two ways to place a bid: non-competitive bidding, where you accept the interest rate decided at the auction, and competitive bidding, where you specify the interest rate you want, but your bid will only be accepted if it is less than or equal to the rate set by the auction.

T-bonds can be held until maturity or sold on the secondary market before they mature. However, they must be held for a minimum of 45 days before they can be sold. The price of T-bonds in the secondary market can be discounted, set at par, or at a premium, depending on economic conditions.

While T-bonds are low-risk, they also offer a comparatively low yield compared to other types of securities. They are less attractive during times of inflation due to their low interest rates and longer terms.

ETFs and Mutual Funds: Key Investment Considerations

You may want to see also

Bond funds

Pros of Bond Funds

- They are a relatively safe investment. Bond values don't fluctuate as much as stock prices.

- They offer a predictable income stream, paying a fixed amount of interest twice a year.

- They can help improve a local school system, build a hospital, or develop a public garden.

- They bring diversification to your portfolio.

Cons of Bond Funds

- They require you to lock your money away for extended periods of time.

- You'll face the risk of interest rate changes.

- There is a risk of the issuer defaulting on its obligations.

- There is less transparency in the bond market than in the stock market.

- The return on investment is substantially lower than with stocks.

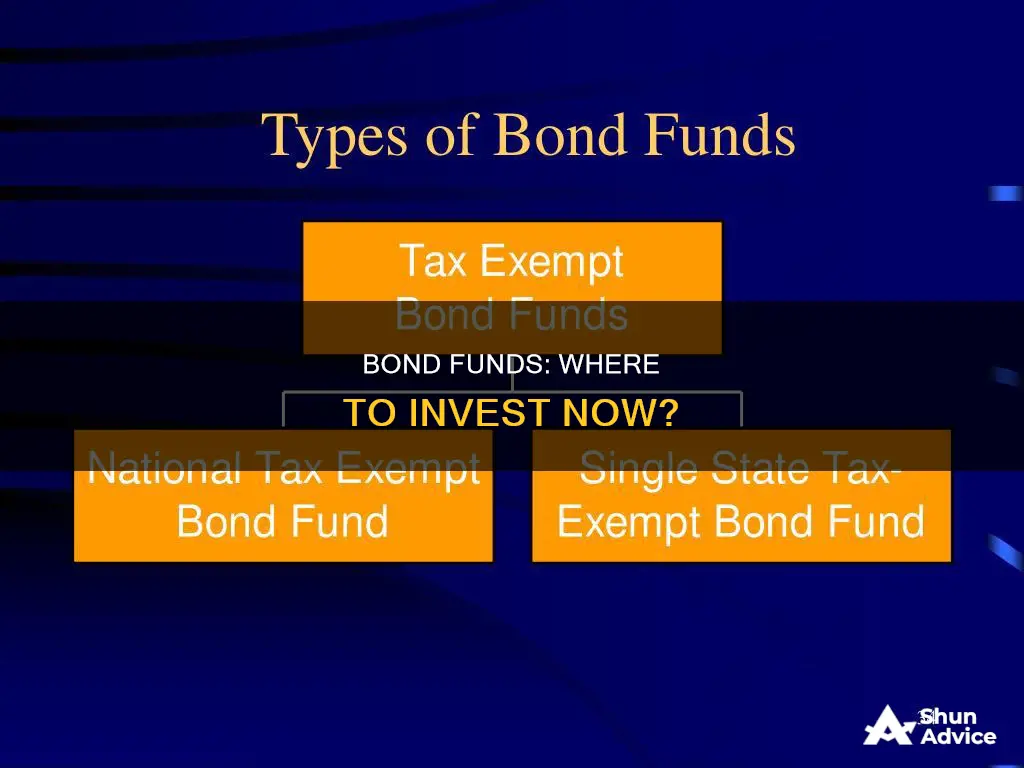

Types of Bond Funds

Domestic Taxable-Bond Funds

These blend government bonds, asset-backed or mortgage-backed securities, investment-grade and high-yield debt, and a modest dose of international bonds.

Flexible-Bond Funds

These can invest across a mix of bond types, including lower-quality bonds and/or international debt. They are the least constrained bond funds.

Government-Bond Funds

These are the highest-quality taxable-bond funds. To be included in one of the US government-bond categories, a fund must keep at least 90% of its assets tucked in government securities.

Corporate-Credit Funds

These favour bonds issued by corporations. There are three categories in this group: corporate-bond funds, high-yield bond funds, and bank-loan funds.

World- and Emerging-Markets Bond Funds

These favour fixed-income securities issued by governments and corporations outside of the US.

Inflation-Protected Bond Funds

These seek to protect investors from rising inflation. They invest in securities whose principal values adjust along with the rate of inflation.

Examples of Bond Funds

- Vanguard Total Bond Market Index Fund Admiral Shares

- PIMCO Total Return Fund

- Dodge & Cox Income Fund

- PIMCO Income Fund

- Vanguard Total International Bond Index Fund Admiral Shares

- Columbia High Yield Bond Fund

- Vanguard Short-Term Treasury Fund Investor Shares

- BlackRock High Yield Municipal Fund Investor Shares

Best TSP Funds to Invest in Now

You may want to see also

Interest rates

In a rising interest rate environment, investors may be inclined to turn to bonds to take advantage of higher yields. This is particularly attractive for short-term bonds, as they have less interest rate risk due to their shorter duration. Additionally, when interest rates are expected to fall, longer-duration bonds become more attractive as they are poised to outperform.

The Federal Reserve's monetary policy decisions, such as adjusting interest rates, can significantly impact the bond market. For example, the Fed's aggressive rate hikes in 2022 led to higher yields and generally lower bond prices. However, predicting interest rate movements can be challenging, and it's important for investors to focus on their long-term investment objectives rather than trying to time the market.

It's worth noting that not all bonds are equally sensitive to interest rate changes. Treasury bonds, backed by the full faith and credit of the U.S. government, are considered risk-free and are less sensitive to interest rate fluctuations. Municipal bonds, issued by local governments to fund public projects, also carry relatively low interest rate risk. In contrast, corporate bonds, issued by companies to raise capital, tend to offer higher interest rates but carry a higher risk of default than government bonds.

IRA Investment Options: Mutual Funds or ETFs?

You may want to see also

Frequently asked questions

The three major types of bonds are corporate, municipal, and Treasury bonds. Corporate bonds are issued by companies to raise capital and usually offer higher yields than government or municipal bonds. Municipal bonds are issued by local governments to raise money for public projects and the interest earned is tax-free. Treasury bonds are issued by national governments and are considered risk-free but offer lower yields than corporate bonds.

Bond funds offer a more stable investment than stocks, with less volatility and lower risk. They also provide a predictable income stream in the form of coupon payments and can help to diversify your portfolio.

It's important to understand the maturity date, rating, and issuer track record of a bond fund before investing. You should also consider your own risk tolerance and investment objectives, and consult an asset allocation calculator based on your age. Finally, remember that bond funds usually include higher management fees and the income they generate can fluctuate.