Venture capitalists (VCs) are private equity investors who provide funding to companies with high growth potential in exchange for an equity stake. VCs typically invest in startups or small companies that lack access to capital markets and need financial support to expand their operations and bring their products to market. This type of investment is often high-risk and high-reward, with VCs aiming for significant returns on their investments. VCs usually invest in companies with strong management teams, large market potential, and unique products or services that give them a competitive advantage. They also consider the industry's familiarity and the potential influence they can have on the company's direction.

| Characteristics | Values |

|---|---|

| Type of Investment | Private equity |

| Who is it for? | Startups and small businesses with long-term growth potential |

| Who is it by? | Investors, investment banks, financial institutions, high net-worth individuals (angel investors), or venture capital firms |

| What is provided? | Financing, technical expertise, or managerial experience |

| What is received? | Equity stake in the company, board seat |

| Risk | High |

Pre-seed funding

To get pre-seed funding, entrepreneurs need to prepare a compelling business plan and prototype, network with potential investors, and pitch their business idea effectively. It is also beneficial to demonstrate market validation, such as customer interest or early sales, to increase the chances of securing pre-seed funding.

The amount of pre-seed funding raised depends on the needs of the startup. In Europe, for example, founders typically secure between €100k and €1M of pre-seed funding.

Best Cash Investments to Make Right Now

You may want to see also

Seed funding

The timing to raise seed funding for a startup can be tricky. Founders should approach seed investors when they believe they have a strong enough product, market, or team to build a company that deserves to be venture-backed. This means that they can scale and grow to the valuations where an investor can generate solid returns on their company.

Math in Finance: Investment Bankers' Secret Weapon

You may want to see also

Early-stage funding

Understanding Early-Stage Companies

An early-stage company is typically defined as one that has tested its prototypes, refined its service model, and prepared a business plan. These companies may have some early-stage revenue but are usually not yet profitable. They are still in the initial “startup phase”, finalising their products or services based on market data and research.

The Challenges of Early-Stage Funding

Securing early-stage funding is not an easy task. Startups face intense competition, with thousands of new ventures entering the market each year. To stand out, entrepreneurs must be able to articulate their vision and demonstrate the potential for future success.

One of the biggest challenges is the financial aspect. Startups require significant capital to develop their products and services, market them effectively, and establish themselves in the market. This often involves a series of funding rounds, as investors are cautious about committing large sums all at once.

Advantages of Early-Stage Investing

Investing in early-stage startups offers investors a unique opportunity to support innovative businesses and promote industry evolution. It allows investors to get involved with the company's process and foster the development of new ideas and technologies. Startups are often founded by ambitious thinkers who are open to advice and guidance, making this a collaborative and rewarding endeavour.

Disadvantages of Early-Stage Investing

Early-stage investing is inherently risky due to the speculative nature of the investments. It can be challenging to assess the true value of a startup, and there is always the risk of overpaying for company shares. Additionally, it may take a significant amount of time for these investments to generate positive returns, and there is no guarantee of success.

The Funding Process

Series A funding is a critical milestone, signalling positive business growth and the potential for long-term success. It is often considered the first stage of venture capital financing, as it provides startups with the financial resources necessary to continue developing their business and scaling their operations.

Pitching to Investors

To convince investors to take on the risk of early-stage funding, startups must be able to clearly articulate their value proposition. This includes addressing the specific market problem they are solving, identifying their target market, demonstrating their unique selling point, and outlining the type and purpose of the investment needed.

Big Data Strategies for Fundamental Investing Success

You may want to see also

Late-stage funding

There are several types of late-stage investors, each with their own unique characteristics and investment patterns. Here are some of the most common ones:

- Traditional Venture Capital (VC) Investors: These investors are often the go-to supporters for funding rounds. They typically participate in rounds up to $50 million and usually expect a seat on the company's board. Traditional VC investors are highly focused on unique business metrics such as macro market trends, overall business strategy, and unit economics. They are also interested in the company's sustainability and potential for longevity.

- Angel Special Purpose Vehicle (SPV): Angel SPVs tend to sponsor investments ranging from $1 million to $50 million in Series A funding and beyond. These investors are often already familiar with the company, having invested in previous funding rounds, and are looking to increase their ownership stake. SPVs thrive on momentum and conduct thorough due diligence before committing.

- Growth Funds: Growth funds are an excellent option for companies seeking investments between $25 million and $500 million. These investors typically target valuations ranging from $100 million to $10 billion. Unlike traditional VC investors, growth funds are less hands-on and more focused on numbers, such as growth rates and customer acquisition costs.

- Hedge Fund Investors: Hedge fund investors typically focus on late-stage companies with funding rounds of $500 million or more. They have extensive experience and are known for their savvy investment strategies. While they usually don't seek a board seat, they are leaders in large markets. To attract their attention, highlight your underlying numbers and long-term cash flows.

- Private Equity Fund Investors: Private equity fund investors usually invest in later-stage rounds, ranging from $10 million to $500 million. They are the most active investors in unicorns and other companies undergoing the later stage of development. They bring the advantage of a massive and diverse network that can open doors for valuable introductions. However, it is important to conduct due diligence when working with private equity funds to avoid potential issues with term sheets.

- Public Market Investors: Public market investors typically deal with large numbers, scoping out valuations in the hundreds of millions to billions and investing up to $500 million. They play a very long game, often holding onto stock even after an initial public offering (IPO). Having these investors on board sends a strong signal to the market about the company's potential.

- Strategic Investors: Strategic investors may come into the picture during early rounds, but they are more commonly involved in later-stage rounds, investing tens of millions to over a billion dollars. They are not deal-breakers when it comes to valuation, and they bring the benefit of a valuable network that can greatly enhance the company's connections and strategic insights.

Strategic Investment: Using SRS for Long-Term Financial Goals

You may want to see also

Equity and debt

Venture capitalists (VCs) are known for making large bets on new startup companies, hoping for a high return on their investment. They provide capital to companies with high growth potential in exchange for an equity stake.

VCs are a form of private equity and a type of financing for startup companies and small businesses with long-term growth potential. They provide financial, technical, or managerial expertise.

VCs are typically very selective in deciding what to invest in. Ventures receiving financing must demonstrate an excellent management team, a large potential market, and, most importantly, high growth potential. This is because VC investments are illiquid and require an extended time frame to harvest.

VCs are compensated through a combination of management fees and carried interest. They receive quarterly payments from limited partners to pay for the firm's investment operations, and they also take a share of the profits of the fund, typically 20%.

VCs can be a critical source of funding for early-stage startups that cannot access loans or capital markets directly. In exchange for VC funding, founders offer investors a percentage of ownership and perhaps a board seat.

VC funding is not expected to be paid back on a planned schedule like a bank loan. VCs typically take a longer-term view and invest with the hope of outsized returns if the company is acquired or goes public.

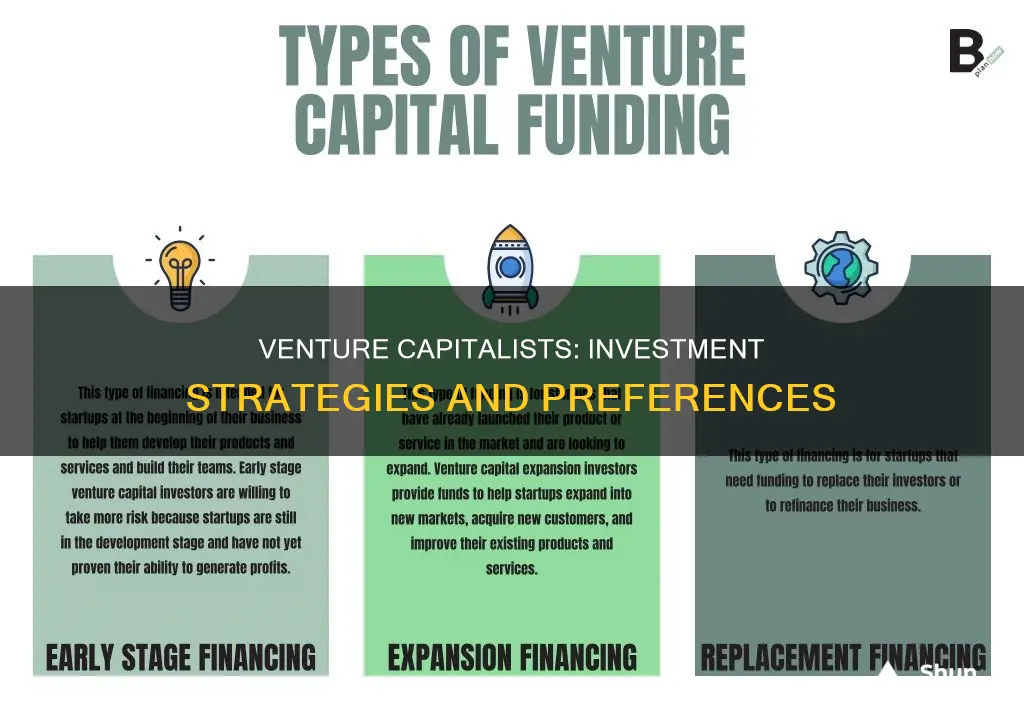

There are multiple stages of venture financing offered in venture capital, roughly corresponding to the stages of a company's development:

- Pre-seed funding: The earliest round of financing needed to prove a new idea, often provided by friends and family, angel investors, startup accelerators, or venture capital funds.

- Early Stage: Early-stage funding includes Seed and Series A financing rounds. Companies use this capital to find product-market fit.

- Growth Capital: Once companies have found product-market fit, companies will use growth capital to scale the business. These are typically larger financing rounds with higher valuations.

- Exit of venture capitalist: VCs can exit through a secondary sale, an initial public offering (IPO), or an acquisition.

VCs provide capital in exchange for an equity stake in the company. This means that they receive ownership of a portion of the company, usually taking a minority stake of 50% or less. The amount of equity they receive depends on the valuation of the company and the amount of funding provided.

VCs also have a degree of control over company decisions and often provide strategic advice to the company's executives on its business model and marketing strategies. They may also have a seat on the company's board of directors, giving them a say in major strategic decisions.

In addition to equity, VCs may also provide debt financing in the form of loans or debt instruments. This is less common but can be used in conjunction with equity funding to reduce dilution.

Overall, VC investment is a risky but potentially highly rewarding form of financing for early-stage companies. The possibility of large losses is factored into the VC's business model, and they anticipate losing money on most investments. However, the potential for high returns makes it an attractive option for startups seeking funding to fuel their growth and innovation.

Cash in Your Investment Allocation: Wise or Unwise?

You may want to see also

Frequently asked questions

A venture capitalist (VC) is a private equity investor who provides capital to companies with high growth potential in exchange for an equity stake.

Venture capitalists typically invest in startup, early-stage, or emerging companies with high growth potential. These companies are often in the technology sector, such as information technology or biotechnology.

Venture capitalists consider several factors when evaluating potential investments, including the management team, business concept and plan, market opportunity, and risk assessment. They look for experienced managers, large market opportunities, and products or services with a competitive edge.

Venture capital provides early-stage companies with the capital needed to bootstrap their operations and can offer mentoring and networking services. However, it can result in a loss of creative control for the company, as VCs may demand a large share of equity and make management decisions.