Cash flow investments are a crucial aspect of financial growth and sustainability for businesses and individuals alike. These investments involve allocating funds towards endeavours that are expected to generate positive cash flow, either in the short or long term. Understanding the different types of cash flow investments is essential for making informed decisions about where to allocate capital.

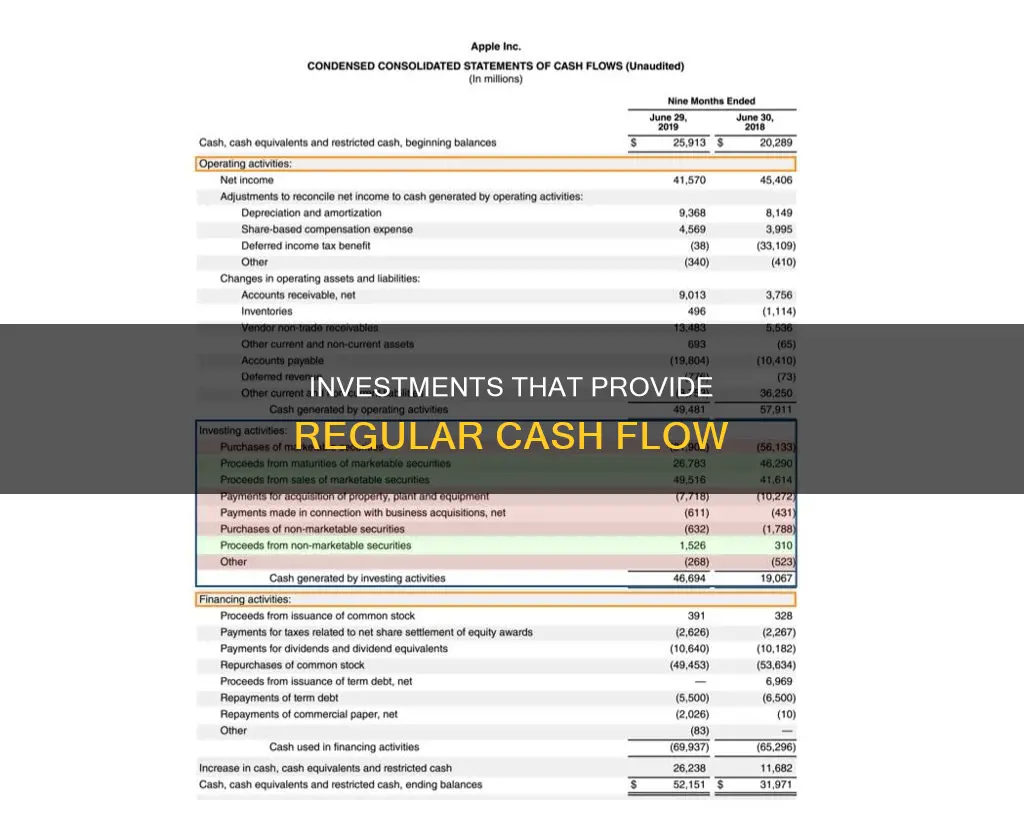

One common classification of cash flow is through operating activities, financing activities, and investment activities. Among these, investment activities, or cash flow investments, offer valuable insights into a business's long-term health and growth potential. Positive cash flow in this context indicates that a company is receiving more cash than it spends on investment activities, often through asset sales or receiving interest and dividends. On the other hand, negative cash flow suggests that a company is acquiring new assets or paying principal and interest on loans.

Businesses can maximise their financial growth through cash flow investments by expanding their operations, improving efficiency, diversifying their portfolios, and innovating new products. Individuals, on the other hand, can build passive income streams through real estate, dividend stocks, bonds, and alternative investments.

Overall, cash flow investments are a powerful tool for generating sustainable cash flow and achieving financial goals, whether for businesses seeking growth or individuals striving for financial freedom.

| Characteristics | Values |

|---|---|

| Cash flow from operating activities | Cash received from the sale of goods and services |

| Cash flow from operating activities | Salary and wages paid |

| Cash flow from operating activities | Payments to suppliers for inventory or goods needed for production |

| Cash flow from financing activities | Bond offerings that generate cash |

| Cash flow from investment activities | Sales of property, plant, and equipment |

| Cash flow from investment activities | Proceeds from sales of assets |

| Cash flow from investment activities | Purchases of marketable securities |

| Cash flow from investment activities | Purchase of property, plant, and equipment |

| Cash flow from investment activities | Investment in joint ventures |

| Cash flow from investment activities | Payments for business acquired |

| Cash flow from investment activities | Real estate |

| Cash flow from investment activities | Dividend stocks |

| Cash flow from investment activities | Bonds |

| Cash flow from investment activities | Buying other profit-generating businesses |

What You'll Learn

Real estate syndications

The benefits of real estate syndications include the potential for strong risk-adjusted returns, diversification, and cash flow. Syndications also offer tax advantages, such as pass-through taxation and depreciation deductions, which can lower taxable income. Leveraging is another advantage, allowing for the financing of a significant portion of the purchase price of an asset.

When investing in a real estate syndication, it is important to carefully vet the sponsor team, review the financials, and understand the risks involved. The success of a syndication heavily depends on positive cash flow, which can be optimised through strategic rental rates, efficient property management, and controlling operating expenses.

Overall, real estate syndications provide an opportunity for individuals to invest in larger real estate assets, offering the potential for strong returns and diversification, while also providing cash flow through rental income and profits from sales.

UK Cash Investment: Strategies for Success

You may want to see also

Renting single-family homes

Renting out single-family homes can be a good way to generate cash flow, but it requires a commitment of time and money. It is a form of real estate investment that can provide a steady income stream for investors.

When choosing a single-family home as a rental property, look for a location with low property taxes, good schools, and walkable amenities such as restaurants, coffee shops, and parks. These factors can attract a larger pool of potential renters. It is also important to consider the crime rate, access to public transportation, and the job market in the area.

Once you've identified the right location, you need to find the right property. Consider the size, condition, and features of the home to ensure it will be attractive to potential tenants. After purchasing the property, you may need to spend time and money fixing any issues and making it ready for renters.

As a landlord, you will be responsible for ongoing maintenance and upkeep, which can decrease your rental income. It is recommended to set aside around 1% of the property's value each year for repairs and maintenance. You can choose to manage the property yourself or hire a property manager, who typically charges between 8% and 12% of the collected rents.

To maximise your cash flow, it is important to keep your operating expenses low. These expenses can include homeowners insurance, homeowners association fees, property taxes, and monthly costs such as pest control, landscaping, and maintenance.

By renting out a single-family home, you can benefit from passive income while also taking advantage of potential increases in real estate values. Additionally, rental income is not subject to Social Security tax, and the interest on your investment property loan may be tax-deductible.

In summary, investing in single-family rental properties can be a lucrative opportunity, but it requires careful research and consideration of the associated costs and responsibilities.

Cashing in on Treasury Investment Growth: Receipt Redemption Guide

You may want to see also

Buying ATMs and other money-generating assets

ATMs can be a stable and hassle-free investment with a low-risk rate and high returns. The demand for ATMs in busy locations such as malls, convenience stores, and restaurants is high, and it is only growing. The busier the location, the more withdrawals from the ATM, and the more money you make.

The funds from the ATM are transferred to your account within 24 to 48 hours, and your money is recycled daily, leading to a substantial return on investment. ATM machines typically require $2,000 to $5,000 to sustain their continued operation, depending on the number of daily withdrawals and how frequently you replenish the machine.

When it comes to investing in an ATM, you can either buy or lease a machine and place it in a merchant's business, agreeing to share a portion of the surcharge fee. This is a great way to increase the business owner's interest in the machine, and it also attracts more customers, leading to more store profits.

If you buy an ATM, you will be responsible for maintaining the machine, including keeping it loaded with cash and ensuring it is working properly. Buying your own ATM can be very profitable, and between 15 and 30 transactions a month can yield a high return, potentially adding up to an extra $20,000 to $30,000 per year.

If you don't want to buy an ATM or worry about maintaining it, you can pay to participate in a full-service program where a retailer maintains the machine for you. In this case, the largest cost is usually the rent paid to the retailer, which is typically a percentage of the service charge.

Other money-generating assets to consider include:

- Real estate: Buying, selling, renting, or developing real estate properties can provide benefits such as rental income, capital appreciation, tax advantages, and equity.

- Stocks: Buying and selling shares of ownership in a company can generate income through dividends, capital gains, or stock splits. Stocks also provide voting rights and influence over the company's decisions.

- Bonds: Lending money to governments or businesses in exchange for interest payments and principal repayment. Bonds can generate income through interest, capital gains, or coupons, and they add stability and security to your investments.

- REITs (Real Estate Investment Trusts): Investing in companies that finance, operate, or own real estate properties. REITs can help diversify your portfolio, offering liquidity and income from rental fees, dividends, and capital appreciation.

- Peer-to-peer lending: Connecting borrowers and lenders online, allowing businesses to participate as lenders and generate income from interest, fees, or commissions.

Understanding Cash Investments: What Qualifies as Cash?

You may want to see also

Dividend (stock) investing

Dividend stocks are shares of companies that pay out regular dividends. Dividend stocks are usually well-established companies with a track record of distributing earnings back to shareholders. Dividend-paying companies tend to be more stable, and their dividends can provide a steady income stream. Dividend stocks can be a good choice for investors looking for passive income, and they can also add stability to your portfolio.

Dividend-paying stocks provide a way for investors to get paid during rocky market periods, and they can be a hedge against inflation, especially when dividends grow over time. They are also tax-advantaged when compared to other forms of income, such as interest on fixed-income investments. Dividend-paying stocks tend to be less volatile than non-dividend-paying stocks.

When investing in dividend stocks, it's important to evaluate the stock's dividend yield, payout ratio, and safety. A dividend yield over 4% should be carefully scrutinized, and those over 10% are considered risky. A high dividend yield can indicate that the payout is unsustainable or that the company is going into debt to pay dividends. The payout ratio tells you how much of the company's income is going towards dividends, and a payout ratio above 80% means the company is putting a large percentage of its income into dividend payments.

There are two main ways to invest in dividend stocks: through funds that hold dividend stocks, such as index funds or exchange-traded funds (ETFs), or by purchasing individual dividend stocks. Investing in dividend funds offers instant diversification, as you own a portfolio of dividend stocks with a single investment. On the other hand, investing in individual dividend stocks allows you to build a custom portfolio that may offer a higher yield than a dividend fund. Additionally, expenses can be lower with individual dividend stocks since ETFs and index funds charge an annual fee.

It's important to note that dividends do have a cost for the company paying them. Dividend payments reduce a company's market value and affect its ability to reinvest in its growth. This results in a downward adjustment in the stock price, known as the ex-dividend date, which typically occurs on the same day as the record date.

Overall, dividend (stock) investing can be a great way to generate cash flow by providing a steady income stream and adding stability to your investment portfolio.

Cashing Out of Circle Invest: A Step-by-Step Guide

You may want to see also

Real estate crowdfunding, REITs, and real estate ETFs

Real Estate Crowdfunding

Real estate crowdfunding allows investors to pool their money together to invest in real estate opportunities. This can include loans to residential rehab investors or equity stakes in larger commercial properties such as apartment complexes, retail shopping centres, and hotels. Investors can receive regular cash distributions from loan payments or "preferred" payouts on equity investments. These recurring cash distributions are known as "cash on cash" returns.

For equity investments, crowdfunding platforms pool investors into a single LLC, allowing them to participate in larger commercial projects with lower minimum investment amounts. The cash flow from these investments comes from the net operating income of the property and is typically paid out quarterly.

REITs (Real Estate Investment Trusts)

REITs are a type of investment vehicle that owns and operates income-producing real estate. They are similar to mutual funds or ETFs but focus specifically on real estate. REIT values are a function of their cash flow returns, which can be analysed through Funds From Operations (FFO) Yield, FFO Growth, and FFO multiple (contraction or expansion).

REITs can provide steady cash flow through dividend yields, and their performance is often compared to the broader stock market. They are considered less risky than stocks due to their lower volatility and proven business models.

Real Estate ETFs (Exchange-Traded Funds)

Real estate ETFs are funds that give investors exposure to REITs and the price performance of various types of real estate. They offer a simple and accessible way to invest in real estate without the hassle of managing properties directly. With as little as $1, investors can buy shares in real estate ETFs that focus on specific asset classes, such as industrial, commercial, or multi-family real estate.

These funds provide diversification, steady cash flow through dividend yields, and protection against inflation as property prices tend to increase during inflationary periods. Real estate ETFs are also more accessible than real estate mutual funds, as they can be traded throughout the day, providing more flexibility for investors.

In summary, real estate crowdfunding, REITs, and real estate ETFs offer investors various opportunities to generate cash flow through investments in the real estate market. Each option has its own unique characteristics, benefits, and considerations, providing a range of choices for those seeking to invest in this asset class.

Cash Value Investing: Strategies for Long-Term Wealth Preservation

You may want to see also

Frequently asked questions

Cash flow from investing activities is a part of a company's cash flow statement that reports the cash inflows and outflows resulting from investment activities. These activities primarily involve the acquisition and disposal of long-term assets such as property, plant, and equipment, and investments in marketable securities.

Examples of cash flow from investing activities include:

- Capital expenditures involving the acquisition of fixed assets, plant, and machinery.

- Proceeds from sales of fixed assets.

- Purchase of investment securities, bonds, debentures, and stocks.

- Proceeds from sales of investment securities, bonds, debentures, and stocks.

- Acquisition of another company.

- Proceeds from sales of other business units.

Cash flow from investing activities does not include short-term investments, cash equivalents, or cash flows from financing activities. It also excludes cash received from sales of goods and services, payments to vendors and suppliers, tax-related payments, dividend payments, expenses related to asset depreciation, debt and equity financing, and income and expenses related to business operations.

To calculate cash flow from investing activities, you add the purchases or sales of property and equipment, other businesses, and marketable securities. You can find the relevant figures in the cash flow statement or by comparing non-current assets on the balance sheet over two periods.

Some examples of investments that can generate cash flow include real estate, dividend stocks, bonds, and buying other profit-generating businesses.