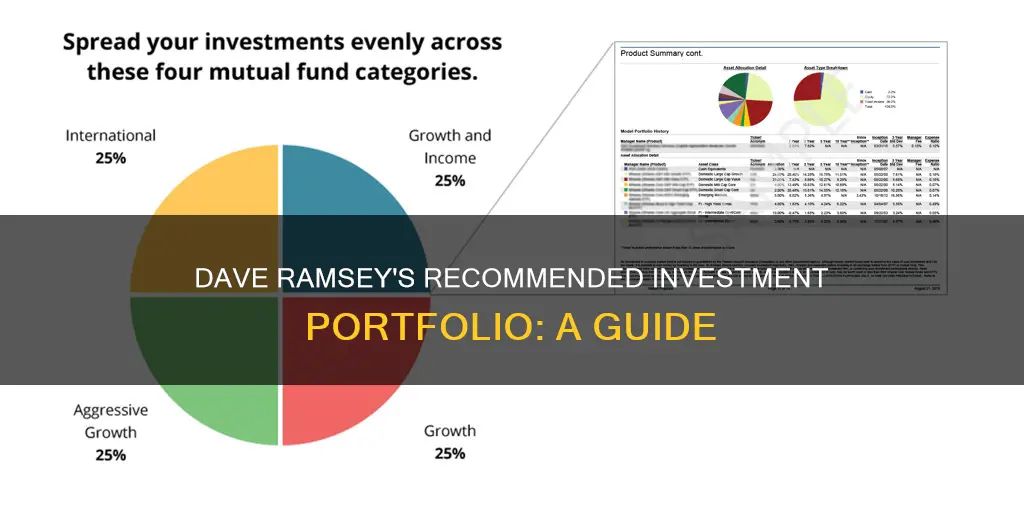

Dave Ramsey is a well-known financial guru who has helped millions of people struggling with their finances. His investment philosophy is conservative and is based on just three steps. He recommends getting out of debt, saving up an emergency fund, and investing 15% of your income in tax-advantaged retirement accounts, preferably in good growth stock mutual funds. Ramsey suggests investing in four types of mutual funds: growth, growth and income, aggressive growth, and international. He also advises working with a financial advisor to navigate market chaos, inflation, and one's future. While Ramsey's advice provides a basic framework, it is important to conduct further research and consider other investment options and strategies to make informed decisions.

| Characteristics | Values |

|---|---|

| Investment type | Mutual funds |

| Number of mutual fund types | 4 |

| Types of mutual funds | Growth and income, growth, aggressive growth, and international |

| Fund manager experience | At least 5-10 years |

| Fund performance | History of strong returns over the long term |

| Fund fees | Front-end load funds |

| Investment amount | 15% of gross income |

What You'll Learn

Get out of debt and save an emergency fund first

Getting out of debt and saving an emergency fund are the first steps in Dave Ramsey's investment philosophy. Here's a detailed look at these steps and how they fit into his overall approach to investing:

Get Out of Debt

Getting out of debt is crucial before starting to invest. Ramsey recommends paying off all debt except for your mortgage. This is because your income is your most important wealth-building tool, and as long as it's tied up in monthly debt payments, you can't build wealth effectively. He suggests using the debt snowball method to eliminate debt, which involves focusing on paying off the smallest debts first to build momentum. By getting out of debt first, you create a solid financial foundation for investing and can fully utilise your income to build wealth.

Save an Emergency Fund

Ramsey recommends saving an emergency fund of 3-6 months' worth of expenses before investing. This step ensures that you have a financial cushion to cover unexpected costs, such as medical bills or car repairs, without derailing your investment plans. It also prevents you from having to tap into your retirement investments in an emergency, which could ruin your financial future. This emergency fund provides financial security and peace of mind as you begin your investment journey.

These initial steps of getting out of debt and saving an emergency fund are part of Ramsey's "Baby Steps" programme, a comprehensive plan to help people get out of debt, save for emergencies, and build wealth.

The Next Steps

Once you've cleared your debt and built your emergency fund, Ramsey's investing philosophy includes the following steps:

- Invest 15% of your income in tax-advantaged retirement accounts, such as a 401(k) or Roth IRA.

- Invest in good growth stock mutual funds, which offer the potential for long-term, consistent growth by spreading your investment across many companies.

- Maintain a long-term perspective and invest consistently, focusing on compound growth over time rather than short-term market fluctuations.

- Work with a financial advisor to make informed decisions and stay on track with your investment goals.

Kids' Guide to Saving, Investing, and Financial Worksheets

You may want to see also

Invest 15% of your income in tax-advantaged retirement accounts

Dave Ramsey's investment philosophy is conservative. His investment strategy consists of just three steps:

- Ask yourself specific questions, such as when you want to retire and what kind of lifestyle you want to live.

- Diversify.

- Invest 15% of your income in tax-advantaged retirement accounts.

The third step is the most relevant to your query. Ramsey recommends investing 15% of your gross income for retirement before investing for kids' education or other short-term goals. This is based on the assumption of an average 11% return rate. If you invest 15% of your income every year for 30 years, you will end up with millions of dollars due to compound growth.

Ramsey suggests that you start by investing in your employer-sponsored plan and see if your company offers a match. If you have a match through your workplace retirement plan, invest enough to receive the full employer match. After that, you and your spouse (if you're married) can open a Roth IRA and max out your contributions there. If you still haven't hit the 15% goal, go back to your 401(k) and increase your contributions.

It's important to note that this advice is general in nature, and individual circumstances may vary.

Designing Optimal Portfolios: Understanding Investment Policy Statements

You may want to see also

Invest in good growth stock mutual funds

Dave Ramsey recommends investing in good growth stock mutual funds as part of his investing philosophy. Here's a detailed guide to investing in good growth stock mutual funds, based on his advice:

Understanding Mutual Funds

Mutual funds are a type of investment that allows a group of investors to pool their money and invest in something together. They are managed by a team of investment professionals who select a mix of investments based on the fund's objective. For example, if the fund is used to buy growth stocks, it would be called a growth stock mutual fund. Mutual funds give individual investors the opportunity to invest in many different companies at once, reducing the risk associated with investing in single stocks.

Mutual funds offer several benefits that make them a recommended investment option. Here are some key advantages:

- Diversification: Mutual funds invest in multiple companies across different industries, reducing the risk of putting all your eggs in one basket.

- Professional Management: Mutual funds are actively managed by a team of investment professionals who set the fund's strategy, perform market research, monitor performance, and adjust investments as needed.

- Dividend Reinvestment: Mutual funds allow for dividend reinvestment, helping your money grow faster.

- Long-Term Wealth Building: Mutual funds are a proven way to build wealth over time, providing a stable and diverse portfolio for retirement.

Choosing the Right Mutual Funds

When choosing mutual funds to invest in, it's important to consider the following factors:

- Fund Type: Ramsey recommends dividing your investments equally between four types of mutual funds: growth and income, growth, aggressive growth, and international. This diversification helps lower your investment risk and creates a balanced portfolio.

- Fund Performance: Look for funds with a strong long-term track record (at least 10 years) of consistently outperforming the S&P 500. Focus on long-term returns rather than short-term gains.

- Fund Manager Experience: Choose funds with experienced managers who have a successful track record. Look for managers with at least 5-10 years of experience, as they are more likely to make informed investment decisions.

- Fund Fees and Costs: Be mindful of mutual fund fees and expense ratios. Avoid funds with expense ratios higher than 1%, as they are considered expensive. Also, consider the fee structure of your financial advisor to ensure you understand the costs involved.

- Sectors and Diversification: Ensure the fund invests in a diverse range of business sectors, such as financial services, technology, and healthcare. This diversification reduces the risk of relying heavily on a single industry.

- Turnover Ratio: Opt for funds with a low turnover ratio of 10% or less, indicating that the management team has confidence in its investments and is not frequently buying and selling.

Working with a Financial Advisor

Investing in mutual funds can be complex, and it's beneficial to work with a financial advisor or investment professional. They can help you navigate the different options, provide insights, and ensure your investment decisions align with your financial goals. Remember to choose a financial advisor who takes the time to answer your questions and empowers you to make informed choices.

Understanding Personal Investment Portfolios: Your Financial Journey

You may want to see also

Keep a long-term perspective and invest consistently

Investing is a long-term game. The stock market is unpredictable, and there will be ups and downs. However, historically, the average annual rate of return for the stock market ranges from 10% to 12%investing for the long haul. He recommends tuning out the noise and avoiding the temptation to time the market, as trying to predict the market's movements can be detrimental to your investment strategy.

Consistency is key when it comes to investing. By investing regularly, regardless of market conditions, you can take advantage of dollar-cost averaging. This means that you acquire more shares when prices are low and fewer when prices are high, ultimately lowering your average cost per share over time.

Ramsey's investing principles emphasise the importance of staying the course and maintaining a disciplined approach to investing. He suggests that investors should not be deterred by short-term market volatility and should continue investing in their 401(k)s and IRAs consistently, regardless of market conditions.

Additionally, your savings rate is a crucial factor in building wealth. It's important to invest a substantial portion of your income consistently over time. Ramsey recommends investing 15% of your gross income for retirement, ensuring that you maximise any employer matches in your workplace retirement plan.

By combining a long-term perspective with consistent investing, you can take advantage of compound growth and put yourself on a path towards achieving your financial goals. This strategy has been proven successful by the "Baby Steps Millionaires," a group of individuals who have followed Ramsey's principles to build their wealth over time.

Remember, investing is a marathon, not a sprint. By adopting a long-term perspective and investing consistently, you increase your chances of success and set yourself up for achieving your financial aspirations.

Maximizing UK Savings: Investment Strategies for Beginners

You may want to see also

Work with a financial advisor

Working with a financial advisor is the fifth and final step in Dave Ramsey's investing philosophy.

No matter where you are on your financial journey, Ramsey recommends teaming up with a financial advisor. Their job is to stay on top of investing news and trends, but their most valuable role is helping you meet your retirement goals.

A good financial advisor or investment professional should give insight and direction based on their years of experience, but at the end of the day, they know you are the decision-making boss.

According to Ramsey, a good financial advisor should take the time to answer your questions and give you all the information you need to make good investing choices. You should leave a meeting with your financial advisor feeling smarter and more empowered than when you went in.

Ramsey recommends his SmartVestor program, which can connect you with investment pros in your area who can help you make informed investing choices.

However, it's important to note that some critics argue that Ramsey's SmartVestor program is geared more towards generating subscriptions and referrals than providing truly independent financial advice. There are also concerns about the high fees associated with his recommended funds.

Therefore, while seeking the guidance of a financial advisor can be beneficial, it is essential to do your research, understand the fees involved, and make informed decisions that align with your financial goals and risk tolerance.

Investment Bankers: Crafting Portfolios, Analyzing Fundamentals

You may want to see also