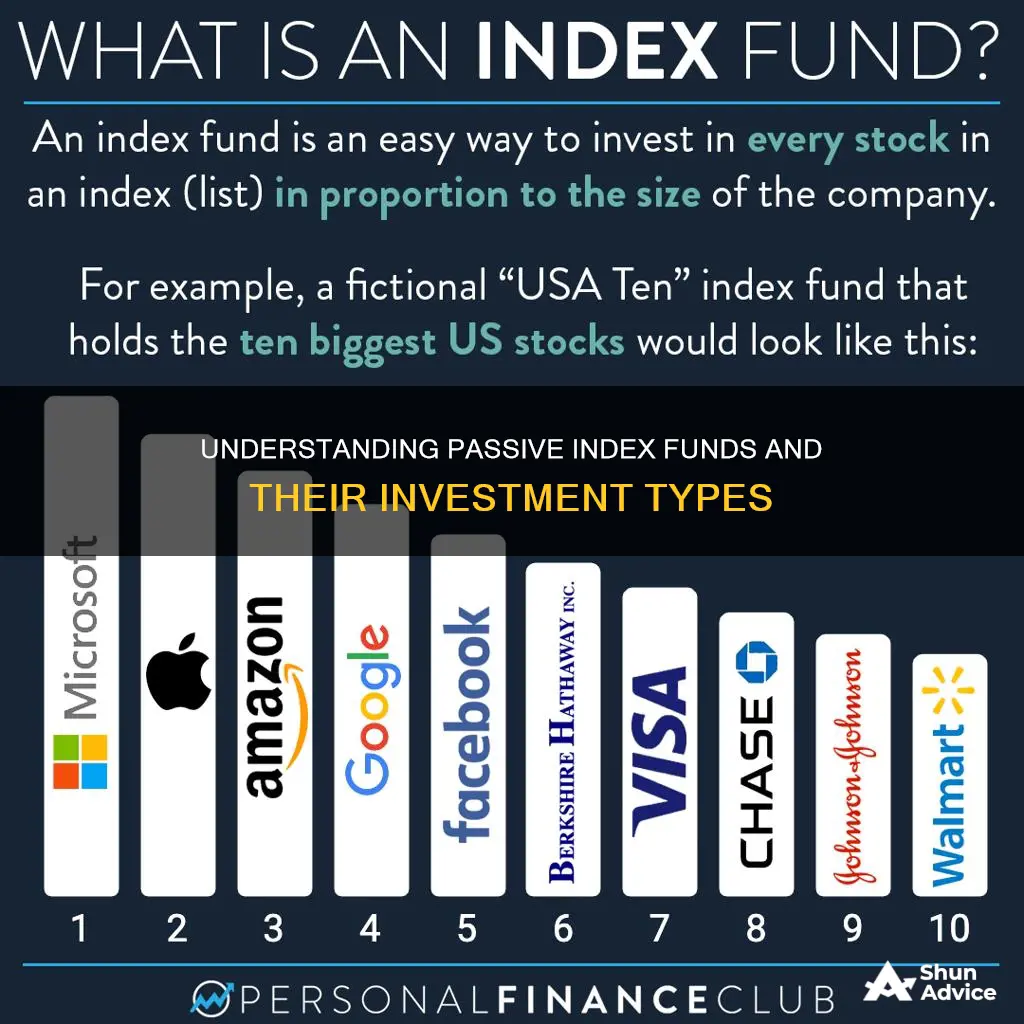

Passively managed index funds are a type of investment strategy where a fund's portfolio mirrors a market index. This means that the fund's investments are designed to keep pace with market returns by trying to replicate the performance of a specific market index, such as the S&P 500. This type of investment strategy is known as passive investing or index investing, and it is the opposite of active investing or active management, where fund managers attempt to beat the market through various investment strategies and buying/selling decisions.

Passive investing is a long-term strategy that aims to build wealth by buying securities that mirror stock market indexes and holding them for an extended period. This approach can lower risk for investors because it diversifies their investments across a mix of asset classes and industries, rather than focusing on individual stocks. Passive investing is also associated with lower fees and expenses since there is less frequent buying and selling of securities.

Index funds, which are a common form of passive investing, aim to replicate the performance of a broad market index or multiple indices. They provide investors with a simple and cost-effective way to gain exposure to a diversified portfolio of investments. However, one of the limitations of passive investing is that it may not provide the potential for above-market returns since the goal is typically to match the market average.

| Characteristics | Values |

|---|---|

| Type of Investment | Passive |

| Management Style | Passive |

| Investment Strategy | Buy-and-hold |

| Investment Objective | Mirror market index |

| Investment Types | Mutual funds, Exchange-Traded Funds (ETFs) |

| Investment Holdings | Stocks, bonds, securities |

| Risk Level | Lower risk due to diversification |

| Performance | Matches market performance |

| Fees | Lower fees and expenses |

| Taxation | More tax-efficient |

| Flexibility | Less flexible |

| Returns | Lower potential returns |

What You'll Learn

Passive investing is a long-term strategy

Passive investing is often associated with mutual and exchange-traded funds (ETFs), where a fund's portfolio mirrors a market index. This approach is in contrast to active management, where fund managers attempt to beat the market through various investment strategies, including buying and selling decisions. Passive management is based on the Efficient Market Hypothesis (EMH), which states that markets at any given time reflect all available information, making it futile to try to select individual stocks.

One of the key advantages of passive investing is its lower cost compared to active management. Passive funds tend to have lower fees because they do not require extensive research, stock picking, or frequent trading. This lack of frequent buying and selling also results in lower capital gains taxes for investors. Additionally, passive investing is less complex and can provide superior after-tax returns over the medium to long-term.

Another benefit of passive investing is diversification. By investing in a broad mix of asset classes and industries, passive investors can lower their risk compared to investing in individual stocks. However, this diversification also means that passive investors may not achieve above-market returns. While passive funds aim to match the market average, they rarely beat the return on the index due to operating costs.

Passive investing strategies include buying index funds or exchange-traded funds (ETFs). Index funds are designed to track the performance of a chosen market index and typically have lower fees. ETFs, on the other hand, are traded on exchanges like stocks, offering more trading flexibility. Both options provide diversification and are suitable for long-term investing.

Real Estate Fund Investing: What You Need to Know

You may want to see also

Passive funds don't attempt to outperform the market

Passive funds are a type of investment vehicle that tracks a market index or a specific market segment to determine what to invest in. They are called "passive" because the fund manager does not decide which securities the fund takes on. Instead, the fund is designed to mirror certain market segments or a specific market index. This is in contrast to active funds, where a fund manager attempts to beat the market by hand-picking investments.

Passive funds are often associated with mutual and exchange-traded funds (ETFs). They tend to charge lower fees to investors than actively managed funds, as there is no need to pay a fund manager's salary. Passive funds are also less complex, as they do not require the same level of research and analysis as active funds. This makes passive funds a popular choice for investors who want to see returns with less risk over a longer period.

Passive funds are designed to keep pace with market returns and match market performance. They do this by constructing well-diversified portfolios of single stocks, which, if done individually, would require extensive research. The goal of passive investing is to build wealth gradually by purchasing securities and holding them for the long term. This is known as a buy-and-hold strategy.

While passive funds can provide steady returns and lower fees, they also have some limitations. One of the main drawbacks is that they will rarely beat the market and usually return slightly less due to operating costs. Passive funds are limited to a specific index or set of investments, so investors are locked into those holdings, regardless of market conditions. Additionally, passive funds may not be suitable for investors seeking above-market returns, as their goal is to match the market average.

In summary, passive funds are a long-term investment strategy that aims to mirror market performance and provide steady returns with lower fees and less risk. They are a popular choice for investors who want a more hands-off approach and are willing to accept market-average returns. However, they may not be suitable for those seeking to outperform the market or have more flexibility in their investment choices.

S&P Mutual Funds: A Smart Investment Strategy

You may want to see also

Passive funds are less expensive

Passively managed funds tend to charge lower fees to investors than funds that are actively managed. This is because passive funds do not involve fund managers picking stocks or bonds, so there is no added expense for research analysts. Passive funds simply follow an index they use as a benchmark, and there is no need to select and monitor individual managers.

The average fee for actively managed mutual funds was 0.71% in 2020, while fees for passively managed funds were an average of 0.06%. These lower fees can make a significant difference over time. For example, if you're investing in a retirement account that you plan to hold for 20 years or more, passive investing may be better as you won't incur the same fees as you would if you were frequently buying and selling.

In addition, passive funds are less complex and often produce superior after-tax results over medium to long time horizons when compared to actively managed portfolios. Passive investing is a buy-and-hold strategy, so there is less buying and selling, and this means fewer taxable capital gains. Passive funds also offer simplicity, as owning an index or group of indices is far easier to implement and comprehend than a dynamic strategy that requires constant research and adjustment.

Fixed Income Funds: Where Are Your Investments Going?

You may want to see also

Passive funds are simpler

Passive investing is a long-term strategy for building wealth. It involves buying securities that mirror stock market indexes and holding them for the long term. It is a "buy-and-hold" strategy, meaning that passive investors are not looking to profit from short-term price fluctuations or market timing. Instead, they aim to replicate market performance by constructing well-diversified portfolios of single stocks.

Passive funds are also simpler because they offer more transparency. The holdings of an index fund are well-known and available on most investing platforms. This is in contrast to actively managed funds, where managers hand-pick stocks or bonds for the fund based on their deep research and expertise.

Passive funds are also simpler in terms of taxes. Because passive funds trade less frequently, they usually distribute fewer taxable capital gains. This makes them more tax-efficient than actively managed funds.

Overall, passive funds are a simpler investment option that can provide a cost-effective way to gain exposure to a broad, diversified portfolio.

Maharlika Investment Fund: A Sovereign Wealth Fund for the Philippines

You may want to see also

Passive funds are tax-efficient

Passively managed funds are often associated with mutual and exchange-traded funds (ETFs). This style of management involves a fund's portfolio mirroring a market index, such as the S&P 500. Passively managed funds tend to charge lower fees to investors than actively managed funds.

Passive funds are considered tax-efficient for several reasons. Firstly, they usually distribute fewer taxable capital gains because the portfolio manager trades less frequently. This buy-and-hold strategy does not typically result in a large capital gains tax for the year.

Secondly, passive funds have ultra-low fees compared to active funds. There is no need for a portfolio manager to spend time and resources on stock selection or market timing, which results in lower management fees.

Thirdly, passive funds are simple and transparent. They require minimal research and expertise, making them more accessible to investors. The simplicity of passive funds also makes it easier to implement and comprehend the investment strategy.

Finally, passive funds can provide tax efficiency due to their long-term focus. They are designed to maximise returns in the long run by purchasing and selling less often than actively managed funds. This long-term approach can result in more favourable tax treatment compared to short-term capital gains.

Overall, passive funds are tax-efficient due to their lower fees, reduced trading frequency, simplicity, and long-term investment horizon. These factors can contribute to lower taxes for investors compared to actively managed funds.

Bond Fund Investment: What Percentage is Smart to Invest?

You may want to see also

Frequently asked questions

Passively managed index funds are a type of investment fund that aims to mirror the performance of a specific market index, such as the S&P 500. The fund will hold the same stocks or bonds, or a representative sample of them, as the index it is tracking.

Passively managed index funds offer a simple, low-cost way to gain exposure to a broad, diversified portfolio. They are often associated with lower fees and expenses when compared to actively managed funds, as they trade less frequently. This makes them a popular choice for long-term investors.

One of the main drawbacks of investing in passively managed index funds is the lack of flexibility. These funds are designed to mirror the performance of a specific market index, so they will decline in value when the market does and are unable to pivot away when the market shifts. They may also include securities that are overvalued or fundamentally weak.