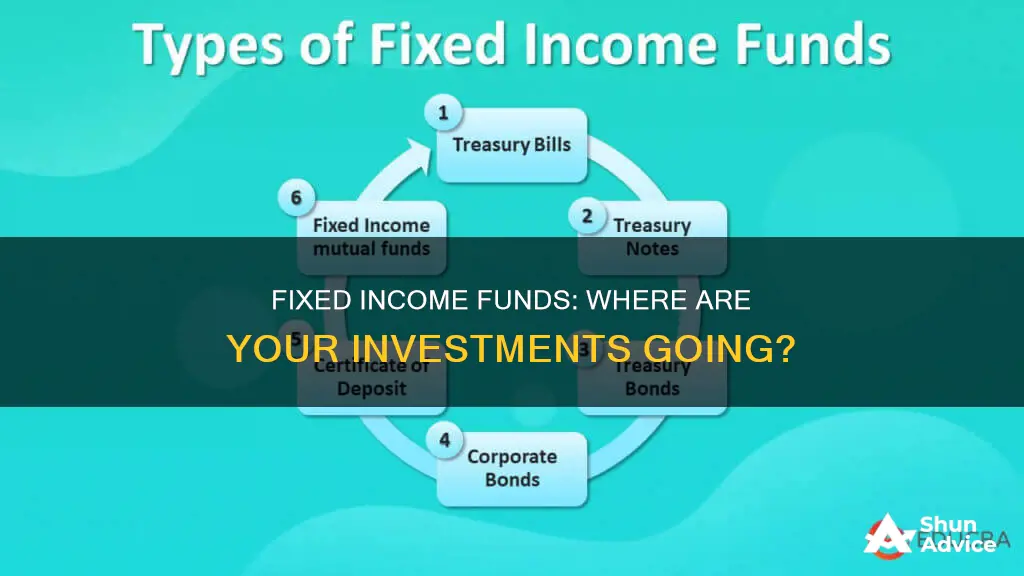

Fixed-income funds are invested in low-risk assets that provide a fixed stream of income through interest or dividends. These include government, corporate, and municipal bonds, as well as certificates of deposit (CDs), money-market funds, and bond mutual funds. Fixed-income funds are considered low-risk investments that provide predictable returns, making them a popular choice for investors seeking stable income and capital preservation.

| Characteristics | Values |

|---|---|

| Investment type | Fixed-income funds |

| Investment approach | Low-risk |

| Income type | Fixed stream of income through interest or dividends |

| Investment examples | Bonds, certificates of deposit (CDs), money-market funds, bond mutual funds, bond exchange-traded funds (ETFs) |

| Interest rate | Fixed |

| Returns | Lower than stocks |

| Risk | Low |

| Volatility | Less than stocks |

Treasury bills

T-bills are sold at a discount from their face value and mature at face value. The difference between the purchase price and the maturity value is the interest earned by the investor. For example, an investor who purchases a $1,000 52-week T-bill for $954.19667 will receive $1,000 upon maturity, resulting in a gain of $45.80 in interest.

T-bills are typically sold in denominations of $100, but can reach a maximum denomination of $5 million in non-competitive bids. The US Treasury sells T-bills through auctions using a competitive and non-competitive bidding process. T-bills can be purchased directly from TreasuryDirect, the platform of the US Treasury, or from a brokerage firm, which may charge a small fee.

T-bills are usually held until maturity or cashed before maturity. They do not pay periodic interest payments but include built-in interest reflected in the amount paid at maturity. The interest income from T-bills is exempt from state and local income taxes but is subject to federal income tax.

T-bills offer a low minimum investment requirement of $100, making them accessible to a wide range of investors. They are also easily transferable, as investors can buy and sell T-bills in the secondary bond market.

However, T-bills offer lower returns compared to other debt instruments and do not provide periodic interest payments, which may inhibit cash flow for investors seeking steady income. Additionally, T-bills are subject to interest rate risk, meaning their rate could become less attractive in a rising-rate environment.

Overall, T-bills are considered a safe and secure investment option for those seeking short-term maturity while parking their money for a short period. They are particularly suitable for risk-averse investors who value capital preservation and stable, albeit typically low, returns.

Bond of America: State Investment Destinations

You may want to see also

Treasury notes

Compared to other fixed-income investments, Treasury notes offer lower yields as they have a lower default risk. They are susceptible to interest rate risk and inflation risk, which can impact their market value.

The Mindset of Investment Fund Managers: Traits and Insights

You may want to see also

Treasury bonds

T-bonds are typically sold in multiples of $100 and have maturities of 20 or 30 years. They are considered a safe investment, as they are backed by the US government's ability to tax its citizens. The US government has never defaulted on its debt, so T-bonds are widely considered a risk-free investment.

T-bonds are one of four types of debt issued by the US Department of the Treasury to finance government spending activities. The other three are Treasury bills, Treasury notes, and Treasury Inflation-Protected Securities (TIPS). All four are considered benchmarks to their comparable fixed-income categories because they are virtually risk-free.

T-bonds pay semi-annual interest payments until maturity, at which point the face value of the bond is paid to the owner. The interest earned is taxed by the federal government but is tax-exempt at the state and local levels.

T-bonds can be purchased directly from the US government on TreasuryDirect.gov, or through a bank or broker, though this may incur fees or commissions. They are also available through exchange-traded funds (ETFs) and mutual funds.

T-bonds are a good option for investors seeking a stable, low-risk investment, particularly those nearing retirement who wish to preserve their wealth.

Maximizing Your HSA Funds: Smart Investment Strategies

You may want to see also

Municipal bonds

Despite these risks, municipal bonds offer investors a relatively stable and low-risk investment option with the potential for tax benefits. They are a common choice for investors seeking a steady stream of income and capital preservation, particularly those nearing retirement.

Investing Now: Choosing the Right Funds for Your Portfolio

You may want to see also

Corporate bonds

When a company issues a corporate bond, it is effectively borrowing money from investors with the promise of regular interest payments, known as coupon payments, over a set period of time. The company also commits to returning the original investment amount when the bond reaches maturity.

The price and interest rate of a corporate bond depend largely on the company's financial stability and creditworthiness. Bonds with higher credit ratings tend to have lower coupon rates, while lower-rated bonds, or "junk" bonds, have higher coupon rates due to their higher risk of default.

Before being issued, corporate bonds are reviewed by credit rating agencies such as Standard & Poor's Global Ratings, Moody's Investor Services, and Fitch Ratings. These agencies assess the creditworthiness of the issuing company and assign a rating that influences the bond's interest rate, investment appeal, and pricing.

Best TSP Funds to Invest in Now

You may want to see also

Frequently asked questions

Fixed-income funds are invested in low-risk assets that provide a fixed stream of income through interest or dividends. These include government and corporate bonds, certificates of deposit (CDs), money market funds, and mutual funds.

Fixed-income funds offer a lower-risk investment strategy that provides a consistent and predictable stream of income. They are also less volatile than stocks and can help to balance out market risk.

While fixed-income funds are considered low-risk, there is still a potential for loss if the issuer defaults on payments. Other risks include interest rate risk, inflation risk, and credit risk.

You can invest in fixed-income funds through a financial broker or directly with the issuing institution, such as a bank or the U.S. Treasury.